Last updated on June 9th, 2024 at 12:44 am

“The path to success is to find your passion, embrace uncertainty and not worry about outcomes”. In

Just like many articles I wrote on CFA with this, CFA with that. Here is one more,” The CFA- MBA!”.

Being a CFA charter holder, I will keep my bias aside and try to give you my take. The way I have tried to answer this is structured below, you can skip to the area which is relevant to you.

Let’s get the dice rolling!

When to do CFA: After, During or Before MBA?

The Mindset Decision:

Whenever you feel you have the mindset to do it. If you have the mindset and commitment before MBA, Go for it. If you feel your MBA program can be managed along with the great commitment required for the CFA program, go ahead too. So this part is really about when you feel right.

The Opportunity Perspective:

If you are trying to aim for a premier( Ivy league) MBA program, you are going to come face to face with a lot of smart ones. Go and beat this before sitting for the MBA interview!

How will this help?

Well, it will let you prove to the interview panel that you are a serious candidate for MBA in Finance.

How does it help the MBA college?

Placing you, the investment banks might give a second look at your profile while skimming through many others.

I will just add a caveat here though! The CFA program or designation is not a sure ticket to high packages or selection. There are a lot of other factors that a company considers before hiring you. So pursue this program in the right spirit, which is to gain a deep understanding of investments.

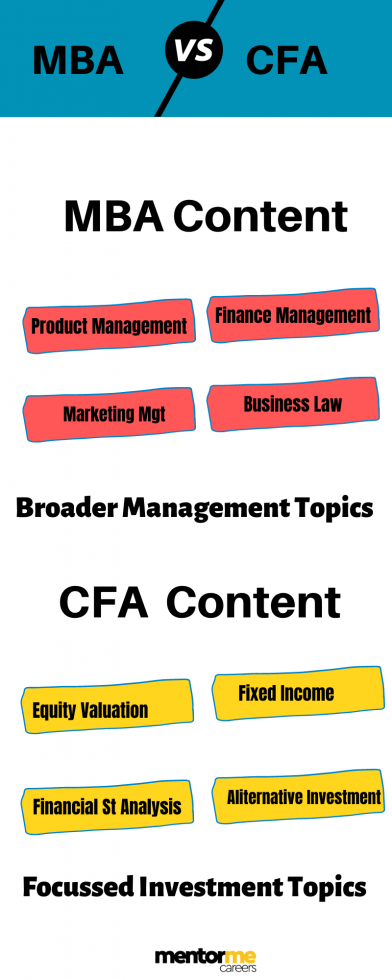

Difference Between MBA & CFA

Below is a brief and objective summarization of the difference between MBA & CFA

| Qualification | CFA | MBA |

| Objective | Investment Analysis Knowledge & Charter | General Management |

| Recognition and Validity | Global 192 countries | Depends on the college’s Tier |

| Cost | 3.4 Lacs INR in total | Tier 1 :17 Lacs and above Tier 2: 6-7 Lacs INR |

CFA vs MBA: Is there a choice to make?

Honestly, Although a lot of students and working professionals ask me this question, this is actually a self-defeating question. I will justify what I just said, Don’t worry!

Generalist Vs Specialist: Take your pick!

Positions like product manager, finance manager etc are generalist roles. They are expected to manage the process, create a process and evolve the process. The MBA program is a generalist program, and in the longer run MBA can help you with the necessary knowledge(IF ivy league MBA).

The CFA program is a specialist program, you are the first person to analyse stocks. Not necessarily getting taught how to build an investment management business. So MBA is a business qualification whereas CFA is a specialist qualification.

Look at the syllabus below: MBA has a little bit of everything, in business that’s how it is. A little bit of everything. As an entrepreneur myself, I also agree that the MBA program is good for business management roles. You can’t say you don’t understand marketing, at the same time you can’t say you can’t read the financials of your own company. Having said that CFA program is focused on analysing, and creating portfolio solutions for clients. See where I am getting at?

Which is more difficult, CFA or MBA?

When comparing the difficulty, I think it’s best to compare the entrance exams (CAT) for MBA with the CFA exam passing percentage.

- MBA gets a total of 2.4 Lac applicants

- Tier 1 MBA have approximately:6000-7000 seats

- Which is roughly a success rate of 2.5%

Compare that to CFA

- CFA level 1 : Pass rate:42% ( recently 27% in 2022)

- CFA level 2: Pass rate:46%

- CFA level 3: Pass rate:55%

So considering that 100 students start at CFA level 1, 42 clear the level 1 exam, 21 clear the level 2 and 10 clear the level 3. This means a 10% pass rate in total. So in comparison getting into a tier 1 college is much more difficult statistically. However, you must understand that candidates who appear for CFA are generally more focused and narrowed, in comparison to MBA which itself has a too broad crowd appearing for this exam.

Placement and salary for MBA & CFA

Companies that hire CFA institute candidates many some of the names are as follows:

- Deutsche bank

- Citi Group

- Goldman Sachs

- Mckinsey and co.

