Last updated on August 6th, 2025 at 06:48 pm

Mumbai is the financial hub of India. Being capital, numerous companies came and settle in Mumbai. Taking finance courses in Mumbai will enhance your career in Finance. This is a good starting point towards you future. Finance passionate candidates lets talk about the best finance courses you can perceive to get into finance.

If you are looking for the best choice and a complete guide for the best Finance courses in Mumbai, then read along. I promise, in the end, you would be able not only to understand what are the opportunities in finance but also to understand what these institutes have to offer.

| Finance Courses in Mumbai- Recommended List | ||||

| Rank | Course | Institute | Ratings on Google | Fees |

| 1 | Financial Modeling | Mentor Me Careers | 4.9 | 45,999 |

| 2 | Financial Analysis-Pro Degree | Imarticus Mumbai | 4.1 | 99000 |

| 3 | PG-IBCM | Proschool Mumbai | 4.5 | 1,80,000 |

| 4 | Masters in Financial Management | Wellinkar Mumbai | 4.4 | 50,000 P.A |

Finance courses in Mumbai recommended by Experts

Last updated on June 4th, 2025 at 12:15 pm

Explore the Best Finance Courses in Mumbai for a Successful Career in Finance.

Mumbai is India’s financial capital, offers many opportunities for aspiring finance professionals. Whether you’re a student, a working professional looking to upskill, or a career switcher, choosing the right finance course in Mumbai can be a game-changer. From short term finance courses like financial modelling and investment banking to globally recognized programs like CFA, Mumbai hosts a wide range of training options tailored to diverse career goals. In this guide, we explore the top finance courses in Mumbai, covering everything from course content, duration, and eligibility to job opportunities and salary expectations so you can make a choice and accelerate your career in the finance industry

Finance Careers in Mumbai: Introduction

Now, there is no need for me to explain that Mumbai is the financial capital of India. So, there is no dearth of opportunities and jobs.

The city hosts companies like JP Morgan Mumbai, Morgan Stanley, Citi Bank, Bank of America, BNP Paribas to name a few.

However, we need to first understand the various branches of finance and the kinds of roles available in finance in Mumbai. In this article I will discuss not just listing out the finance courses in Mumbai but also suggest the best finance courses in Mumbai.

Categories of Finance Courses in Mumbai

Now I think whenever students like you start looking for finance courses, you approach it a never generic way. This is actually the case because you think that all size fits one in Finance. But reality is that Finance is wide. Hence each sub sector requires different kinds of skill sets.

Now based on my 15 years of experience in finance, I would categorise finance courses in three major categories

- Corporate Finance Courses

- Investment Finance Courses

- Generic Skill Sets Courses

Brief About These Fields

Corporate Finance

Now, you might ask what is corporate finance? So, think of it in this example. So lets say you have a company and the business is related to developing housing societies. Hence, your core business is developing residential buildings and selling it to customers.

Now, that’s easier said then done because from the point of ideation to execution and finally selling a property requires

- Building a plan or idea

- Setting budgets to each projects

- Evaluation the performance of each projects.

- Meeting the regulatory requirements for reporting

- Managing surplus profits or meeting capital shortfalls.

- Defining long term strategy of the company.

All of these would fall under the category of corporate finance, because it’s the finance functions in a normal company.

Corporate finance roles:

- Skills: Financial Modeling course is the best suited course because it requires a thorough understanding of financial statements, budgeting, and forecasting. Also, valuation if you primarily targeting investment banking jobs in front office.

Investment Finance

Having a solid foundation in investment banking is very important no matter which career path you are targeting in finance or finance related courses in Mumbai. Mumbai offers some of the best courses in investment banking. Investment banking certification leads to high paying finance jobs in front office. On the other hand investment finance are services where investment banks provide value added services like research, fund management, broking and consulting.

So, the only difference between corporate finance & Investment finance, is that the latter is an external service.

