Last updated on June 29th, 2024 at 11:32 pm

A small desert in the middle east is a hub of the finance & investment banking industry. However, you might be wondering what would be the investment banker’s salary in Dubai, before you even foray into this quest.

We will attempt to address each of the questions raised above in this article.

Important facts about Dubai’s Economy

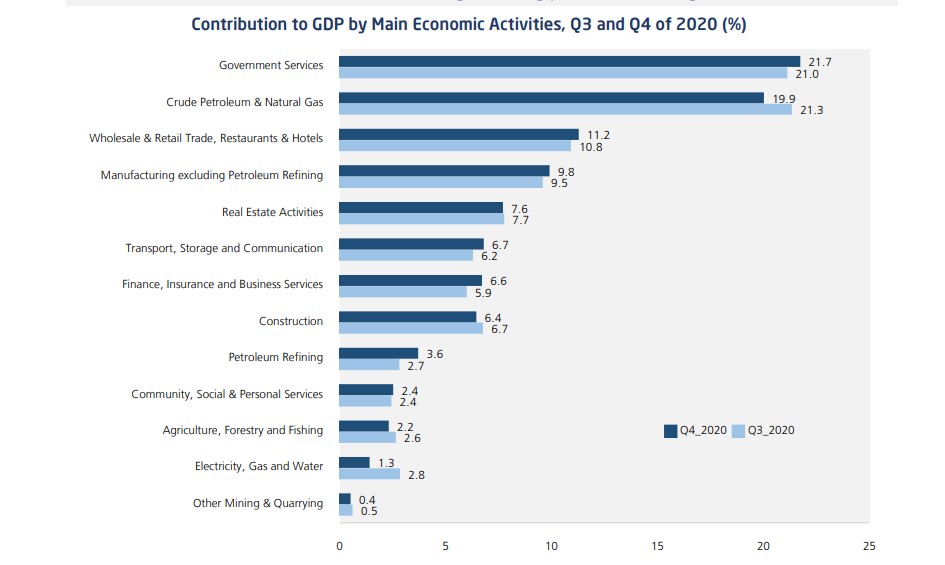

You might come to the conclusion, that Dubai is rich only because of Oil but the fact is that;

Only 1% of the GDP of Dubai comes from Oil, whereas 20% comes from tourism.

As Per the data given

Now, that is in sharp contrast to other middle eastern countries like Saudi. Where 24% of the GDP comes from oil revenues.

Factors for Growth of the Finance Industry in Dubai

I am going to list down the major factors, which led Dubai to become the financial capital.

- Firstly, In total, the UAE hosts three exchanges, NASDAQ Dubai, Abu Dhabi Securities Exchange & Dubai financial market.

- Secondly, In 2004 the Dubai International Financial Center was created, which is a free trade zone.

- Thirdly, there is a business-friendly tax regime and also independent courts to settle disputes.

Growth of the Investment Banking Industry in Dubai

Firstly, Dubai’s investment banking industry is growing. Also, Dubai’s investment bankers primarily serve the MENA (the Middle East and North Africa) region. Now, there are nearly 20 countries in the MENA region (Algeria, Bahrain, Djibouti, Egypt, Iran, Iraq, Israel, Jordan, Oman, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates, Kuwait, Lebanon, Libya, Malta, Morocco, West Bank and Gaza, and Yemen). So, Additionally, transactions in Dubai primarily concern these nations.

Firstly, the Local banks typically handle smaller deal sizes, while bulge bracket investment banks typically work on larger deals. The top investment banks in Dubai, both local and subsidiary, serve a variety of industries. Financial sponsors, sovereign wealth funds, and other holding companies make up the majority of their clientele.

Investment Banking Activities in Dubai

Corporate Finance Advisory:

So, A wide range of corporate finance advisory services, including risk management, deal structuring, capital structure, credit rating, and liquidity, are provided by local investment banks. Also, another factor is that Banks are friendly, customer-focused, and service-oriented as they manage smaller-scale deals.

Corporate Advisory:

Similarly, UAE's small to medium-sized businesses, are served by small investment banks in Dubai that provide corporate advisory services. They provide various services, such as debt advisory, equity research, and M&A services.

