Last updated on August 16th, 2025 at 04:12 pm

One recent example of types of mergers is, between Brookfield Asset Management and Oaktree Capital Group. The deal, announced in September 2021, would combine two of the world’s largest alternative asset managers with a combined $475 billion in assets under management.

What is a merger?

A Merger is an agreement between 2 companies that result in uniting together to form one company. There are many different reasons why companies merge. Mergers are usually to expand a company’s reach, expand into new segments, or gain market share. All these are to increase the shareholder value. During a merger, companies have a no-shop clause so that any other companies will not be able to buy or merge with that company—merger results in a fusion of two companies on broadly equal terms into one new legal entity. For example, in 1998, a merger deal occurred between the Digital Equipment Corporation and Compaq, whereby Compaq absorbed the Digital Equipment Corporation. Compaq later merged with Hewlett-Packard in 2002. Compaq’s pre-merger ticker symbol was CPQ. This is combined with Hewlett-Packard’s ticker symbol (HWP) to create the current ticker symbol (HPQ). [1]

How do Merger’s work?

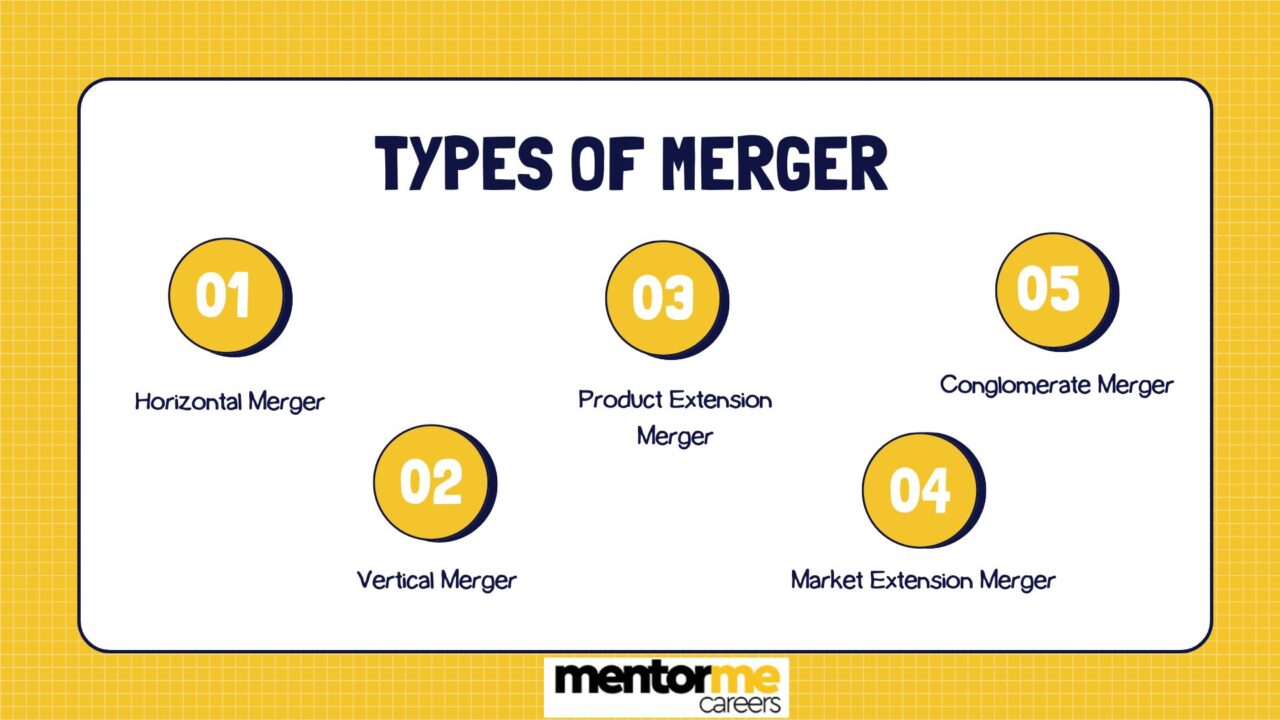

The firms/companies that agree to merge are roughly equal in terms of size, customer, and scale of operation. As a result, the term “Merger of Equals” is sometimes used. Mergers are typically done t reduce the cost of operation, gain market share, expand to new territories, unite common products, increase revenues and profits. All these have an impact on the firms’ shareholders. After a merger, shares of the new company are distributed to existing shareholders of both original businesses. There are five major types of mergers. They are Conglomerate, Congeneric, Market Expansion, Horizontal, and Vertical.

Basic Structure of Board of Directors

The responsibilities, structure and powers are determined by the bylaws of the company. The bylaws generally determine how many board members there are, how the members are elected, and how frequently the board members meet. There’s not a set number or structuring for a board of directors; it depends largely on the company or organization, the industry in which the company or organization operates, and the shareholders. The following image shows the basic structure of the Board of Directors [2]:

Types of Mergers

There are five major types of Mergers:

Horizontal Mergers:

A horizontal merger is a merger between companies that directly compete with each other. Horizontal mergers are often done to increase market power, further utilise economies of scale, and exploit merger synergies. A famous example of a horizontal merger would be the merger of HP and Compaq in 2011. This merger created a global technology leader valued at over US$87 billion.

