JP Morgan Interview Questions- Detailed Tutorial with Template

Sticky Phone Number +91 70214 50511 If you’re preparing forJP Morgan interview questions or other roles at Corporate Finance roles at JP Morgan, understand this clearly:

Practical valuation training with the best financial modelling course in Chennai.Train with Industry experts with Investment banking experience,Real world case studies,Guaranteed Interviews in core finance companies,Batches available for weekday & weekend training,Average packages starting from 5 LPA for freshers

To evaluate whether this program fits your long-term finance career goals, the financial modeling course with placement explains the full curriculum and interview readiness approach.”

Master Financial Modelling with Mentor Me Careers

At Mentor Me Careers, we know that finance is the lifeblood of any business. The Financial Modelling Course online and offline in Pune offered by us is designed to help you learn those practical skills that will make you a great financier. Taught by experienced professionals from top investment banks, our curriculum includes Corporate Finance, Capital Budgeting, Risk Management and Portfolio Management using tools like Excel among others.

• Hands-on Training: Real-world case studies and discussions.

• Flexible Payment: Easy installments

• Proven Success: Over 50,000 students trained worldwide.

• Flexible Formats: Live, offline or recorded sessions available in weekend or weekday format

• High Placement Rates: verifiable placements with contact details of placed students.

Some top Recruiters in Chennai include with Mentor Me Careers include;

Silverskills:244 Anna Salai, 2nd Floor, Chandok Center, Mount Road, Chennai, India 600006

Accenture Chennai: No.7, DivyaSree Point, OMR Service Rd, Laxmi Nagar Extension, Sholinganallur, Chennai, Tamil Nadu 600119

Crisil Chennai: Prestige Polygon, Anna Salai, Rathna Nagar, Teynampet, Chennai, Tamil Nadu 600035

Service 2026verified by TrustindexTrustindex verifies that the company has a review score above 4.5, based on reviews collected on Google over the past 12 months, qualifying it to receive the Top Rated Certificate.

