Last updated on July 26th, 2025 at 02:55 pm

So, Equity research interviews can sometimes be smooth like butter, or rough like thunderstorms depending on the interviewer. Some interviewers focus on the fundamentals, while some might grill you on sector-specific questions. In this article, I will cover the most relevant equity research analyst interview questions.

First Round- Equity Research Analyst Interview Questions

So, you don’t really get to the main interview of the face-to-face round, unless you get filtered in this first round. Now usually, I have seen that companies can conduct the first round of interviews in either of the three ways;

- Case-Based

- Aptitude Based quizzes.

- Finance technical quizzes

Case-Based Equity Research Analyst Interview Questions

Now, when I say case-based it means an actual equity research model, part model completion or finding errors in a model. Also, you might either be told to complete the case and send the working file back or there might be a quiz in which you might have to select the right answer. Also, a note here the assessment can take place in either of the three areas;

- Firstly, Financial statement analysis

- Second, Excel for Finance

- Finally, Valuation based questions.

Behavioural questions

SWOT analysis includes questions about your personality, choices, perspective which will let them know about you better and also will know how you will handle the tasks which will be given to you. This enables the interviewer to know your current priorities also predict future from your answers. This analysis basically lets you know your future in the company, image of yours also builds a connection with the company.

Why equity research ? Most of the like 90% you will be asked this question please don’t give a straight forward answer to this one. Tell them a story, make a connection this is the chance to convince them that you are the perfect candidate for this role in their company. Take that chance hit it. This is not just me but anyone you ask in the industry they will tell you how much a question or this question matters. Story telling in these situations which is connected to your life helps very much. They want a right candidate which will stay for longer in the company and will growth.

Walk me through your resume, same as earlier make a story but stay true to your own story here when I say make a story it doesn’t mean it literally mean make a story, meaning is connect with them with your own story big companies are hiring for long term make sure you keep a good reputation make a place in company and interviews is the first step towards it.

So, to get started check out the excel based case below, this is a live case based equity research interview case. Download, the template and then once solved use the quiz to check if you got it right.

Excel Case- Equity Research Interview

After solving the case, Complete the quiz.

Financial Statement Analysis-Based Questions

So, a lot of companies would rather do the case based questions during the advanced stages rather than at the start. While, they might want to test your fundamentals first. Which is why I always advice students to prepare for fundamentals thoroughly, rather than just focussing on valuation. To get a feel of the preparation, you can try taking the below financial statement analysis quiz, which I created after observing many equity research interviews we did for our students.

Valuation-Based Equity Research Interview Questions

So, this type of interview case study might include an existing model, which needs to be completed. The objective of the case is to test if you understand how valuation works in real-time at the fundamental level.

Technical Second Round- Equity Research Analyst Interview Questions

So, once you clear the first round of screening and you get shortlisted. Now, its time where the recruiter usually wants to confirm the results, by doing a live in person technical assessment. While, you might think, you have already cleared the test. However, the problem is that many candidates, do perform good on a test based interview. As soon, as the same questions are asked in person, the results look very different.

Beginner Level- Technical Equity Research

So let me take you through some range of questions.

What comes in the asset side of the Balance sheet?

The asset side of the balance sheet includes current and non current assets. Current assets include liquid assets like inventory, cash , recivables. While non current assets include, fixed assets, intangible assets.

If we forget to charge Rs.10 in depreciation in the income statement and tax rate is 10%, how will we correct the other statements and what will be its effect on the income statement?

So, we need to reduce the profit by 10% of 10, which is 1, similary reduce retained earnings in the equity side of the balance sheet. While add 10% of 10 in the cash flow statement. At the same time reduce the relevant fixed asset account with 10.

What is NPV?

So, if we invest $100 in a project and which generates cashflows of $50, $100, $300 over three years. At the same time, the cost of capital is let’s say 10%. The net present value calculates, the present value of cash flows minus our initial investment. So essentially, it calculates the absolute return generated by the project.

What comes under current assets ?

Under current assets, these are assets which can be converted into cash within a year. Out of which cash and investment securities are the most liquid while, inventory, recivables and pre-paid expenses are less liquid comparatively.

