Last updated on November 20th, 2025 at 11:48 am

I have typically found these questions from students, who by default are frustrated with CA asking me ACCA vs CA.

Trying to find some hope, somewhere to satisfy their fear, looking for some ray of hope in an answer that they already have fixed it be “Easy”.

I am going to answer this in the most truthful, blunt, and easy-understanding way so that you don’t have to do any soul-searching henceforth. Let’s dive in.

Key Takeaway

- CA has signing authority, ACCA doesn’t

- You can work only in MNC-based companies with ACCA

- CA is more difficult than ACCA at any level

- ACCA is more costly than CA

- CA will always be in more demand than ACCA

- CA candidates get lot of exemptions in ACCA,but claiming them can be costly

- A good combination with CA, Is dip IFRS provided by ACCA

You are free to use this image on your site, template etc. Just provide us the attribution link

What is CA?

CA (Chartered Accountancy) is India’s most respected professional qualification in accounting and finance, governed by the Institute of Chartered Accountants of India (ICAI).

It’s ideal for students who want to build a strong career in accounting, taxation, auditing, or finance within India.

The most sought-after professional qualification in the field of accounting, auditing, and taxation.The qualification is a standard in India for accounting careers, and are the only persons who can actually audit financial statements and have the requisite signing authority for it.CA-qualified professionals can not only make careers in the regular accounting-related industry but also in investment banking, financial planning, and credit rating careers.

Due to the high competition and very low passing rates, CA-qualified candidates tend to get immense opportunities, not only in Indian firms but also in MNCs.

Anyone can pursue CA, after 12th or HSC, also there is no specific timeline or limit on the age to become a CA. In fact there are a lot of candidates who clear CA, very later in their age.

The CA program is authorized by the law, in the Chartered Accountants Act 1949, also the reason why everyone wants to become a CA.

The average salary of a fresher CA in India is around: INR 6.98 Lacs, which is pretty high compared to other competitive qualifications and can go up to INR 40 Lacs in some cases.

Around 17000 CA’s enter the job market every year which is a fraction passing percentage, compared to the amount of applicants.

Key Highlights:

Duration: 4.5 to 5 years

Regulating Body: ICAI (Institute of Chartered Accountants of India)

Levels: Foundation → Intermediate → Final

Eligibility: After Class 12 (Commerce preferred)

Passing Percentage: ~8–12% (highly competitive)

Skills You Gain:

Financial and Corporate Accounting

Taxation and Auditing

Business Laws and Ethics

Costing and Strategic Financial Management

Career Roles After CA:

Chartered Accountant (CA)

Tax Consultant

Forensic Auditor

Finance Controller

Internal Auditor

CFO or Finance Head

Best For:

Students who aim to build a stable, high-reputation accounting career in India with deep knowledge of Indian tax laws and financial regulations.

Mercantile Law and Financial Management in CA Curriculum

The CA curriculum covers a wide range of subjects, including mercantile law and financial management. These subjects are part of the CA Intermediate course and are crucial for developing a comprehensive understanding of business laws and financial strategies. Successfully completing the CA course equips students with the knowledge and skills needed for a rewarding career in various financial sectors.

What is ACCA?

ACCA is a globally recognised accounting qualification awarded by the Association of Chartered Accountants, U.K.

The qualification has gained prominence and is available in more than 180 countries and was set up initially in 1904.

One must understand that ACCA is not enabled or supported by any act like CA. In fact, in the UK itself, the main qualification for accounting is ICAEW ( Institute of Chartered Accountants in England and Wales).

Having said that ACCA has more than 4 Lac students globally, focussing on the knowledge of GAAP and IFRS.

Why ACCA?

ACCA (Association of Chartered Certified Accountants) is a UK-based global accounting qualification recognized in 180+ countries.

It is designed for students who want international exposure and global career opportunities in finance, audit, and consulting.

Key Highlights:

Duration: 2.5 to 3 years

Regulating Body: Association of Chartered Certified Accountants (UK)

Levels: Applied Knowledge → Applied Skills → Strategic Professional

Eligibility: After Class 12 (Commerce or equivalent)

Passing Percentage: ~40–50% globally

Skills You Gain:

International Financial Reporting (IFRS)

Auditing, Management Accounting, Taxation

Financial Analysis and Strategic Decision-Making

Career Roles After ACCA:

Global Accountant / Auditor

Financial Analyst

Tax Specialist

Risk Manager

Finance Manager

Corporate Finance Consultant

Best For:

Students looking for international accounting exposure, mobility, and Big 4 opportunities in India or abroad.

