Last updated on August 2nd, 2025 at 06:05 pm

Being a financial professional is a lofty aim that needs effort, discipline, and commitment. The Chartered Financial Analyst (CFA) and Chartered Accountant (CA) qualifications are two of the most sought-after in the financial industry. In the finance sector, the CFA and CA credentials are both widely recognized and respected. Nonetheless, there is ongoing discussion regarding which is more difficult to do. In this article, we will look at the distinctions between the two certifications and determine the answer to: is cfa harder than ca?

Overview of the CFA and CA Designations:

The CFA Institute, a global group of investment professionals that promotes ethical and professional standards for the financial sector, bestows the CFA designation. The CFA program consists of three levels of exams covering a wide range of topics including ethics, economics, portfolio management, and investment analysis. The curriculum is noted for its difficulty, and completion takes a substantial amount of time and work experience requirement of 4 years to acquire the CFA certification, candidates must have a minimum of four years of professional experience in the finance industry.

Many professional accounting organizations across the world award the CA designation. The Institute of Chartered Accountants of India (ICAI) is the statutory body in India that issues the CA designation. The CA program includes three levels of tests covering accounting, auditing, taxation, and business law. The program is also noted for its complexity and the amount of time and work required to complete it. To achieve the CA designation, candidates must have a minimum of three years of professional experience in the accounting field.

Aditya Mehta, CA, CFA:Is CFA Tough than CA

Q: How is CFA different from CA in terms of difficulty?

Aditya: CFA is fundamentally different from CA. One major distinction is the absence of absolute passing criteria in CFA. Instead, you’re competing against other candidates globally. This makes it more challenging because you’re up against professionals who might already be working in top hedge funds or banks. Many of them have degrees in Economics or Finance, giving them a natural edge in mastering the material.

Q: Did you personally find CFA harder than CA?

Aditya: Honestly, yes. Despite being a CA myself, I struggled with CFA. One reason was overconfidence. As a CA, I assumed my broad knowledge base would be sufficient, but CFA demands a different approach. While CA covers a wide range of topics in accounting, law, and taxation, the depth isn’t comparable to CFA, which focuses exclusively on finance and investment concepts.

Q: What makes CFA particularly tough for CA candidates?

Aditya: For CAs, the challenge is transitioning from a wide-but-shallow syllabus to a deep-and-concentrated focus. CFA dives deeply into financial modeling, portfolio management, derivatives, and other investment topics. It requires mastery over finance, which many CA candidates don’t inherently have because our syllabus touches on finance but doesn’t explore it deeply.

Another factor is the attempt limit. CFA gives you only six chances per level, and failing six times means you’re banned from the program for life. This adds immense pressure.

CFA Versus CA Difficulty: Content & Exam Perspective

Both the CFA and CA programs are rigorous, and it is hard to determine which is more difficult. There are, however, some significant variations between the two programs that may be used to compare their complexity. This will be the first step to answer if, is cfa harder than ca?

Curriculum and Problem Solving

The CFA curriculum is notably broad, encompassing topics such as economics, portfolio management, and investment analysis. This extensive coverage makes the CFA program challenging, especially in terms of problem-solving skills required for success. The CA program, while also demanding, has a more focused curriculum on accounting, auditing, and taxation. However, the CA Intermediate level tests require students to tackle complex problems and apply theoretical knowledge in practical scenarios, which can be quite demanding.

Exam Format and CA Student Experience

The exam formats for the CFA and CA programs differ significantly. The CFA program has three levels of exams, each building on the previous one, while the CA program has a tiered structure that includes Foundation, Intermediate, and Final levels. For CA students, the Intermediate exams present a significant challenge as they require not only a deep understanding of accounting principles but also the ability to apply them effectively in problem-solving scenarios. Passing the CA exams involves rigorous preparation and practical experience, adding to the overall difficulty.

| CA | CFA |

| Group 1-Inter | Level 1 |

| Group 2-Inter | Level 2 |

| 3 Years Article ship | Level 3 |

| Final level | 4 Years Experience |

The Tougher Journey: Who’s got the Grit?

So, the exam structure for the CFA program differs from that of the CA program. Whereas, if you do the CFA program then you have to clear three levels of exams, whereas the CA program has three levels of exams but in a different format; It offers a three-tiered qualifying system that includes Foundation, Intermediate, and Final examinations.

However, in my opinion, the CA program becomes slightly more taxing, because in between getting the happiness of clearing intermediate. Finally, you also have to wait and sweat it out to complete the three years of internship with almost no real earnings.

