Last updated on December 31st, 2025 at 04:14 pm

Let me put it this way, the trade settlement process is the following step after the stocks and bonds are purchased to move the securities from the seller to the buyer. So, from the context of Indian capital markets trade settlement usually happens in T+3 Days i.e 3 Days from the data of execution of the trade.

Trade settlement involves the actual exchange of cash and securities between buyers and sellers after a trade is executed. A smooth settlement process reduces counterparty risk, improves market trust, and ensures investors receive shares and money on time. In India, SEBI’s adoption of the T+1 settlement cycle has made markets faster, safer, and more efficient.

Trade settlement Process Overview

So, trade settlement process involves finalising a trade by exchanging assets and funds between parties. It ensures transaction completion according to terms. Now let me summarise the various kinds of settlement process’s examples;

- Stock Market Trade: After buying shares, the trade settles when the buyer’s account is debited, and the seller’s account is credited with the shares and funds.

- In foreign exchange trading, the parties exchange currencies, usually two days after they execute the trade.

- Commodity Trade: When a commodity trade is settled, the buyer receives the physical goods, and the seller receives the payment as per the trade agreement.

- Bond Trade: Settlement involves transferring the bond ownership to the buyer’s account and transferring funds to the seller based on the bond’s agreed price.

- Cryptocurrency Trade: Once a crypto trade is executed, settlement takes place when the agreed-upon amount of cryptocurrency is transferred from the seller’s wallet to the buyer’s wallet.

- Derivatives Trade: Settlement varies based on the derivative type. For futures, daily settlements occur, and for options, the settlement depends on the option’s exercise.

T+1 Settlement Cycle in India (Current SEBI Rule)

Step 1: Trade Execution (T Day)

1.The investor places a buy or sell order on the stock exchange (NSE/BSE).

2.The exchange’s trading system electronically matches the order.

3.Once the system matches the order, it confirms the trade at the agreed price and quantity.

Step 2: Trade Confirmation & Clearing (T Day)

1.Trade details flow to the Clearing Corporation (e.g., NSCCL, ICCL).

2.The clearing corporation calculates net obligations for brokers:

a. How many shares to deliver or receive

b. How much money to pay or receive

This netting reduces overall settlement risk and volume.

Step 3: Pay-In of Funds & Securities (T+1 Day – Morning)

1.Selling brokers deliver shares to the clearing corporation via depositories (NSDL/CDSL).

2.The buying brokers transfer funds to the clearing corporation through approved clearing banks; this process is called pay-in.

Step 4: Pay-Out of Funds & Securities (T+1 Day – Afternoon)

1.After successful pay-in, the clearing corporation releases:

a.Shares to buying brokers’ demat accounts

b.Funds to selling brokers’ bank accounts

Step 5: Final Credit to Investor Accounts

1.Brokers credit:

a. Shares to the buyer’s demat account

b. Money to the seller’s trading/bank account

Benefits:

Faster liquidity for investors

Better risk containment vs T+2 markets abroad

Trade Settlement Process Across Countries

Now, various countries and exchanges strive for different targets for settlement. Let me quickly take you through various trade settlement process across countries and exchanges.

Settlement process in NSE

The National Stock Exchange’s (NSE) rolling equity settlement cycle is as follows:

- Rolling Settlement Trading – T

- Clearing, which includes confirmation of custody and delivery generation – T+1

- Securities and Funds for Settlement Payments in and out – T+2

- Post Settlement Auction – T+2

- Auction Settlement – T+3

- Reporting for Bad Deliveries – T+4

- Rectified Bad Deliveries Pay-In-Pay-Out – T+6

- Bad Deliveries are re-reported – T+8

- Re-Bad Deliveries are now closed – T+9

Settlement Process in BSE

Mentioned below are the steps of settlement by the Bombay Stock Exchange:

- The shares on the Bombay Stock Exchange (BSE) are all settled in T+2 days.

- T+2 days are also used to close government securities and fixed income instruments for individual investors.

- When you buy or sell securities, you pay in and out on the same day of the trade.

- After the BSE completes the pay-out of monies and securities, the client deposits the securities within one working day.

Settlement Guidelines in the U.S

Following are the guidelines for trade settlement process in the U.S markets according to various assets.

T-2 settlement dates for:

- Certificates of deposit (CDs): Same day

- Commercial paper: Same day

- U.S. equities: Two business days

- Corporate bonds: Two business days

- Municipal bonds: Two business days

- Government securities: Next business day

- Options: Next business day

- Spot foreign exchange (FX): Two business days

Trade settlement process Flow

1. Trade Execution (NSE / BSE)

A trade is executed when a buy order and sell order match on stock exchanges like NSE or BSE. The trade price and quantity are fixed at this stage.

2. Trade Confirmation & Matching

The exchange confirms trade details (security, quantity, price, buyer, seller). Clearing corporations verify and match all trades to avoid errors.