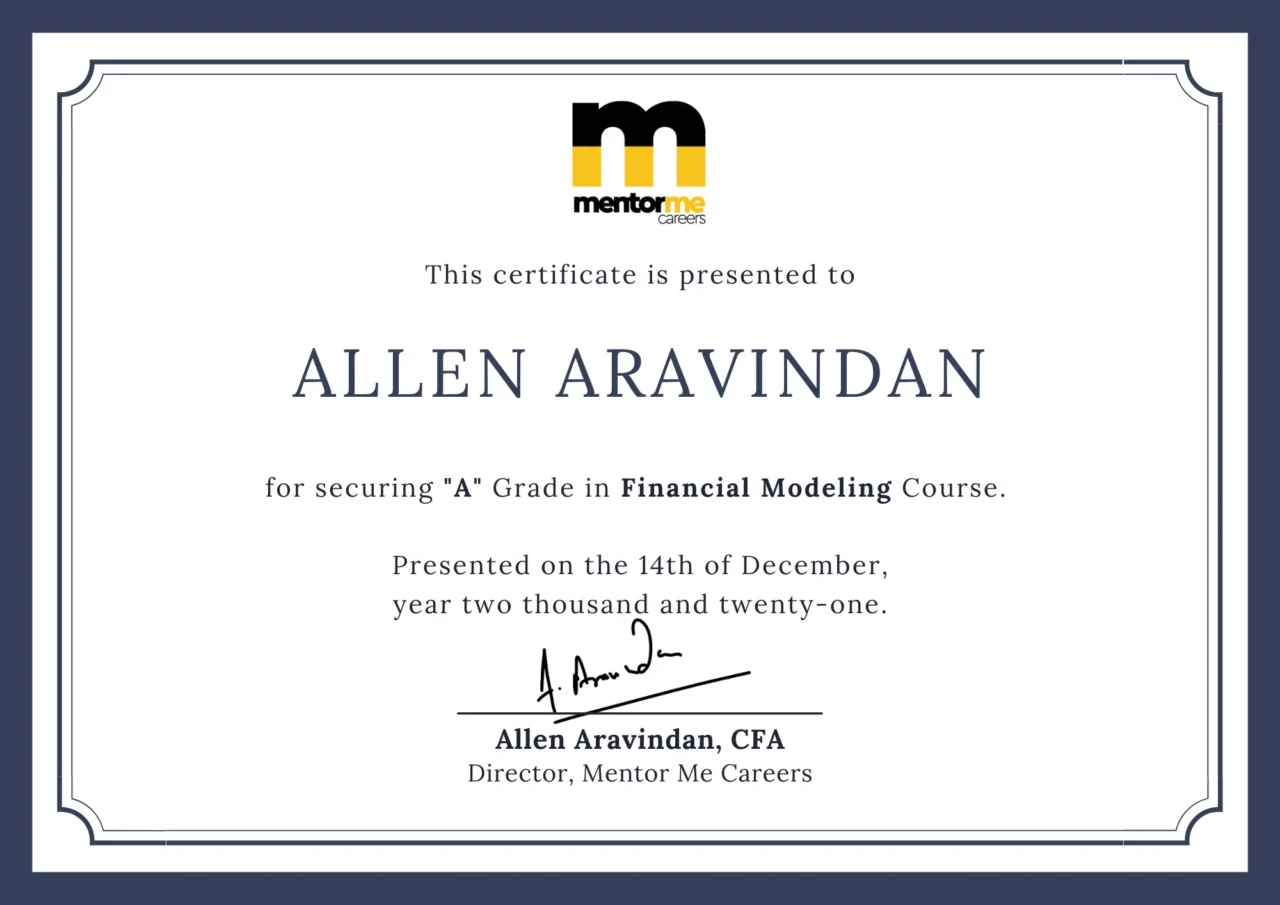

Mentormcareer's financial modelling course comes with a built industry recognised certifications

₹39,999 + GST

₹49,999 + GST

Below is the core program outline of the NSE fmva course details with Placement offered. Now, this forms the base foundation before the candidate, is eligible for specializations in advanced financial modeling certification and modules.

Also, You can download the brochure for more details.

Our Excel workshop empowers participants with the knowledge needed for finance analyst roles in consulting, equity research or investment banking. The training starts from basic to advanced levels of excel skills so that every possible area is covered.

Key Learning Areas:

• Efficient navigation of excel using keyboard shortcuts

• Advanced techniques for sorting and filtering data

• Better management of data by freezing panes

• Making your presentation more impactful through conditional formatting

• Financial modeling linkages and formula creation

• SUM, PRODUCT, DIVISION, CONCATENATE are essential functions

• VLOOKUP, HLOOKUP and MATCH are functions used to lookup data

• You can combine functions to solve complex problems: VLOOKUP + MATCH; INDEX + MATCH; VLOOKUP + IF.

CAGR IRR EMI are examples of financial calculations.

Table usage and pivot table utilization will also be taught during this session.

Logical/reference functions such as IF SUMIF COUNTIF SUMIFS SUMPRODUCT should not miss out too!

So if you want a strong foundation in Excel or become an expert at it which is crucial for building efficient financial/business models then join us!

Curriculum of Advanced Excel Workshop

Our workshop takes you to the next level after mastering basic skills, focusing on complex formulas and advanced data analysis techniques in Excel. The emphasis is placed on using Excel for fast data analysis and presentation.

Advanced Formulas and Analysis:

Combining multiple functions (VLOOKUP + MATCH, INDEX + MATCH, VLOOKUP + IF)

Applying the OFFSET function

Techniques for Sensitivity Analysis

Application of Scenario Manager

Management of iterative calculations

Statistical Analysis (Correlation, Regression, Variance)

Summarizing data with INDIRECT function

Charting and Visualization:

Making appropriate charts (bar, pie etc.)

Using dynamic charts and Name Manager

Advanced chart types (Waterfall, Thermometer)

Charts with Sensitivity analysis

Charts with Form Controls that are interactive

Practical Application:

Building dashboards using advanced formulas, conditional formatting and charting techniques

PowerPoint Training: Creating impactful slides through data representation including effective charting as well as visual appeal.

Key Learning Outcomes:

Efficiently analyzing data with advanced excel functions

Professional charting & Data Visualization

Creation of comprehensive dashboards

Effective PowerPoint presentations fit for corporate standards.

