Last updated on November 20th, 2025 at 05:19 pm

So much has been spoken about risk management but more often than not the question still lingers-” Is Risk management a good career option in India?”. So, I am going to cut the chase and give all the details about this question. Pursuing a career in Risk Management in 2025 is a very good choice, thanks to the rising demand, attractive salaries, global opportunities, and job security. As financial risks, cyber threats, and regulatory challenges continue to increase globally, businesses are in greater need of skilled risk management professionals than ever before. Regardless of your current experience level, obtaining certifications such as FRM or PRM can accelerate your advancement into influential and lucrative positions in banking, fintech, consulting, and corporate finance.

What is Risk Management

Often people think that risk management is this sexy job, where I will be monitoring the graphs, isntructing people what they can or cant do. Well! To tell you the truth, its not exactly real.

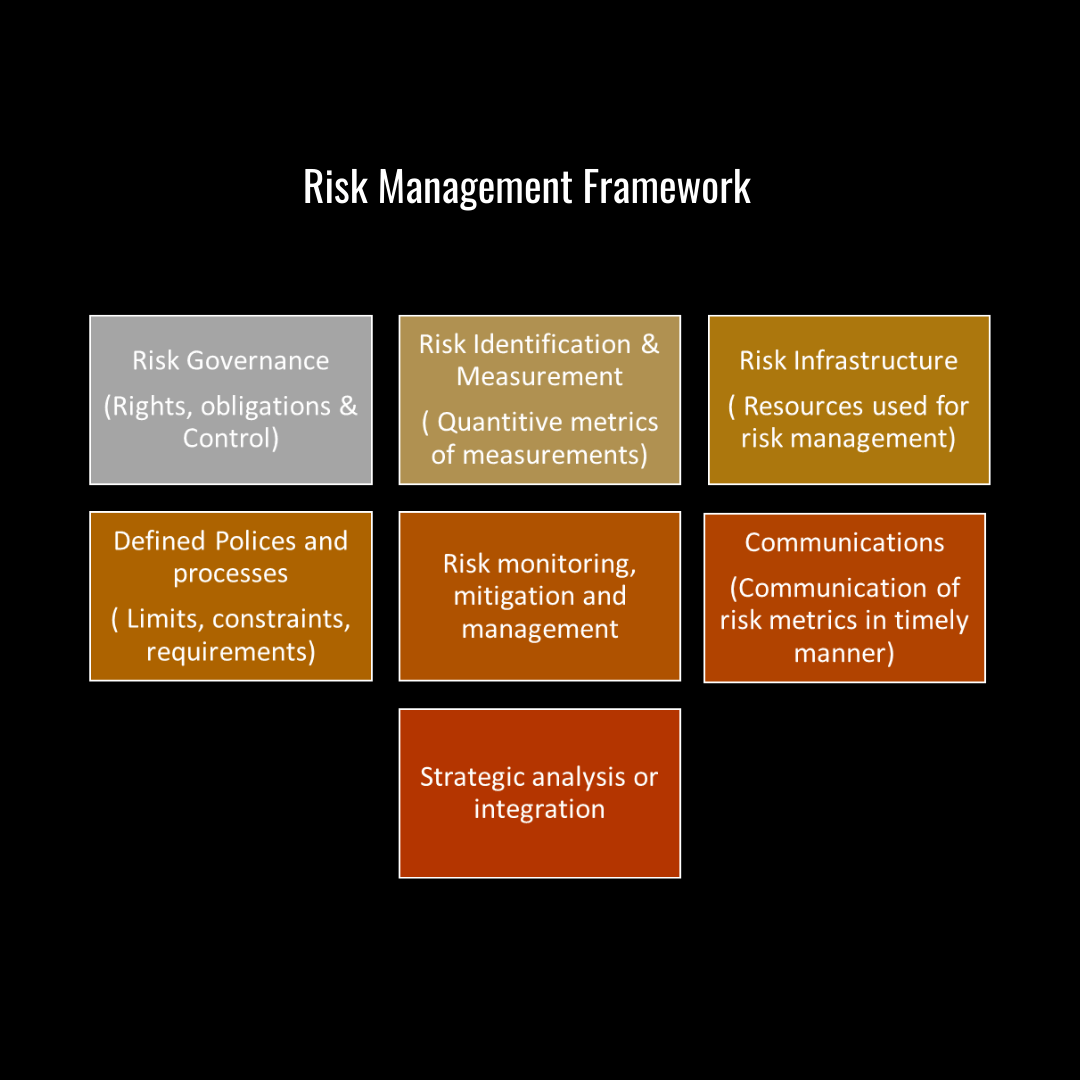

Framework

- Risk Governance:This is the top management of any organisation, which sits and decides the risk budget. Whats acceptable risk and what is not. For eg. a risk governance team of a hedge fund might decide that we will not accept a standard deviation of more than 25% in the overall investments