3. Position Netting & Margin Check

The clearing corporation nets buy and sell positions to calculate net obligations. Margin availability is checked to manage counterparty risk.

4. Settlement Instruction to Depositories

Settlement instructions are sent to depositories (NSDL/CDSL) for securities and to clearing banks for funds transfer.

5. Funds & Securities Movement (T+1 Cycle)

1.Sellers’ securities are debited from demat accounts

2.Buyers’ funds are debited from bank accounts

3.Securities and funds are exchanged securely on T+1 day

6. Settlement Completion & Reporting

Once funds and securities are successfully transferred, the trade is marked as settled. Participants receive settlement reports and confirmations.

Entities Involved in the Trade Settlement Process

| Participant | Role |

| Clearing Corporation (CCP) | Guarantees settlement; manages counterparty risk |

| Depositories (NSDL/CDSL) | Transfer and hold securities in Demat form |

| Clearing Members / Brokers | Ensure margin, trade management |

| Custodians | Institutional trade settlement |

| Banks | Fund transfer |

Clearing & Risk Management in Settlement

After a trade is completed, it needs to be cleared prior to settlement. Clearing guarantees that both the buyer and seller will meet their commitments, delivering securities and making payments without any issues.

Role of the CCP (Central Counterparty)

In India, the Clearing Corporation (like NSE Clearing Ltd) acts as a Central Counterparty (CCP).

It steps into the trade and becomes:

1.Buyer to every seller

2.Seller to every buyer

This process is called novation.

Novation simply means the CCP replaces the original buyer and seller, guaranteeing the trade even if one party defaults.

This greatly reduces counterparty credit risk in the market.

Trends in Settlement

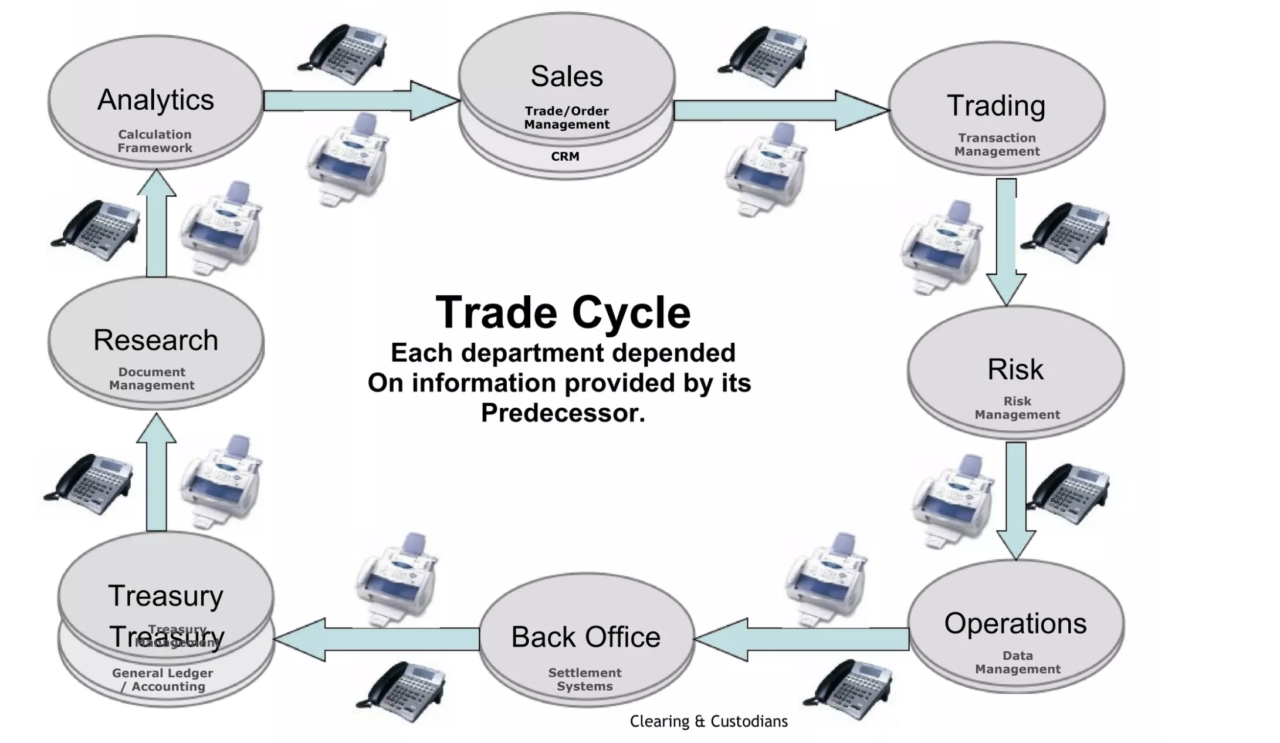

There are various trends in trade settlement process going on across markets. While in the olden days settlement were static, and done on only specific days. Against which trade settlement process became a rolling affair, without any regards to a specific day. Now, the demands on the industry is towards faster trade settlement process. Let me summarise these trends below;

- Firstly the increase in trading volumes, which by the way puts direct pressure on manual settlement process and also leads to errors.