This workshop equips you with practical skills needed for a finance analyst role where complex data analysis becomes simple yet impactful when presented.

No one can become a financial analyst without knowing accounting and financial statement analysis required for investment finance field for analysing the financial performance. The investment banking course offered by Mentor Me will teach you financial accounting , analysis, various line items from the basics.

Introduction to Fundamental Analysis Framework– Annual report reading, Con Call reports, Quarterly reports, statement of change in equity, Supplementary information

Financial statement linkages and creating financial statement in excel

Income statement– Revenue recognition principles, Expense recognition principles, Diluted EPS, EPS, LIFO, FIFIO,AVCO

Balance Sheet– Format of balance sheet, current assets, current liabilities, Fixed assets, Non current liabilities

Cash flow statement– Format of cash flow statement, Direct method , Indirect method, FCFF, FCFEE

Ratio analysis– Solvency Ratios, Profitability ratios, Activity Ratios.

Ratio Analysis Case Study- Analyse persistent systems annual report

How to Read an annual Report step by step

Franchisee Business Model Valuation- NPV , IRR, Sensitivity analysis

Minority Interest, Impairment, Good will analysis

Once the finance fundamentals are set now its time to dig into creating financial models in practice. We will start applying all the concepts learnt into practical real life financial decision making. Check a project finance class here.

Start-Up Model Travel agency Business

You will learn how to think of the template of the business model. How a three statement financial model is made . Also you will learn how small business assumptions can make the decision making difficult

Manufacturing Plant Business Modeling

In this financial model you will learn how funding complications affect the model. Interest capitalisation, Construction phasing , Soft cost and hard cost of projects will be taught in this section

Tax Modeling

Tax is an important part of investment decision making calculation. Taxation is much more complicated than calculating 30% of the PBT. Here you will learn tax loss carry forwards, Carry forward loss set off, Minimum alternate tax, MAT Credits, MAT Set off,Deffered tax liability & Deffered Tax Asset. All of this practically using excel

Manufacturing Plant Set Up Model

This is a real model of the industry made from scratch using real world assumptions and calculations. You will learn what it means to work in a industry level financial model from zero. All the complications thrown into one project finance case. You also learn how to create deb schedule with various interest rate calculations.

Trading Comps Valuation Technique

Investment bankers and finance professionals widely use the trading comps valuation method, which compares a company with other similar companies to find its market value. In this course you will learn:

Building Trading Comps: From choosing peers to analyzing final output.

Understanding Multiples: How they are compared and used, the reasons for their differences, and how to deal with them.

Detailed Analysis:

Constructing analyses (enterprise value, latest twelve months, cleaning financials, calculating multiples)

Convertible securities impact, leases, R&D expenses

Different multiples in same sector and why they vary

IPO valuation multiples

Regression analysis on multiples

Industry relevant multiple

High growth vs low multiple scenarios

Differences among industry multiples and their drivers

Peer selection when there are no similar listed companies available

By taking this comprehensive approach you will be able to use trading comps effectively for accurate company valuation.

Investment bankers use the precedent transaction method or deal comps as a vital valuation technique to supplement trading comps and DCF valuation. To find out what a deal is worth, this method looks at past deals that have been done under similar circumstances.

Key Points:

Building Transaction Comps: Involves calculating transaction multiples, cleaning up financials, benchmarking multiples among others.

Comparative Study: The distinction between transaction and trading comps.

Controlling Premium: Its effect on multiples and how to measure it.

Right Situations: When to apply transaction comp multiples for accurate valuation.

Market behavior is better understood through this approach which also assists in valuing firms based on historical transactions data.

Check out our demo class of financial modeling valuation .

This is the final section before the specialization kicks in. In this section we will take a publicly listed company from NSE stock exchange and create a DCF Valuation Model and Relative /Comparable analysis financial model. This is one of the other applications of financial modeling in decision making. This model is specifically useful for people who want to pursue to join equity research and Investment banking

Valuation Basics- DCF, Gordon growth, WACC, Cost of equity , Levered, Un levered Beta, Terminal Value

Creating a model template

Data collection and data feeding in financial model

Revenue Driver- breaking the business into Price and quantity metrics, so that you can forecast those metrics

Cost Driver

Debt Schedule , Asset schedule Forecast

Free Cash flow calculation

Valuation Calculation

Sensitivity Analysis

Report Writing

This is our major success metric at Mentor Me, your placement. With over a decade of experience in this field, we have developed resources and process which will make you polished for the interview and job in investment banking and research. This module will include

Employability quizzes for each skill tested in the interview

Case studies practice for interview

Written test question bank

Mock Interviews- Face to face

Stress Interviews

CV Edits and recommendation

Soft Questions practice for HR Rounds

More and more finance Jobs require candidates to know the basics of python. In the Financial modeling course with placement in the weekday program we cover

Case study for finance on python.

