Last updated on February 23rd, 2026 at 10:47 am

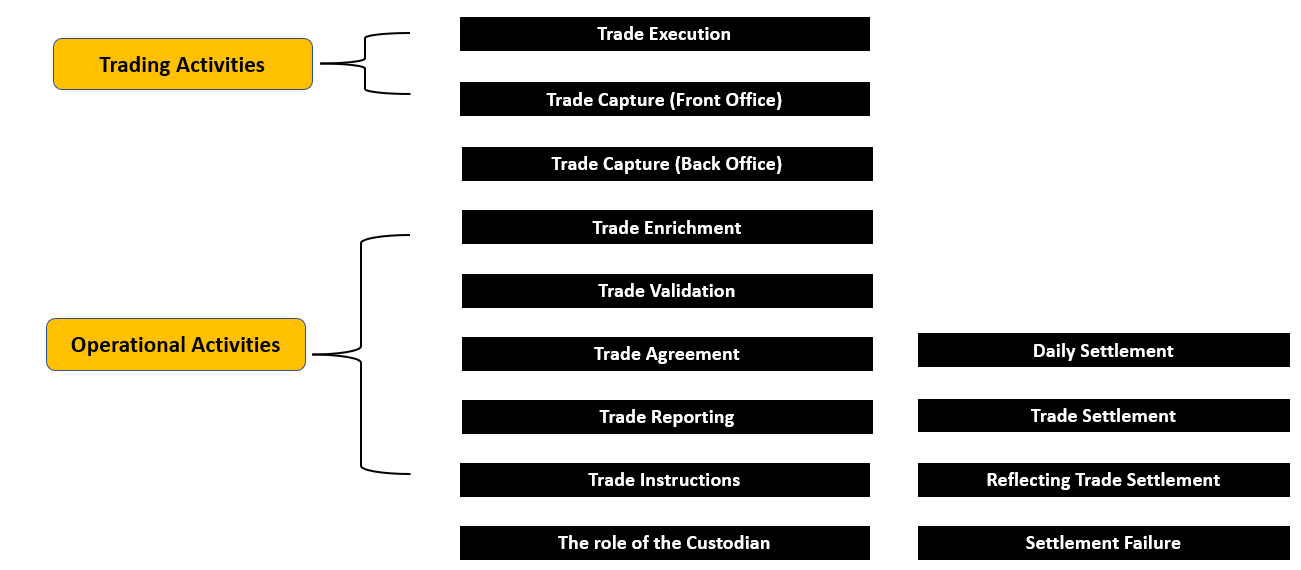

The trade life cycle in a capital market includes all the activities from the first step of initiating a trade, capturing the information at the front office, middle office and back office, all the way to settlement. In other words all the activities involved in a trade, from start till the end.

Understanding the Trade Life Cycle in Investment Banking Operations

The trade life cycle in investment banking operations encompasses a series of critical stages that ensure seamless execution and settlement of financial transactions. From pre-trade activities to post-trade processing, each stage plays a crucial role in maintaining efficiency and mitigating risks within the capital markets.

Over of Trade Life Cycle in Investment banking

All the activities falling between the receipt of an order receipt to the settlement of it is called a trade lifecycle.

Trade life cycle in capital market

securities trade life cycle

Before I jump into the pool explaining the trade life cycle, which practically takes us thirty hours to each in our certificate in Investment Banking operations.

Hence I want to spend some time first discussing the context of this topic.

So when I say trade life cycle, how is this different from the usual trade you make from a simple trading account?

Simply put, not much, with the exception that I am talking about millions here! Which requires some careful planning and process.

For example; I want to buy $1 million dollars worth of alphabet stock, only to realise that the stock scrip code I entered was wrong.

Which might have cost me some thousands of dollars in a matter of seconds. So basically big money requires big processes and that’s how this topic became popular in the IB world.

So now I will jump to the explanation part.

Stages of Trade Life Cycle:

The securities or stock market encompasses various stages in the trade life cycle, from the initial order placement to settlement and clearing. Understanding these stages is crucial for investors and participants in the market. Let’s explore the five key stages of the trade life cycle, each with its specific functions and examples.

Order Placement:

The first stage involves the placement of an order by an investor or trader. They communicate their intention to buy or sell a particular security to their broker or through an electronic trading platform. For instance, You as an investor might place an order to buy 100 shares of Company XYZ at a specific price.