What are prepaid expenses?

So, pre-paid expenses is an asset, which is created when I pay an advance to another businesss for which the other business is yet to provide services.For example; pre-paid rent.

What are outstanding liabilities ?

There can be multiple definitions for outstanding liabilities. But one interesting example is contingent liabilities, which are liabilities related to a pending legal case.

Explain your Previous internships.

Usually, you want to be able to explain your achievements in previous internships and do it more quantitatively.

What is DCF?

So, DCF is discounted cash flow and is used to find the present value of future cashflows in a equity valuation model. While the same concept also calculates net present value in case of a project finance model.

What is CAPM?

CAPM, stands for capital asset pricing model is used to calculate the cost of equity for a company. Which is Risk free rate+ Beta( Return on Market – Risk free rate). We use this rate, as discount rate in DCF Models.

What is WACC?

While, discounting Free cash flow to the firm we use WACC instead of cost of equity. Which is because the firm has multiple source of capital, with different types of cost.

What is FCFF, FCFE and it’s formulas?

FCFF= EBIT(1-T)+ Dep+ Changes in Wc- Capex

FCFE= Net Income+ Dep+ Changes in wc- capex +- Deb raised or repaid

Explain all the 3 financial statements and it’s components.

The three financial statements are income statement, balance sheet and cash flow statement. Income statement has revenue- cogs= Gross profit- indirect expenss= EBITDA- DA= EBIT-I=EBT-T=PAT. Cash flow statement has CFO, CFI, CFF. While balance sheet has assets with current and non current, liabilities side has current and non current liabilities, while equity has contributed capital and retained earnings.

Advance Level- Aptitute Testing Equity Research Questions

How many burgers are sold during the lunch hour in the office complex?

Now, here the whole object of asking you this question is to test on how you think. Not necessarily, that the answer has to be exact. After all, everything research is based on assumptions.

So, you could answer this by first taking the following approach

- What is the size of the building?- It may be an approximate but lets say we quantify in terms of number of estimated companies in the building and average number of employees per company. So, may be 300 employees, 10 companies= 3000 Total population.

- Next, lets say for serving 3000 people, there must be at least 20-30 stalls or mini restaurants.

- Out of that since we giving an Indian interview, the maximum variety of options available can be ( mexical, Chinese, Indian, general cafes, south Indian).

- So even if there are 2 stalls per type of food, then we are saying that total 2 cafes which might be selling burgers.

- Now, out of 3000 employees there is a good change that more than 50% of the population will eat the more cheaper option which is Indian and south Indian. While Chinese and Mexican at lunch time or office time looks like rare. So let’s assume that 35% of the population might take a quick snack at a café. But since its an office café, not all will eat burger because its heavy, most will prefer sandwiches.

- So, out of that 35%, lets assume 5% will take burger and most will eat light sancks. So 5% of 3000 x2 times a day=300 burgers.

- Now, the trick here is to see if 60,000 per day of revenue makes sense from 5% of the food sale.

Here the major object is approach and logic, not the answer.

There are 27 identical balls with only one ball having a different weight from others. Give the minimum possible steps to identify that mis-weighted ball.

- Firstly, Divide the balls into 2+2+1 parts. Weigh the groups with 2 balls.

- Secondly, If they weigh the same the other is having a different weight.

- Otherwise, take the group with greater weight(as it has the required ball) and

measure them one vs one (2 times measuring case).

Take out exactly 4 litres of water using a 5 litres and a 3 litre can, with unlimited supply of water

So, this is simple take fill half of the 5 Litre can and 3 Litre can. It makes it 4 Litre.