- Risk Identification: This is where we decide the measurement metrics of risk. What is risk for you? It can be different for different kind of business’s. For eg in a bank risk might be liquidity, so we say liquidity risk

- Risk Infranstructure:These are the tools and softwares and systems to manage risk.

- Risk Policies:The limits to what can be done and what cannot.You see this is where the risk management policies get nailed.

- Risk Monutoring: Ways of monitoring the defined risk limits for eg in a bank you would keep checking on wether you are meeting the liquidity parameters or not.Also in this level you would also try to figure, what to do in case thre liquidity drops?

- Communication: These are pre defined channels of communication in case, we encounter risk limits that we cross. Who comes to know first, how they come to know and how fast.

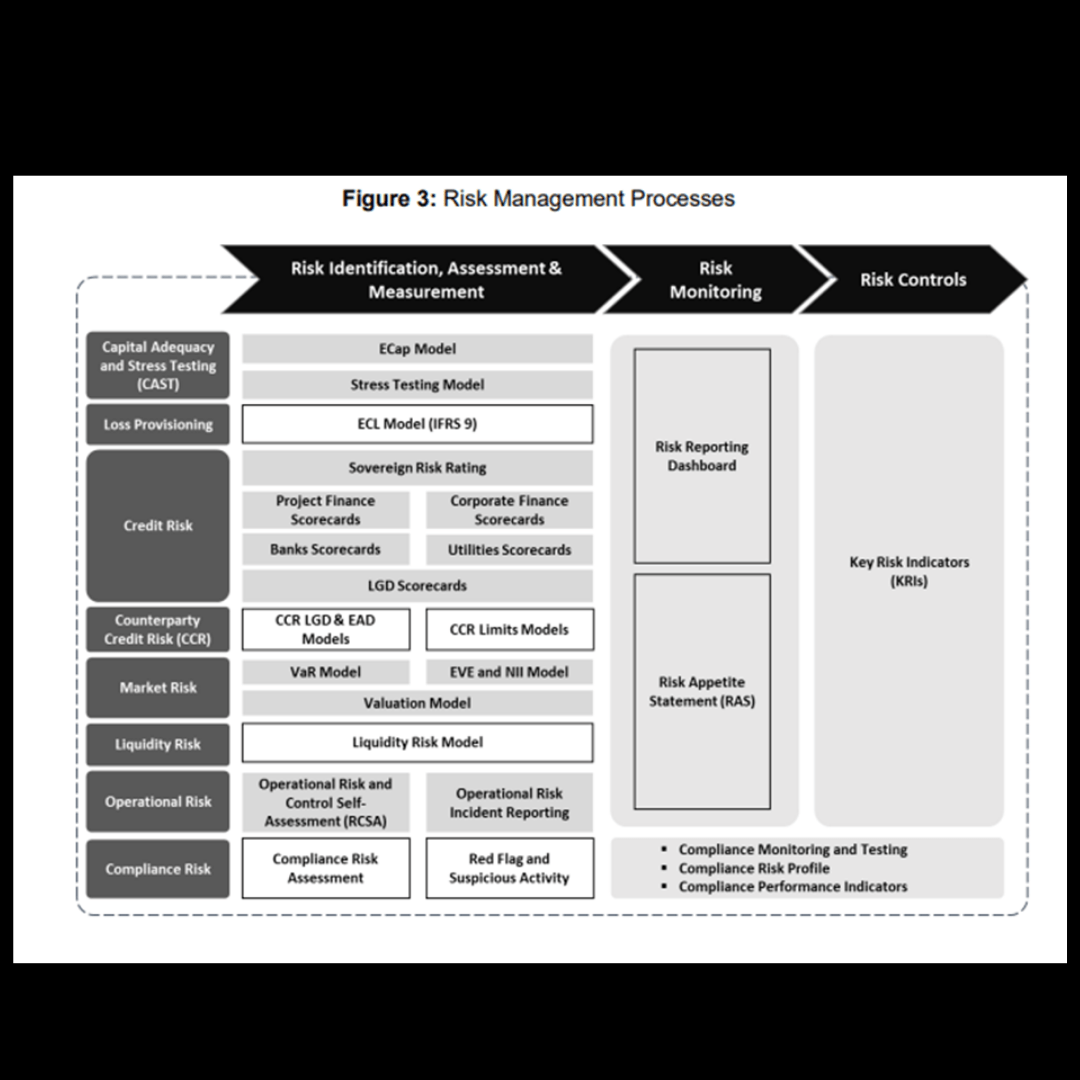

Risk Management Process: Detailed overview and steps in the risk manaegemnet function

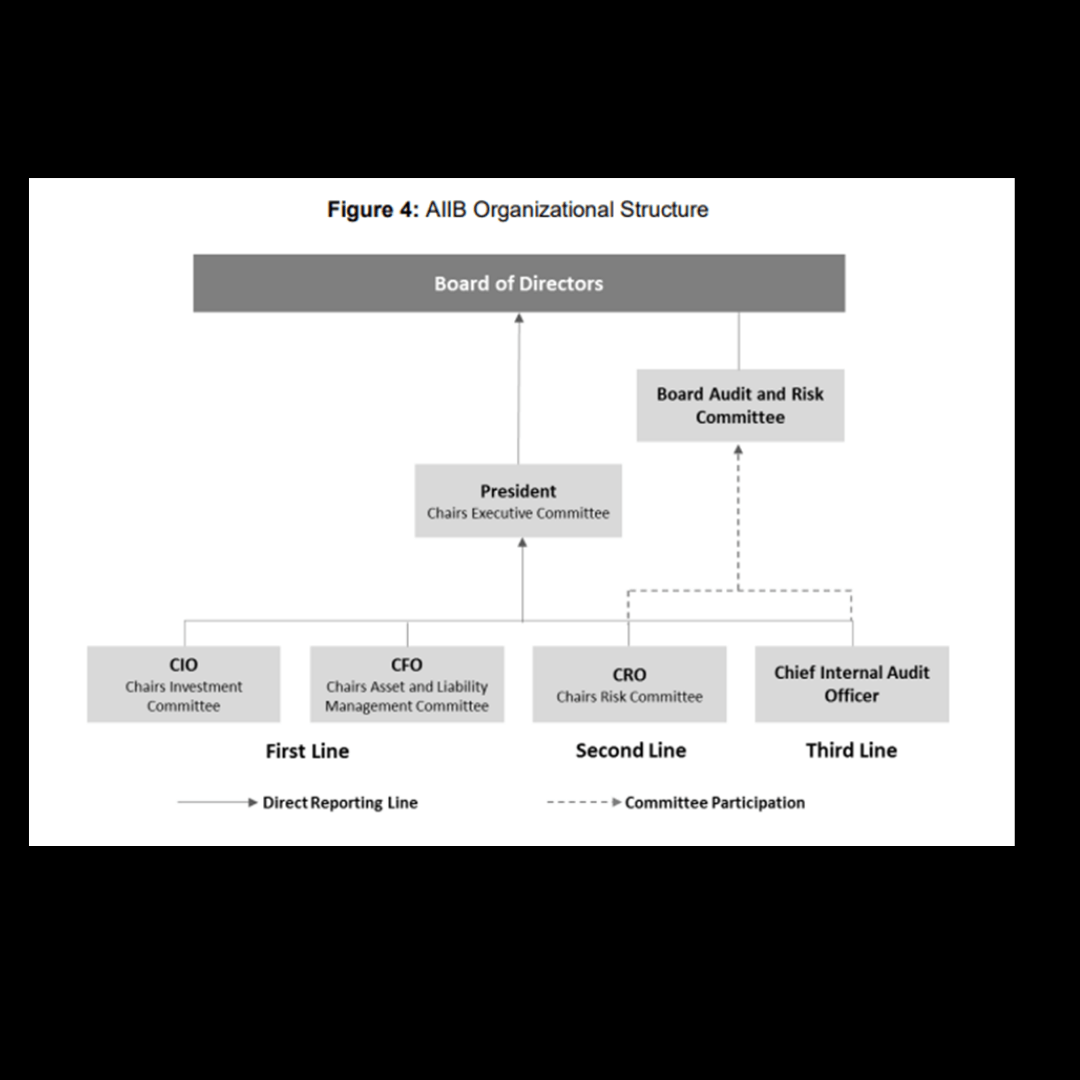

Risk Management Organisation Structure:

The risk management process also entails structuring the entire organisation for managing and implementing all the risk manageent policies.Below is a sample organisation strutucture of a large bank. Look at how the framework finally matches with the structure.