Private Placements:

Now, One of the most significant services is provided by investment banks in Dubai in private placements. Which, brings together companies and sophisticated investors, assisting the latter in selling complex securities to those knowledgeable buyers who are aware of the potential risks and rewards. Hence, speeding up the process by which businesses generate revenue from sales.

M&A :

Now, It's critical for two or more businesses to combine through mergers and acquisitions in order to benefit from synergy. They require a similar level of expertise to complete mergers and acquisitions, despite their different size and nature, and local investment banks in Dubai provide this.

Services & Structured Investments:

In addition to structured investments (as single security or a basket of securities), local investment banks in Dubai also provide other specialized services. The goal is to concentrate on small and medium-sized businesses so they can receive all of the capital and financial advisory services available, both domestically and internationally.

Finally, to conclude this section, the aforementioned services might resemble those of a large investment bank. Nevertheless, there are two differences:

- First, to these local investment banks, the relationship is everything. And every transaction is carried out in a friendly environment with mutual trust.

- Second, these small investment banks prioritize supporting small and medium-sized businesses.

Role of an Investment Banker and Career Opportunities

The role of an investment banker involves managing financial transactions, analyzing financial data, and preparing financial statements. Investment bankers play a crucial role in mergers and acquisitions, corporate finance advisory, and private placements. The demand for investment bankers in Dubai is high, driven by the city's robust financial sector and its strategic location serving the MENA region.

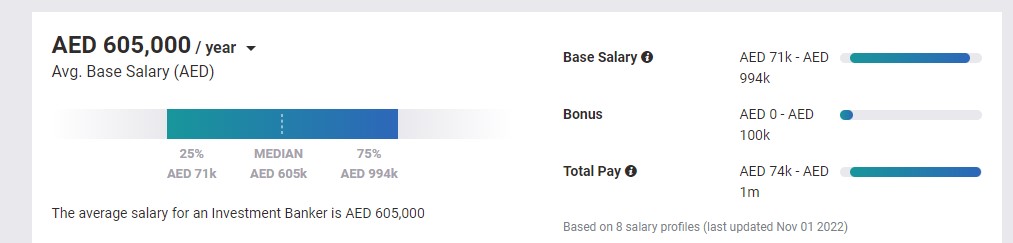

Investment Banker Salary in Dubai

So, Investment banker's salaries in Dubai, are among the niche professionals with some of the highest salaries overall. Hence, you can expect a starting salary of over 367300 AED (INR 7970189), as an entry-level investment banker. You can expect the salary to increase as the years of experience earns more value in the industry.

Compared to this, if you are interested in finding a salary in India, read our article on financial modeling salary in India.

- Analyst- 312205 AED (INR 67,74,661)

- Associate- 367300 AED (INR 79,70,189)

- Vice President- 440760 AED (INR 95,64,227)

- Managing Director- 1101900 AED (2,39,10,569)

Why is the pay for investment bankers salary in Dubai so high?

The banks' work on significant transactions that result in high fees is the reason they are paid so much. They must be intelligent, diligent, and highly skilled in exchange for such crucial work, and they must also be well-compensated.

They are paid well because their jobs are extremely demanding, have a rigid hierarchy, and require long hours. In actuality, they don't make that much per hour because the hours are so long.

Comparison with Investment Banker in India

Comparatively, the investment banker in India faces a different landscape. The banker salary in India varies widely depending on experience, with entry-level salaries significantly lower than those in Dubai. However, the average investment banker salary in India can still be quite lucrative, particularly for those working in major financial hubs like Mumbai and Delhi. Understanding the salary of an investment banker in different regions can help you make informed career decisions.

How to start in Investment Banking in Dubai?

First of all, just like in any other country you need the basics right.

So, let me list out the basic requirements first;

- Get a qualification in Finance

- MBA( Top 10 Colleges) in India or any premium business schools elsewhere.

- CFA level 1 or 2 . You can read about the CFA course details here.

- CA( ICAI)

- Secondly, get some experience.

- Finally learn skills like financial modelling. You can read about the detailed discussion on what is financial modeling.

So, the second point is more important and critical than the first one. Since Dubai is an international hub, the industry is competitive. Hence, you can expect to get your first job in Dubai, without experience as an Indian student.

