Last updated on December 9th, 2024 at 04:08 pm

Trade cycle means all the phases including price fluctuation, demand changes, supply constraints, change in employment, profits etc.

According to Keynes :

Trade cycle is composed of price fluctuations including price rise and low un- employment. And likewise periods of falling prices and large unemployment.

Features of Trade cycle

First let me give you the basic features of trade cycle.

- A trade cycle is inter linked, when it affects one sector or industry. The effect spreads to other industries as well.

- Also, in a usual trade cycle prosperity stages are followed by depression.

- Trade cycles are rhythmic and reoccourent.

- While each phase of a business cycle will fuel the next stage of business cycle.

- Another important feature and observations of business cycle is that. The prosperity stages are slow, while depression stages are rapid.

- Finally there is no standard time limit for prosperity or depression.

- Also, with the effect of globalisation. The effects of prosperity or depression is international in nature.

Nature of Trade Cycle

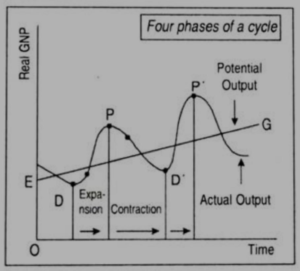

In this section I will discuss both the nature and phases of trade cycle.Starting with first my article will explain phases of trade cycle.

Depression

This is a phase of constant low economic activity, pressure on employment, resources are idle. Followed with low prices and inflation. At this stage all types of industry and people would suffer financially.

Some major indicators of Depression are:

- Opposite of Wealth,

- Extended beyond a downturn,

- persistent condition for financial systems,

- Prime instance The Great Depression of 1930 (alternatively 1870),

- Substantial rise in joblessness,

- decline in the accessibility of loans,

- diminishing production,

- increased insolvencies,

- notably decreased levels of trade and business, fluctuations in currency value,

- Cost deflation, economic crises, stock market collapse, and banking collapses.

Prosperity

This is an opposite stage of depression where there is usually economic expansion. Price level are increasing. Also at the same time interest rates are low done by the central banks, which lead to higher money supply.

Also which leads to increase in aggregate demand and full employment.

Now let me summarise the most common indicators of this stage;

- Favorable luck

- Achievement,

- Abundance of riches,

- Joy,

- Adequate standard of living (Health & education)

- Enhance farming, commerce and services,

- Numerous quality employment,

- Incentives for financial investment and commerce, •

- Enduring variety, creativity, rivalry, entrepreneurship and natural resources

- .

Recovery

Recover is the turning point between depression and prosperity. For example the first place to look out for as an indicator for recovery is ; the performance of automobiles. If automobiles sales are taking place then its a sure indicator of recovery.

Now let me discuss some usual signs of recovery stage of economic cycle.

- The cost of goods begins to escalate or inflation begins to ascend.

- The central bank indicates a reduction in interest rates.

- The sale of home loans begins to accelerate.

- Joblessness begins to decrease.

- The turnover of goods and services begins to increase.

Recession

Recession is basically two quarters of consecutive de growth in the GDP. Not all recessions will lead to depression. For example during covid 19 in 2020, we experienced recession but post that we did not see depression.

In summary we need to understand that expansion and contraction are two sides of the same coin. Neither of them can continue forever. Hence there will be a period of time where the business economics will take a hit and other times large economic fluctuations will take place. Both of which leads to depression and recovery.

Theories of Trade Cycle

Psychological Theory:

According to this theory depression and prosperity is cause either by excessive pessimism or excessive positivity. However, this theory is a very basic observance which doesn’t point to the cause.

Over investment Theory

Somewhat an application of positivity during the prosperity phases, when business’s over commit. Which also means that business’s will over invest in capital expenditure creating excess supply. but eventually it will not be meat by matched up demand, Leading to losses.

Keynes’ Theory of Trade Cycles

The keyless theory works on the two major concepts which is Marginal efficiency of capital . Which again depends of prospective yield and supply of capital asset.

In a nutshell what this means is that when the situation is prosperous, businessman can’t stop being optimistic. Which leads them to commit more investments, however until a limit, Beyond which the marginal efficiency of capital starts falling. Which also leads to losses.