Trade Execution:

Once the order is placed, it moves to the trade execution stage. This is where the order is matched with a suitable counterparty willing to buy or sell the same security at the desired price. The execution can occur on a stock exchange or through alternative trading venues. For example, if the investor’s buy order matches a sell order from another market participant, the trade is executed, and the transaction takes place.

Trade Confirmation:

After the trade is executed, the parties involved receive trade confirmations. These documents provide details about the executed trade, including the security name, quantity, price, and settlement date. Investors and brokers use these confirmations to ensure that the trade was executed correctly. For instance, you as an investor placed an order to buy 100 shares of Company XYZ, and the trade was executed at the desired price, they would receive a trade confirmation reflecting these details.

Settlement:

The settlement stage involves the transfer of securities and funds between the buyer and the seller. It ensures that the ownership of the securities is properly transferred, and the financial obligations are fulfilled. Settlement can occur either in a physical or dematerialized form, depending on the market infrastructure. For example, in a dematerialized settlement, the buyer’s securities account would be credited with the purchased shares, while the seller’s account would be debited.

Clearing

The final stage of the trade life cycle is clearing, which involves the calculation of obligations and the management of credit risks associated with the trade. The clearinghouse acts as an intermediary between the buyer and the seller, guaranteeing the settlement of the trade. It ensures that both parties meet their financial and contractual obligations. For instance, if the buyer fails to deliver the funds on the settlement date, the clearinghouse steps in to ensure the seller receives the payment.

Trade Life Cycle with Real Examples

Now in contrast to what you might imagine, trading at the institutional level is a little more complicated than me sitting in front of my personal trading system.

However, in an institutional system, we have little more process, simply because we have a lot of money in hand. So in your personal account, your broker gives you all your portfolio account status like shown below

Your typical trade order terminal

Also, your broker might give you the holding positions including the profit and loss in each of the quantities purchased.

Institutional trading is very similar in the outcome but varies a lot in the detailing of these processes.

So, this is how it goes! There would be the front office trader or investment manager who would call the executor trader, typically a STO(Security Trading Organisation)

Then the trader at the STO would call multiple investment banks like Goldman Sachs, JP Morgan, Barclays etc to find the counterparty.

Once the trader finds the counterparty, is when the trade goes through the entire detailed process of trade life cycle in capital market.. Which we will cover in the coming sections.

Trade Capture in trade life cycle

So, what is trade capture? It’s exactly what is shown even on a retail trading terminal with a little more extra details.

Trade Capture Details

So, what are those extra details? Remember in the previous section we discussed that the trader would be calling various investment banks?

Hence, in the case of an institutional scenario, we also add counterparty details.

Trade Execution

Now, right after the trade capture in this case a trade confirmation in the Trade life cycle in capital Markets would be sent to the client.

In the olden days, a trade confirmation would look something like this. Nowadays it’s more computerized and no physical papers like these are sent.

Trade Confirmation in Trade life cycle in capital Markets

The trade confirmation also affirms the trade agreement, which means that the counterparty and you agree to carry out the transaction.

Again, remember that this happens over an email. Which course is unlike the physical agreement with green papers but an email with the trade confirmation details.

Now, it’s your job to check the details against the intention. So if there was a mismatch and you don’t reply within a reasonable time then it’s assumed that you agree. So, that concludes stage two of Trade life cycle in capital Markets .

Trade Settlement

Now, it ain’t over until it’s over!

You got to send the cash, and at the same time receive the securities, which is nothing but settlement. However, settlement need not always be like this!

So there can be settlement variations like

- Free of Payment: This means that we agree on exchanging the security today and paying the counter party at a later date

- Cash Settlement: Paying cash today and receiving the security at a later date.

However, the above scenarios are exceptional cases.

Now, think about this.

If you agreed to buy or sell something and pay for it, you would want to get it done asap right?

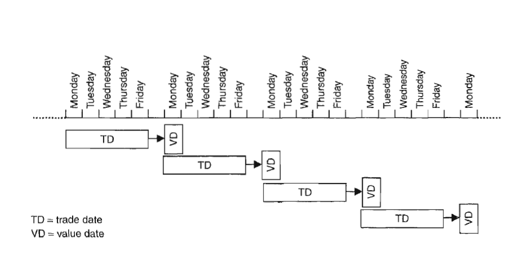

Nowadays, settlement happens within T+2 or T+3.

