Last updated on December 31st, 2025 at 04:15 pm

The Indian capital market is much younger compared to peers across the world. Although the first start of trading happened in the eighteenth century, during the East Indian Company. Also, your guesses might be correct; Mumbai and Kolkata were the centres for it. Since then, India has grown many folds with the boom of business listings and the creation of two major exchanges. Let me discuss the entire structure of Indian capital Markets in this article.

History of Indian Capital Markets

So, its important to know how it all started in everything and capital markets is no different. Now, a market for capital is created as long there is a need for capital. Hence, that need ofcourse started during the british era in India, where even Indian railways used to raise capital in the london exchanges.

Now, fast forward that 100’s of years and the first exchagne was started in surat and mumbai almost at the same time. Which we know today as the bombay stock exchange and dalal street. This actually began below the banyan tree.

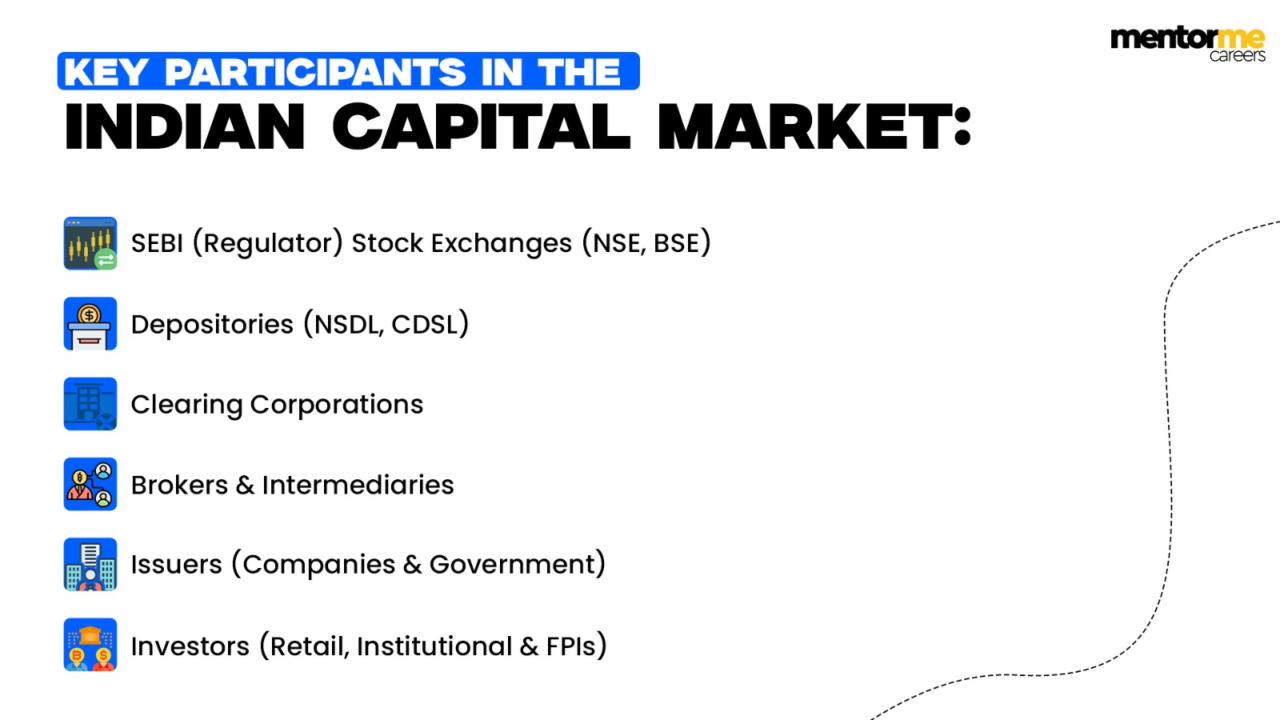

Participants in the Indian Capital Markets

Now having discussed a brief trailer of the birth of BSE, let me quickly show you the various participants of the Indian capital market.

Stock Exchanges

So, exchange as the word itself suggests is a place where things exchange. In our case of course it relates to the exchange of securities. So the exchange is a platform which is run mutually by market participants, to enable a quick and efficient way of exchanging securities. Where the exchange acts as a guarantor of the transaction.