If you want to read more about the exam details of CA, then check out our article on CA.

Now, if I compare that to the CFA journey, the industry starts accepting candidates for jobs right after level 1 of the CFA exams. Plus, there is the flexibility of gaining experience later, which also means that the lack of experience doesn’t stop you from giving and clearing all three exams.

So in the question of is cfa harder than ca, CA is tougher because you have to complete three years of articleship with no money, while preparing for the final exams.

Is CFA Easier than CA: Pass rates Perspective?

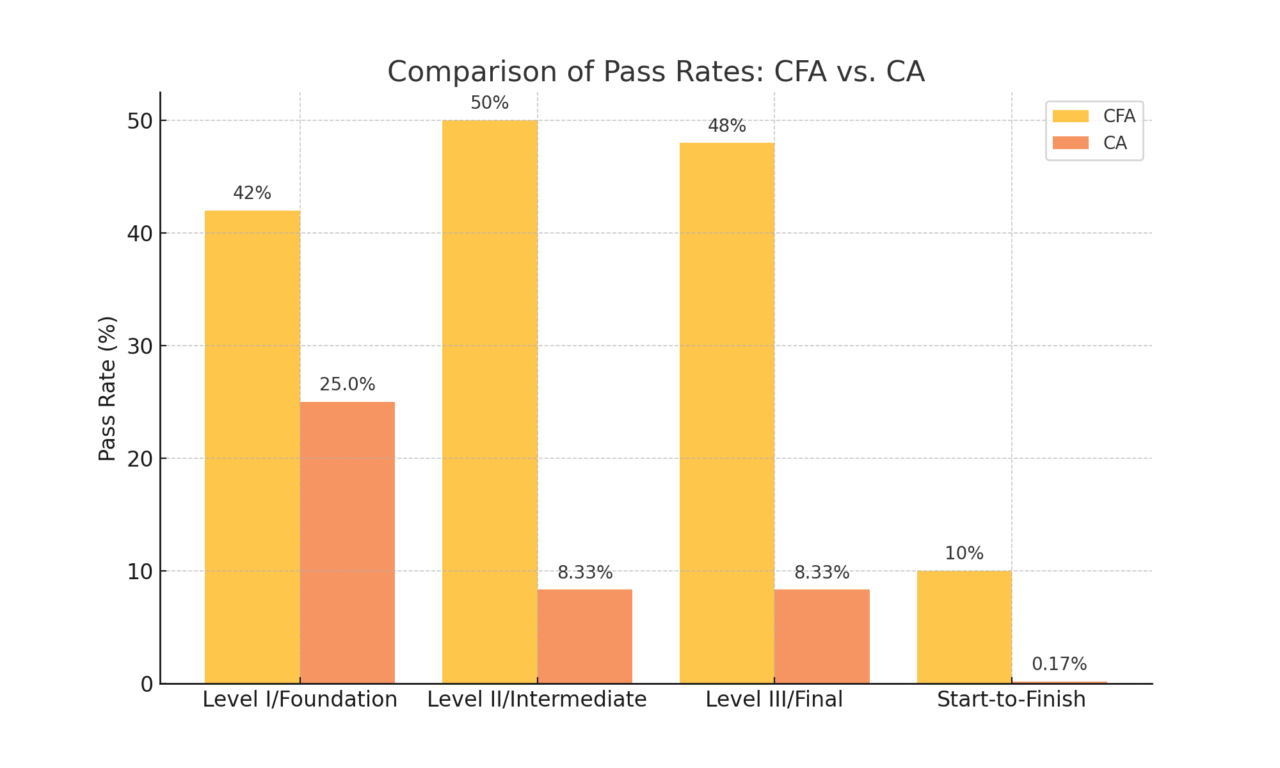

The 1st Level of the CFA exam has seen abnormal fluctuations in the pass rate which dropped from an average of 42% to 25% due to the recent COVID-19 pandemic. In 2025, the pass rate for Level I Feb & May was 45% and Feb 49% for Level III. However, these pass percentages might vary from year to year due to a variety of factors. These include- exam difficulty, applicant readiness, and market circumstances.

However, CFA Institute has implied that this low pass rate is temporary due to pandemic disruption. From 2011, Level 2 pass rates have been largely consistent and over 40%, with a notable increase to 55% for Dec 2020 Level 2 applicants. Moreover, the pass rate of Level 3 has been consistent with an average of 48%.

