Last updated on October 24th, 2025 at 01:03 pm

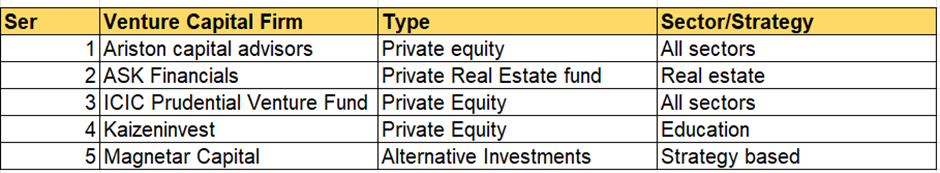

So, are you thinking of venturing your chances, of working with venture capital firms in Delhi? Then, ill take you through a filtered list of venture capital firms that might be interested in hiring new talent. Now this article will also be useful to you, because of most of these venture firms are SEBI registered. Hence, as per the SEBI rules of alternative investment fund, none of them are allowed to market themselves.

What is Venture Capital?

Venture capital is a type of private equity investment that provides funding for early-stage or high-risk companies. It is typically provided by institutional investors, high-net-worth individuals, or venture capital firms. The goal of venture capital is to help young companies grow and become successful by providing them with financial resources and strategic support.

Venture capital firms invest in companies with high growth potential in exchange for equity ownership in the company. This means that the venture capital firm becomes a shareholder in the company and receives a portion of the profits if the company becomes successful. In addition to providing financial resources, venture capital firms also offer valuable support to their portfolio companies, including business advice, strategic guidance, and connections to industry leaders and potential customers.

One of the key benefits of venture capital is that it provides funding for companies that may not be able to secure traditional bank loans or public financing. This is because venture capital firms are willing to take on higher risks in exchange for the potential for higher returns. Additionally, venture capital allows companies to grow and scale quickly, which can be crucial for success in highly competitive industries.

Drawbacks of Venture Capital

However, venture capital also has some drawbacks. One of the main drawbacks is that it can be difficult for startups to secure venture capital funding. This is because venture capital firms are selective about the companies they invest in and are only interested in companies that have the potential for high returns. Additionally, venture capital investment can dilute the equity of the founding team and can come with high expectations for rapid growth and profitability.

In conclusion, venture capital is an important source of financing for high-growth companies that are seeking to scale their operations and achieve success. Although it can be challenging to secure venture capital funding, the benefits of this type of investment can be substantial. VC provides companies with financial resources, strategic support, and the potential for rapid growth and success.

Venture Capital Trends in India

Venture capital (VC) in India has experienced significant growth in recent years, driven by a number of factors including an increasing entrepreneurial ecosystem, a growing economy, and favorable government policies. The Indian startup ecosystem has attracted a large amount of venture capital investment, leading to the growth of several unicorns and a vibrant startup culture.

Here are some of the recent VC trends in India:

- Rise of Indian Unicorns: In recent years, India has seen the rise of several unicorns, including companies such as Flipkart, Paytm, Ola, and Byju’s. This has been a major driver of VC investment in the country.

- Focus on Technology and Digital Companies: With the growth of the digital economy in India, there has been an increased focus on technology and digital companies, particularly those in the e-commerce, fintech, and healthcare sectors.

- Growth of Corporate Venture Capital: There has been an increase in corporate venture capital (CVC) investment in India, as established companies look to invest in startups and tap into the innovation that they bring.

- Expansion of Early-Stage Investment: Early-stage investment has been growing in India, as investors look to identify and support promising startups at an early stage.

- Increasing Government Support: The Indian government has been supportive of the startup ecosystem, providing tax incentives, funding, and other support to encourage entrepreneurship and innovation.

In conclusion, the Indian VC market has grown rapidly in recent years, and is expected to continue to grow in the future. The country’s supportive environment, growing economy, and large pool of talented entrepreneurs have made it an attractive destination for venture capital investment.

Venture Capital Firms in Delhi

Ariston Capital Services- Venture Capital Firm in Delhi

So, Ariston capital services is a venture capital firm registered in Delhi, office is in Mumbai which specializes in;

- Private Equity Advisory

- Proprietary Fund management

Now, as per their website in the proprietary fund management, they use the following approach

- Quantitative approach using derivatives, and options to generate returns.