Popular exchanges include; NSE, BSE, MCX etc

Brokers

Brokers are the members of the same exchange created by them, howoever in today’s regulation world also ensure that they do not enforce rules for the exchanges. However, a broker is the member throught which retail investors like you and me can buy and exchange securities,

Regulators

In Indian capital and elsewhere, there is a regulator who ensures that the market is fair and free from bias. In India, this role is done by SEBI( Securities Exchange Board of India). SEBI ensures that investors interest is protected at all costs, and also it regulates how companies get access to capital and the various parameteres it has to meet.

Asset Management Companies

Unlike big investors, most of the retail investors can’t afford a private fund manager. Hence, in India such capital is pooled in a trust and then an asset management company is appointed to manage and generate returns on the capital. These asset management companies are also regulated by SEBI.

Clearing Corporations

1.Clearing corporations guarantee settlement of trades.

2.They handle trade confirmation, netting, margin collection, and risk management.

3.This reduces counterparty risk and ensures timely settlement.

Depositories (NSDL, CDSL)

1.NSDL(National securities depository limited) and CDSL(Central depository securities limited) hold securities in electronic (demat) form.

2.They eliminate physical certificates and enable safe transfer of ownership.

3.Depositories work through Depository Participants (DPs) like banks and brokers.

Issuers (Companies & Government)

1.Issuers raise funds by issuing shares, bonds, or other securities.

2.Companies use the capital market to finance growth.

3.Government issues bonds to meet fiscal requirements.

Investors (Retail, Institutional & FPIs)

1.Retail investors invest personal savings.

2.Institutional investors include mutual funds, insurance companies, and pension funds.

3.FPIs (Foreign Portfolio Investors) bring global capital into Indian markets.

Capital of India and Its Influence

New Delhi, the capital of India, situated along the banks of the Yamuna River, plays a crucial role in the nation’s financial landscape. The city not only hosts key government institutions but also influences economic policies that shape the capital markets. The proximity to the Yamuna River underscores its historical significance and strategic importance as a hub for financial activities and regulatory frameworks governing India’s economic growth.

Financial Instruments Traded in the Capital Market

Capital markets enable businesses, governments, and investors to gather and put up long-term capital using a variety of financial tools. These tools are generally grouped into equity, debt, derivatives, and collective investment vehicles.

Equity Instruments

Equity Shares

Equity shares represent ownership in a company. Investors earn returns through dividends and capital appreciation. Equity shares carry higher risk but offer higher long-term growth potential.

Preference Shares

Preference shares offer fixed dividends and priority over equity shareholders during dividend payments and liquidation. However, they usually do not carry voting rights and have limited capital appreciation.

Debt Instruments

Government Bonds

Government bonds are issued by the central or state government to finance public spending. They are considered low-risk instruments and provide fixed interest income, making them popular among conservative investors.

Corporate Bonds & Debentures

Companies issue corporate bonds and debentures to raise long-term funds. These instruments offer higher returns than government bonds but carry credit risk, depending on the issuer’s financial strength.

Derivatives

Futures

Futures are contracts to buy or sell an asset at a predetermined price on a future date. They are widely used for hedging, speculation, and risk management in equity, commodity, and currency markets.

Options

Options give the holder the right, but not the obligation, to buy or sell an asset at a specific price. They are used to manage downside risk while allowing upside participation.

Collective Investment Vehicles

Futures

Futures are contracts to buy or sell an asset at a predetermined price on a future date. They are widely used for hedging, speculation, and risk management in equity, commodity, and currency markets.

Options

Options give the holder the right, but not the obligation, to buy or sell an asset at a specific price. They are used to manage downside risk while allowing upside participation.

Recent Regulatory Developments (2024–2025)

India’s securities market is undergoing major regulatory reforms to simplify laws, protect investors, and align with global best practices while supporting innovation.

SEBI has streamlined compliance by introducing a unified reporting platform, reducing regulatory burden for stock brokers and intermediaries.

Mutual fund expense rules were updated, shifting from Base Expense Ratio (BER) to Total Expense Ratio (TER) to improve cost transparency for investors.

A new stock broker framework (2025) modernises rules for intermediaries, making compliance simpler and more efficient.