Hence, roles in equity research would be classified as front office & Trade operations roles would be classified as middle office roles. At the same time, corporate actions would be called back office roles.

Category of Finance courses in Mumbai

Now, that you know the three major category of Finance courses in Mumbai, let me list out the broader courses applicable . So thats very important to know the most relevant corporate finance training mumbai which actually helps in your career.

Corporate Finance Courses

Now starting with the first category you are broadly looking at courses which cover financial management, corporate strategy & Financial planning.capital budgeting and valuation courses

Qualifications & Courses

- Chartered accountancy, ACCA or CPA(certified public accountant (cpa) mumbai)

- CIMA, CMA(ICWAI) Or CMA (US)

- Financial Modeling Course

In my opinion these are the necessary courses for corporate finance career.

Investment Finance Courses

Now, the second category of courses is for careers in investment finance. Which according to me are;

- CFA(chartered financial analyst certification mumbai) or FRM or CAIA

- Financial modeling with focus on valuation & Research

These are the most relevant finance courses in Mumbai for investment finance careers.

Popular Finance Course in Mumbai

Now that I have discussed the category and relevancy of courses and skills. Let me start reviewing and giving you the most popular and high quality courses that you can opt for in Mumbai.

The parameter to judge and review is based on content, case studies, placement assistance and general student feedback about these courses. Primarily the important aspect is placement assistance for finance courses in mumbai

Financial Modeling & Valuations

NSE Financial Modeling Course in Mumbai Mentor Me Careers

For a career in corporate finance & investment finance, financial modeling is a basic tool used for decision-making. Also, most of the interviews will test you on financial modeling skill.

Check the interview questions asked in finance interviews.