- Secondly, due to lower barriers to entry into the trade settlement process. Market participants are adding more value added services.

- Thirdly, reduction in margins and cost pressures due to the second effect.

- Fourthly, the customers are demanding faster execution and super fast information availability.

- Finally, the emergence of standards like FIX, ISO, ISIN which further complicates matter.

Settlement Modes in India

In the Indian capital markets, settlement means the procedure of swapping securities and money once a trade goes through on the stock exchange. SEBI oversees various settlement methods to make sure of safe and risk-averse transactions.

| Settlement Mode | Use Case | Explanation |

| Rolling Settlement (T+1) | Default for equity markets | Trades are settled one business day after trade date. This is the standard settlement cycle for NSE & BSE equities in India. |

| Spot Settlement | Certain negotiated trades | Settlement happens on the same day (T+0) or next day (T+1), mainly for off-market or special transactions. |

| Auction Settlement | Failed trade recovery mechanism | Used when a seller fails to deliver securities. The exchange buys shares in the market and recovers the cost from the defaulting seller. |

Key Points to Remember (For Exams & Interviews)

1.T+1 rolling settlement improves liquidity and reduces counterparty risk.

2.Spot settlement is limited and not used for regular exchange trades.

3.Auction settlement protects buyers from delivery failures.

4.All settlements in India are backed by clearing corporations and depositories (NSDL/CDSL).

Straight Through Processing (STP)

Straight Through Processing (STP) means the complete automation of the trade settlement process, allowing transactions to move smoothly from brokers – clearing corporations – depositories – banks without any manual steps. In India’s current market setup, STP guarantees that after a trade is done, all connected instructions, trade confirmation, clearing, settlement, and reporting, are handled electronically and automatically.

Why STP Matters

1.Reduces operational failures: Automation minimizes human errors such as mismatches, delayed instructions, or incorrect data entry.

2.Speeds up settlement: STP is a key enabler of SEBI’s T+1 settlement cycle, allowing faster transfer of funds and securities.

3.Improves accuracy & transparency: Real-time data sharing across systems ensures consistent records for brokers, clearing members, and depositories.

4.Lowers risk & cost: Fewer manual processes mean reduced settlement risk, lower reconciliation costs, and better compliance.

Categories of Risks in Trade Settlement Process

Now, let me briefly discuss on what critical risks exists in case of trade settlement process.

Principal Risk

Principal risk includes the risk of loosing the principal amount in the trade settlement process due to the counter party defaulting on the settlement.

Operation Risk

So, operation risk includes the risk to the capital due to inffeceient information systems or mis managed trading operations systems

Liquidity Risk

The risk of having low volumes and thus not able to execute a trade due to it.

India vs Global Settlement Process

Trade settlement cycles determine how quickly cash and securities are exchanged after a trade is executed. Faster settlement reduces counterparty risk, improves liquidity, and strengthens market stability. In 2025, India stands among the fastest-settling major markets globally.

| Country / Region | Settlement Cycle | Key Notes |

| India | T+1 | Fastest among major global markets; fully implemented by SEBI for equities |

| United States | T+1 | Adopted in 2024–2025 to align with global best practices |

| Europe (EU) | T+2 | Still follows T+2 for most equity markets |

Conclusion

Now, you might think that technology is the only challenge in this industry but for the trade settlement process to move towards T+1, is going to require more than that.

With features such as Straight Through Processing (STP), robust SEBI oversight, and cutting-edge depository infrastructure (NSDL/CDSL), the Indian settlement system ensures efficiency, clarity, and safety for both retail and institutional investors.

For finance students and professionals, understanding this process is crucial, not only for exams and interviews but also for careers in capital markets, operations, risk management, and brokerage services.

Want to get into Investment Banking and get a stable job? Check out Mentor me careers website and get to know more how you can achieve your dream of getting into finance.

FAQ

The trade settlement process is the final step of a securities transaction where the buyer receives shares in their Demat account and the seller receives money, under SEBI’s T+1 settlement cycle.

The settlement is guaranteed by the Clearing Corporation (CCP), while NSDL/CDSL transfer securities and banks handle fund movement, ensuring a secure, risk-free exchange.

In India, shares are credited to your Demat account on T+1 one working day after the trade execution date, if all obligations are met.

If a broker or seller fails to deliver securities or funds, penalties are imposed, and short delivery may go into an auction settlement to protect the buyer.

DVP (Delivery vs Payment) means securities are delivered to the buyer only when payment is successfully received, eliminating counterparty default risk.