Hence it’s obvious that if you want a career with them, then you need to have a stronghold on.

- Statistics

- Risk Modeling

- Also, some background in derivative products.

Jobs at Ariston Capital Advisors

Now, generally speaking, a team in any venture capital firm is small. Hence, seldom will you see these firms being very big on hiring. So, in case of ariston, you can send your resume, with some good work that you have done on: [email protected]

ASK Financials: Venture Capital Firm in Delhi

Ask financials is a group of firms in the investment and wealth management domain. The group started its operations in the year 1983 by Sameer Kotecha. Also a side information, that the firm is also part owned by black stone a popular investment firm out of U.S

Their operations is divided across;

- ASK investment management

- Private wealth operations

- Proprietary Fund

Again just like any other private equity or a venture capital firm, you need to apply directly with ASK. Here is how you can apply

Jobs at ASK Capital

If you are interested in a job opportunity with ASK Group, please mail us at [email protected] with details about you and your work experience. Do mention the area of expertise you are interested in working in.

ICICI Prudential Venture Capital Firm in Delhi

Now, ICICI prudential is a join venture between united trust of India & technology development and information company of India limited. Also, it was started way back in the year 1988, where most of you might not have been born too.

Also now, ICICI Venture is a wholly owned subsidiary of ICICI Bank Limited (which is the successor entity to ICICI Limited). Till now, this fund has raised $5 Billion.

Their areas of operations include;

- Private equity

- Real estate

- Special situations

- Infrastructure investments

Job Application at ICICI Venture Capital

Click on the link below to apply for a position at ICICI Venture

Kaizen Capital Venture Firm in Delhi

Kaizen venture capital services firm in Delhi is a private equity firm that has its most of the investment in ed tech companies.

So, there is nothing apart from private equity & venture capital, that the firm does.

Magnetar Venture Capital Firm in Delhi

So founded In the year 2005, magnetar capital has as an Aum Of 12.4 Bn with 201 employees worldwide.

About Magnetar Venture Capital Firm

Their Operations and strategies include

- Systematic Investing

- Alternative credit and fixed income

- Energy and Infrastructure

Jobs at Magnetar Venture Capital Firm

So, their hiring course is spread across the globe but you can keep yourself updated with the latest opportunities here.

Venture Capitals by Sector in Delhi

| Firm | Primary HQ / Base | Sector focus (primary → secondary) | Stage focus | Source |

|---|---|---|---|---|

| growX Ventures | New Delhi | Deep tech, DefenceTech, B2B SaaS, Fintech (early-stage) | Seed → Series A (Fund II active) | growX site (news & portfolio). |

| HealthQuad | New Delhi | Healthtech, healthcare services, medtech (healthcare-specialist) | Early → Growth (healthcare VC) | HealthQuad site; ET coverage of Fund III (2025). |

| She Capital | New Delhi | Consumer, D2C, FemTech, women-founder emphasis | Seed → Series A | She Capital site / portfolio. |

| OTP Ventures | New Delhi | Consumer platforms, Fintech, D2C | Seed / Early-stage | OTP Ventures site & profiles. |

| GSF India | Gurugram (Delhi NCR) | Mobile, SaaS, Deep tech, consumer apps | Pre-seed / Seed (incubator / fund) | GSF / OpenVC listings. |

| growX portfolio (Armory / PeelON) | New Delhi (investor) | DefenceTech, BioTech / CleanTech | Seed (2025 deals noted) | growX News: “GROWX LEADS INVESTMENT IN ARMORY” (Jun 25, 2025). |

| Recur Club | Delhi NCR | Fintech (revenue-based finance, lending) | Growth / Revenue finance | Recur Club site. |

| Sangam Ventures | Gurugram (Delhi NCR) | Energy transition, ClimateTech, Sustainable infra | Seed / Early-stage (impact VC) | Sangam site / OpenVC. |

| Mapleblock Capital | India / Global (active in Delhi ecosystem) | Web3 / Blockchain / Crypto startups | Early-stage | Mapleblock site. |

| 100X.VC | Mumbai (active across India, including Delhi startups) | Pre-seed / Tech (cohort model) SaaS, consumer | Pre-seed / Accelerator-style syndicate | 100x.vc site (active nationwide). |

