Last updated on September 19th, 2025 at 04:44 pm

Often when you see the balance sheet of a company, you will notice a line item showing “Goodwill”. In this article we will discuss on how to calculate goodwill using Capitalisation of average profit formula. Profit is the heartbeat of any business. Whether you’re running a startup, managing a project, or analyzing financial data, understanding profit metrics is essential. Among these, average profit is a simple but powerful measure. It shows you how much profit a business makes on average over a given period or across a set of products.

What is Average Profit Method?

Average profit is the mean profit earned over a period of time or across multiple items, transactions, or business activities. Instead of focusing on a single figure (like profit in one month), average profit smooths out fluctuations and provides a clearer picture of consistent performance.

For example:

- If a company earned ₹20,000 profit in January, ₹30,000 in February, and ₹10,000 in March, the average profit helps us see the typical monthly earnings rather than just peaks or lows.

Step by Step Calculation:

Suppose a business reports these annual profits for the last 4 years:

- Year 1: ₹50,000

- Year 2: ₹70,000

- Year 3: ₹40,000

- Year 4: ₹60,000

- Add the profits:50,000 + 70,000 + 40,000 + 60,000 = ₹220,000

- Divide by the number of years (4):₹220,000 ÷ 4 = ₹55,000

Average Profit vs. Net Profit vs. Operating Profit

- Net Profit: Profit after all expenses, taxes, and interest are deducted.

- Operating Profit: Profit from core business activities (before financing costs and taxes).

- Average Profit: The mean of profits over multiple periods or activities.

Applications of Average Profit

- In Business Valuation:Goodwill of a firm is often calculated using the average profit method, especially when partners enter or exit.

- Formula:{Goodwill} = {Average Profit} \{Number of Years’ Purchase}

- In Project Analysis:Average profit helps compare projects with varying profits over time.

- For Small Businesses:It simplifies record-keeping and gives owners a quick sense of how they are doing financially.

What is Capitalisation of average profit method formula?

The capitalization of average profit method formula is as follows;

Goodwill= Capitalised average profits – Actual Capital Employed

- Where capitalized average profits= Average profits X 100/ Normal rate of return.

- Also actual capital employed = Total Assets(Excluding goodwill)- Outside Liabilities

Capitalisation of Average Profit Method Formula- Example

Let’s try to understand this using an example;

Let’s say Steve and Sam are working as business partners and both in total have a credit amount of 200,000 in the company’s capital account. Also they have 20,000 each in their current account. The general normal return of business is 10% and the average profit is 100,000. Find the goodwill using the Capitalisation of average profit method formula?

Answer: So, now let me calculate this using the same formula given above.

Here the capitalized average profit= 100,000 x 100/10= 1 Million. Now, the total capital employed is 200,000+ 40000( Current account)= 240,000

Hence, the good will be= 1000000-240000= 760,000.

Common Mistakes to Avoid

- Not considering losses – If one year shows a loss, it must be included in the calculation.

- Mixing gross and net profit – Always use consistent profit figures (net or operating) across all periods.

- Ignoring inflation or market changes – Average profit is historical and may not reflect future conditions if costs or demand shift drastically.

Understanding Goodwill: Super Profit and Weighted Average Profit

Goodwill valuation often involves different methods, including the calculation of super profit and weighted average profit. The goodwill super profit method assesses the excess of actual profits over normal profits. To use this method, you first need to calculate the super profit, which is determined by subtracting the normal profit from the actual profit. The normal profit itself is derived from the average profit, which is calculated by multiplying the average profit by the normal rate of return. This approach helps in understanding the premium value a business commands over its net assets.

On the other hand, the goodwill weighted average profit method considers the varying profitability of a business over time. Instead of using a simple average, this method gives more weight to higher profits and less weight to lower ones, providing a more nuanced view of the company’s value. The formula for calculating goodwill in this case is the weighted average profit multiplied by the number of years of purchase. This method can be particularly useful for businesses with fluctuating profit levels.

