Last updated on September 29th, 2023 at 02:53 pm

So, are you thinking of venturing your chances, of working with venture capital firms in delhi? Then, ill take you through a filtered list of venture capital firms that might be interested in hiring new talent. Now this article will also be useful to you, because of most of these venture firms are SEBI registered. Hence, as per the SEBI rules of alternative investment fund, none of them are allowed to market themselves.

What is Venture Capital?

Venture capital is a type of private equity investment that provides funding for early-stage or high-risk companies. It is typically provided by institutional investors, high-net-worth individuals, or venture capital firms. The goal of venture capital is to help young companies grow and become successful by providing them with financial resources and strategic support.

Venture capital firms invest in companies with high growth potential in exchange for equity ownership in the company. This means that the venture capital firm becomes a shareholder in the company and receives a portion of the profits if the company becomes successful. In addition to providing financial resources, venture capital firms also offer valuable support to their portfolio companies, including business advice, strategic guidance, and connections to industry leaders and potential customers.

One of the key benefits of venture capital is that it provides funding for companies that may not be able to secure traditional bank loans or public financing. This is because venture capital firms are willing to take on higher risks in exchange for the potential for higher returns. Additionally, venture capital allows companies to grow and scale quickly, which can be crucial for success in highly competitive industries.

Drawbacks of Venture Capital

However, venture capital also has some drawbacks. One of the main drawbacks is that it can be difficult for startups to secure venture capital funding. This is because venture capital firms are selective about the companies they invest in and are only interested in companies that have the potential for high returns. Additionally, venture capital investment can dilute the equity of the founding team and can come with high expectations for rapid growth and profitability.

In conclusion, venture capital is an important source of financing for high-growth companies that are seeking to scale their operations and achieve success. Although it can be challenging to secure venture capital funding, the benefits of this type of investment can be substantial. Venture capital provides companies with financial resources, strategic support, and the potential for rapid growth and success.

Venture Capital Trends in India

Venture capital (VC) in India has experienced significant growth in recent years, driven by a number of factors including an increasing entrepreneurial ecosystem, a growing economy, and favorable government policies. The Indian startup ecosystem has attracted a large amount of venture capital investment, leading to the growth of several unicorns and a vibrant startup culture.

Here are some of the recent VC trends in India:

- Rise of Indian Unicorns: In recent years, India has seen the rise of several unicorns, including companies such as Flipkart, Paytm, Ola, and Byju’s. This has been a major driver of VC investment in the country.

- Focus on Technology and Digital Companies: With the growth of the digital economy in India, there has been an increased focus on technology and digital companies, particularly those in the e-commerce, fintech, and healthcare sectors.

- Growth of Corporate Venture Capital: There has been an increase in corporate venture capital (CVC) investment in India, as established companies look to invest in startups and tap into the innovation that they bring.

- Expansion of Early-Stage Investment: Early-stage investment has been growing in India, as investors look to identify and support promising startups at an early stage.

- Increasing Government Support: The Indian government has been supportive of the startup ecosystem, providing tax incentives, funding, and other support to encourage entrepreneurship and innovation.

In conclusion, the Indian VC market has grown rapidly in recent years, and is expected to continue to grow in the future. The country’s supportive environment, growing economy, and large pool of talented entrepreneurs have made it an attractive destination for venture capital investment.

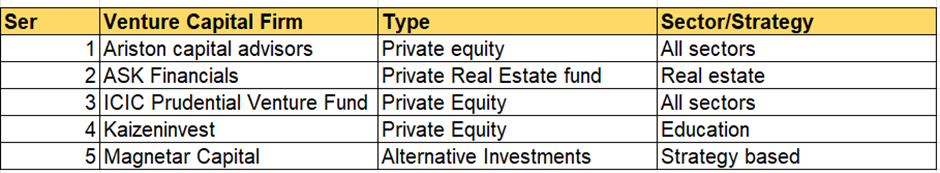

Venture Capital Firms in Delhi

Ariston Capital Advisors- Venture Capital Firm in Delhi

So, Ariston capital advisor is a venture capital firm in Delhi, which specialises in;

- Private Equity Advisory

- Proprietary Fund management

Now, as per their website in the proprietary fund management, they use the following approach

- Quantitative approach using derivatives, and options to generate returns.

Hence it’s obvious that if you want a career with them, then you need to have a stronghold on.

- Statistics

- Risk Modeling

- Also, some background in derivative products.

Jobs at Ariston Capital Advisors

Now, generally speaking, a team in any venture capital firm is small. Hence, seldom will you see these firms being very big on hiring. So, in case of ariston, you can send your resume, with some good work that you have done on: [email protected]

ASK Financials: Venture Capital Firm in Delhi

Ask financials is a group of firms in the investment and wealth management domain.The group started its operations in the year 1983 by Sameer Kotecha. Also a side information, that the firm is also part owned by black stone a popular investment firm out of U.S

Their operations is divided across;

- ASK investment management

- Private wealth operations

- Proprietary Fund

Again just like any other private equity or a venture capital firm, you need to apply directly with ASK. Here is how you can apply

Jobs at ASK Capital

If you are interested in a job opportunity with ASK Group, please mail us at [email protected] with details about you and your work experience. Do mention the area of expertise you are interested in working in.

ICICI Prudential Venture Capital Firm in Delhi

Now, ICICI prudential is a join venture between united trust of India & technology development and information company of India limited. Also, it was started way back in the year 1988, where most of you might not have been born too.

Also now, ICICI Venture is a wholly owned subsidiary of ICICI Bank Limited (which is the successor entity to ICICI Limited). Till now, this fund has raised $5 Billion.

Their areas of operations include;

- Private equity

- Real estate

- Special situations

- Infrastructure investments

Job Application at ICICI Venture Capital

Click on the link below to apply for a position at ICICI Venture

Kaizen Capital Venture Firm in Delhi

Kaizen venture capital firm in delhi is a private equity firm that has its most of the investment in ed tech companies.

So, there is nothing apart from private equity & venture capital, that the firm does.

Magnetar Venture Capital Firm in Delhi

So founded In the year 2005, magnetar capital has as an Aum Of 12.4 Bn with 201 employees worldwide.

About Magnetar Venture Capital Firm

Their Operations and strategies include

- Systematic Investing

- Alternative credit and fixed income

- Energy and Infrastructure

Jobs at Magnetar Venture Capital Firm

So, their hiring course is spread across the globe but you can keep yourself updated with the latest opportunities here.