The results of the CA foundation exam, which was held in May 2025, were announced by the Institute of Chartered Accountants of India. The overall national success percentage was 15.09%.

So, in conclusion I can say that considering 100 people start both the programs, from an exam point of view we can see lesser candidates reaching the end in terms of CFA exam. However, this can also be true because many candidates in case of CFA, already have some other qualifications. Moreover, even if you didn’t complete all the levels of the CFA exams, you could still work in the industry at a good salary.

CA or CFA which is tough?

The Chartered Accounting (CA) curriculum is a three-year program divided into five phases, each with its own set of exams. You can become an Associate Member of the Institute of Chartered Accountants in India after completing Stages I and II (ICAI). To become a full Chartered Accountant, however, you must finish all five phases, involving approximately three years of practical instruction.

The CFA Institute offers the Chartered Financial Analyst (CFA) curriculum, which is separated into levels with exams. The full process of becoming a CFA charter holder entails completing all of the following levels: Level 1 (10 months); Level 2 (9 months); Level 3 (6 months).

While objectively, if we look at the time commitment then CA takes approximately 3.5 years, provided you started after graduation, while CFA takes the lowest time at 18 months excluding the Charter membership. Hence, even in terms of time commitment, to answer the question of is cfa harder than ca, it would be CA.

Concluding: Is CFA harder than CA

After evaluating these factors, it is clear that the Chartered Accountancy (CA) program is more difficult than the Chartered Financial Analyst (CFA) program. Both programs are rigorous and challenging, but the CA program requires greater concentration, time commitment, and experience than the CFA program.

By Duration

The duration of the CA program is one of the major elements contributing to its difficulty. The CA program takes around 4-5 years to complete, and students must pass three tiers of tests, including the difficult final exam, to get their certification. The CFA program, on the other hand, takes an average of 4 years to complete, with applicants required to pass three tiers of tests.

Furthermore, the CA program’s curriculum is significantly broader and lengthier than the CFA program’s. The CA program is far more thorough and rigorous since it includes a wide variety of disciplines such as accounting, taxation, law, auditing, and finance. The CFA program, on the other hand, is highly specialized, focusing on investment analysis, portfolio management, and ethical standards.

Skills

The amount of skill necessary to become a CA is also more than that required to become a CFA. CA candidates must grasp complicated accounting and taxation concepts, as well as be able to evaluate financial statements, audit reports, and financial regulations. CFA candidates, on the other hand, are primarily concerned with investment analysis and portfolio management, which necessitates a thorough grasp of financial markets and securities.

Additionally, the CA program has a lower pass rate than the CFA program. The CA final exam has a passing percentage of about 26%, whereas the CFA Level III exam has a pass rate of about 50%. This illustrates the greater level of difficulty and skill necessary to successfully complete the CA program.

So Which is harder?

To summarise, while both the CA and CFA programs are arduous and demanding, the CA program is unquestionably the more difficult of the two. The program’s duration, thorough and lengthy curriculum, the necessary degree of competence, and lower pass rates all contribute to its difficulty. Individuals who wish to become a CA must be willing to devote substantial time, effort, and resources in order to succeed in this difficult program.Top of Form

FAQ: Is CFA Harder than CA?

Q: What is the CA program, and how difficult is it?

The Chartered Accounting (CA) program is a professional training program that trains students to become accounting, tax, auditing, and finance professionals. It is well-known for its difficult curriculum, extensive program duration, and tough test format, which necessitates a high degree of competence, devotion, and effort to complete effectively.

Q: What is the CFA program, and how difficult is it?

The CFA program is a worldwide financial analysis recognized professional qualification that focuses on investment analysis, portfolio management, and ethical standards. It is a specialist program that necessitates applicants’ knowledge of financial markets, securities, and investment methods.

Q: Which program has a more extensive and challenging curriculum – CA or CFA?

The CA degree offers a more comprehensive and demanding curriculum that includes accounting, taxation, law, auditing, and finance. In comparison, the CFA program is more specialized, focusing on investment analysis, portfolio management, and ethical standards.

Q: Which program requires a higher level of expertise – CA or CFA?

Candidates for the CA program must have a thorough grasp of complicated accounting and taxation concepts, as well as the ability to read financial statements, audit reports, and financial regulations. CFA candidates, on the other hand, are primarily concerned with investment analysis and portfolio management, which necessitates a thorough grasp of financial markets and securities.

Related Articles