Last updated on February 8th, 2024 at 02:28 pm

So, huge inflection points are being created in various sub parts of the capital market sector. While these changes are a culmination of decades of development, nevertheless they are happening. In this article, I will discuss the five major trends in Indian capital market, with a special emphasis on the year 2023.

Democratisation of Advice- Recent Trends in Indian capital Market

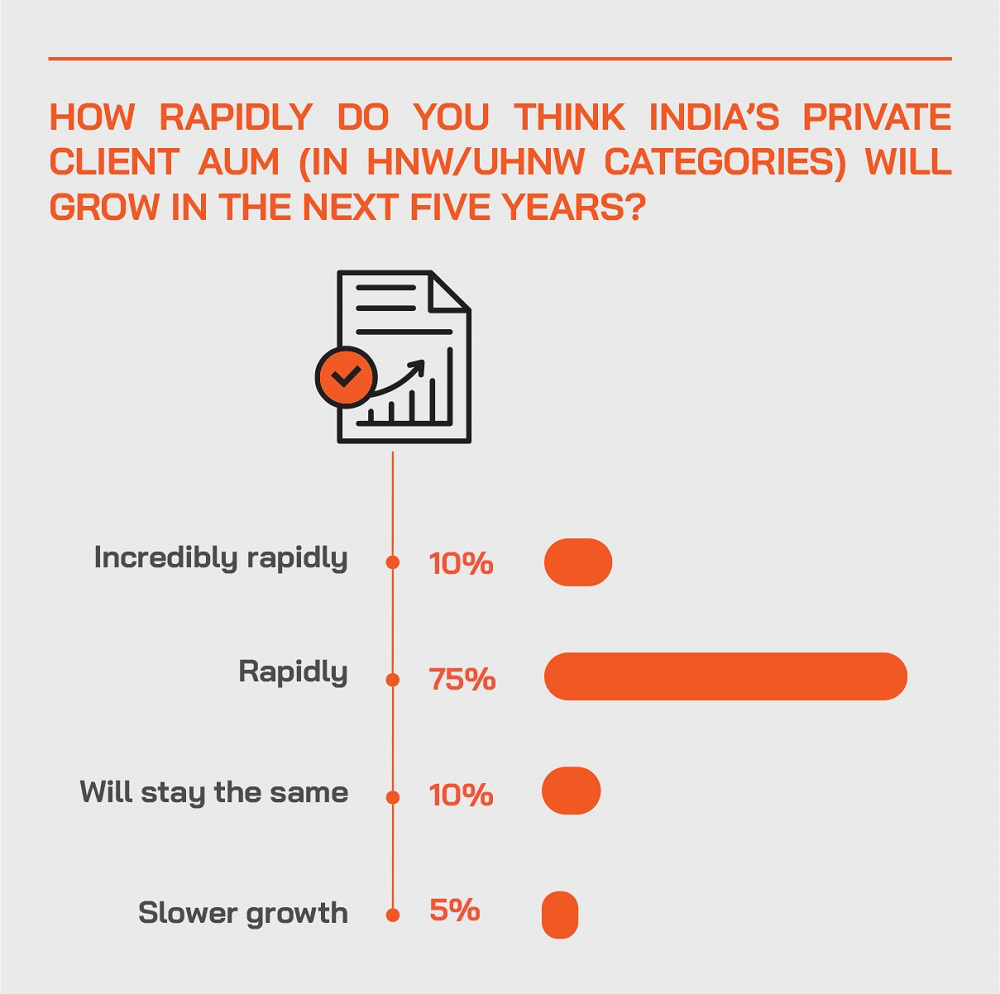

According to Inc42 and various other data sources, Indian HNI’s are poised to double to 6 Lac from 3.5 Lacs by 2025. At the same time the total wealth of India, is expected to increase at 10% CAGR to $5 Trillion by 2025. Which means, that all these wealth would need wealth managers. However, it might not just happen in the usual way. The generic means of managing these advices and portfolio management was the same old financial advisory form a.k.a mutual fund distributors.

However, with the wave of technology and its use in India, it is obvious that a lot of these advices will happen over the phone.

As this overall inflection point takes in the wealth management industry, more and more wealth tech players are expected to increase.

