Last updated on January 25th, 2023 at 05:11 pm

Fisher equation states that the nominal interest rate (r) is equal to the real interest rate (r*) plus the expected rate of inflation (π).

What is the Fisher Equation?

The Fisher equation explains the relation between the nominal and real interest rates under the influence of inflation. This equation is named after an American economist, Irving Fisher. The equation states that the nominal rate is equal to the sum of the real interest plus inflation. The equation is often used in situations where the investors ask for additional rewards to compensate for losses in purchasing power due to high inflation. It is a widely used concept in the field of economics and finance. It is mainly used in the calculation of return on investments or in predicting the behaviour of nominal and real interest rates. It is also used to compare the actual rate of interest on investment with respect to the effect of inflation.

Fisher Equation Formula

The fisher equation is expressed through the following formula:

(1 + i) = (1 +r)(1 + π)

Where:

- i – Nominal interest rate

- r – Real interest rate

- π – Inflation rate

Example

Let’s take a look at an example of the Fisher equation

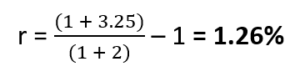

Bob owns an investment portfolio. Last year, that portfolio earned a return of 3.25%. However, last year’s inflation rate was around 2%. Bob wants to determine the real return he earned from his portfolio. In order to find the real rate of return, we use the Fisher equation.

(1 + i) = (1 +r)(1 + π)

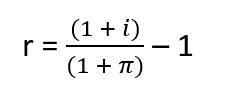

We can rearrange the equation to find the real interest rate:

Therefore, the real interest rate or actual return on investment of the portfolio equals

This means that Bob’s portfolio earned 1.26% last year.