Vertical Mergers:

The companies that undergo vertical mergers operate along the same supply chain. A vertical merger is the combination of companies along the production and distribution process of a business. Vertical mergers result in higher quality control, better flow of information along the supply chain and merger synergies. For example, the merger that happened between America Online and Time Warner in 2000 was a vertical merger. This was due to each company’s different operations in the supply chain. Time Warner supplied information through CNN and Time Magazine, while America Online provided the information through the internet.

Market Extension Merges:

Market Extension mergers happen between companies that wish to sell the products or services but operate in different markets. The end goal of a market extension merger is to gain access to a larger market and thus a more extensive client base. For example, RBC Centura’s merger with Eagle Bancshares Inc. in 2002 was a market-extension merger. This helped RBC with its growing operations in the North American market. Eagle Bancshares owned Tucker Federal Bank, one of the biggest banks in Atlanta, with over 250 workers and $1.1 billion in assets.

Product Extension Mergers:

Companies that sell related products or services and that operate in the same market undergo Product Extension mergers. Product extension mergers are also known as Congeneric Mergers. After the merger, both the companies can group their products together and gain access to more customers. It is important to note that the products and services of both companies are not the same, but they are related. For example, the merger between Mobilink Telecom Inc. and Broadcom is a product-extension merger. The two companies operate in the electronics industry, and the resulting merger allowed the companies to combine their technologies. The merger enabled the combination of Mobilink’s 2G and 2.5G technologies with Broadcom’s 802.11, Bluetooth, and DSP products. Therefore, the two companies can sell products that complement each other.

Conglomerate Mergers:

A Conglomerate merger is a merger that happens between totally unrelated companies. There are two types of conglomerate mergers: pure and mixes.

- A pure conglomerate merger involves companies that are totally unrelated and that operate in distinct markets.

- A mixed conglomerate merger involves companies that are looking to expand product lines or target markets.

For example, Walt Disney Company and the American Broadcasting Company (ABC) merger was a conglomerate merger. Walt Disney Company is an entertainment company, while American Broadcasting company is a US commercial broadcast television network (media and news company).

Examples on Types of Mergers

One recent example of a merger and acquisition is the merger between Brookfield Asset Management and Oaktree Capital Group. The deal, announced in September 2021, would combine two of the world’s largest alternative asset managers with a combined $475 billion in assets under management. The merger would create a global alternative asset manager with a diversified portfolio of real estate, infrastructure, renewable energy, and private equity investments. The deal is expected to close in 2022 and is subject to regulatory approvals.

Another example is the acquisition of the social media platform TikTok by Oracle. The deal announced in September 2020 and completed in November 2020, Oracle, an American multinational computer technology corporation, was chosen by TikTok’s parent company, Bytedance, as its “trusted technology partner” to help the platform in the US. The deal was a result of the U.S Government’s threat of a ban on the app due to national security concerns.

Another example is the merger between Discovery Inc and WarnerMedia. The merger, announced in May 2021, would combine two of the largest media and entertainment companies in the world. The merger would create a global media giant with a portfolio of popular cable networks, streaming services, and production studios. The deal is still subject to regulatory approvals and is expected to close in 2022.

These are just a few examples of recent mergers and acquisitions that have taken place. M&A activity can be found across different industries and geographies, reflecting the dynamic nature of the global business landscape.

Legal structure used in types of merger

- Statutory Merger: Where one company aquires another. One company survives while other is dissolved. All the assets and liabilities are transferred to the survival company. The shares are also divided of the dissolved company.

- Statutory consolidation: Two or more companies combine to become One new company as above all the assets and shares are divided.

- Triangular Merger: Aquirer form a subsidiary where target company merges into susbsidiary. The susbsidiary remains.

- Reverse triangular merger: The aquirer’s susbsidiary mergers into the target.

- Statutory Share Exchange: The aquirier exchanges its shares for the shares of the target.

For more information you can refer to this article by wolterkluwer

FAQ

What are 5 types of merger?

- Horizontal

- Vertical

- Conglomerate

- Market Extension

- Product extension

Why firms do merge?

- For growth

- Increase market share

- Reduce costs

- Expand into new market

What the types of merger in business?

- Horizontal Acquisition.

- Market Extension Acquisition.

- Vertical Acquisition.

- Conglomerate Acquisition.

- Congeneric Acquisition.

- Reverse Takeover (SPAC)

- Acqui-Hire

What is horizontal and vertical merger?

Horizontal merger: Similar product merging

Vertical merger: When two or more companies who are in different stages of a supply chain in the production of common products or services.