Last updated on January 28th, 2026 at 04:32 pm

CFA or Chartered Financial analyst is a U.S based investment finance designation, which is also now popularly a standard of knowledge. The question is, if CFA is worth it in India for you? The simple answer to that is, every dime and minute I spent on CFA exams and gaining that charter experience requirement was worth it.

The qualification over the years has gained immense popularity and following in the Asian sub continent.

Total CFA Institute Members (Candidates who have completed CFA exams and are membership fee paying charter holders)

- China: 65K

- U.S: 59 K

- India: 22k

India has been the third largest source of CFA institute membership and growth.

It is not just a popular qualification just because it is India.

There have been multiple such qualifications, which have come to India and not reached such popularity.

Now coming to the question of its CFA’s worth in India, most of the candidates are apprehensive about the salary and opportunities. Also at the end of this article, I shall conclude if CFA is worth it? or not.

This is going to be the focus of our discussion here.

Is CFA worth it?- Main Points

- CFA salary in India can average upto 8 Lacs INR in best case scenario

- The highest compensation increment happens between CFA level 1 and CFA level 3

- CFA qualfication has more credibility in investment banking than MBA and CA

- CFA salary in Singapore averages $73,034 for entry level CFA jobs

Is Chartered Financial Analyst (CFA) Really Worth it for a Better Salary in India?

The Chartered Financial Analyst (CFA) designation, originating in the U.S., has established itself as a global standard in investment finance, including significant recognition in India. Many wonder about its relevance and potential benefits in the Indian context. The answer lies in the substantial career opportunities and financial rewards it offers to those dedicated to mastering investment analysis.

As the qualification name states: Financial analysis. Hence not to be confused with accounting or CA. That’s the common dilemma, when candidates try to ask “CFA or CA?”. A chartered accountant is responsible to create financial statements and make sure that business report the correct picture of performance. Also make sure you pay the correct amount of taxes to the government!

However imagine for a second, the surplus profits made by the company. What should happen with that? Should we invest it in the business back or may be invest in some mutual funds. How much risk should we take in that? Should we directly buy stocks? May be bonds? May be hedge fund?

Now that information and knowledge is privacy to some hard core knowledge, which is what CFA program focuses on. Hence the roles we are expected after CFA program, are mostly related to investment finance related. Broadly speaking these roles should fall under, the below keywords

- Investment Banking

- Sell Side Equity Research

- Fund Management

- Portfolio Manager

- Investment Advisor

- Wealth Manager

- Fund Manger

- Private Equity

- Trader

- Hedge Fund

Exploring the Scope and Benefits of CFA

CFA charter holders in India experience a wide range of career paths, from investment banking to portfolio management and equity research. The average salary for CFAs can vary significantly based on experience and expertise in handling diverse asset classes like equities and real estate. Starting salaries after clearing CFA Level 1 can range from 5 Lacs to 8 Lacs INR annually, with notable increments as one progresses through the levels.

Career Advancement and Opportunities

Beyond salary considerations, the CFA designation equips professionals with specialized knowledge in investment finance, distinguishing them in a competitive job market. The scope of CFA extends beyond generic finance courses like MBA or CA, focusing deeply on asset classes and financial analysis. This specialization not only enhances job prospects but also ensures steady career progression and increased credibility in the investment sector.

Salary and compensation CFA in India

Now lets talk about the compensation/ Salary After completing each level of the CFA program. Yes you might think, that you get to reap the benefits of this qualification after all the levels. However with the right skill sets and guidance you can enter the industry even after clearing CFA level.

After CFA level 1

As small or insignificant you might think this achievement is, the reality is different.

As a CFA level 1 cleared candidate, you have more knowledge of investment finance than any other qualifications like CA,MBA etc.

| Outcome | Salary |

| Best Case | 8 Lacs & Above |

| Average Case | 5-6 Lacs |

| Worst Case | 3.5 Lacs |

This is not an exaggeration, the best case is possible and happens all the time with companies like crisil, tres vista, transaparent value, gallagahr and mohan etc.

There are multiple companies like this who will treat you equivalent to an MBA, in terms of salary

- After CFA level 2: An assumption here is that, you haven’t been a couch potatoe after CFA level 1.

- Which means you have tried and started working even with a small salary after level 1.

However having said that, the progression is salary between CFA level 1 and level 2 is nothing more than a few claps and motivation gestures by your colleagues.

| Outcome | Salary |

| Best Case | 10 Lacs |

| Average Case | 5-6 Lacs |

| Worst Case | 3.5 Lacs |

I find level 2 status kind of like, a stuck phase. You are neither a wizard, nor a dummy. Hence its good to complete this phase and focus on getting the experience

- After CFA level 3: Of course by now you must have gained at least 2 years of finance experience and completed all the levels. Waiting to wear the crown of achievement with your charter, which is 2 year shorts from being a reality.

I will skip putting numbers at this level but I will say that you are entering the premium lounge of the best

- After CFA Charter: At the minimum you have 4 years of core finance experience, you should expect your salary to be in the following ranges

CFA Vs Other Qualifications in India

| Outcome | Salary |

| Best Case | 15 Lacs and above |

| Average Case | 12 Lacs |

| Worst Case | 10 Lacs |

Well done and now you will understand that beyond this, no qualification can help in increasing salaries. Its going to be your interpersonal skills, core skills, business acumen and enthusiasm. I am being pretty serious here!

At this stage , talking about your qualifications is like saying that you belong to a certain state and ethnicity.

Now you would be competing against skill not qualification or the skill of clearing exams.

Is CFA Worth it in Singapore?

The salary of CFA in Singapore averages to $103,201, which equates to $50 per hour.