Other Methods for Valuation of Good will

So, there can be many types of methods of calculating good will. So, let me just enumerate the various methods that can be used briefly

- First is the average profits method

- Simple Average: In this method the total good will is just basically calculated using average profits x number of years of purchase

- Weighted Average: Compared to that, in case of this method more weightage is given to higher profits and lower weightage to lower profits. So the formula becomes= Weighted average profit x Number of years of purchase

- Second Super Profits Method

The super profit method of valuation of good will covers the excess over normal profits. The formula for which is Super profit x no of years of purchase. Also in this formula ( super profit= average/Actual profit – Normal profit). And normal profit =(capital employed x Normal rate of return/100).

Disadvantages of Capitalisation of average profit method formula

Now, every method obviously have some shortcomings because any formula carries certain assumptions with it.

- The capitalization of average profits method formula assumes the calculation of average profits which can either be an underestimation for a growing business and over estimation for a mature company

- Another big disadvantage of problem with the formula is that the formula needs the assumption of normal rate of return. Which again requires an assumption. A normal rate of return might fluctuate basis the business conditions. For example post covid era the normal rate of return fluctuated between the year 2019 and 2023.

- Also the formula has one more issue that it does not capture intangible issues of business’s like management quality, the quality of products etc.

FAQ’s

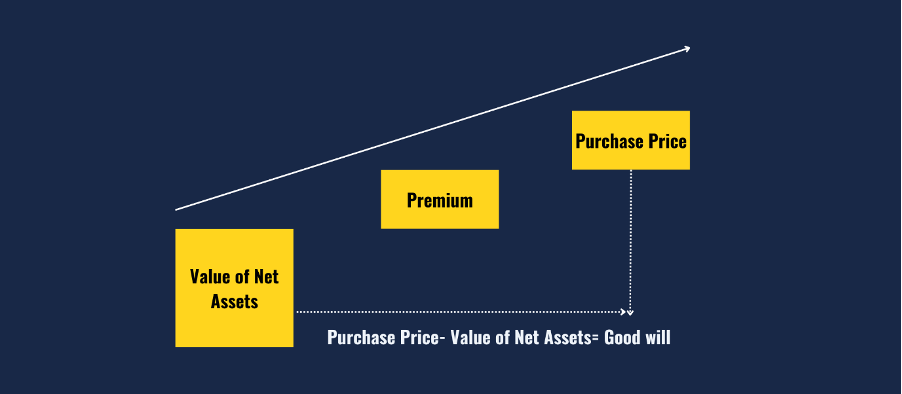

What is meant by the valuation of the good will?

Goodwill is an intangible assets that is created when a company gets purchased over its net assets. The premium is nothing but good will. Hence its basically created during the acquisition of a company.

What are the approaches to calculate good will?

Ther are multiple approaches to goodwill calculation and there are certain controversies related to it because it requires you to take certain assumptions.

What is the Impairment of good will?

Good will impairment basically happens when the the acquired company, for which the excess prices given falls in value. Which leads to goodwill impairment. Which results in the decrease of good will in the balance sheet and an impairment loss is recognized in the income statement.

What are the limitations of good will?

Since it should be clear to you that good will just an accounting treatment of the excess purchase price. Hence if the company is acquired for less than its net fair value of assets then the good will will turn negative.

How do you calculate average profit?

You can calculate average profit by dividing the total profit divided by the number of years.

What is the average profit formula in Good will?

Goodwill = Average Profit × Number of Years’ Purchase

Steps to Calculate Goodwill Using the Average Profit Method:

1. Determine the Profits:

• Collect the net profits of the business for the past few years (e.g., 3-5 years).

2. Calculate the Average Profit:

• Use the formula:

\text{Average Profit} = \frac{\text{Sum of Total Profits}}{\text{Number of Years}}

3. Multiply by the Number of Years’ Purchase:

• Multiply the average profit by the agreed number of years’ purchase (a factor decided based on the business type, industry, and negotiation).

Example:

Suppose a business’s profits for the last 3 years are as follows:

• Year 1: ₹1,00,000

• Year 2: ₹1,20,000

• Year 3: ₹1,10,000

1. Average Profit:

\text{Average Profit} = \frac{1,00,000 + 1,20,000 + 1,10,000}{3} = \frac{3,30,000}{3} = ₹1,10,000

2. Goodwill:

If the number of years’ purchase is 3:

\text{Goodwill} = 1,10,000 × 3 = ₹3,30,000