Last updated on May 31st, 2024 at 02:31 pm

Do you remember the recent business’s in India, which had some very dramatic ends? For example consider the following business’s

- WeWork which raised more than 11 billion dollars filed for bankruptcy

- BYJU which is on the brink of shutting down

- Unacademy which as posted losses around INR 1536 Cr.

- Eruditus: ₹1,934 crore worth of losses.

And the list can keep going, where we see the rise of these names and then sudden fail. All of them though have one thing in common. All of them ignored the importance of capital budgeting in their start ups and business’s.

What is Capital Budgeting?

In a nutshell, capital budgeting means planning the best combination of expenses considering the highest return. Let me also list down some official capital budgeting definition;

- A plan set of projected activities of a company for a firm or process of capital allocation.

- Or a plan created to achieve the stated objectives.

Capital Budgeting Methods

Now let me discuss some of the most important methods of capital budgeting process. While I also discuss the major capital budgeting techniques. Which also throw some light on the features of capital budgeting. which are used in financial modeling

So firstly the major three methods are;

- Discounted cash flow analysis

- Pay back analysis

- Throughput analysis.

Now let me discuss each of these methods in more detail with examples;

Discounted cash flow analysis

So, this method looks at the present value of future cash flows versus the investment done for it. Below I illustrate this method, with the equation. So in essence all that the below calculation is confirming is the concept of time value of money.

This is also one of the more traditional methods of capital budgeting.

Pay back analysis

The payback period method is a more institutive method of capital budgeting. Where you shift the scope of capital budgeting from value to time. The numerator is basically the current cost or investment that you are incurring, and you divide that by future cash inflows.

Also, you can change and fine tune this method to also discount the future cashinflow and outflow. Which will basically get you the discounted payback period.

Throughput analysis

As compared to the two methods which I discussed, this method is slightly different. Until now, you were looking at investment which is compared to the cashflows. So, basically we are looking at how fast and how valuable the project is.

But the method of Throughput goes into the direction of your capacity to deliver. In terms of formula,

the formula is

T= I/F ( Where, I is the inventor in production and F is the time inventory spends in the entire production process). Moreover this method focusses on the efficiency of delivering rather than just investment.

Nature of capital Budgeting with Examples

Example 1: Payback Period

So, there is a company which has invested INR 100 Cr, in a phased manner across three years.Now, you are expecting as a CFO, to get cashflows(FCFF), in the following manner

- Year 1-3 , investments for 50, 25, & 25 respectively.

- Year 4-7, cashflows of 25,50,75,120 Cr.

What would be the pay back period. Which in other words is also asking, when do you recover the investments of 100 cr.

Solution:

Hence, here when the question of recovering the initial investment arrives.Which also means that the nature of capital budgeting is in answering the time related question.

So, notice that the cumulative cashflow goes from -25 to 50 between year 5 & 6. Which also means, that the payback period is somewhere between 5 and 6th year.So, how do you calculate the exact time period? Its very simple;

All you need to do is calculate 5th year + ( Cashflow to be recovered/ Cashflow in 6th year) x 12 months. Which is 5 years+(25/50)*12, or 5.5 Years to be precise.

Example 2: Net Present Value

Now, let me discuss another nature of capital budgeting which is the net present value. So, the right question which portrays this concept, is the following question. What would be the present value of all the future cash flows that you generated, minus the investment that you have done.

Now, consider the same example above; but the question now is how much profit you generated in present value terms. However, if you know or remember, the present value formula; which is PV= Future value/(1+r)^n. So we know the future cashflows, however what about the r? r is nothing but the discount rate, which is the opportunity cost. In other words, how much return in percentage would you generate elsewhere, if you don’t invest here. Let’s say that number is 12%.

Solution: Net Present value

So, before you check the calculation below, understand what you need to do. Which is you have to bring all the cashflows, irrespective of whether it is investment or returns to today. Which is nothing but present, the present is always 0.

So you can conclude that at the net level, by executing this project we would end up with 54.2 INR Cr.

Just as a side note, NPV is also termed as the more modern methods of capital budgeting.

Example 3: Nature of capital Budgeting

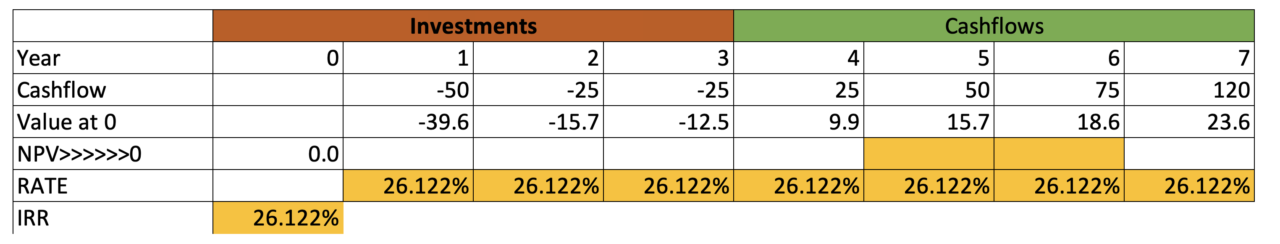

Now, let me discuss the last example in the context of capital budgeting, which is IRR( Internal rate of return). Again, let me put this in the business context. For eg; if I ask you by investing in the above case, how much return in percentage did you generate on an average year on year compounding? Then the answer you would find out would be called as internal return of return. Another important metric in the nature of capital budgeting.