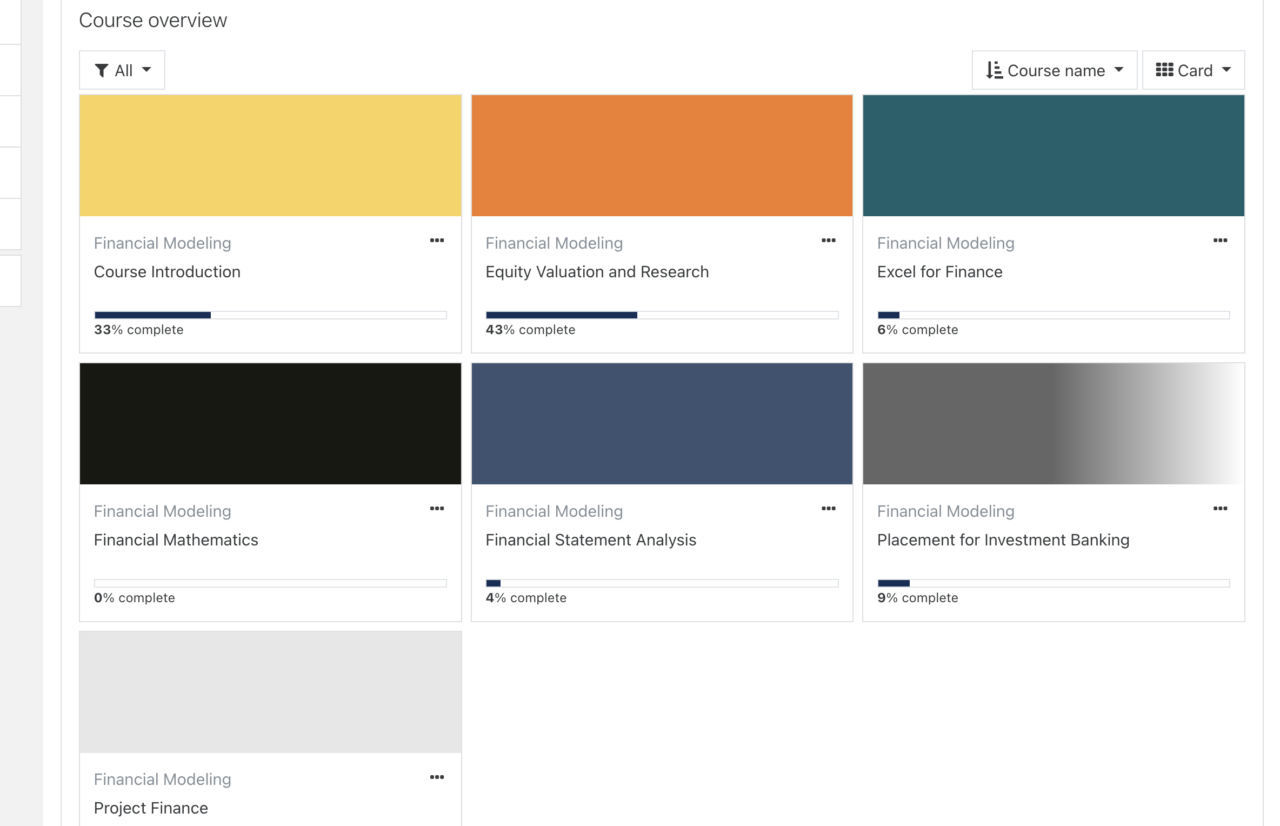

Course Learning Portal Review

Now, the course is divided into 5 Modules or core modules while the 12 specialization modules are separate. Below you can see an inside look at their learning portal.

Further more let me take you inside the equity valuation topic , and show you how the entire module begins and ends its learning.

So, the equity valuation module itself if you can see consists of a division from the first step of industry overview all the way into a practice assignment. And in my own experience I think, the best value is the employability tests which prepare you for the interview level tests.

Course Duration:

The financial modeling course in Mumbai is for three months or 12 weeks in total. Also the total duration of the course in terms of Hrs. is around 200.

Placements Assistance

Check the entire placement report here.

Reviews and Ratings:

Mentor Me Careers is rated as 4.9 on Google and one of the most popular finance certification with job placement

Position and salary after completing finance courses in Mumbai

Analyst position are mostly given to the students with financial modelling skills in companies like morning star and other firms where the starting package is 4.0 LPA and changes by experience also your position. Same goes for financial analysis as the main skill you are gaining here is excel which is used for main finance operations.

Investment banking courses gives you a new opportunities in aml kyc which is totally for freshers although the management part of job roles in finance are gained by the experienced people in the industry, wealth management but it is not for freshers you have to gain experience before you enter in wealth management. The starting packages in Investment can go from 3.5 LPA to depending upon background, experience also qualifications like CFA candidates get more preferences.

Masters in Finance in Mumbai- Degree Courses

Looking for pg courses in finance in Mumbai? We got you! Pursuing pg courses in finance in Mumbai is very powerful why? You get exposure to major institutions like NSE, BSE, RBI etc. There is specialized curriculum with practical examples, also in Mumbai there are better opportunities for internship than in other cities big companies are situated in Mumbai who need internships every year, they do pay good and you will get a hands on experience in the field of finance. Doing masters in finance in Mumbai will ensure you to get better job positions like portfolio analyst, equity researcher, risk manager and so on. Masters degree meaning a long term finance course where you experience a lot more than a short term finance course.

Now let me look at the most recommended and popular masters degree courses in finance in Mumbai.

Masters in Financial Management- Wellinkar

Now, if you are thinking about a full time course not short term finance course which is finance related courses in Mumbai and you have the budget then this course might be a good option. Wellinkar has established Weschool, under the SP Mandali trust in Mumbai. Wellinkar provides practical oriented financial management courses which focuses on real life examples rather than theory in Mumbai. This course is gaining recognition very fast, it is designed for both fresher and also experienced professional which helps enter core finance skill concepts.

Now, if you are thinking about a full time course in finance in Mumbai and you have the budget then this course might be a good option. Wellinkar, has established Weschool, under the SP Mandali trust in Mumbai.