Let me list down some reasons for this recent trends in Indian capital market.

Reasons for Surge in Wealth Management

Now, it’s very easy to think that all of this growth is attributed to the growth of technology. However, technology just doesn’t appear by itself, unless there is a catalyst. Now, to keep things simple let me call that catalyst, a boost. So what changed in the past 10 years, which is boosting this rapid change?

- Reduction in data charges

- Implementation of GST- Formalisation of economy

- Lower incentive to invest in real estate market- due to crackdown on black money.

- 60% penetration of data and smart phone penetration.

Hence, this process of formalisation of economy will strengthen further in the coming years.

Effect on Jobs in Wealth Management

Now, this obviously means that it also means that there would be more people required to reach to these clients. Hence, if you are someone, who believes in this story and wants to make a lasting career. Then wealth management can be a great destination.

Transaction Flows & Fintech- Recent Trends in Indian capital Market

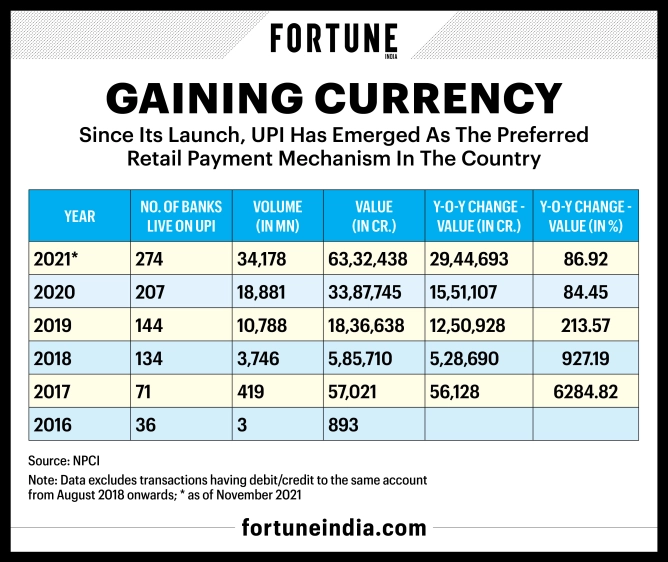

The image above should suffice the inference. The payments mode of Unique Payment interface is one of the biggest recent trends in Indian capital market. While the adoption has been high, at the same time this means that the velocity of money increases further. This also means that there would new players in the digital banking space and there would more financing happening as this increases the overall capital availability for the market.

Investment Banking-Trends Recent Trends in Indian capital Market

Investment banking has been taking the AI wave with a storm. For example; Morgan stanley recently announced that they have been creating an internal generative AI Tool which provides insights directly, rather than wasting a lot of time on research. Similarly in the banking side, regulations are increasing and becoming more stringent to prevent another bank failures like 2008. Also, talent management & recruitment is another big challenge in investment banking industry. The infamous Forbes article is the proof of it.

The work from Home Shift-Recent Trends in Indian capital Market

A 2021 survey by Microsoft revealed that over 70% of workers preferred to predominantly work from home, and yet many investment banks still have strict in-person work policies. The overarching industry trend is that investment banks are catching on to the importance of meeting some of the requirements posed by the employees they want to attract—they are offering more benefits and introducing new measures like faster promotions, higher bonuses, more hires to reduce workloads, and more limited working hours.

Market Infrastructure-Recent Trends in Indian capital Market

The market infrastructure of the future is going to be nothing but more digital. With the optimisation of more faster robotic process automation in the future, and smaller transaction times. So, this is going to be nothing but more complex. The question to ask is whether all of this benefits or harms the industry.

So let me summarise some important recent trends in the Indian capital market from the perspective of market infrastructure

- Demand for data and analytics increasing

- Secondly, the direct infrastructure availability to buy side participants

- Thirdly, newer avenues of access to capital

- Finally higher regulation for even the same infrastructure developed.

Conclusion

So, in summary I can say that a lot has been happening and in the services side I don't see that work is actually going to decrease but become more complex. There would be still a huge demand for analysts, however the analysts requirement is going to just keep on increasing in the future. For example; Financial modelling is not going to be enough but the ability to think about the financial model in the overall context of investments is going to be critical.