Module 1: Power BI Set up

Learn the basic set up requirements of Microsoft Power BI & Overview of the major functionalities.

Module 2: EDA Using Power BI

Learn how to use the easy to use power BI Functionalities, to explore the data. Before beginning any analysis further

Module 3: Data Visualization with Reports Learn how to create beautiful charts and data presentation using Power BI

Module 4: Dashboards using Power BI

Learn how to create powerful interactive dashboards to summarize the data analysis in Power B

• Resume Building & LinkedIn Optimization

• Sector Analysis & Real Estate Modeling

• Internship-based Project Submissions

• Recorded Sessions for Revision

• Success-based Placement Fee Structure

Mergers models are A+B=C or A+B= A. The purpose of this kind of a model is to actually find the synergies and cost benefits.

M&A Merger Model Explained

A merger model predicts how much money shareholders of the new company will make in the future. It indicates whether a deal is beneficial or harmful to shareholders’ earnings.

Important Features:

• Building The Model: Making an integrated merger model that can evaluate transaction effects.

• Deal Structure Impact: How stock deals or cash deals affect future earnings.

• Synergies: Pro forma earnings should include anticipated synergies.

• Debt Refinancing: Existing debt in the target company needs to be accounted for when adjusting.

More Things You Can Learn:

• Complete overview of M&A process

• PowerPoint basics for presentations

• Drafting Letters Of Interest and Intent

• Fundamental Merger Model concepts

• Access to model files and detailed M&A notes

This method helps us understand financial implications during mergers and acquisitions completely.

A Leveraged Buyout (LBO) is when a company buys another company primarily with external debt.

Valuation: The target company’s worth is analyzed.

Transaction Assumptions: Major presumptions for the purchase.

Debt Assumptions: Conditions of the borrowed money.

Goodwill Calculation: Establishing intangible value.

Closing Balance Sheet: Financial standing after acquisition.

Income Statement: Expected revenues and costs.

Balance Sheet: Overall fiscal condition after LBO completion.

Cash Flow Statement (CFS): Money movements in and out.

Key Metrics: Success measurement for LBOs

LBO Files: All-inclusive modeling files for review

This framework guarantees an exhaustive comprehension of leveraged buyouts and their monetary consequences.

One of the favorites of the industry, because of its large contribution to India’s GDP. A very engaging model to make and easily understandable

Learn about the renewable energy project finance case on solar business. Learn its challenges, accounting assumptions and return potential

Aviation is more than just tickets. The major complication of making a aviation Model is the lease calculations and forecasting of it in the future

Education industry has changed over the years and is one of the most sought after business for investment banks. Learn how to model and value such business

Road development projects are the most interesting project finance application because of its easy to understand business details You will learn how to to estimate tolls, construction phasing and Return calculation

This is one of the complicated business to create a financial Model with various factors and a huge number of assumptions to be taken.

Did you know that real estate business model are only created using a one statement model and not three statements. A fairly easy model but complicated excel functions to manage delays

Learn to make a business plan on a star up idea from product to implementation . This can be suitable for those who have a fair idea on products and have worked with start ups before

This is guided full fledged course in which you will be told to research on strategies, read published material and execute a back tested performance of a strategy. Should be done only those, who possess strong statistics background

Make a model on one of the most talked about industry, E commerce. Learn how to forecast sales, handle negative cash flows and complete valuation

Our placement process in the best finance course in Chennai is robust yet personalized for each candidate. Additionally, each candidate gets access to a mentor, which promises unbiased decision-making help throughout the success journey. Every student has to display a certain level of financial modeling skills to be eligible for investment banking placements.

