Last updated on December 11th, 2025 at 11:12 am

FIFO Full form stands for first in first out, and is an inventory valuation method available under most of the accounting standards like IFRS, U.S GAAP. However, in this article we shall discuss also, how this accounting method compares with LIFO.

If you are studying accounting or preparing for finance exams, you may have come across the term FIFO and thought about its importance in inventory valuation. FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are two of the most commonly used inventory accounting methods. They can greatly affect the cost of goods sold, profits, and tax calculations. Understanding the differences between FIFO and LIFO is essential for students, accountants, analysts, and business owners who want to ensure accurate financial reporting and make better decisions.

In this article, we define FIFO and LIFO clearly. We include basic journal entries, simple numerical examples, and explain when to use each method based on different accounting rules like IFRS and GAAP. Whether you are just starting or brushing up on your knowledge, this guide makes inventory valuation easier and helps you prepare for your exams.

You are free to use this image on your site, template etc. Just provide us the attribution link

FIFO full form stands for first in first out. A simple analogy to understand this could be:

You bought one kg of onions at $4.Another kg at $6 next day. Next day you used randomly one kg to cook a meal and sell it at $10.

Now as per FIFO, you would say that the cost is $4 but as per LIFO it would be $6

It wasn’t until I became a financial analyst while investing my own money that I realised how subtle things could significantly impact financial statements.

Let me explain why you should understand FIFO beyond the academic mandate of clearing exams.

As per the Cambridge Business School study over 25 years, this is what the guys concluded:

A powerful CEO with a reputation for always performing will generally resort to malpractices

Cambridge Business School

Enough of the jibber-jabber for now!

Principle Behind FIFO Full Form( First in First Out)

First things first, FIFO system or first-in, first-out accounting method works on the principle of, selling the goods we purchased first.

Sounds confusing?

Simply FIFO full form means, the oldest inventory of raw materials, get sold first. This means older costs are new and newer costs are old.

Also I can understand it by saying that older items are sold first and then we gradually progress to the newer purchased inventory.

Wait! That doesn’t mean I literally go out and search for the old cupboard and then lay out like a maniac.

lol!

It’s just a calculation man! You can sell whatever reaches your hand first, and anyway who cares?

All I care about, albeit, is the accuracy of my calculation, right?

Moreover, any financial statements should depict an accurate picture, which the FIFO principle proposes.

Let me first argue for:

- Firstly, if we do not take the old prices first and use current prices instead, hence the raw material bought before has no meaning.

- Secondly, the whole sequence of selling what we bought first is generally more intuitive and easy to understand.

- Finally, not using the FIFO principle could lead to obsolete and low-priced inventory, which could lead to higher profits on paper.

The FIFO method is allowed under all the popular accounting standards, including Ind As.

How FIFO works (step-by-step + numeric example)

- Identify inventory lots chronologically

Track purchases (or production) as separate lots with their purchase date and unit cost (e.g., Lot A: 100 units @ ₹50 on Jan 1; Lot B: 200 units @ ₹55 on Feb 1). - When a sale occurs, issue oldest stock first

Under FIFO you remove units from the earliest lot(s) still on hand, the first items purchased are the first sold. - Calculate COGS using oldest costs

For each sale, multiply the quantity taken from each lot by that lot’s unit cost; sum those amounts to get Cost of Goods Sold (COGS). - Update inventory balances (lot by lot)

Reduce quantity in the oldest lot(s). If a lot is exhausted, move to the next oldest lot for further sales. - Value ending inventory at latest purchase costs

After sales in the period, the remaining units are valued using the most recent purchase costs (because older lots were sold first). - Record journal entries (perpetual system)

On each sale:

1.Debit Cost of Goods Sold (COGS), amount computed using FIFO.

2.Credit Inventory, same amount.

(Sales revenue is recorded separately as usual.) - Periodic vs perpetual difference

1.Perpetual FIFO: you update inventory and COGS on every sale (preferred for accuracy).

2.Periodic FIFO: you compute COGS at period end by assuming oldest units were sold first across the whole period.

- Use for financial reporting & analysis

FIFO typically yields lower COGS and higher profits during rising prices, and ending inventory reflects recent (higher) costs, useful for balance sheet valuation.