ACCA vs CA Difficulty Level (Exam Pattern Comparison)

| Criteria | CA (India) | ACCA (UK) |

| Regulating Body | ICAI (India) | ACCA (UK) |

| Levels | Foundation → Intermediate → Final | Applied Knowledge → Applied Skills → Strategic Professional |

| Total Papers | 20+ (Including electives) | 13 papers |

| Pass Rate (Average) | 8–12% | 40–50% |

| Mode of Exam | Offline (in India) | Online (Global centers) |

| Exam Frequency | May & November | 4 sessions/year |

| Duration | 4.5–5 years | 2.5–3 years |

| Difficulty Level | High (India’s toughest professional exam) | Moderate-High (Global standard exams) |

Step-by-Step Exam Roadmap

CA Pathway

12th (Commerce Stream)

→ CA Foundation (Entry-level)

→ CA Intermediate (8 Papers)

→ 3 Years of Articleship

→ CA Final (8 Papers)

Earn “Chartered Accountant (CA)” title

ACCA Pathway

12th (Commerce Stream)

→ ACCA Knowledge Level (3 Papers)

→ ACCA Skill Level (6 Papers)

→ Strategic Professional Level (4 Papers)

→ 3 Years of Professional Experience

Earn “Chartered Certified Accountant (ACCA)” title

| Factor | CA | ACCA |

| Full Form | Chartered Accountancy | Association of Chartered Certified Accountants |

| Country of Origin | India | United Kingdom |

| Recognition | India-specific | Global (180+ countries) |

| Duration | 4.5–5 years | 2.5–3 years |

| Passing Rate | 8–12% | 40–50% |

| Focus Area | Indian Accounting, Tax, Audit | IFRS, Global Accounting, Financial Strategy |

| Average Salary (India) | ₹8–₹25 LPA | ₹6–₹15 LPA |

| Global Opportunities | Limited to India | Strong global recognition |

| Top Recruiters | Deloitte, PwC, EY, KPMG, Indian corporates | Big 4, MNCs, International Finance Firms |

ACCA vs CA – Cost comparison

ACCA is significantly more expensive than CA, primarily due to its international registration fees, higher exam fees, and annual subscription costs.

- ACCA total cost ranges from ₹3.5–₹5 lakh, depending on coaching and exemptions.

- CA total cost averages ₹1.2–₹2 lakh, making it one of the most affordable professional qualifications in India.

| Cost Component | ACCA (India) | CA (India) | Notes / Insights |

|---|---|---|---|

| Registration Cost | ₹8,000 – ₹10,000 | ₹9,000 (CA Foundation) | ACCA costs slightly more but offers global registration. |

| Exam Fees | ₹12,000 – ₹15,000 per paper (13 papers) | ₹1,500 – ₹3,300 per exam (Foundation/Inter/Final) | ACCA exam fees significantly higher overall. |

| Total Exam Cost | ₹1.8 – ₹2.5 lakh | ₹25,000 – ₹35,000 | CA exams are subsidized by ICAI, hence cheaper. |

| Coaching Cost | ₹1.5 – ₹2.5 lakh (full course) | ₹1 – ₹1.5 lakh (full course) | CA usually needs coaching for 3 stages; ACCA coaching is modular but costlier. |

| Total Estimated Cost (All-Inclusive) | ₹3.5 – ₹5 lakh | ₹1.2 – ₹2 lakh | ACCA is 2–3x more expensive than CA. |

| Additional Costs | Annual subscription ~₹12,000; Exemption fees (if applicable) | Articleship expenses (opportunity cost) | ACCA has recurring yearly fees; CA has mandatory articleship. |

If you’re choosing based on cost-efficiency, CA is the clear winner. If your goal is global mobility and IFRS-based careers, ACCA may justify the higher investment.

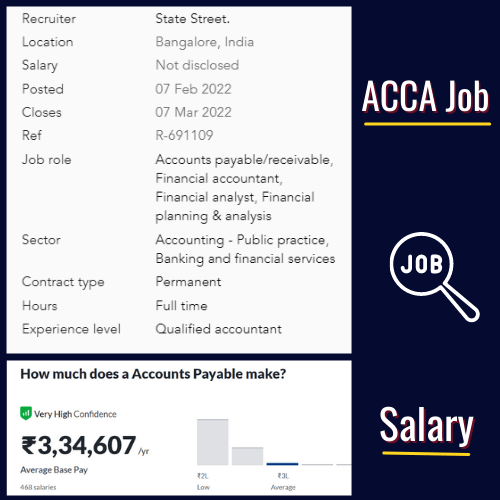

Jobs After ACCA

Now it may sound like ACCA is nothing but some educational qualification, but since India has been majorly a major destination for outsourcing accounting work.

