Last updated on August 8th, 2025 at 02:42 pm

Do you know the 3 year degree that you pursue, is basically a combination of small courses. Also, ask yourself did you actually find all the subjects you learned useful for placements? If the answer is no, then I have good news for you. Which is, in today’s corporate era, you need short term certification courses in finance to get a job. Finance certification demand increased by 50% in last some years. This industry is trending but college curiculum is not enough you to enter into this industry.

So, before I jump into the short term certification courses in finance, I will take you through the industry trends, then various roles in finance and finally will link that to the short term certification courses.

Why should you perceive short term certification courses in Finance

Faster career impact because the courses are short. Courses are in deep and to the point. Perfect for you to opt for you first finance job role. Due to industry recognized skills and courses you get better job opportunities. The job roles are more flexible also provide you better pay. The reason being is the company wont have to invest extra time in you to teach you the skill. As you are trained by the institutes you will be comfortable around the work given to you. Which is very much less stressful. Perceive short term finance certification courses because they provide you in depth about the topics with real case studies. You can opt for the courses from anywhere and do it anytime. Self paced courses can be opted if you a working professionals. You get a added advantage when you have a extra skill in resume indicating your knowledge and abilities. These courses don’t take much time to complete making sure to stay updated by the industry standards is important. Whether you are a student or working professional skilling up never stops or should not be stopped.

Summary: Short Term Certification Courses in Finance

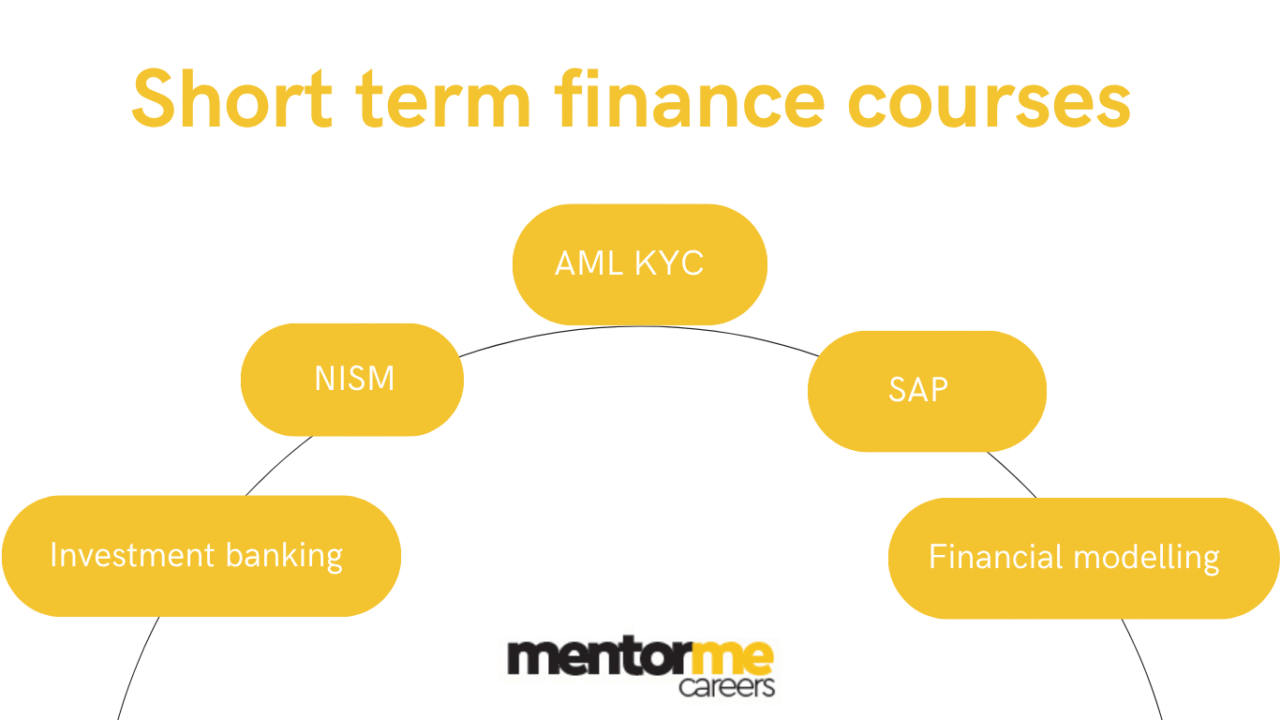

| Course Name | Certification Body |

| Financial modeling By Mentor Me Careers | NSE Academy |

| Investment Banking Operations | Mentor Me Careers |

| SAP FICO | SAP |

| NISM 5A | NISM |

| GST Practitioner | ICAI |

| AML KYC | Mentor me careers |

Top Trends in Finance Industry

Now, it’s extremely important to understand what is changing in finance. Which should guide into selecting the right short term certification courses in finance.

- Investment Banking Broker Research on the decline.

- Secondly fund management companies are outsourcing research.

- Thirdly,Use of Generative AI in customer support.

- Fourthly, the rise of wealth management in India.

- Finally, the growth of risk management.

Now, these trends will give us a framework for a basis to narrow down on actionable courses.

Short Term Certification Courses in Finance

So, since you understand now the general trends now let me take you through the relevant courses which will be helpful.