Short numeric example

Purchases:

1.Jan 1: 100 units @ ₹50 = ₹5,000

2.Feb 1: 100 units @ ₹60 = ₹6,000

Sale:

1.Mar 1: sell 120 units.

FIFO COGS calculation:

1.From Jan lot: 100 × ₹50 = ₹5,000

2.From Feb lot: 20 × ₹60 = ₹1,200

Total COGS = ₹6,200

Ending inventory: remaining 80 units from Feb lot × ₹60 = ₹4,800

Journal entry on sale (perpetual):1.Dr. COGS ₹6,200

2.Cr. Inventory ₹6,200

How to calculate FIFO?- (FIFO Full form- First in First out)

Trust me on this! but calculating FIFO is best understood with an example, rather than a formula.

Also, memorising formulas can be disastrous.

Too idealistic, eh?

Aye, sir! Here is an example for you.

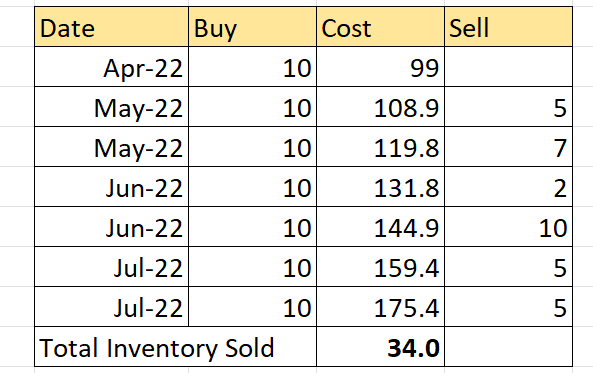

So, John Wick runs a gas station and has a capacity of 50,000 litres.

For which the supply of gas is done in barrels, and each barrel has 200 litres of petrol.

Below is the sequence of purchases with the date given

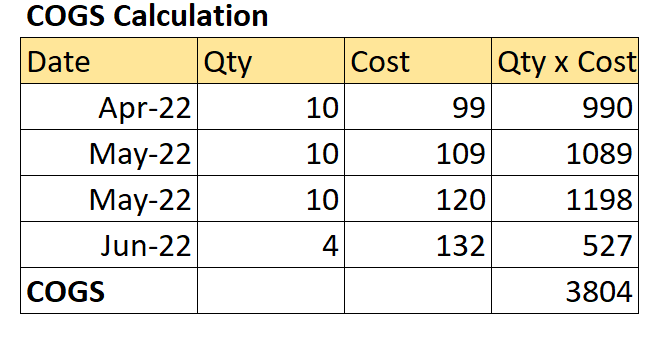

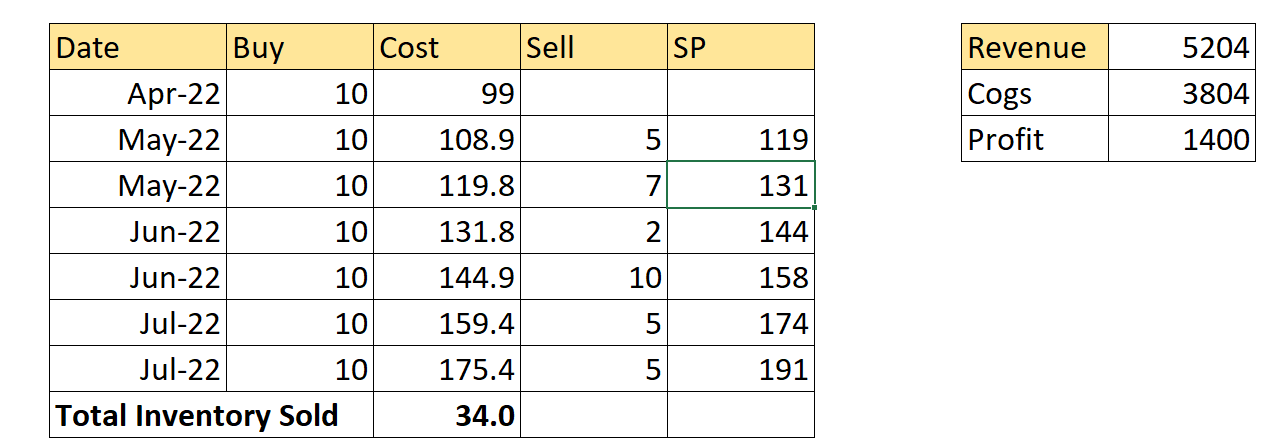

So, let’s start calculating the price paid. First of all, notice that we have sold 34 units in total.