The qualification may make sense for students who wish to forgo the legal benefit of doing CA.

ACCA students can work in

- Treasury

- Accounts receivable

- Budgeting Or Management Accounting

However the concern is always on the quality of jobs available after taking so much main of clearing the ACCA exams. On the right you can see one of the job postings for freshers, this job profile clearly doesn’t even require you to do ACCA. In fact even as a graduate you could enter this job profile.

The more alarming data is that on the ACCA portal itself, there are only 52 jobs posted for entry level and are basically not high quality jobs expected after completing the qualifications like ACCA.

ACCA vs CA job scope

CA vs ACCA global opportunities

CA (India): Recognized and regulated within India, though limited recognition abroad (except some mutual recognition agreements with a few countries).

ACCA (UK): Recognized in 180+ countries, including the UK, UAE, Singapore, Canada, and Australia providing international mobility and better salary potential.

Recruiter Insight (Case Study Quote)

“We often prefer candidates with ACCA qualification when hiring for global finance roles,”

says Rahul Mehta, Finance Director at KPMG India,

“because ACCA-trained professionals understand IFRS and global compliance standards better than region-specific qualifications.”

| Region | CA Demand | ACCA Demand |

| India | Very High | Growing Rapidly |

| UK | Limited | Extremely High |

| Middle East (UAE, Qatar) | Moderate | Very High |

| Singapore | Low | High |

| Australia / Canada | Moderate | High |

| Europe | Limited | Very High |

Jobs after CA

CA professionals have excellent job opportunities across India’s top financial and corporate hubs.

| Job Position | Top Cities | Hiring Companies |

| Audit Manager | Mumbai, Delhi, Chennai | Deloitte, PwC, EY, KPMG |

| Financial Analyst | Bengaluru, Pune, Hyderabad | HDFC, ICICI, Axis Bank |

| Tax Consultant | Ahmedabad, Mumbai | Grant Thornton, BDO, RSM |

| CFO / Finance Head | Delhi, Mumbai | Tata Group, Infosys, Reliance |

| Internal Auditor | Chennai, Pune | Larsen & Toubro, Mahindra, Wipro |

| Forensic Accountant | Mumbai, Gurugram | EY Forensics, KPMG Risk Advisory |

ACCA Vs CA salary in India

Now, let’s seal the deal and discussion by looking at the most important figure, salary. A CA earns on an average INR 9.5 Lacs compared to 4.4 Lacs for an ACCA. Which by the way we are talking in terms of inexperienced CA’s.

| Category | ACCA Salary (India) | CA Salary (India) | Insights |

|---|---|---|---|

| Freshers Salary | ₹4.5 – ₹7 LPA | ₹7 – ₹10 LPA | CA freshers earn more due to India-specific demand; ACCA slightly lower but strong global scope. |

| Post-Qualification Salary (3–5 yrs exp) | ₹8 – ₹15 LPA | ₹12 – ₹20 LPA | CA gets faster salary growth within India; ACCA grows strongly in MNCs. |

| International Salary (UK / UAE / Singapore) | ₹30 – ₹60 LPA (equivalent) | ₹25 – ₹45 LPA (equivalent) | ACCA has broader global recognition → higher overseas opportunities. |

| Big 4 Salary – Entry Level | ₹6 – ₹10 LPA | ₹8 – ₹12 LPA | CA preferred for statutory audit; ACCA preferred for IFRS, global reporting. |

| Big 4 Salary – Senior / Assistant Manager | ₹12 – ₹20 LPA | ₹15 – ₹25 LPA | Both can grow; CAs have slight advantage in Indian taxation roles. |

| Big 4 Salary – Manager / Above | ₹20 – ₹35+ LPA | ₹25 – ₹40+ LPA | At higher levels → qualification matters less, performance matters more. |

ACCA Vs CA- Which is better?

We compiled the main points of comparison between ACCA & CA, on practical aspects that any qualification should offer.

| Comparison | Chartered Accountancy (ICAI) | ACCA |

| Practice In India | Allowed by Law | Not Allowed |

| Demand | Very High | Low |

| Creditability | Very High | Average |

| Fees | 1.85 Lacs | 4.23 Lacs |

| Difficulty | High | Easy |

Pass Rate ACCA vs CA.

It may sound like pursuing CA is very difficult, because of a very low pass rate but you should understand that any legitimate qualification which is respected in the industry for employment will have a low pass rate. Let’s look at some examples

| Qualification | Pass rate |

| CA | 6% |

| CFA | 5-6% |

| CAT ( Tier 1 college) | 2-3% |

The pass rates usually tell us very little about the actual difficulty but the popularity of the qualification or degree.

