Financial Modeling Course Fees Guranteed Interviews

3 Months Financial Modeling Course with Interview specific preperation & Guranteed Interviews

- Live Online Classes ₹38999 + GST

- 💼 Interviews Untill You Get Placed

- 🗓️ 3 Months — Offine/Online Batches

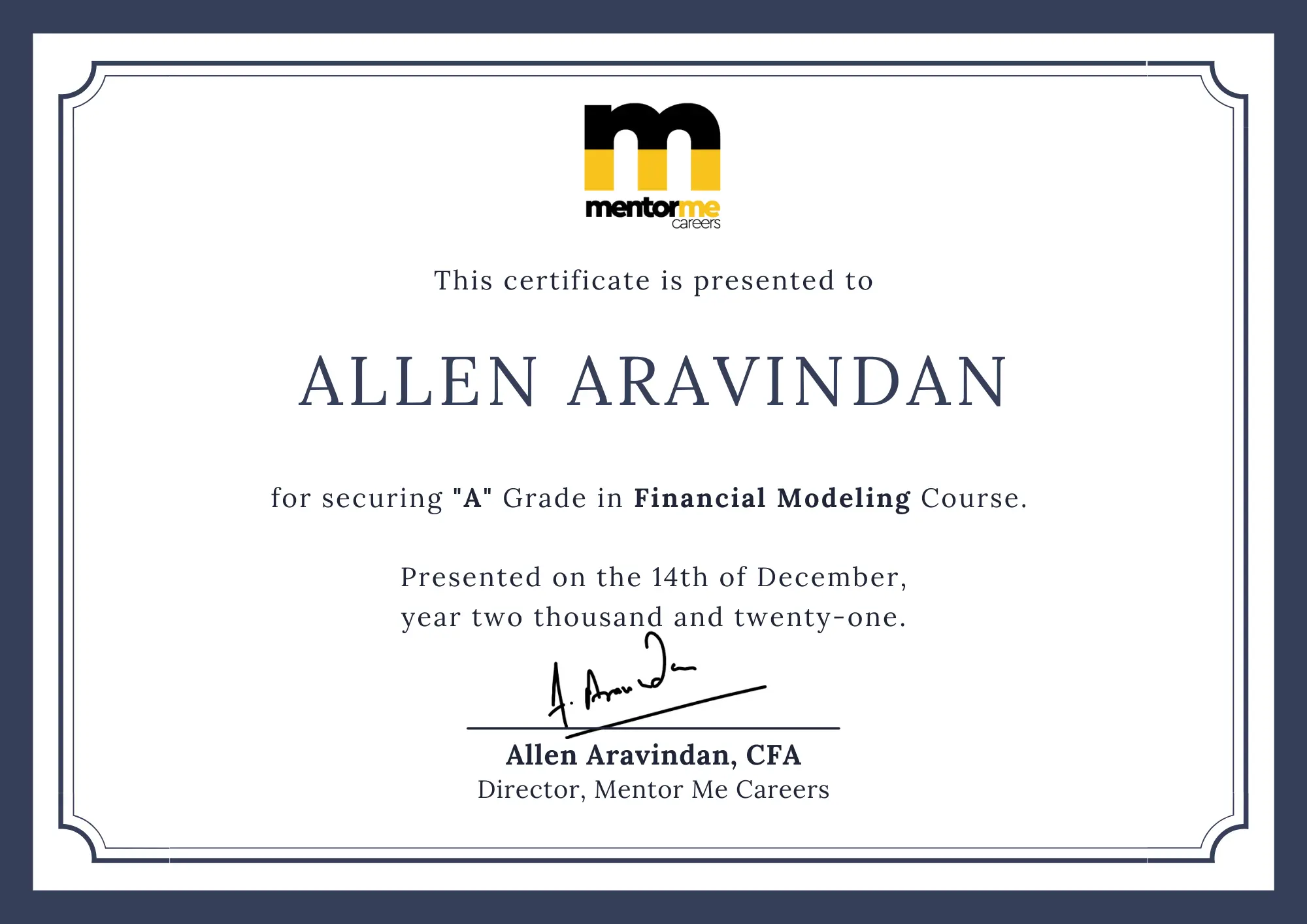

- 🎓 Industry Recognised Certification

Fees & Variants

Financial Modeling — Online (Live)

2.5 months of Live Training with expert faculties and hands-on practice.

- Live instructor-led classes

- Access to portal & recordings

- Real-world case studies

- Placement Assistance

Financial Modeling — Offline (Classroom)

3.5 months of Live Training with expert faculties and hands-on practice.