- BCG

- J.P. Morgan Chase

- Morgan Stanley

- HDFC Bank

- ICICI Bank

- SBI Bank

- EY

- Deloitte

- KPMG

- PWC

- Black Rock

- Mirae Asset Management

- Morning Star

- Nomura

- CRISIL

- Care Ratings

- Bloomberg

- And many more

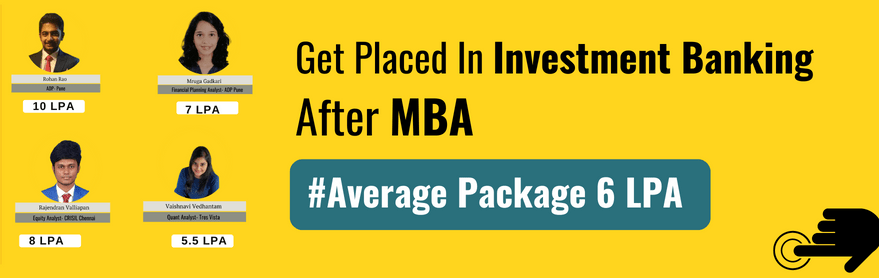

MBA CFA salary in India

| Level | CFA salary in India | CFA MBA SALARY |

| After CFA level 1 salary | 4-5 LPA | 10 LPA |

| After CFA level 2 & 3 Salary | 10 LPA | 15 LPA |

| Post-CFA Charter | Above 20 LPA | 25 LPA and more |

Tier I MBA colleges, since they hold the most cream crowd, will attract higher entry-level salaries. The difference actually is the start, in the case of CFA your start is small but eventually, with work experience, you reach comparable levels if you combine that with a tier I MBA, Then of course you are eyed for recruitment by top IB Companies.

We must note that the average MBA salary in India is 2.74 Lacs, whereas the average CFA salary is around 6 Lacs. The higher salary can be commanded only with premiere MBA colleges, but if you are with an average college then combining CFA can be an excellent choice.

Exploring High-Paying Roles with an MBA and CFA

Combining a CFA with an MBA degree opens doors to high-paying roles in finance and business. Pursuing an MBA from a top business school can significantly boost your starting salary and position you for high-demand roles such as an investment banker, marketing manager, or vice president. The synergy between the specialized knowledge of a CFA and the broad managerial skills of an MBA creates versatile professionals ready to tackle various job opportunities.

Job Roles for CFA with MBA

Now, as an MBA graduate, you are majorly considered a generalist even with an MBA specialisation in finance. However, when you do add the knowledge earned through the CFA program then the depth of opportunities increases.

So, let me illustrate this point! For example; let’s look at the below job role of private equity analyst from e-value serve.

Designation: Private Equity Analyst

Major Role:- Provide support to Buy Side Research teams like Private Equity Clients.

Qualification Required:- Postgraduate preferably MBA (specialization finance & econometrics)/CFA/CA.

So, look at the qualification required, MBA or CFA, but we can clearly predict that having both will have the added advantage.

Some of the other deeper roles, that can be found after combining these qualifications are;

- Portfolio Manager

- Assistant Fund manager

- Equity research analyst

- Financial planning & Analysis

- Project management

Real Benefits of doing with MBA

By now you must have realised what is the MBA program about and CFA too. So now let me list the benefits of getting an MBA with CFA, for those who are focussed on finance roles:

Four Benefits of Doing CFA with MBA Finance

- Placement Opportunities: You will get better opportunities with this combination because the Investment banks like this qualification. In fact, there are 50 large investment banks, which recognise this as a formal qualification. Look at this report given by CFA

- Better Networking: As a CFA charter-holder you become a member of the brotherhood. You get to meet and network with the top investment professionals, including fund managers who are CFA charter holders.

- Credibility: CFA program is a rigorous qualification and is known to be very consistent with its policies. Even a fund manager has to go through the same route of writing all three levels and trust me it’s difficult even for them.

- Diverse Roles: As a pure MBA you might not be looked at favourably for some specific specialist roles, purely due to the lack of knowledge. There are many roles nowadays, which specifically list CFA as the required qualification.

Operation Management and Business Analytics

For those interested in operation management or business analytics, an MBA provides a comprehensive understanding of these fields. MBA students gain insights into efficient business operations and data-driven decision-making, which are critical in today’s competitive landscape. Combining this with the CFA charter enhances your ability to analyze financial data and make strategic business decisions, making you a valuable asset to any organization.

Who is CFA for?

We are getting into now a philosophical question, Why? You should ask yourself the question, of why ( For everything) even an MBA. The industry nowadays is much deeper In its selection and no degrees are a guaranteed ticket to success. So ask yourself the following three questions

- What makes you feel strongly about the fact that you like Investments? Write it down! Have you ever your own interest, or bought any stocks? Have you ever read any investment books?

- What is your real objective of doing CFA?- Is it purely a job

- , if yes then you won’t have much motivation left in the longer to continue

- Would you blame a qualification for the failures of a candidate: You don’t want to put all the hours and effort while blaming it later that CFA is useless. So the objective has to be the knowledge and knowledge you get in CFA.

Concluding Thoughts

Well, a short article but I guess I said what I wanted to say! It's not flashy, it might not sound like a magic wand! But I am just sharing my experience with the qualification and also the experience I had using it in my own career. So do feel free to write to me at [email protected].