Last updated on October 23rd, 2024 at 04:59 pm

A shutdown point is a level of operation in which the company no longer benefits from continuing its operations and hence decides to shut down temporarily or permanently. The company no longer benefits from continuing production in the short run when the revenue from selling the product does not cover the cost of production. The shutdown point indicates that if the company continues production, it will keep on incurring higher losses. It occurs where marginal profit reaches a negative scale

Key Takeaways from the Applications of Shut Down Point in Economics:

- The shut down point helps in short-run decision making during temporary downturns or unexpected circumstances. It helps determine whether to continue production or shut down temporarily based on covering variable costs.

- Long-run planning and investment decisions benefit from analyzing the shut down point. It assists in assessing the viability of expansion and market entry by comparing projected revenue against both variable and fixed costs.

- The shut down point has implications for public policy. Policymakers can evaluate economic feasibility and social impact by considering the shut down point when making decisions and formulating policies.

- Real-world case studies highlight the practical applications of the shut down point. For example, in the artisanal ceramics manufacturing company case study, the shut down point analysis helped determine the scale of operations to maintain profitability during a decline in demand.

- The shut down point offers businesses and policymakers valuable insights into cost optimization, revenue generation, and overall sustainability. Understanding and utilizing the concept can contribute to informed decision-making, efficient resource allocation, and improved economic outcomes.

Understanding shutdown points

A shutdown arises when price or average revenue falls below the average variable cost at the profit-maximizing output level. A shutdown point is usually a short-term position; however, in the long run, the firm shuts down and leaves the industry if its product price is less than the cost price. The shutdown point does not include an analysis of fixed cost in its determination. It determines at what point the marginal costs associated with operation exceed the revenue being generated by those operations.

The shutdown point has the following characteristics:

- It is the output and price point where a firm is able to cover its variable cost

- The average variable cost (AVC) is at its minimum point

- It is where the marginal cost curve intercepts the average variable cost(AVC) curve

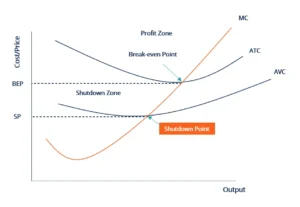

Shutdown point diagram

Where:

- MC – Marginal Cost

- ATC – Average Total Cost

- AVC – Average Variable Cost

- SP – Shutdown Price

- BEP – Break-even Price

Types of Shutdown points

The duration of the shutdown may be temporary or permanent depending on the nature of the financial conditions of the company. For goods that are not essential, the demand can recede from customers, forcing them to shut down temporarily until the economy recovers. The demand may also go down due to changes in consumer preference. For instance, no one produced CRT televisions in the era of LED and OLED. Another reason for fluctuation could be their production frequency. For e.g., Apples are found all year round whereas mangoes are only found in summer.

Applications of Shut Down Point- Part 1

One significant application of the shut down point is in short-run decision-making. When a firm faces a temporary downturn in demand or encounters unexpected circumstances, it must evaluate whether it is more beneficial to continue production or shut down temporarily. By calculating the shut down point, businesses can determine whether their variable costs can be covered even if they operate below full capacity. Transition words such as “furthermore,” “additionally,” and “moreover” can be used to connect ideas smoothly while maintaining clarity and simplicity.

Example

For instance, let’s consider a case study of a small-scale manufacturing company that produces artisanal ceramics. Due to a sudden decline in consumer demand and an increase in the cost of raw materials, the company’s revenue starts falling short of covering its fixed costs. Using the shut down point analysis, the management realizes that by operating at a reduced output level, they can still cover their variable costs. As a result, the company decides to continue production at a lower scale, avoiding the immediate closure of operations and retaining skilled employees. This decision is guided by the understanding that even though profits are reduced, the losses incurred from shutting down completely would be greater.

Applications of Shut Down Point- Part 2

Another application of the shut down point is in the long-run planning and investment decisions of businesses. When evaluating potential expansion or entering new markets, firms need to assess whether their projected revenue will exceed both variable and fixed costs. By considering the shut down point, businesses can determine the minimum scale of operations required to achieve profitability in the long run. Simple language and transition words such as “in addition,” “similarly,” and “likewise” can be employed to maintain clarity and coherence.

Example

To illustrate this application, let’s examine the case of a renewable energy company considering the construction of a new wind farm. By conducting a thorough analysis of the shut down point, the company evaluates the projected revenue from electricity generation and compares it to the total costs, including fixed costs such as construction expenses and variable costs such as maintenance and operation. This analysis allows the company to determine the minimum capacity required for the wind farm to cover both types of costs and generate a profit. If the projected revenue falls below this threshold, the company may decide to abandon the project or explore alternative options.

Conclusion

Moreover, the shut down point also has implications for public policy and government decision-making. Understanding this concept enables policymakers to assess the economic feasibility and social impact of various industries and initiatives. Transition words such as “conversely,” “on the other hand,” and “in contrast” can be used to introduce contrasting perspectives and facilitate smooth transitions between ideas.

For example, consider a government considering the introduction of a subsidy program to support small-scale farmers. By examining the shut down point of these farmers, policymakers can determine whether the subsidies provided will be sufficient to cover their fixed costs and prevent them from going out of business.