Solution: Internal Rate of Return

So, the way to understand IRR, is to get this logic. Which is, in the present value formula PV= FV/(1+r)^n. What value of r, would make the net present value =0?. Confusing?

Alright, so let me explain why you want to find that kind of rate.

- Firstly, when we first found the net present value at a rate of 12%, we found the excess return we made.

- Which, means that the return is above 12%, else the NPV would be negative.

- However, the actual level of compounding of cashflows, must be the rate which would leave 0 net present value.

You get that? IRR is the average rate at which the cashflows are compounding, making the net present value zero. Which means it’s an approximation and that is also an important point for the nature of capital budgeting.

Example 4: Accounting Rate of Return

So, accounting rate of return as opposed to internal rate of return, is metric to calculate the ROI year on year. Which is very different compared to IRR.

- IRR measures the average compounding of cashflows.

- Whereas, account rate of return calculates average profit generated over the investment.

Solution

For example; in the above case the accounting rate of return would be as follows; Here you basically take the revenue and reduce any depreciation expense from the revenue. Which you divide it by the initial investment of 100 Cr.

Types of Capital Budgeting Decisions

So, the methods of capital budgeting decisions will be better understood when you understand the process. So, this is how the capital budgeting process flows from the start;

- First is identification of investment opportunities.

At this stage you basically list out different kinds of options available for investments. For example; assume that there is a real estate development company, which specialises in luxury apartments. Now, the new products team wants to expand the business and look for new opportunities. So, they come up with the following options;

- Retirement homes on leases

- Garden renovation business for buildings

- Education college

Now, at this stage you basically check the expected returns, the risks involved and capital expenditure involved. More than these numerical calculation, there are other concerns like area of expertise that needs to be considered.

- Estimation of Cashflows

This is the second step where for all the opportunities which are selected are then projected for cashflows. So this is stage of financial modeling, where all the cash inflow and outflow needs to be calculated.

- Evaluation of Projects

So, at this stage you are basically calculating certain metrics to evaluate whether the projected will be accepted or rejected.

- Implementation of Projects

The above step is self explanatory.

- Review and Monitoring

Once projets are implemented there are many appraisal methods of capital budgeting which can be used to continuously evaluate the performance of the plan.

So this basically summarises the kinds of capital budgeting decisions.

Need of Capital Budgeting

In this section. I will discuss the major significance of capital budgeting and which should throw some light on the need and importance of capital budgeting.

- Helps in generating highest returns possible

- Eliminates projects which are not viable

- Helps improve overall profitability of the business.

- Points to business inefficiencies that can be corrected.

- Scientific approach to budget allocation.

These are just some pointers which throw light and explain the importance of capital budgeting.

Factors Affecting Capital Budgeting

In my opinion this is one of the more important things to consider in the capital budgeting process in financial management.

A sound capital budgeting technique is based on;

- Organisational capability

- Political and policy factors

- Long run alignment of business strategy

- Capital expenditure and fixed assets involved.

- Risk considerations of the project.

Limitations of Capital Budgeting

So, I know it sounds fancy to do the above calculations, but for a second the assumptions above.Which should point you to think, that it’s hardly an exact science. Let me summarise the limitations of capital budgeting below

Discount Rate

So, one of the biggest limitation of capital budgeting is the discount rate i.e the rate. Whenever, you calculate net present value or internal rate of return, the number is an approximation. Another issue with discount rate, is that it is not an available rate like interest rate or government bond yield. Contrary to this, the rate has a severe disadvantage for the following reasons;

- Firstly, even if I say my existing investments are earning 15%, the next question is can I keep adding capital to earn 15%.

- Secondly, is the risk of my existing investments earning 15%, similar to this new project. Because it turns out its quite possible that the new investment is more risky.

- Thirdly, changing the discount rate even by 1%, has a significant effect on NPV.

Cashflows

So, ultimately your capital budgeting decisions are actually based on your forecasts. Which can never be called as accurate. Either you over forecast or you under forecast, which can make the important metrics swing from positive to negative. Hence, just like any other limitations, cash flows occupy a significant place in the limitations of capital budgeting.

Implicit Assumption of Reinvestment

Another significant limitation of capital budgeting decision making is with metrics like IRR.Which implicitly assume that all the cashflows are getting reinvested at the IRR Rate itself. However, there are ways to counter that by using alternative methods like MIRR(Modified Internal rate of return). But even then the reinvestment rate and amount of reinvestment is again an assumption.

Non Numeric Factors

So, the success and failure of a project or investment, can be as a result of factors which are not financial. For example; regulatory changes, changes in interest rates, pandemics or even industry level changes. So, let’s suppose you started a lithium battery manufacturing unit, however by the time you started selling your batteries. The industry evolved into newer alternatives, leaving your capital budgeting decisions biting the dust. Hence this is the nature of capital budgeting at the same time the limitation of capital budgeting.

Conclusion

So, in conclusion of the nature of capital budgeting and the limitations of it. I hope I was able to shed some context for your understand. However, it also brings me to the question that even with such limitations, is it worth not planning itself? I’ll leave that question for you to decide and reflect.