In the earlier days, settlement followed a specific day logic.

Account Settlement: Basically settling on a specific day irrespective of when you put the trade.

So, this meant that if I put the trade today, no matter if it’s Monday or Friday, it would settle on let’s say next Monday.

However, this method had issues, because the longer we wait between the trade date and the settlement date higher the risk. Which also means, this is an important aspect of risk management framework.

But why?

Well, simply put! What if I change my mind? or what if the security starts moving away from the direction from what I bought the security for.

Considering this limitation of the account settlement method, the industry moved to rolling settlement.

Rolling Settlement: Trade date + x no of days

Today the world is moving into T+1, even india.

So, that’s the summary of stage 3 of the Trade life cycle in capital Markets .

Trade Reconciliation

So all is good, we captured, executed and settled. But what next?

Well, take this analogy.

A sports shop which buys sports goods from wholesalers pays the cash and receives the goods at its warehouse. Then it checks if it got what it wanted and then updates its inventory to show that the goods now are available. At the same time, it updates the bank account with the cash deduced for it.

Now, imagine if they did receive the goods but didn’t update their internal systems!

The retailer sales system wouldn’t show the new inventory, so it won’t be able to sell.

At the same time, the purchasing department would be under the wrong impression, that it has more cash than it actually has.

If you did understand the analogy, then just replace the sports company with a securities trading organisation.

- The trader at the front office would wrongly commit to selling securities it doesn’t have.

- The risk department wouldn’t really understand the real cash position

- The trade also would end up placing orders for which he/she doesn’t have the cash.

Regulatory Requirements and Ongoing Position and Risk Management

The trade life cycle is also governed by strict regulatory requirements to ensure transparency and fairness in financial markets. Compliance with these regulations is critical for maintaining investor confidence and market integrity. Additionally, ongoing position and risk management are essential components of the trade life cycle. Institutions continuously monitor their positions and manage risks to prevent financial losses and ensure stable operations. This proactive approach helps in identifying potential issues early and implementing necessary measures to mitigate them.

Trade life cycle PDF

So here is some self-reading content on the trade life cycle if you do wish to read in this detail.

Hope you benefit from that reading material and do send us your thoughts.

Conclusion

The trade life cycle in investment banking operations underscores the meticulous process from order inception to settlement, encompassing Pre-Trade preparations, Trade Processing Including execution and confirmation, and final Settlement and Clearing procedures. Understanding these stages is essential for participants in capital markets, ensuring seamless transactions and robust risk management practices. Mastery of the trade life cycle enables financial institutions to navigate complexities with confidence, supporting sustainable growth and compliance in the dynamic realm of investment banking.

FAQ’s

The trade life cycle process is the journey of a securities trade from order placement to settlement, involving stages like execution (matching orders), confirmation (trade details), settlement (transfer of securities/funds), and clearing (managing risk). Example: Investor placing an order to buy shares, trade execution, receiving trade confirmation, settlement of shares/funds, and clearing of obligations.

The trade life cycle in investment banking refers to the process of executing and settling financial transactions, including order placement, trade execution, confirmation, settlement, and clearing, specific to investment banking activities.

The trade life cycle in case of equity differs only, with respect to the cash involved in the transfer of any other asset. Hence, instead of a derivative instrument where the trade life cycle as multiple complications. So here the only difference is that in case of an equity instrument, the confirmation needs to be on the availability of the asset.

Below is a brief description of the derivatives trade life cycle

Clearing Members: The clearing members facilitate the movement of money and due payments from on trading member to another.

Buyer is the person who believes the asset’s price will increase and aims to profit from it. The buyer anticipates a rise in the asset’s value. They are looking to make money from the asset’s price going up.

The Seller (Short Position): The party who anticipates a price decrease and is willing to profit from the decline.

The Exchange is where contracts like NGX30 and NGXPension index futures are listed for trading.

The Central Counterparty (CCP): As the CCP, NG Clearing acts as a neutral intermediary, guaranteeing the contract’s performance, and managing counterparty risk.

Trading members are licensed by the Exchange. Investors use them to make trades.