For entry level Chartered financial analyst, the gross salary is approximately $73,034.

As per salaryexperts.com

You check the detailed salary survey here:

Is CFA Worth it in Canada?

The median base salary of CFA’s in canada is around $300,000 according to CFA society.

Mean total compensation received in 2014 is $296,020

up from $232,267 in 2013, $239,215 in 2011 and

$214,885 in 2010.

You can read the full report here!

CFA Vs Other Qualification in Canada

We need to discuss this in the right spirit, since we are learning investment finance. Every qualification degree or designation is designed for a certain domain.

We are talking about CFA for Investment careers.

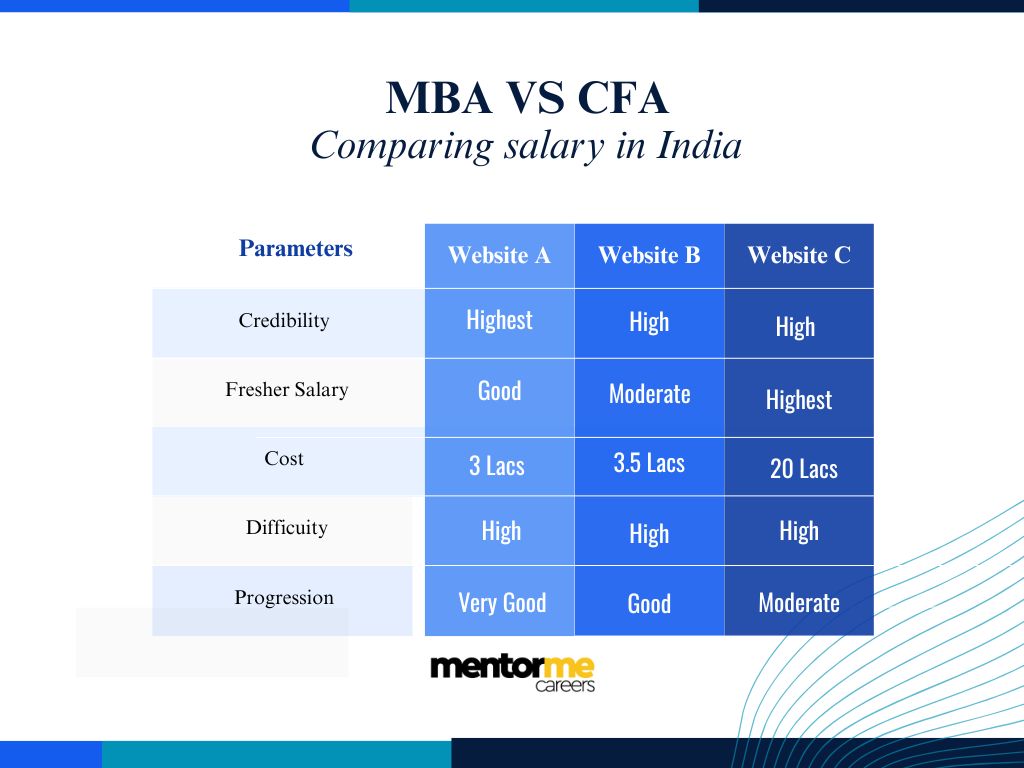

| Parameters | CFA | CA | Tier 1 MBA |

| Credibility | Highest | High | High |

| Fresher Salary | Good | Moderate | Highest |

| Cost | 3 Lacs | 3.5 Lacs | 20 Lacs |

| Difficulty | High | High | High |

| Progression | Very Good | Good | Moderate |

If you compare for careers in investment finance then CFA in the longer run has more progression, even compared to MBA. Simple reason is the knowledge and specialization in investments, very few people get to put the CFA credentials after their name.

You have spent 900 hrs of your life learning about only investments, hence there is no way any person with any other qualification can come close to it.

Is CFA worth it in India?

Often candidates in India in finance think about CFA. The main reason being global qualification and dreams of high paying job, but still a question always arises “Is CFA worth it in India?”. If we talk specifically of India. Yes it is worth it all, you know why? because market demands it. Looking at the global market we see there numerous institutes who provide degrees but value of those degree? None. This is the realty of India or rather i will say global. Everyone have degrees but no Skill. CFA qualification will help you boost your career, increase your credibility. Plus CFA gets you job anywhere in the world. This Global recognition will help you get better paying jobs and more opportunities. Indian Finance industry is booming. Companies are hiring more people looking at their skill and not degree. Focus on skill, competency. Better pay and Stable life will come to you. If you are passionate enough about finance you are good to go. Passion, Dedication and hardwork will get you to heights.

CFA course details and Preparation

CFA is divided in to three levels and requires clearing three examinations and submitting 4 years of experience in investment finance.

I have covered this in this article: CFA Course details

Conclusion

Well to put in simple non complex words “CFA is worth every dime and every minute you spend”. The only question is your conviction and consistency with not just CFA but also the industry.

FAQ

Is CFA still in demand?

Yes CFA is very much in demand in 2025. There is a need in finance industry for more CFA’s and their skills.

Is CFA really worth it in India?

India’s financial sector is growing everyday. Need for skilled professionals who can handle the work is essential. Having a CFA qualification will get you better pay and credibility.

How to become a CFA?

The basic skill needed for financial modelling after that prepare from modules for almost 6 months. Register and you are good to go for the examination. Take help from relevant sources.

Is CFA hard to pass?

CFA passing percent per year is about 40-45% so i will say still easier than CA. CFA is pure practical applied study with real case studies. If you understand the concepts you will crack it. Plus the syllabus of CFA is wide so going through everything is a task.