Last updated on October 23rd, 2024 at 04:59 pm

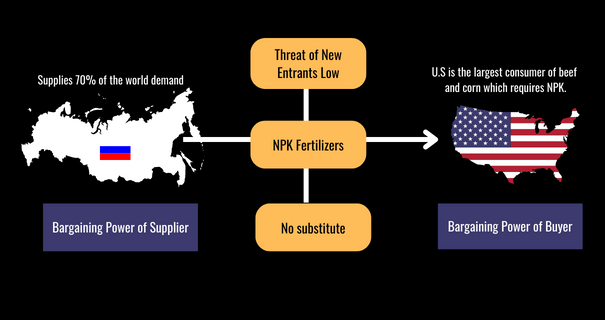

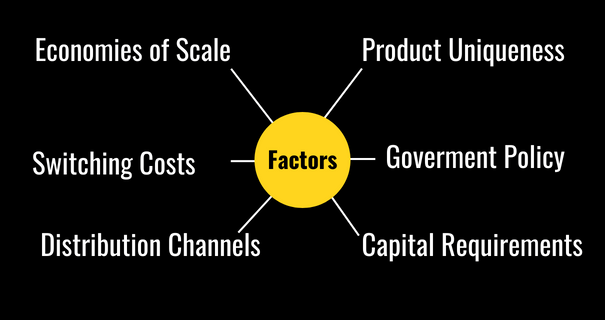

The bargaining power of suppliers means, the pressure that suppliers can put on buyers by changing their prices, reducing the supply or dropping the quality

As you might have noticed, I have explained this using the current inflation problem in the U.S.

Did you know that the real problem is that Americans eating too much beef, which requires corn?

Leading to requiring this famous fertiliser called NPK.

If your mother and father do gardening, this should be pretty common.

So as you can guess, Americans sanctioned Russia, but Russia stopped the NPK supply.

Now, since 70% of the NPK was imported from Russia, which by the way was cheap. So without cheaper alternatives, the American farmers had to start using expensive alternatives.

That’s what is called as bargaining power of suppliers, in its widest sense, which can affect business models or products or services.

What is the Bargaining Power of Suppliers?

Strictly speaking academics, its basically one of Porter’s five forces but if you think of it then it’s common sense.

Think of industries that can put pressure on companies by raising their prices, lowering their quality, or reducing the availability of their products.

Sounds monstrous?

What about middle east oil to India?

Now, before India became creative and signed a deal with Iranian oil, the Saudi sheikhs had more bargaining power as a supplier.

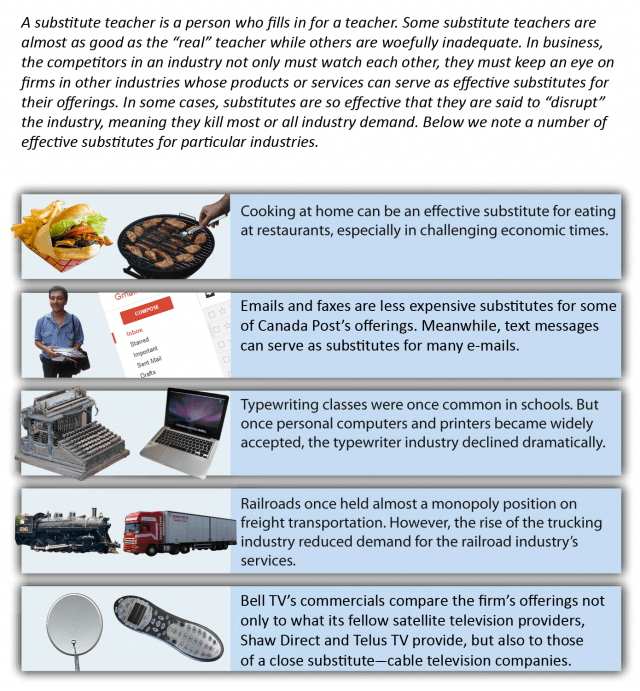

Overall if you think of it, then these industries should have a high barriers to entry?

I mean who doesn’t want to be the dominator in a relationship right? However you don’t dominate without some moat, and it requires huge investments.

Which itself will ward off many, because of the huge risk of investment.

Supplier bargaining power examples

You could have such monstrous bargaining power of suppliers in the following ways;

- Manufacturers and Vendors: Sells their products to distributors, retail and/or wholesalers

- Distributors and Wholesalers: They purchase goods in high quantity to sell them to retailers or local distributors

- Independent Suppliers: They sell unique products directly to retail

- Importers/Exporters: They purchase a product in one country and sell it in another country

- Drop Shippers: Suppliers of products for different kinds of companies

Determining Factors for The bargaining power

You can find such industries, in which there exists a great deal of the power of bargaining power of suppliers, if the folllowing conditions exisits.