Always remember to look at these calculations in total, rather than getting confused with the individual numbers.

So this is how the calculation would work:

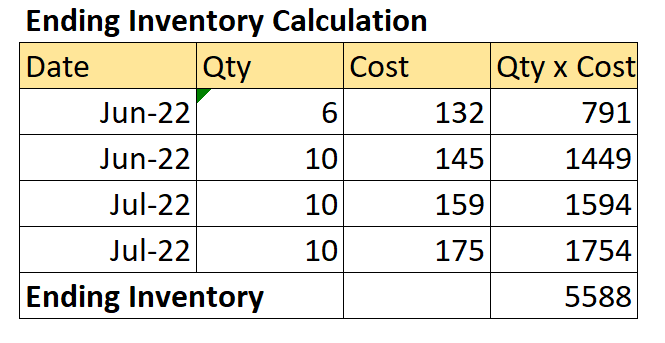

Hence, the June inventory is only partly used, which would mean that 6 units would accumulate in the ending inventory.

However, what’s the profit?

You can check and practice the entire calculation using this template.

FIFO vs LIFO: comparison table

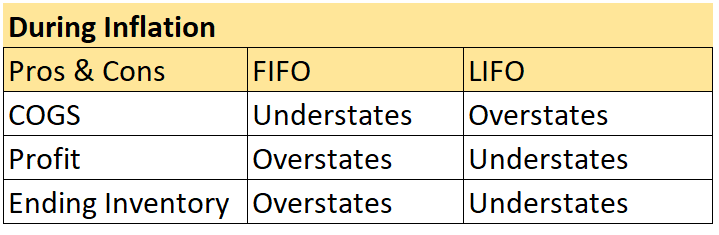

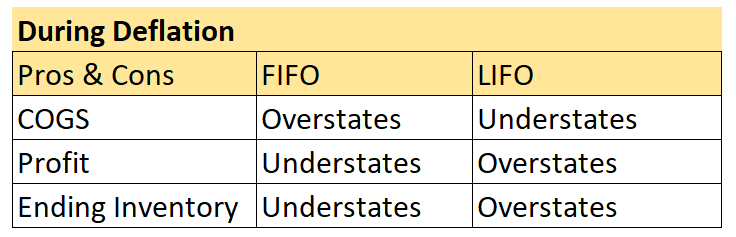

The choice between FIFO and LIFO is important for inventory valuation in accounting. FIFO emphasizes selling older inventory first. This can lead to higher profits during inflation. LIFO, on the other hand, focuses on selling the newest stock first, which results in lower profits. Both IFRS and Ind AS allow the use of FIFO but do not permit LIFO.

| Criteria | FIFO (First-In, First-Out) | LIFO (Last-In, First-Out) |

| Meaning | Oldest inventory sold first | Newest inventory sold first |

| Valuation Impact | Lower COGS, higher profit during inflation | Higher COGS, lower profit during inflation |

| Ending Inventory | Reflects latest/current market prices | Reflects older/cheaper inventory costs |

| Tax Impact | Higher taxable income in inflation | Lower taxable income in inflation |

| Financial Statements | Higher profit, higher inventory value | Lower profit, lower inventory value |

| Best For | Perishables, FMCG, pharma, retail | Inflationary environments, industries with non-perishables |

| Allowed Under IFRS(International financial reporting standards)? | Yes | No (LIFO is prohibited under IFRS) |

| Usage in India (Ind AS) | Commonly used & acceptable | Not allowed under Ind AS (IFRS aligned) |

