Last updated on October 23rd, 2024 at 02:55 pm

Understanding this basic components of the accounting equation formula can make your life simpler with finance and accounting in general.

Whether you are a CA candidate or a financial analyst?

Maybe you are a non-finance student facing this horrific concept.

It’s pure logic! Let’s get started.

Key Takeaways

1. Assets=Total liabilities + Equity, the golden formula is the basis for all accounting calculations i.e balance sheet equation or statement of financial position.

2. The principle works on that after each transaction both the liabilities and assets are equal.

3. For example:A company buys a car worth $10000, in this case also the assets will increase by the cost of the car($10000), the cash will reduce with the price of the car(if purchased with cash).

Examples of accounting equation

Expanded Accounting Equation- Example 1

If we stop looking at accounting from an academic perspective and use a rather practical common sense approach. Then this equation will be child’s play to understand.

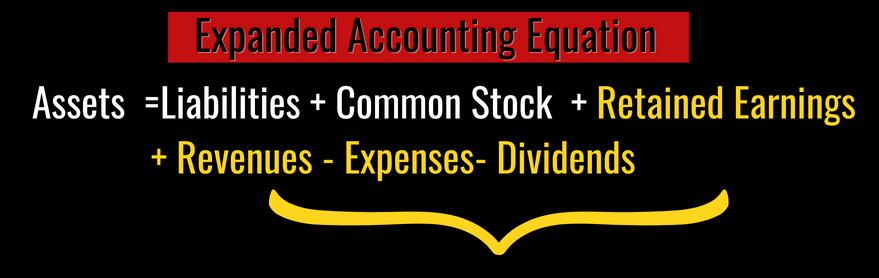

- The equity capital of 2012 was 40, plus the reserves in 2011 were 707.

- You add the new profit of 2012 to the reserves after paying of dividends

- This gives you the total equity for 2013.

Expanded Accounting Equation- Example 2

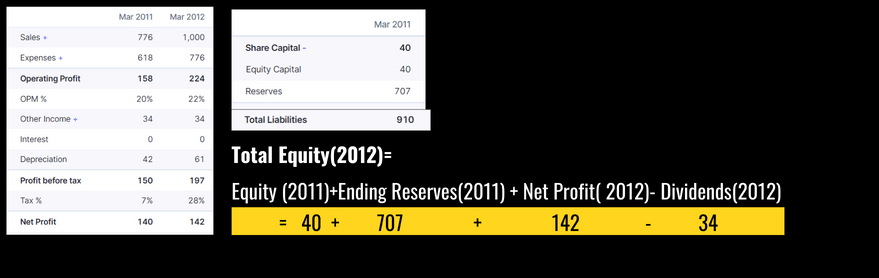

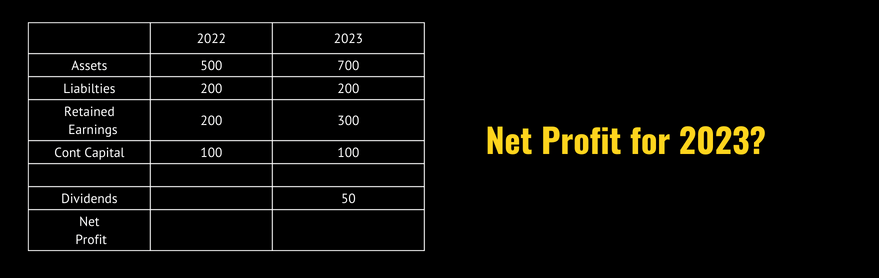

Here is a reverse question. You have been given all the values except net profit.

- Lets us again go back to the original formula.

- Ending Retailed Earnings= Begining retained earning+Net Profit – Dividends.

- Rearrange the equation

- Net Profit = Ending Retained Earnings- Begining Retained Earnings + Dividends.

- Hence the answer would be = (300-200)+50= 150

However, note that I did not use the owner’s equity in the equation because I was not trying to find the total equity. Rather Was trying to find the change in retained earnings.

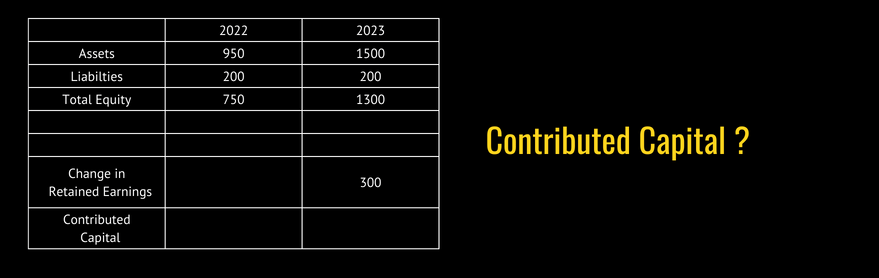

Expanded Accounting Equation- Example 3

- We have been given the change in retained earnings and total equity

- Let’s write our equation: Total Equity Ending= Beg Equity( Contributed Capital+ Begining Retained Earnings)+ (Net Profit – Dividends)

- We can expand the equation to Beginning Retained Earnings)+ (Net Profit – Dividends can also be called = Change in Retained Earnings

- Total Equity Ending= Contributed Capital+ Change In Retained Earnings

- Therefore 1300= CC+300

- Contributed Capital = 1300-300=1000

- If we had dividends too of let’s say 100 then, contributed capital= 1300-300-100=900

Logic Behind the accounting equation Formula?