| Indian Angel Network (IAN) | New Delhi (IAN Group) | Sector-agnostic strong early/angel in SaaS, consumer, fintech | Angel / Seed | IAN site / group pages. |

| CX Partners (CX Advisors) | New Delhi | Financial services, Consumer, Healthcare (mid-market PE / growth) | Mid-market (PE/ growth) | CX Partners site. |

| Ariston Capital / ASK / ICICI Venture (listed on MentorMeCareers) | Listed as Delhi on MentorMeCareers; HQs vary (ASK/ICICI: Mumbai) | Broader asset management / PE / VC activities across sectors sometimes infra, fintech, consumer | Growth / PE / VC | Mentor Me Careers + firm sites. |

Recent Delhi-relevant VC deals 2025

Jun 25, 2025 growX leads seed investment in Armory (defence-tech)

What happened: growX led a round into Armory (AI counter-drone / defence-tech), a clear example of Delhi VC investing in deep-tech startups in 2025.

Source: growX News & Economic Times reporting.

Jun 17, 2025 HealthQuad targets / raises funds for larger Fund III ($300M)

What happened: HealthQuad (New Delhi-based healthcare VC) was reported as raising / targeting a $300M fund (Fund III) to back healthcare enterprise innovation in India a major fund in the healthtech category for 2025.

Source: Economic Times report (HealthQuad Fund III coverage).

2025 (midyear) HealthKois announces plan for a $400M healthcare fund

What happened: HealthKois (healthcare-focused investor) publicly announced plans to launch a $400M fund targeting healthcare investments in India (reporting 2025). This amplifies health-VC capital flowing to the ecosystem.

Source: Economic Times fund coverage.

June 2025 Wiom raises growth capital (growX-backed portfolio news; Jun 26, 2025)

What happened: growX portfolio company WIOM raised growth capital (reported on growX news feed). Shows follow-on activity for Delhi VCs’ portfolio companies.

Source: growX news page.

2025 ReelSaga (Delhi-based) raises $2.1M seed (lead: Picus Capital + co-investors)

What happened: ReelSaga, described as a New Delhi mobile entertainment startup, raised $2.1M in seed funding led by Picus Capital and other investors. This demonstrates Delhi startup funding activity in media / consumer.

Source: Economic Times article covering this seed round.

2025 TrusTerra raises ₹9 crore pre-seed (led by Finvolve & India Accelerator)

What happened: TrusTerra (EV marketplace) closed a pre-seed led by Finvolve and India Accelerator; included strategic investors and signals activity in EV / mobility verticals that investors (including Delhi/NCR active funds) participate in.

Source: Economic Times / small-biz news.

2025 Delhi Government launches Startup Policy + ₹200 Crore VC co-investment fund (policy rollout 2025)

What happened: Delhi’s 2025 Startup Policy includes a ₹200 Cr VC fund and co-investment schemes that will mobilise local capital and create co-investment signals for early-stage startups in Delhi. This is a structural, ecosystem-level fund announcement important for local VCs & founders.

Source: Delhi Startup Policy coverage.

FAQ

What role do venture capital (VC) firms in Delhi play for someone building an investment banking career?

VC firms offer exposure to deal sourcing, due diligence, financial modelling, and term sheet negotiation all transferable skills for investment banking. Working at a VC helps you understand startup economics, valuation in early stages, and investor negotiation, strengthening your IB profile.

What junior roles are available at VC firms in Delhi for freshers?

Common entry roles include VC Analyst, Research Associate, Investment Analyst (intern), and Operations/Portfolio Associate. These roles focus on market research, financial model support, and portfolio monitoring.

What skills should I build to be competitive for VC analyst roles in Delhi?

Prioritise: financial modelling (three-statement models & cap table modelling), startup valuation methods, market research, pitch decks, Excel, PowerPoint, and basic SQL/BI skills. Strong written communication and deal awareness are essential.

How do I find internships or entry roles at Delhi VC firms?

Use LinkedIn, AngelList, VC firm career pages, university placement cells, and startup networking events. Cold-emailing partners with a targeted note and a one-page project sample (market map or model snapshot) can also work well.