| Complexity | Simple to apply | Requires detailed tracking of layers |

| Example | Old batches issued first | Recent batches issued first |

FIFO Vs LIFO Vs Weighted Average Method

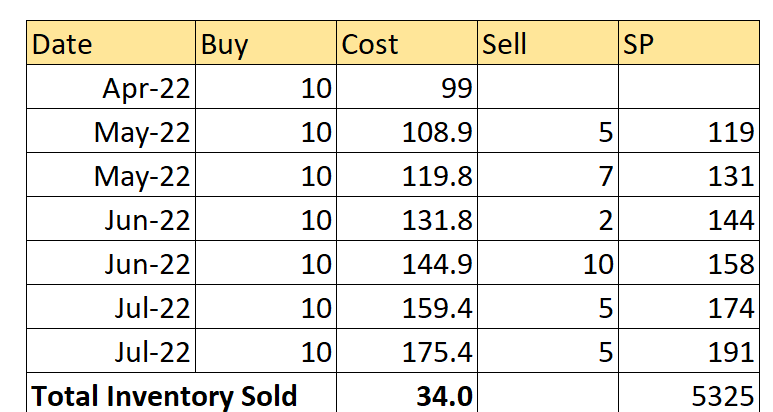

Now we know something about FIFO, likewise, the LIFO method of inventory valuation would start the calculation in reverse order.

I am going to directly give the total calculation of LIFO, rather than going step by step life before.

Nevertheless, in summary, I started counting the 34 Units from July 22 to Jun 22.

Are you still with me?

Thus even without me saying this, indeed the COGS as per LIFO is higher.

Can you take a second to reason that?

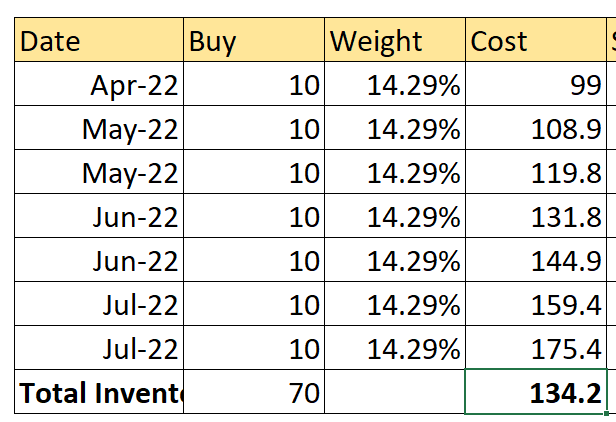

Furthermore, let’s look at the weighted average method, which rather than following an order conversely finds a middle ground.

What do I mean by middle ground?

For example, in our case, we can notice, that each lot of petrol barrel is the same. However, that doesn’t have to be the case always.

Even so, the weightage comes out to be 14.29%, as a result of which if we multiply the cost for each lot gives us the weightage average price.

As a result, our total cost of goods sold, thus becomes 4562.

I told you, just hang on! Clearly, the weighted average method is so easy, right?

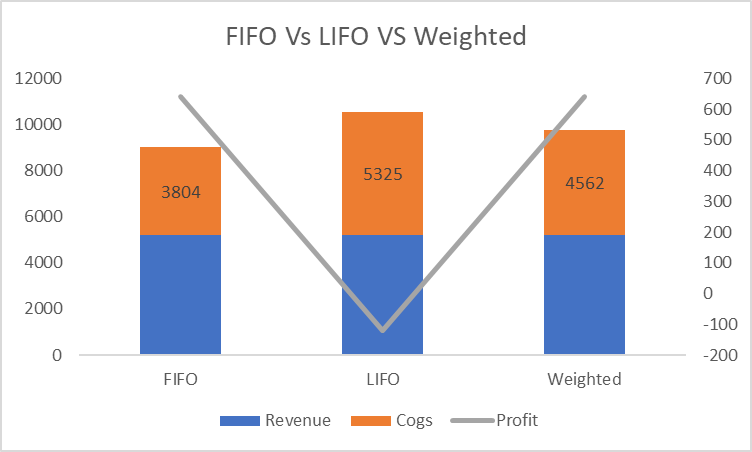

Of course, the chart should make things crystal clear!