Course Structure

The program has six semesters;

Semester 1:

- Managerial economics

- How business works

- Accounting for business

- Marketing management

- Operations management

- Business statistics

- Organisational behaviour and people management

Semester 2:

- Legal aspects of business (including basic taxation)

- Design thinking and innovation

- Business communication

- Intro to e-commerce and digital marketing

- Management accounting & fundamentals of finance management

- Business research

Semester 3:

- International Business

- Corporate Law

- Advanced aspects of taxation

- Advanced financial management

- Financial markets, products and institutions

- Elective – 1 (choose anyone)

- Fixed income

- International finance

Semester 4:

- Strategic management (Focus on strategic financial management)

- Financial risk management

- Financial modelling

- Security analysis and portfolio management

- M&A and restructuring

- Elective -2 (choose anyone)

- Management of banks and financial services Behavioural finance

Semester 5:

- Research project

- Executive skills

- Book review

- Elective – 3 (choose any 1)

- Investment banking Wealth Management

Semester 6:

- Research project

- Executive skills

- Book review

- Elective – 3 (choose any 1)

- Investment banking Wealth Management

Admission & Fees

So, unlike the expensive options discussed which anyways costed you more than 1Lac, this can come as good option

- For Mumbai university students INR 49,775 .PA. Hence for three years, it would be approximately 1.5 Lacs

- Even for outside Mumbai students but in mahrastra, the fees is INR 50,155. P.A.

MSC in Finance In Mumbai- JBIMS

Jamnalal Bajaj Institute of Management Studies’ is the most practical, case study-driven pg courses in finance in Mumbai and most prestigious postgraduate finance degree in India. This program is idea for all those students who aim to build career in Investment banking, Corporate finance and research. JBIMS also known as “CEO factory” is affiliated with university of Mumbai which offer excellent industry exposure. JBIMS’s MSc in Finance program is well-structured and is planned in such a way that it develops future professionals in two years. This course has been developed with the help of various leaders like the former Prime Minister Dr. Manmohan Singh and is designed from courses offered by some of the best universities in the world including the London School of Economics.

Course Content

This course works on the amalgamation of theory with the practice in almost all areas of finance. In the first two years, students get basic education in areas such as accounting and finance and various analytical tools. Later on, they are exposed to corporate governance, econometrics, ethics in finance, investment banking and portfolio management.

Fees

The fees of the Msc In finance course by JBIMS is 6 Lacs for the 2 years of program. Now provided that you get the platform of JBIMS for placements then the fees sounds very reasonable.

Testimonial by Ex Student

- The JBIMS M.Sc. Finance Program offers a unique opportunity to students willing to work hard and is relatively more attractive because of the placement numbers. The M.sc. is clearly a money spinning program as one is able to generate an average CTC of 21.36 lpa and gainfully find top offers around 27 lpa.

- Names such as Bloomberg, Citi, HDFC that are recruiting from JBIMS just goes on to establish the placement strength of the program.

- It is a highly selective program and the criteria may seem rigid but making an application even with only slightly lower scores to cutoff can yield returns exponentially in the career path.

FAQ

What are the fees in Mumbai for finance courses?

Fees for finance courses in Mumbai range from 45,999 to 1.5 Lakhs even more depending on the course duration.

How much package can i get as a fresher analyst in Mumbai?

As a fresher in Mumbai you will get around 3.5 Lakh as a financial analyst if you have relevant skills. Skills which are in demand in the market like financial modelling and investment banking also portfolio management.

Which is the best finance professional qualification?

CFA (Chartered Financial Analyst) is the best finance professional qualification. CFA candidates are high in demand it definitely will get you into the interview room.

Which skill is best for finance?

As a fresher student you should opt for financial modelling. It is the basic skill which includes how to value company also forecast its revenue with the help of Excel. This skill will get you junior analysr job in a good finance company.

Which branch of finance is highest paid?

- Hedge Fund Management

- Private Equity

- Investment Banking

- Portfolio Management