Common Equity analyst interview questions

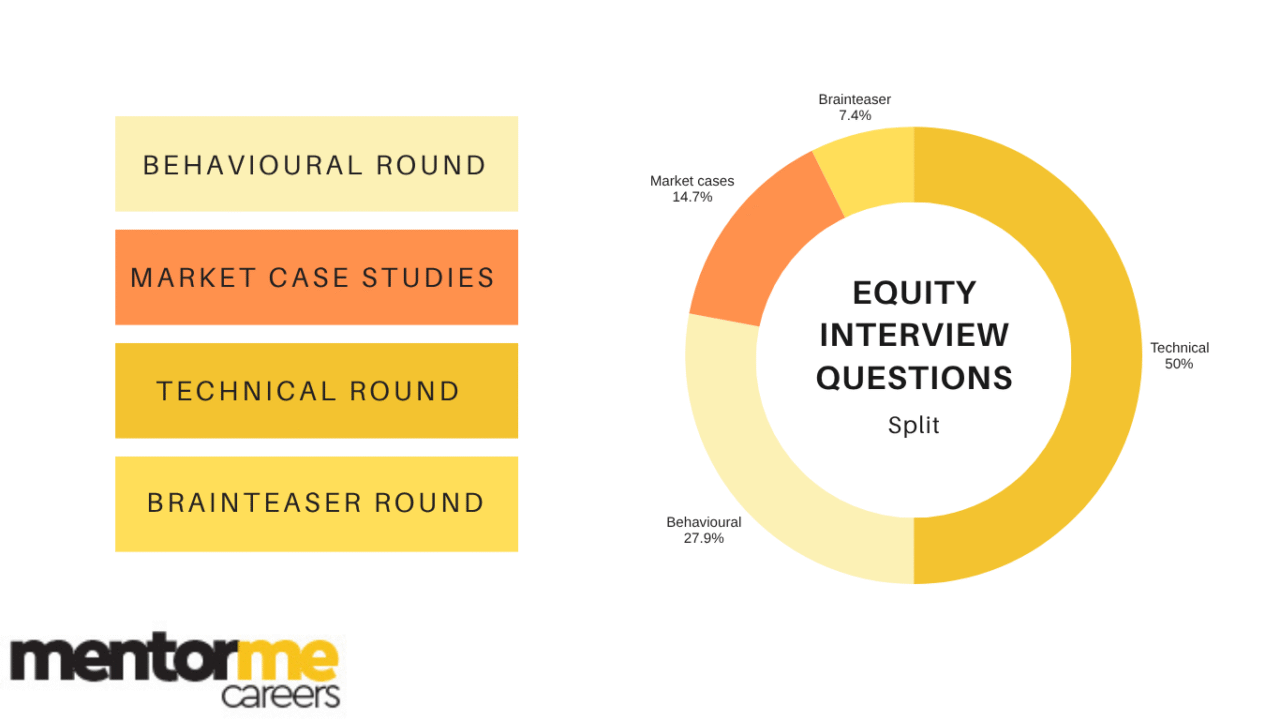

As seen earlier there are 3 rounds in these rounds. In these rounds theory, technical & other questions asked. Lets see some common questions asked by companies. So you wont miss anything when you go in for interviews

What is IRR?

Internal Run rate is financial metric used to measure the profitability of a organization. Higher IRR meaning high profitability which attracts more investors.

What is enterprise value?

Enterprise value is the value of the company as whole. Metric used to identify the value of company.

How to calculate MOIC ?

Multiple invested on capital is total cash inflows/Initial Investment. MOIC is used to calculate the performance of the investment done by investors.

What is entry/exit multiple? How to calculate entry/exit multiple?

The entry multiple represents the price paid for a company as a function of a financial metric at the time of acquisition. The exit multiple is the valuation multiple applied when selling or exiting the investment, again as a function of a financial metric (often EBITDA).

- Entry Multiple = Entry Price (or Enterprise Value) ÷ Financial Metric at Entry

- Exit Multiple = Exit Price (or Enterprise Value) ÷ Financial Metric at Exit

Why do you want to work with us?

What did you learn in Financial Modelling?

FAQ

How do i prepare for equity research analyst interview?

Go through theory and concepts. Terms and their formula. Read as many case studies you can. Also prepare for behavioural questions, last but not least soft skills communication. Present yourself with confidence.

Skills Required for Equity Research analyst?

Excel is a must for equity research analyst. Communication skills and analytical skills is some used on everyday basis. Also you should know how to make models.