Last updated on February 14th, 2023 at 04:44 pm

What is Net Book Value?

Net Book Value, also known as the net asset value, is the value at which the company reports its assets on their balance sheet. It is calculated by netting against its accumulated depreciation. This is how many companies also calculate their NAV (net asset value). It is calculated as total assets- minus intangible assets and liabilities. The Net Book Value is calculated using the asset’s original cost and the depreciation and amortization are subtracted from it. The book value of any company is often lower than the company’s market value. Book Value plays a very crucial role in fundamental analysis.

Calculating Net Book Value

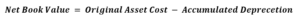

The formula for calculating the Net Book Value is as follows:

Where:

- Accumulated Depreciation = Depreciation per year × Total Number of Years

Let’s look at an example. A logging company purchases a truck for $200,000 and the truck depreciated $15,000 per year for 4 years. The NBV would be calculated in the following way:

Accumulated Depreciation = $15,000 × 4 years = $60,000

Net Book Value = $200,000 – $60,000 = $140,000

So, the NBV of the logging companies after 4 years would be $140,000.

Importance of Net Book Value

Book value is one of the most crucial and important aspects when it comes to financial analysis. It is important for the valuation of the company when and if the company is considering liquidation or a merger with another company. The Net Book Value and market value are typically not equal. Market value depends on supply and demand for the asset. The depreciation is always accumulated every year. The NBV is affected by this as it is netted against the accumulated depreciation. It makes fair and accurate accounting records and helps express a true approximation of the company’s value.

Since the company’s book value represents the shareholding worth, comparing the market value of the shares can serve as an effective technique while deciding the share price. By using the book value, one can determine if any share is underpriced, overpriced or at par. Book value has two main uses:

- Serves as a total value of the company’s assets that the shareholders receive if the company liquidates.

- Valuation in the share price of the stock.

Book value per share (BVPS) is a method of calculating the per-share book value of a company based on common shareholders’ equity in the company. If the company dissolves, the book value per common share indicates the price value remaining for common shareholders after all assets are liquidated and all debtors are paid. If a company’s BVPS is higher than its market value per share, then its stock may be considered to be undervalued.