Investor-friendly reforms now allow easier issuance of duplicate securities and higher documentation thresholds, improving ease of market participation for retail investors.

SEBI has formed technical working groups to strengthen exchange oversight and market resilience using advanced technologies.

Ongoing regulatory consultations focus on:

1.Responsible use of AI and machine learning

2.Angel fund regulations

3.Social Stock Exchange guidelines

In late 2025, the Government introduced the Securities Markets Code, 2025 in Parliament.

The Code consolidates three major laws into one:

1.SEBI Act, 1992

2.Securities Contracts (Regulation) Act, 1956

3.Depositories Act, 1996

The Securities Markets Code, 2025 aims to:

1.Reduce legal complexity

2.Strengthen regulatory oversight

3.Improve governance and compliance

4.Enhance investor protection

5.Support ease of doing business

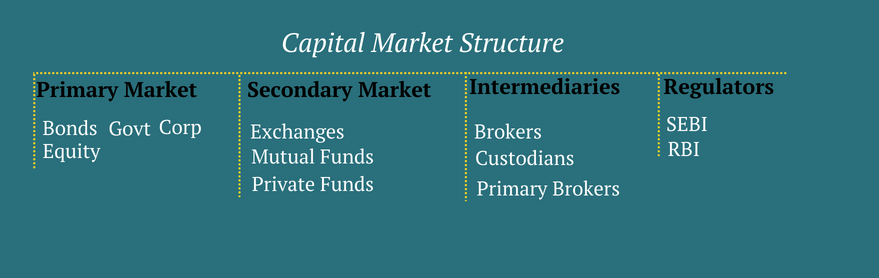

Structure of Indian Capital Markets

Size

The Indian capital markets, against the general perception, are not all about stocks but bonds, derivatives, cash etc. Equities form a tiny proportion of the total market size of the entire capital market.

So, you can see bonds are double the size of equity markets, followed by equity, double the value of derivatives.

Structure

Now, let’s focus on the structure after I have established the size perception.

There are multiple ways I could look at the capital markets, but I feel this is the most easiest way.

- Primary Market

So, the primary market is the place where the real action begins. For example, zomato getting funded by info edge during the start-up phase is an example of the primary market. However, at the same time, the IPO listing of zomato initially is also immediate.

Similarly, you buy government bonds also from the primary market. ICICI is one of the direct brokers to purchase government bonds.

- Secondary Market

This is where zomato, once bought by you in the IPO, will keep changing hands. Suppose you purchased Zomator stock in IPO and then sold it to me. The critical distinction is no new security is created in the process.

Also, this is facilitated by exchanges like the National stock exchange or the Bombay stock exchange. If you are not investing directly, you gain exposure through asset management companies like mutual funds.

- Intermediaries

So, someone has to specialise in helping a customer purchase stocks or bonds from the exchanges. In the process, also adds the value of research done by the brokers. On the other hand, custodians offer the service of holding your securities in digital form like CDSL.

- Regulators

This complex movement of securities, purchasing and listing can lead to disputes. So, it would be best if you had a watchman to guard the interest of all the parties. Which is done by the regulator. The Securities Exchange Board of India mainly regulates capital markets in stocks, derivatives, mutual funds etc.

On the other hand, RBI deals with bonds and currencies.

Recent Trends in Indian Capital Markets (2025)

India’s capital markets in 2025 are evolving rapidly, driven by retail investors, technology adoption, and strong global interest. Key trends shaping the market include:

1. Rising Retail Participation

1. Retail investor participation has surged due to easy access via mobile trading apps, low-cost brokers, and financial awareness.

2.Demat accounts have crossed record highs, reflecting strong participation from first-time investors and millennials.

3.Systematic Investment Plans (SIPs) and direct equity investing continue to grow steadily.

Source: NSE, SEBI investor data, AMFI reports.

2. Strong Growth of IPOs & ETFs

1.India remains one of the top IPO markets globally, with strong listings across technology, manufacturing, and consumer sectors.

2.Exchange Traded Funds (ETFs), especially index ETFs and Bharat Bond ETFs, are gaining popularity due to low costs and transparency.

3.Retail and institutional investors increasingly prefer passive investing strategies.