Schumpeter’s Innovation Theory:

The theory is a little more technical yet intuitive. So this is how it goes. You make a new design of product i.e innovation. Which is more reliable and more profitable and has a lot of demand. During this time, the entrepreneur will remove the factors of production from other process and invest in this.

Now once this is done, this leads to supernormal profits for the business. However, once this is discovered by other entrepreneurs, even they jump into producing this product. All of this leads to increase in prices of factor, lower margins and finally depression.

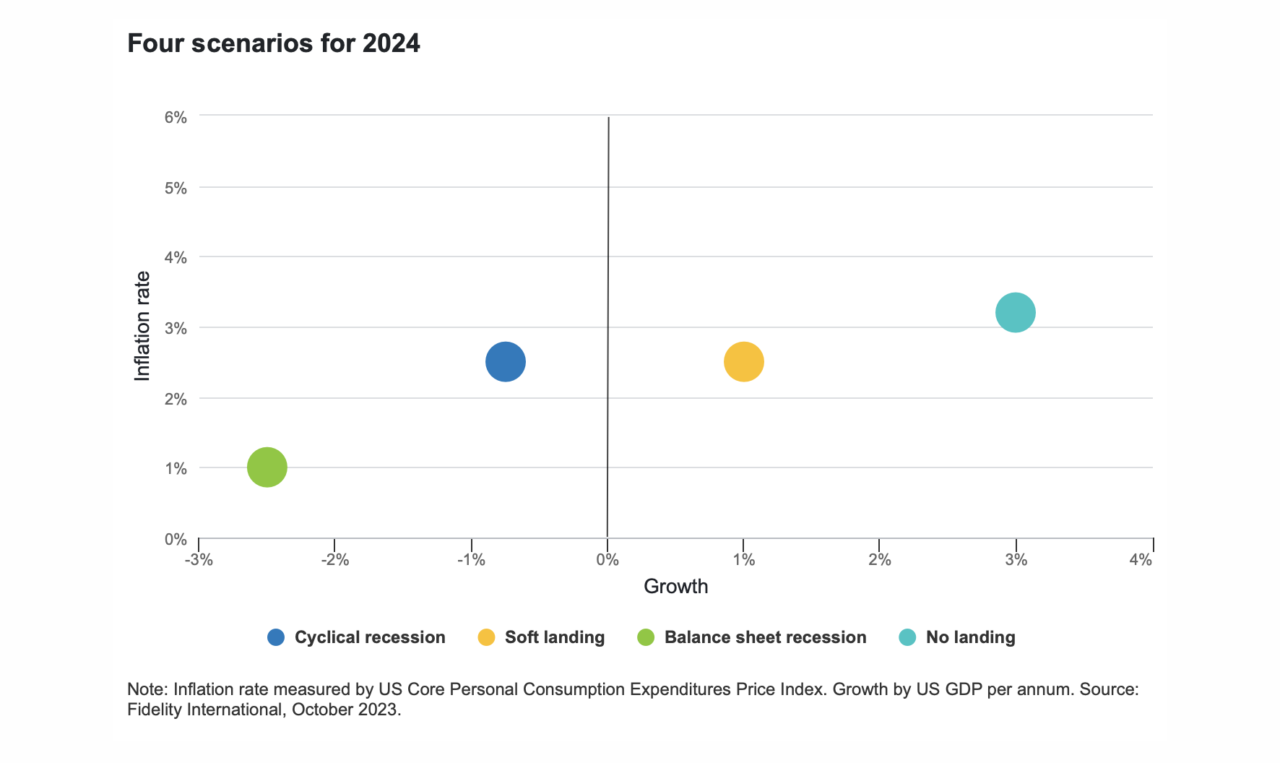

Current Situation in the Year 2024

So 2023 was a world wide employment cut back. All throughout the industries hiring and recruitment was slow. And so was new investments. In the case of 2024, we are at the brink of contraction with wide employment cuts.

For example Tesla has cut more than 10,000 Jobs in U.S. Amazon has cut more than 14000 jobs .At the same time real GDP growth of almost all major economies are lower than 2023.

Understand Trade Life Cycles

Conclusion

To conclude trade cycles are good on an approximate state of the situation of economy. However, it’s not an exact science where you know exactly when the recession will happen or when the cyclical fluctuation will lead to positive outcomes.