Source: https://www.cfainstitute.org/

Courses and Certification Relevant For Risk Management Career?

FRM (GAARP)

A Financial Risk Manager (FRM) is an accreditation offered by the Global Association of Risk Professionals (GARP) that certifies the understanding of risk management concepts that are validated by international professional standards. This designation is recognized globally. Financial risk management is the process by which the economic value of a company is protected by using different financial mechanisms to reduce and mitigate risk exposure. To earn the FRM certification, the candidate must pass two exams and also work two years in the field of risk management.

Understanding the FRM program

The FRM curriculum covers the application of risk management tools and techniques to the investment management process. Professional who holds the FRM designation can participate in optional continued professional development. FRM program follows the major strategic disciplines of risk management such as market risk, credit risk, operational risk, liquidity risk, and investment management. The exam is recognized in over 90 countries and is designed to measure a financial risk manager’s ability to manage risk in a global environment. The questions are practical and related to real-world work experiences. Candidates are expected to understand risk management concepts and approaches as they would apply to a risk manager’s day-to-day activities.

Part 1 of the FRM exam is 100 questions that focus on the following four topics (weight as such):

- Foundations of risk management (20%)

- Quantitative analysis (20%)

- Financial markets and products (30%)

- Valuation and risk models (30%)

Part 2 of the exam consists of 80 questions from the following topics (weighted as follows):

- Market risk measurement and management (20%)

- Credit risk measurement and management (20%)

- Operational risk and resiliency (20%)

- Liquidity and treasury risk measurement and management (15%)

- Risk management and investment management (15%)

- Current issues in financial markets (10%)

Tools & Skills Required in Risk Management

By now you must have understood that a risk management role is not exactly as simple as we think. In terms of tools and skills that are required, let me be a little bit blank here.

- You need to know finance as a starter, you cant really understand risk management unless you understand finance.

- You need to learn statistics in depth- st dev, var, annova, simulations atleast an understanding on how to calculate in excel. Highly recommed to learning financialmodeling.

1. Core Technical Tools Used in Risk Management

a) Quantitative & Statistical Tools

- Excel (Advanced) – pivot tables, financial modelling, sensitivity analysis.

- R / Python – used for risk modelling, backtesting, machine learning, and scenario analysis.

- SAS / SQL – for large dataset analysis, credit scoring, and regulatory reporting.

b) Risk Modelling & Analytics Tools

- MATLAB – complex market risk models, simulations, stress testing.

- Power BI / Tableau – risk dashboards, heat maps, trend analysis.

- RiskMetrics / Bloomberg Risk – VaR calculations, portfolio-level analytics.

c) Compliance & Governance Tools

- GRC Platforms (Archer, SAP GRC) – audit, internal controls, policy management.

- AML/KYC Tools (Actimize, ComplyAdvantage) – transaction monitoring, sanctions screening.

- Credit Risk Engines (Moody’s, FICO) – PD/LGD/EAD modelling.

d) Cyber & Operational Risk Tools

- SIEM Tools (Splunk, IBM QRadar) – cyber threat detection.

- Business Continuity & BIA Tools – operational resilience planning.