Source: SEBI IPO statistics, NSE India, AMFI

3. Technology & Algorithmic Trading Expansion

1.Use of algorithmic trading, AI-based analytics, and automated strategies has increased among institutions and proprietary traders.

2.SEBI has introduced tighter oversight to ensure fair access, risk controls, and market stability.

3.FinTech platforms continue to enhance speed, efficiency, and data-driven decision-making.

Source: SEBI circulars, stock exchange technology updates

4. Increased Global Investor Interest

1.Foreign Portfolio Investors (FPIs) show renewed interest due to India’s strong economic growth, stable regulatory environment, and digital market infrastructure.

2.India is increasingly viewed as a long-term structural growth story among global funds.

3.Inclusion of Indian bonds in global indices has further boosted inflows.

Source: RBI, SEBI, Bloomberg, MSCI reports

Essential Facts about the Indian Capital Market

Now, let me discuss some important facts about the Indian capital markets which any person should be aware of.

- BSE Stock exchange is the largest stock exchange in the world, with about 5500 companies listed.

- BSE stock exchange is the oldest stock exchange in Asia, founded by a business named Premchand Roychand.

- Only 2.5% of the Indian population invests, and the growth potential is excellent. This means only around 8 Cr people in India invest in the markets.

- NIFTY, which is an index of NSE, has given 11.2% returns since its inception in 1995.

- Mumbai city has the highest number of dematerialised account holders.

- The market capitalisation of Tata consultancy services is greater than the total market cap of the Pakistan stock exchange.

- Believe it or not India has a total of 23 stock exchanges apart from NSE & BSE

- The first stock listed in India was D.S.Prabhudas & Company, a joint venture with Merill Lynch.

- The Harshad Mehta scam in 1992 was worth 4500 Cr, equivalent to 35000 Cr today. That’s close $5 Billion dollars in today’s terms.

Structure of Indian Capital Markets – For Students & Exams

The structure of Indian capital markets explains how funds flow from investors to businesses and the government. This topic is highly important for CA, CFA, MBA, and competitive exams, and it is frequently tested in interviews for finance, banking, and market roles.

Why This Topic Is Important

For CA / CFA Students

1.Forms the foundation of financial markets, securities regulation, and investment analysis.

2.Directly tested in subjects like Financial Markets, Corporate Finance, Economics, and Portfolio Management.

3.Helps in understanding equity, debt, derivatives, settlement systems, and regulatory roles.

For Competitive Exams

1.Asked in UPSC, RBI Grade B, SEBI Grade A, Banking, SSC, and State PSC exams.

2.Common MCQs focus on SEBI, NSE vs BSE, primary vs secondary markets, depositories, and clearing systems.

For Interviews & Job Preparation

1. Frequently asked in finance, investment banking, equity research, and risk roles.

2. Interviewers expect you to clearly explain:

a. How capital markets are structured

b. Who regulates them

c. How trading and settlement work

Common Exam & Interview Questions

1What is the structure of Indian capital markets?

2.Difference between primary and secondary markets.

3.Role of SEBI, NSE, BSE, NSDL, and CDSL.

4.How does the trade settlement process (T+1) work?

5.Who are the key market participants?

6.Why are capital markets important for economic growth?

Conclusion

The Indian capital markets have a long way to go, imaging that only 2.5% of people have exposure to the markets today. In the U.S, the retail participation is close to 25%, close to 10 times the Indian share.

The Indian capital market is structured into primary markets (where new securities are issued) and secondary markets (where existing securities are traded), supported by regulators, exchanges, intermediaries, and investors.

The Indian capital market is regulated by SEBI (Securities and Exchange Board of India), which protects investors, ensures fair trading, and regulates stock exchanges, intermediaries, and market practices.

NSE and BSE provide electronic platforms for buying and selling securities, ensure price discovery, maintain transparency, and support efficient settlement and trading of shares, bonds, and derivatives.

Primary market: Where companies raise funds by issuing new shares or bonds (IPO, FPO).

Secondary market: Where investors trade existing securities among themselves on stock exchanges.

Capital markets trade equity shares, preference shares, bonds, debentures, derivatives (futures & options), ETFs, mutual funds, REITs, and InvITs.