All three of the above qualification are popular and hence has a huge following or volumes, making the focussed lot lower. Resulting in a low pass rate.

Why CA’s are in Demand and Will be?

Becoming a CA is more than just clearing exams, the students also have to go through the grueling article ships under a practicing chartered accountant.

Ask any chartered accountant and they will share the hard work both physical as well as mental that the ICAI body makes you go through.

The result is that every candiate that manages to complete the ICAI program or becomes a chartered accountant is a filtered high quality resource.

That is the reason why CA’s are in demand, not just because of the exam or low pass rate.

How to do ACCA after CA?

There would be no real logic of combining ACCA with CA, because by 2022 when you are reading this Ind As has already been implemented, which is a deto of IFRS, so whatever benefit ACCA had over CA, related to the IFRS understanding is over.

However if you still decide to do ACCA after CA, then this is how it will workout

- You will be entitled to the following exemptions. F1-F9 – All Papers CA Final Student Qualified IPCC benefits + F5 (if cleared AMA), F7 (if cleared FR), F9 (if cleared SFM)

- You need to submit your qualification documents to ACCA

- You must also be aware that exemptions come at a cost and since CA gets a lot of exemptions. This can become a costly affair

Now in case you take my advice, then the combination below makes more sense than ACCA after CA.

A good combination though could be doing the following

- Dip IFRS as an additional certification

- CPA after completing CA ( Opens doors abroad )

- Financial modelling ( Opens doors for investment banking )

- CFA ( Opens door towards all finance careers)

You can also read a detailed article on: Certifications along with CA here

ACCA vs CA: which is better?

The future of accounting is going to be more competitive than ever, with a lot of automation and technology use. This alone is going to be difficult for CA, let alone doing a sub standard wanna be qualification like ACCA. With all the due respect for ACCA, we cannot deny the data, that would be the wrong advice just to make things sugary and rosy. Hope this article helped you, even if it didn’t excite you on a easy alternate to CA.

| Student Goal | Best Qualification | Why This Is the Better Choice |

|---|---|---|

| Want a global finance or accounting career | ACCA | Globally recognized in 180+ countries; strong demand in UK, UAE, Singapore, Europe; IFRS-focused. |

| Want to build a long-term career in India | CA | Highly respected in India; best for taxation, audit, and statutory roles; strong brand value. |

| Looking for faster completion and flexible exams | ACCA | Multiple exam windows per year; modular structure; higher pass rates (40–50%). |

| Can dedicate 4–5 years to a difficult qualification | CA | Rigor + depth; higher difficulty but strong payoff in India; top salaries. |

| Interested in Indian taxation, audit, compliance | CA | ICAI’s curriculum is India-specific; high demand in CA firms and corporates. |

| Interested in international accounting (IFRS), MNC roles | ACCA | Curriculum aligns with global accounting rules; preferred by Big 4 global teams. |

| Want higher starting salary in India | CA | CA freshers usually start with higher domestic salaries. |

| Planning to work abroad after studies | ACCA | Provides global mobility; exemptions and pathways available in many countries. |

| Prefer practical + skill-based learning over heavy theory | ACCA | More application-driven; integrates financial reporting, audit, business analysis. |

| Aspiring to start their own CA practice | CA | Only CAs can sign audit reports and start licensed firms in India. |

Choose ACCA → If you want global exposure, flexible exams, and work in MNCs/Big 4 worldwide.

Choose CA → If you want a premium Indian qualification, higher domestic salary, and long-term practice opportunities.

FAQ

No. CA is considered more difficult due to its lower pass rate (8–12%), longer duration, and in-depth coverage of Indian tax laws.

ACCA is challenging too but has a structured global syllabus with higher pass percentages and flexible exam schedules.

Yes. In fact, qualified CAs get exemptions in up to 9 ACCA papers, allowing them to complete ACCA faster (in about 1–1.5 years).

Many professionals do this to gain global recognition and work opportunities abroad.

In India, CAs generally earn more initially (₹8–₹25 LPA).

However, ACCA professionals working internationally can earn ₹20–₹40 LPA+, depending on their experience and country of employment.

Yes, ACCA is recognized by top MNCs and Big 4 firms in India for roles in financial reporting, taxation, and audit.

However, for statutory audits and signing authority, only CAs registered with ICAI can do so.

On average, it takes 2.5 to 3 years to complete all ACCA exams and gain the required 3 years of practical experience for certification.

Students with B.Com or CA background may complete it faster due to paper exemptions.