Our placement system includes soft skills training , career counselling , and mock interviews, ensuring you are prepared both technically and behaviorally. We operate a success-based placement feemodel, making the process outcome-driven.

Our financial modelling course in chennai fees ranges between INR 18,000 To INR 49,999. Depending upon the features and services you opt for.

We definately don’t call ourselves perfect, neither do we claim that we are the best financial modelling course in chennai but we definately are the only one’s that have the capability and expertise to place students in companies.

After completion of the course and successfully clearng all the assignments. Freshers with graduate degrees can expect between INR 3.5 To 5 Lpa and post graduates and ivy league backgrounds can expect salaries to begin with 7-9 lpa for freshers

Financial modeling is increasingly becoming a critical skill in Chennai, especially in sectors like investment banking, equity research, corporate finance, and financial analysis. With the growing demand for data-driven decision-making and financial forecasting, the trend is toward more sophisticated modeling techniques incorporating tools like Excel and PowerBI, as well as AI-driven analytics.

Yes, mentormecareers offers job placement assistance as part of their financial modeling courses in Chennai. They provide support in resume building, interview preparation, and connecting students with potential employers in the finance industry.You can check the detailed placement report

To enroll financial modeling course in Chennai:

•Visit the official website or contact their Chennai branch.

•Choose the appropriate batch (weekend or weekday) based on your schedule.

•Complete the registration form and pay the course fee online.

•You may also visit their Chennai office for direct enrollment and counseling.

The advantages of learning financial modeling include:

•Enhanced decision-making abilities in finance and business strategy.

•Increased employability in high-demand fields like investment banking, equity research, and corporate finance.

•Better understanding of financial statements and the ability to forecast future performance.

•Ability to assess investment opportunities and risks effectively

Yes, financial modeling has significant scope in India, especially in sectors such as investment banking, private equity, venture capital, corporate finance, and financial consulting. The increasing need for data-driven financial analysis and forecasting has made financial modeling an essential skill for finance professionals in India.

Skills required for learning financial modeling include:

•Strong proficiency in Microsoft Excel.

•Understanding of financial statements and accounting principles.

•Analytical and problem-solving skills.

•Knowledge of valuation techniques and financial metrics.

•Familiarity with data visualization tools like PowerBI.

•Attention to detail and the ability to work with large data sets.

Typically, candidates should have:

•A background in finance, accounting, economics, or business management.

•Basic to intermediate knowledge of Excel and financial statements.

•A bachelor’s degree in a related field, although some courses are open to undergraduates or professionals from non-finance backgrounds with relevant experience.

The average base salary for financial modeling jobs varies by experience:

•Freshers: INR 5-7 Lakhs per annum.

•Mid-level professionals: INR 8-12 Lakhs per annum.

•Experienced professionals: INR 15 Lakhs and above per annum.

Yes, obtaining a financial modeling certification significantly aids in career development by:

•Enhancing your credibility and skill set in the eyes of employers.

•Providing a competitive edge in job applications and interviews.

•Offering practical skills that are directly applicable to roles in finance, thus improving job performance.

•Facilitating career transitions into more specialized roles within finance.

These responses are crafted to address the common queries around financial modeling and how it pertains to the career landscape in Chennai.

Yes, we provide access to recorded sessions, and select students are offered internship opportunities during the course to gain hands-on exposure.

Sticky Phone Number +91 70214 50511 If you’re preparing forJP Morgan interview questions or other roles at Corporate Finance roles at JP Morgan, understand this clearly:

Last updated on March 5th, 2026 at 03:14 pm Sticky Phone Number +91 70214 50511 If you’ve landed on this page from my YouTube tutorial

Sticky Phone Number +91 70214 50511 The demand for finance certifications in India is rising fast as students and professionals look for specialized, global credentials

Last updated on February 13th, 2026 at 06:02 pm Sticky Phone Number +91 70214 50511 Choosing between a CFA and an MBA has become one

Sticky Phone Number +91 70214 50511 If you’re learning private equity modeling, the Leveraged Buy Out Model (LBO Model) is the one framework almost every finance student

Sticky Phone Number +91 70214 50511 Learning how to build a financial model isn’t just about entering numbers into Excel — it’s about structuring information so you