2. Essential Skills Required in Risk Management

Analytical & Quantitative Skills

- Probability, statistics, regression, forecasting

- Scenario analysis and stress testing

- Financial modelling and valuation basics

Regulatory & Compliance Knowledge

- Basel III/IV norms

- RBI, SEBI, FATF, and global regulatory frameworks

- Internal controls, audit, and reporting requirements

Technical Skills

- Python/R for modelling

- SQL for data extraction

- Excel for financial calculations

- Data visualization for reporting

Business & Behavioural Skills

- Critical thinking and problem-solving

- Strong communication for presenting risk insights

- Decision-making under uncertainty

- Stakeholder management and cross-team collaboration

Jobs in Risk Management

In 2018, the median salary for financial managers including FRMs was $127,990/year, according to the US. Bureau of Labor Statistics. FRMs are vastly employed in the financial services industry. According to the GARP, these are the top 10 companies employing the most FRMs:

- ICBC

- Bank of China

- HSBC

- Agricultural Bank of China

- Citigroup

- KPMG

- Deutsche Bank

- Credit Suisse

- UBS

Risk management job positions & salary in India

| Role | What They Do | Avg Salary (LPA) | Who It Fits |

| Risk Analyst | Monitor risks, reports, basic modelling | ₹4–8 | Freshers & grads (B.Com/BBA/Finance) |

| Credit Risk Analyst | Loan assessment, credit scoring | ₹5–10 | Banking/credit-focused profiles |

| Market Risk Analyst | VaR, stress testing, derivatives | ₹6–14 | Quant/finance grads, FRM candidates |

| Operational Risk Manager | Process risk, KRIs, controls | ₹8–18 | MBA/CA/FRM professionals |

| Enterprise Risk Manager | ERM strategy, board reporting | ₹12–30 | Mid-level managers, consultants |

| Compliance / AML Officer | KYC/AML, STR filings, monitoring | ₹6–15 | Law/commerce + AML certifications |

| Liquidity Risk Manager | LCR/NSFR, treasury risk | ₹10–22 | Treasury & finance professionals |

| Risk Consultant | Advisory, frameworks, audits | ₹12–30 | Big 4/consulting aspirants |

| ESG Risk Analyst | Climate/ESG risk, data analysis | ₹6–18 | Sustainability + finance profiles |

| Cyber Risk Analyst | Cybersecurity, vendor risk | ₹8–20 | Tech/IT risk profiles |

| Chief Risk Officer (CRO) | Risk strategy & leadership | ₹30–100+ | Senior leaders (12+ yrs experience) |

Risk management offers strong career growth in 2025, with roles across credit, market, operational, liquidity, ESG, cyber, and enterprise risk. Salaries range from ₹4-8 LPA for entry-level analysts to ₹30-100+ LPA for CROs. Qualifications like FRM, CFA, MBA, and skills in analytics, modelling, compliance and governance significantly boost job prospects.

Conclusion:

Its definitely a good career option, if you like process and systems and like to be the one involved in monitoring work. Do not approach this field as a fancy, adrenalin pumping career and neither expect every day to be new too. Pursuing a career in Risk Management is viewed as a robust option due to its job security, attractive salaries, global prospects, and potential for long-term advancement. It offers a variety of specializations including market risk, credit risk, operational risk, enterprise risk, model risk, and cybersecurity risk enabling professionals to select roles that align with their skills, whether they be quantitative, analytical, business-oriented, or technical.

Holding certifications such as FRM, CFA, PRM, CISA, or ISO 31000 can accelerate a professional’s journey into senior positions like Risk Manager, Senior Analyst, AVP/VP of Risk, Chief Risk Officer (CRO), and even executive roles within banks and multinational corporations. With India becoming a leading center for risk analytics, it presents an exceptional career opportunity for both new graduates and seasoned finance experts.

FAQ

Yes. Risk management is one of the fastest-growing careers in 2025 due to rising regulatory requirements, digital transformation, cyber risks, and the need for financial institutions to strengthen governance. It offers strong job stability and excellent long-term growth.

Key skills include analytical thinking, financial modelling, problem-solving, knowledge of regulations, data analytics, communication, scenario analysis, and understanding of business operations. Certifications like FRM, CFA, or PRM add strong value.

Degrees in finance, commerce, economics, mathematics, statistics, engineering, or business administration are common. Professional qualifications like FRM (most preferred), CFA, MBA (Finance), PRM, or ACCA increase your chances of landing a role.

Yes. Demand is rising across banking, fintech, insurance, consulting, cybersecurity, asset management, and corporate firms. Countries like the UK, USA, UAE, Singapore, and Canada have strong demand for risk professionals.

Entry-level salaries range from ₹4–8 LPA, mid-level professionals earn ₹10–20 LPA, and senior risk managers or CRO-track roles can earn ₹25–60 LPA+, depending on industry and experience.