- Number of suppliers as compared to the buyers: Usually less for eg: Batteries in India

- How much a buyer is dependent on the supplier’s sale: OEM’s heavily dependent on batteries manufactured by Exide and Amron.

- Switching costs of the suppliers: Although not much in the case of batteries may carry a lot of risk with quality.

- Availability of the suppliers for immediate purchase: Very low suppliers may be one or two. So that makes it difficult.

- Possibility of forwarding integration by suppliers: That is possible and does happen too in batteries. Exide tying up with other battery companies or suppliers of raw materials.

Identifying if the Bargaining Power ?

Strong bargaining power of suppliers.

- Increase Switching cost of buyers is High

- The threat of forwarding integration is high

- Suppliers are less in comparison with the buyers

- Low dependence of supplier’s sales on buyers

- Switching cost of suppliers is low

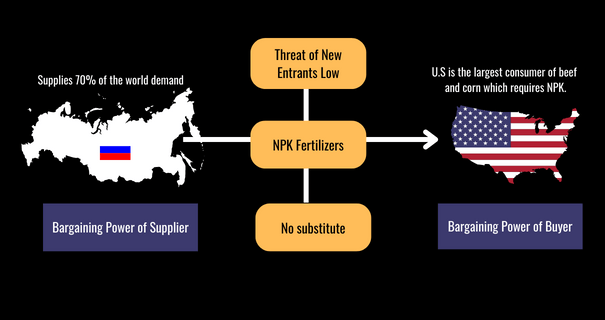

- Substitutes are unavailable

- Buyers heavily rely on sales from suppliers

- Competitive advantage

Weak bargaining power of suppliers;

- Switching cost of buyers is low

- The threat of forwarding integration is low

- Suppliers are more in comparison with the buyers

- High dependence of supplier’s sales on buyers

- Switching cost of suppliers is high

- Substitutes are available

- Buyers do not rely heavily on sales from suppliers

Bargaining Supplier Power in the Retail Industry

I mean the images should seal the question right away. If McDonald’s doesn’t work then KFC and if both don’t work then we’ve got Subway.

So, the bargaining power of suppliers from the customer angle definitely doesn’t exist.

Let us consider the following analysis in order to determine whether McDonald’s faces high or low bargaining power from suppliers

- The number of suppliers compared to buyers: There is a significant amount of suppliers relative to buyers. Therefore, supplier power is low.

- Dependence of a supplier’s sale on a particular buyer: If we consider that the suppliers have few customers, they are likely to give in to the demands of buyers. On the other hand, if we assume suppliers have several customers, they have more power over buyers. Since we do not know whether these suppliers have few or many buyers, a middle ground would be a reasonable answer. Therefore, supplier power is medium.

- Switching Costs: Switching costs are low as there are a significant number of suppliers in the fast-food industry. As a result, Supplier power is low.

- Forward integration: There is low forward integration in the fast-food industry

After analyzing all these factors, McDonald’s has very low bargaining power as a supplier.

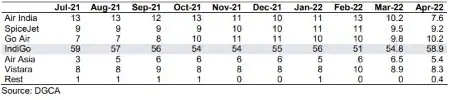

Bargaining Power in Aviation Industry in India

This industry is interesting from this perspective because, although there are limited suppliers and requires huge investments.

Moreover, Aviation is a very difficult place to make money, because of this high dependence on oil.

However, from the customer angle, consider this proposition.

If you want to fly to the usual destinations like Mumbai to Delhi, you have a good number of options.

As soon as we talk of tier 2 cities, then the options reduce, switching cost increases and suddenly Indigo has good bargaining power.

Also, considering most of the aviation companies in India, eventually, run out of fuel and go bankrupt. Indigo keeps increasing its fleet.

So does indigo enjoy bargaining power as a supplier?

- Aircraft Order: They have the power to reduce the cost of purchase by making big orders, in other words, scale.

- Fuel efficiency: Right on top, because they keep buying newer planes to keep the mileage high.

- Uniqueness: Always on time, I would pay INR 1000 more to reach on time rather than fly Air India and never reach. Even worse fly spice jet and worry about if the wheels have come out.

Conclusion

The bargaining power of suppliers alone does not determine the overall attractiveness of an industry. The remaining forces (bargaining forces of buyers, rivalry among existing customers, the threat of new entrants, and the threat of substitutes) must be taken into consideration when determining overall industry attractiveness.

Related Articles