- Classroom sessions

- Interview Preparations & Mocks

- Class recordings

- Placement Assistance

Service 2026verified by TrustindexTrustindex verifies that the company has a review score above 4.5, based on reviews collected on Google over the past 12 months, qualifying it to receive the Top Rated Certificate.

Financial Modeling Fees Comparison

Finance Placement Reports

Download past placement reports to see our student success.

| Period | View Report |

|---|---|

| Q1 FY 26 | View Now |

| Q4 FY 25 | View Now |

| Q3 FY 25 | View Now |

| Q2 FY 25 | View Now |

| Q1 FY 25 | View Now |

| Q4 FY 24 | View Now |

| Q3 FY 24 | View Now |

| Q1 FY 24 | View Now |

Financial Modeling

Course Curriculum

Course Modules & Topics

Mentor me career's financial modelling and Valuation course comes with a built in industry recognised certification for providing valid core finance certification for students..

Why Our Students Crack Interviews?

Basic to Advance Excel & VBA +

Excel mastery for analysts: shortcuts, dynamic ranges, LOOKUPs, INDEX-MATCH, Pivots, What-If, sensitivity & scenario tools. Intro to VBA for automation.

Fundamentals of Accounting for Financial Modeling +

Three-statement links & flows, working capital, accruals vs cash, common adjustments for modeling.

Financial Modeling Fundamentals +

Drivers, revenue/COGS modeling, operating schedules, debt schedule, interest circularity, model audit & hygiene.

MS PowerPoint in Investment Banking +

IB deck standards, football fields, comps tables, charting, and client-ready formatting.

DCF Valuation +

FCFF/FCFE, WACC, terminal value, bridge to EV/equity value, sensitivities.

Trading Comparable +

Peer set selection, normalization, key multiples (EV/EBITDA, P/E, P/B), adjustments & benchmarking.

Transaction Comparable +

Precedent deals, premiums, control & synergies, deriving valuation ranges.

Football Field Analysis +

Visualizing valuation ranges from DCF, comps & transactions; presentation best practices.

Leverage Buyout (LBO) +

Sources & uses, capital structure, returns (IRR/MOIC), value creation levers & sensitivities.

Merger Model (M&A) +

Accretion/dilution, purchase accounting, synergies, financing & pro-forma analysis.

Valuation of a Banking Company +

Bank-specific statements, NIM/asset quality, regulatory capital, P/B & residual income approaches.

Real-estate Model +

Project cash flows, sales schedules, debt draws, IRR/NPV, sensitivity to price/absorption.

Oil & Gas Company Model +

Commodity drivers, reserves, lifting costs, DD&A, and sector-specific valuation notes.

Key Features

Learn Live Online or Offline

Learn concepts with industry led experts.

1:1 doubt solving

Get your doubts solved by experts through Q&A forum within 24 hours.

Interview Based Tests

Get Tested on Real Interview level assessments

Live Mock Interviews

Get Tested by Investment bankers

Interview Preperation

Comprehensive Interview Preperation

Get Placed

Unlimited Interviews Till You Get Placed

FAQ's Financial Modeling Course Fees

The course stresses on DCF and other valuation based financial modeling which is advanced in nature by exposing learners to practical case studies as a preparation for financial analysis, investment banking and corporate finance careers.

- Such a course is perfect for finance practitioners, MBA’s, engineers, and other career changers who are looking to move into, amongst others, investment banking or financial analytics.

he course comprises 240 hours of practice-based training with gaming, modeling with AI, and individual assistance in job placements.

Yes, the course has well structured placement services relevant to acquiring the desired position in top financial institutions.

In addition to Power BI, the course focuses on Excel, and how to employ Python in financial modeling and data analysis.

Financial Modelling course in Mentor me careers ranges from 39,999 to 49,999 if you include CFA coaching as well in it.

Duration for financial modelling course is 3.5 months and after that mock test will be taken for placement preparation.

Yes totally, financial modelling is the basic skill in finance field. Acquiring this skill is the first step and for freshers this is a very important skill.

Yes, on YouTube you can learn financial modelling for free. Enrolling in institutes like mentor me careers gives a opportunity for more than just learning.

Other Related Courses

Certificate in Investment Banking Operations Analyst

- 3–6 months program

- 100% Interview Guaranteed

CFA Level 1 Training

- 6 months exhaustive prep

- 3 Mock Exams

- ~80% Pass Rate*

AML KYC Certification

- IIBF Certification Prep

- 100% Placement Assistance