First and foremost, try answering two simple questions with every transaction.

- Is the transaction related to one year or multiple years?

- Is there any cash exchange in the transaction?

The most important area of knowing what goes in the balance sheet and the income statement is the current year versus the future.

Let’s decode this with the same examples.

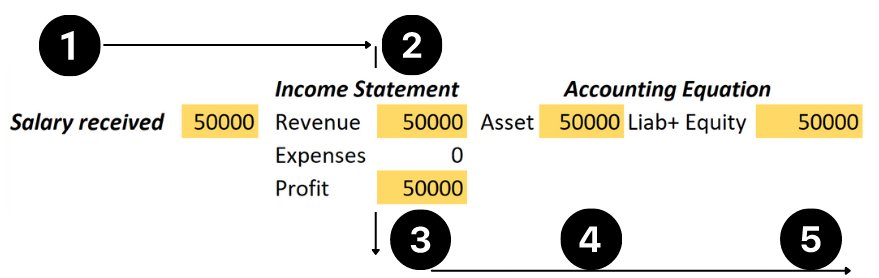

1: Salary: You receive the salary (after rendering your service for the month) in cash

The two keywords here are after and cash.

That means both these transactions are related to one year and aren’t creating a need for us to remember future commitments.

We worked for that given month, and we got the salary in cash; that’s it!

Hence, first of all, the salary is income, so it goes to the income statement but remembers that the income statement works on

Revenue – Expenses = Profit

So, in this case, our revenue = salary, and at the moment, we don’t have any expenses, so the profit is the same as revenue.

However, what if, after ten years, you want to see how you performed?

It will become tedious to keep looking at each income statement and then add.

So what’s the solution? Simply let’s take the profit and add it to retained earnings.

Of course, your salary was not spent but retained as savings.

Testing this accounting equation Logic Part 1

At this moment, let’s explore this transaction completely!

The flow is more revenue than profit, leading to retained earnings.

Of course, you have cash, right? To increase cash, which is an asset by the same amount, making both side balance.

- The liability and share holders Equity side of the equation is linked to profits.

- The asset side is linked to cash transactions and total credits in terms of income.

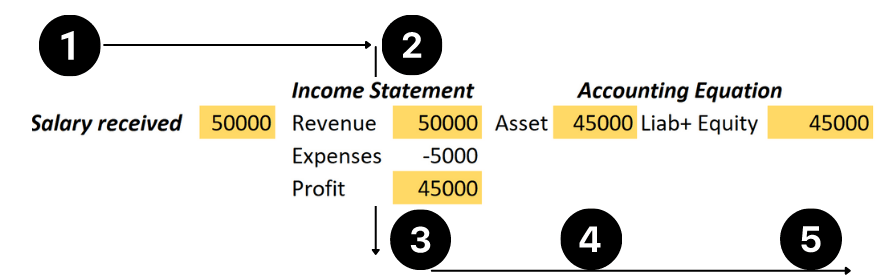

Testing this Logic Part 2

Paying electricity bills and buying a mobile phone with cash or a loan, how’s that going to work?

Well! Again let’s get to the basics first,

- Is the electricity bill paid for using the electricity this year and is it paid in cash?

The answer could be, Yes!

It is paid for after using the electricity; at least, that’s how it works in India.

Your next question could be, what if it was paid in advance?

Well, I will get there; just hang on!

So the expense qualifies for the equation, Revenue – Expenses.

Second it then it reduces our profit and finally reduces our retained earnings.

But what about the assets side?

The same flow debits cash on the asset side.

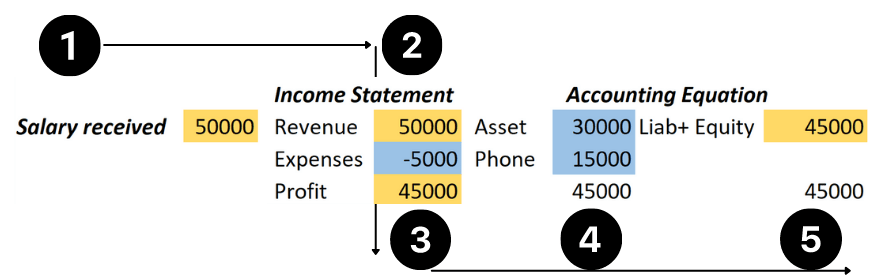

Testing the logic Part 3

Well, now let’s test the buying of gadgets first with second cash and later see how it works with the loan.