However, the next question might be how much experience is needed.

So, my answer to that would be a minimum of 2-3 years of core research experience with some reputed names would be the best.

General Skills to Hone

Candidates who possess the following abilities may be able to perform the job more successfully in addition to the education and other requirements:

- Analytical abilities: Workers need to have excellent numerical, spreadsheet, and analytical abilities.

- Team player: People need to be excellent at leading teams and cooperating with others.

- Communication skills: Candidates must possess exceptional communication and interpersonal skills.

- Time management: Management of time and projects is a skill that investment bankers must possess.

- Work hard: The position of investment banker calls for commitment, devotion, and high vigor.

- Confidence: The position calls for candidates to possess self-assurance and the capacity to make difficult decisions, frequently while working under pressure.

Top Investment Banks in Dubai

Now, let me list the Top investment banking companies in Dubai:

- HSBC

- Emirates Investment Bank

- Noor Capital

- Allied Investment Partners

- Morgan stanley International

- Rasmala

- Entrust Paramel

- Palma Capital

- Wealth Face

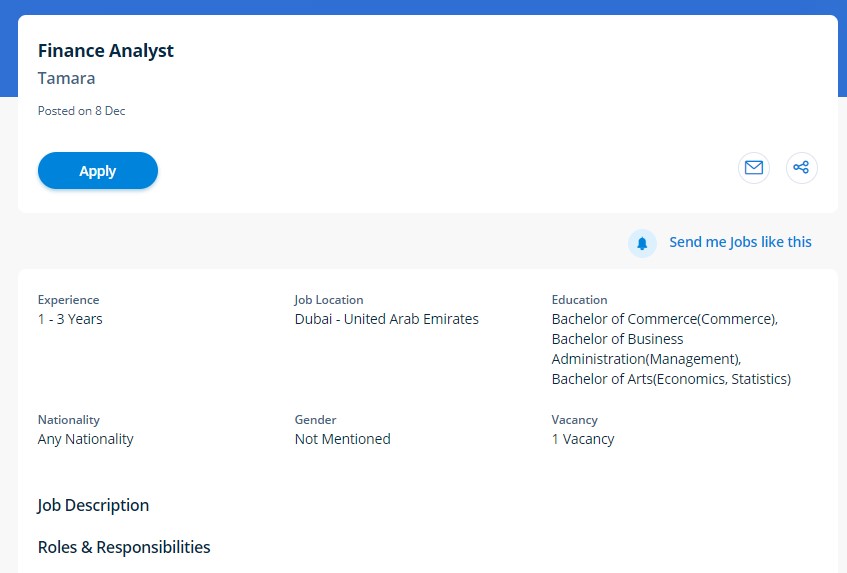

How to Apply for Investment Banking Jobs in Dubai

Now, although Dubai just takes 2.5 Hrs to 3 Hrs flight from India, but you can keep travelling there to give interviews. So, the most practical method of getting a job and work visa is the following.

- First, start applying for jobs online via linked in or Naukri gulf.

- Second, give interviews online and prepare first on the expected questions in the interview. You can check out the most asked questions in investment banking in this article.

- Finally, if you are selected then the investment bank will apply for a pink card visa on your behalf.

- Once, the visa is approved then you have two months to enter Dubai.

- Also, please remember that once you enter Dubai, you have to apply for a residence visa within 60 days. However, a residence visa is valid for one year to three years.

Dubai's Investment Banking: Exit Opportunities

- The notion of leaving investment banking after two to three years is invalid in this country due to cultural differences. People enter investment banking with the intention of staying for a very long time. So once they enter the banking industry, people hardly ever look for exit opportunities.

- In addition, the opportunities for private equity are extremely limited in comparison to those in Europe and the USA, even if they decide to leave investment banking.

However, when people move, it is usually for one of two reasons. Private equity is the second, and sovereign wealth funds (SWF) are the first (even if the opportunity is limited).

Conclusion

We sincerely hope that this information on the typical Dubai investment banker's salary was useful. This field is ideal for you if you enjoy working with numbers or if you enjoy interacting with people. As you can see, it's one of the finance industry's highest-paying and most promising careers. The need for investment bankers is expanding not just in Dubai but all over the world. The time is right for you to start a career in this area.