Financial modeling Course

Now, coming up the first course that is pretty straight forward for all finance students in the short term category i.e Financial modeling. Accordingly, Financial modeling is decision making finance tool, involving spreadsheets, financial calculations and valuations.

Fees & Duration

Financial modelling

3.5 months 46k

The Mentor Me Careers Financial Modeling course is an Excel-based certification designed to advance careers in finance. Created by industry veterans including retired investment bankers, credit analysts, and fund managers it teaches practical, real-world financial applications.

Job Roles Targeted Using Financial modeling

Now, let me take you through the various job roles which would require Financial modeling as the basic skill.

- Firstly, Investment banking analyst

- Secondly, Equity research analyst

- Thirdly, Financial planning and analysis

So, all of the above roles will have their interviews testing this skill in one form or the other. You can check the interview questions on Financial modeling.

Investment Banking operations Course

Another course, which is a short term certification courses in finance. Targeted at investment banking trade operations. So, to give you the context, the companies in this field include.

- BNY mellon

- Goldman Sachs

- JP morgan

- BNP Paribas

Just to name a few.

However the scope of this course in terms of learning include

- Financial markets i.e Equity markets, derivatives, Fixed income

- Trade life cycle operations

- AML kyc

Fees & Duration

3.5 months 46k provided by mentor me careers

Jobs Targeted Using this course

Firstly, let me list down the type of roles this Course would be relevant for;

- Trade reconciliation

- Trade support

- Derivatives Trader

- Operations analyst

Also, the CTC ranges between 5-6 Lacs P.A for freshers.

SAP FICO

Another short term course which is very useful to get a job in accounting and finance. SAP is an international business management tool, which is used by many companies. Hence, there is huge demand for SAP professionals, who know the implementation of SAP FICO systems. The course for SAP covers the following;

- SAP Fico environment

- The set up of SAP System

- Tools, Reports and features

- Implementation of SAP

SAP Certification exam, two attempts 252 USD

Features:

- Includes:

- Two SAP Certification exam attempts, either In two separate solution areas or in one solution in case you need to try again.

- 10 hours of access to certification-relevant hands-on practice systems to experiment and learn in real SAP environments without risking live projects.

Major Roles after Completion of SAP FICO

The major roles targeted after completion of SAP fico is of the SAP consultant role. Which basically means you act as the agent of implementation of SAP modules in various companies.

NISM VA- Wealth Management

Now, this short term course in finance I am suggesting because of the surge in wealth management. Because India is on the path of formalisation and as the economy becomes more formalised. Firstly, a lot of wealth gets converted from non formal assets to formal assets like mutual funds. Which would mean that, all of these people would require wealth management services.

NISM provides variety of courses for investment banking and also basic finance courses their fees are not high for exam registeration also the syllabus and study material is easy to understand can be studied in less amount of time mostly students opt for NISM for the first time in their finance career step because the courses are affordable, easy to obtain.

Job Roles After NISM VA Course

So, if you are seriously thinking about getting into the wealth management field. Then the first certification course to complete would be the NISM VA. Firstly, it’s a very basic module, which covers the basic of financial products and financial advisory. However, it is the compulsory certification required to work in the field of wealth management.

Some of the roles in wealth management include

- Relationship Manager

- Financial Advisor

- Mutual Fund Distributor

Check out more courses from NISM.

GST Practitioner Course

In order to understand why I am recommending this course, is to first understand the concept of ” Formalisation of an economy”. So, post the implementation of GST in India, everyone has to pay GST and eventually file for it either quarterly or monthly. Which means, that regulatory compliance increases. However, there are millions of business’s in India, and the number of Chartered accountants are not enough.

Hence there is a scope for you to either practice as a GST agent or practitioner in your own set up.

Recommended Course

In my opinion the course given by ICAI on GST practitioner is the best suited program.Plus its affordable.

AML KYC

Anti money laundering know your customer is a emerging field in finance lately as the world is heading towards digital zone more & more it is becoming important for all the institutions especially finance institutions. AML KYC analyst handle the documentation, analysis and risk management part to avoid any financial digital crimes or to analyze, solve the crime happened. Make policies to not let anyone attempt any digital crime these analyst make sure of this processes.

Mentor me careers provide a high quality course for the people who are passionate about this field. This course is of 1.5months online mode with full access of study material and also placement assistance after the course is completed which goes for about 40k.

The course is designed around the huge influx of AML KYC realted processes which are migrating towards India.According to grandviewresearch AML KYC Market in India is expected to grow at a staggering 20% CAGR.

The CARK( Certified AML & Regulatory KYC) course is designed for entry level jobs in this field. Students with a graduate degree can purse this course to get employment opportunities in AML KYC Jobs.

Trends of Short Term Certification Courses in Finance

Looking at the market and its situation, companies are looking for people who have the skill rather than the degree. Degree is just a benchmark if at the end you don’t have a skill you wont get the job role you are looking for.

- Skill based job ready curriculum

- Flexible and more accessible

- Fintech & Digital tranformation

- ESG

- Cost and outcome focused

Conclusion

So, those we the short term certification courses in finance, which can help you in not only upgrading your skills. But the important thing is that it helps you in finding relevant jobs in the industry.

Related Articles