Undoubtedly, LIFO shows the lowest profit, followed by the weighted method and finally the FIFO.

However, I said shows in bold letters, whereas this calculation has no effect on what we actually earned in cash.

Journal entries & accounting treatment

Under FIFO (First-In, First-Out), the oldest inventory costs are recorded as Cost of Goods Sold (COGS) first, while the latest purchases remain in ending inventory. This affects journal entries, profit, and taxes.

1. Purchase of Inventory

When inventory is bought, it is added to the inventory account at purchase cost.

Journal Entry:

Inventory A/c …………. Dr

To Accounts Payable / Cash

Effect: Inventory increases at actual purchase cost (batch-wise tracking).

2. Sale of Inventory

Revenue is recorded at selling price.

Journal Entry:

Cash / Accounts Receivable …….. Dr

To Sales

3. Recording COGS using FIFO

COGS is computed from the earliest purchased units.

Example:

1.Batch 1: 100 units @ ₹100

2.Batch 2: 100 units @ ₹120

If 120 units are sold → COGS = (100×100) + (20×120)

Journal Entry:

COGS …………………………. Dr

To Inventory

Effect: Inventory is reduced using earliest cost layers.

4. Ending Inventory Valuation

Ending inventory contains the most recent costs.

Financial Statement impact:1.Inventory (Balance Sheet) = newer, higher prices (during inflation).

2.COGS (P&L) = older, lower prices.

Tax & financial statement impact

1. FIFO increases profit during inflation

Since older, cheaper inventory is used in COGS:

1.COGS decreases

2.Gross Profit increases

3.Net Income increases

This also leads to higher income tax liability.

2. FIFO shows higher inventory value

Because ending inventory uses latest, higher-cost purchases, balance sheet inventory appears stronger.

Impact:

1.Better liquidity ratios

2.Stronger current ratio

3.Higher asset valuation

3. FIFO reduces profit during deflation

When prices fall:

1.Older, higher-cost inventory increases COGS

2.Profit decreases

4. FIFO is compliant globally

1.Allowed under IFRS & Ind AS

2.Fully allowed under US GAAP

3.Preferred by auditors for simplicity, transparency, and lower manipulation risk

5. Cashflow Impact

Higher taxes under FIFO- lower operating cash flow during inflation.

FIFO journal entries follow a simple pattern: record purchases into inventory, record sales at selling price, and compute COGS using the oldest cost layers. In 2025, FIFO results in higher profit, higher taxes, and higher ending inventory values during inflation, making it a widely accepted method under IFRS, Ind AS, and GAAP.

Pros and Cons FIFO Vs LIFO

For one thing, I expect now that you can read between the lines on this topic?

So, I hope you get the idea that both the methods are extremes, for this reason, the weighted average is the most used method.

| Pros of FIFO | Cons of FIFO |

| Simple FIFO is intuitive and widely understood across industries. | Higher tax liability during inflation older, cheaper costs go to COGS, increasing taxable income. |

| Financial statements look better COGS is lower and net profit appears higher in inflationary periods. | Not ideal in volatile markets may not reflect true replacement cost during rapid price changes. |

| Ending inventory value is realistic FIFO aligns closing stock with current market prices. | Can inflate profitability managers may misinterpret inflated profits caused by outdated cost layers. |

| Accepted under IFRS & Ind AS globally compliant and widely required in many jurisdictions. | Doesn’t match current costs with current revenues COGS may not reflect present-day cost structure. |

| Reduces risk of obsolete inventory oldest stock is sold first, helping maintain freshness/quality. | More complex for high-volume industries tracking cost layers can be difficult without software. |

| Preferred in FMCG, manufacturing, retail works well where inventory moves quickly. | Not suitable for declining prices may understate COGS and overstate inventory in deflationary cycles. |

Of course, who wants a roller-coaster income statement right?

Accounting Scams using FIFO & LIFO

Ok, this is the most interesting and I want you to hear this out because even if the methods weren’t clear to you, this will seal it.

So , this story relates to an analyst named,Gary Mishuris, who was hired as an equity analyst in one of the largest mutual funds.