The first question: Is it bought to be used only for one year?

Of course not! This asset or mobile phone can be used for multiple years right?

Then the problem is, how can we put the entire mobile phone expense in the income statement?

Remember? The income statement is just for one year. Now before you run for cover and apply complicated terms.

How about we simply divide the mobile phone cost across multiple years?

Yes! Simply evenly distributing the expense across years, makes sense?

So now, how would that work out in the equation?

First and foremost let’s deal with this in two parts: Buying first and expensing second.

When we bought the mobile phone, it created an asset. So asset increased? But how does the equation balance?

It balances with cash reduction since we are buying it with cash.

Secondly, how does the expense get recorded?

The distributed expense reduces the income in the form of depreciation, which reduces retained earnings.

Similar to the asset side, it reduces with depreciation.

Increase expense with the distributed mobile phone cost, and reduce retained earnings.

What would have happened if we had bought the same with a loan?

Simple! The cash wouldn’t be affected but Liabilities would increase with the loan amount.

Summarising the logic

If you got the logic, then we are in a position to summarise this logic in terms of an equation:

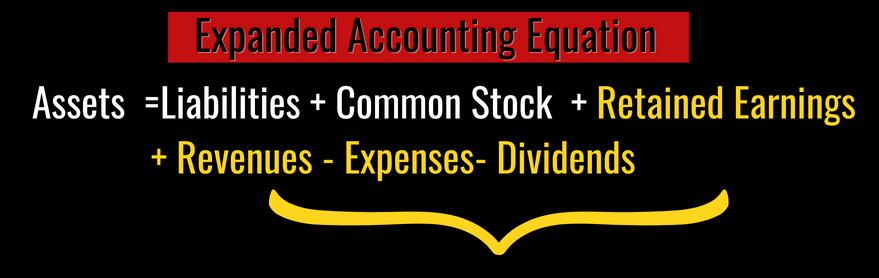

Further, you could decompose the basic accounting equation further as:

- CC = Contributed Capital (comes from capital provided by shareholders)

- BRE = Beginning Retained Earnings (carryover retained earnings that were not given to stockholders)

- R = Revenue (comes from sales and operation)

- E = (-) Expenses (costs associated with running the operation)

- D = (-) Dividends (earnings distributed by the company to its shareholders)

Hopefully, you have understood this and I would recommend you test your understanding with various examples.

Test your Understanding

Answer:

Components of the Equation

Let me give you a brief break-up of what all are included in these main headings, of the accounting equation formula.

Capital

- Common share capital: In a business context, this is the initial money added to start the business

- Preference share capital: Still the capital but with rights on fixed dividends

- Preference convertible capital- Capital with fixed dividends and converting to common equity option.

Liabilities

Similarly, let me show your what Liabilities can include both short-term or long-term?

- Accounts Payable: Things taken on credit from suppliers

- Short-term loan: Loan taken for short-term purposes like working capital

- Long-term loan: Debt taken for expansion

- Salary Payable: Salaries were not paid in cash but were supposed to be paid

- Unearned revenue: Advance cash received from customers but services not rendered

Assets

What about Assets? Assets are simple to understand.

- Cash in bank: Simply the cash accumulated over years of operations

- Accounts receivable: Product or service rendered but cash not received.

- Fixed assets: Assets to be used for the long term in the business. May include machinery, equipment etc

Some Random Transactions

- Buy Raw materials with Cash: Effect- Asset increases and Asset ( Cash decreases) with an equal amount. Leading to its balance again

- Buy Raw material on credit: Effect- asset increases( raw materials) and Payables increases (liabilities) with the same amount

- Sell products on cash: Effect -revenue increases (leading to an increase in retained earnings leading again to an increase in equity).

- On the other side of the equation, the cash increases with the same amount

- Sell products on credit, Effect- revenue increases (leading to an increase in retained earnings leading again to an increase in equity).

- On the other side of the equation the accounts receivable increase with the same amount

Limitations of accounting equation

- Quality

- Human resource

Although I could argue that both get captured in the performance of the company itself. However, I would like to comment that, the accounting equation’s biggest necessary evil is accrual.

The accrual system is both a necessity, as well as an evil which can be used to show a very rosy picture.

Accrual means, the non-necessity of exchange of cash for it to be recorded as revenue.

Think about a real estate company, as per the accrual rules the company doesn’t even have to sell it to record revenue.

It can use the percentage completion method of the project and record the revenue.

The Importance of the Accounting Equation is that.

Without them, it would be impossible to understand how a business performs or even keep tabs on the various transactions of the company.

Use Cases

- Creating financial statements for company performance

- Creating business models

- Performing fundamental analysis of a company

You may try to use the below video, to see how this gets used in financial modeling

Related