So Gary was given the task of analysing a company named OM Group, which was at the time one of the famous metal processing companies.

I will cut things short and In summarise what exactly happened:

- The company had positive earnings but no cash flow, a big red flag

- Also, this led to the analyst to confront the management and CFO to get more answers.

- On confrontation, the question arose on which method they were using, namely FIFO or LIFO

I will injunct the story Just a little bit here, remember that LIFO can create some abnormal profits if we start selling oldest inventory from the balance sheet.

- At that year cobalt prices were falling and on asking the management they agreed they were buying more

- As terror stuck, the main question came:” Are you buying more cobalt now with all the cash flow, because oldest inventory would reduce your earnings?

As a result, the stock fell from $70 to $4 in three months.

You can read the full SEC Case.

What is Called LIFO?

LIFO stands for last in first out, is an inventory recognition method. Where the recent purchased materials are assumed to be sold or used first.

FIFO Method Questions

FIFO problems with some simple calculation based questions, I have made it below for your reference to just get a fair idea.

Question 1

Q: On May 10, I sold 150 widgets. My beginning inventory was 100 widgets at $10 each, and I purchased 200 widgets at $12 each on May 5. What is the cost of goods sold (COGS) for the May 10 sale?

Ans:

• 100 widgets from beginning inventory at $10 each: 100 \times 10 = $1000

• 50 widgets from the May 5 purchase at $12 each: 50 \times 12 = $600

• Total COGS for the May 10 sale: 1000 + 600 = $1600Question 2

Q: On May 20, I sold 180 widgets. The remaining inventory from the May 5 purchase is 150 widgets at $12 each, and I purchased 100 widgets at $13 each on May 15. What is the COGS for the May 20 sale?

Ans:

• 150 widgets from the May 5 purchase at $12 each: 150 \times 12 = $1800

• 30 widgets from the May 15 purchase at $13 each: 30 \times 13 = $390

• Total COGS for the May 20 sale: 1800 + 390 = $2190Question 3

Q: On May 30, I sold 120 widgets. The remaining inventory from the May 15 purchase is 70 widgets at $13 each, and I purchased 150 widgets at $14 each on May 25. What is the COGS for the May 30 sale?

Ans:

• 70 widgets from the May 15 purchase at $13 each: 70 \times 13 = $910

• 50 widgets from the May 25 purchase at $14 each: 50 \times 14 = $700

• Total COGS for the May 30 sale: 910 + 700 = $1610Question 4

Q: After the May 30 sale, how many widgets do I have left in inventory and at what cost?

Ans:

• 100 widgets from the May 25 purchase at $14 each: 100 \times 14 = $1400

• Total ending inventory cost: $1400Question 5

Q: What is my total cost of goods sold (COGS) for May if I had sales on May 10, May 20, and May 30 with the respective COGS calculated as $1600, $2190, and $1610?

Ans:

• Total COGS for May: 1600 + 2190 + 1610 = $5400Conclusion

I know, this was a long post for something this simple but I don’t care about the concept academically! I mean think about this analyst, even he knows LIFO and I am sure millions know it as well.

However, look at how a simple concept like FIFO, when learnt with the correct perspective and avert disasters worth billions.

So if you want to learn analysis that matters, then do care to check out our financial modeling course, which makes you more capable than educated.

Ciao!

FAQ

FIFO stands for First In, First Out, an inventory valuation method where the earliest purchased goods are recorded as sold first.

FIFO sells the oldest inventory first, while LIFO (Last In, First Out) sells the newest inventory first. This leads to different cost and profit outcomes.

FIFO is preferred when inventory must move in a natural order (perishables, retail) and when companies want cleaner balance sheets and higher inventory accuracy.

Yes. Under inflation, FIFO results in higher profits because older, cheaper costs are matched against current sales prices.

No. IFRS does not allow LIFO. Only FIFO, Weighted Average, and other permitted methods can be used internationally.

Record Cost of Goods Sold (COGS) using the cost of the oldest units first, while remaining inventory reflects the most recent purchase costs.

A business buys 10 units at ₹100 and later 10 units at ₹120. If it sells 10 units, under FIFO, the first 10 units (₹100 each) are counted as sold.