Last updated on January 29th, 2023 at 01:22 pm

The CFA 2023 syllabus of CFA has introduced a new topic of Geopolitics, and I have got it covered for you in this article.

In the end, you also can download the reading material.

What is Geo Politics

Geopolitics- the study of geography and its effects on politics and trade.

•Trade relations

•Agreements

•Policies

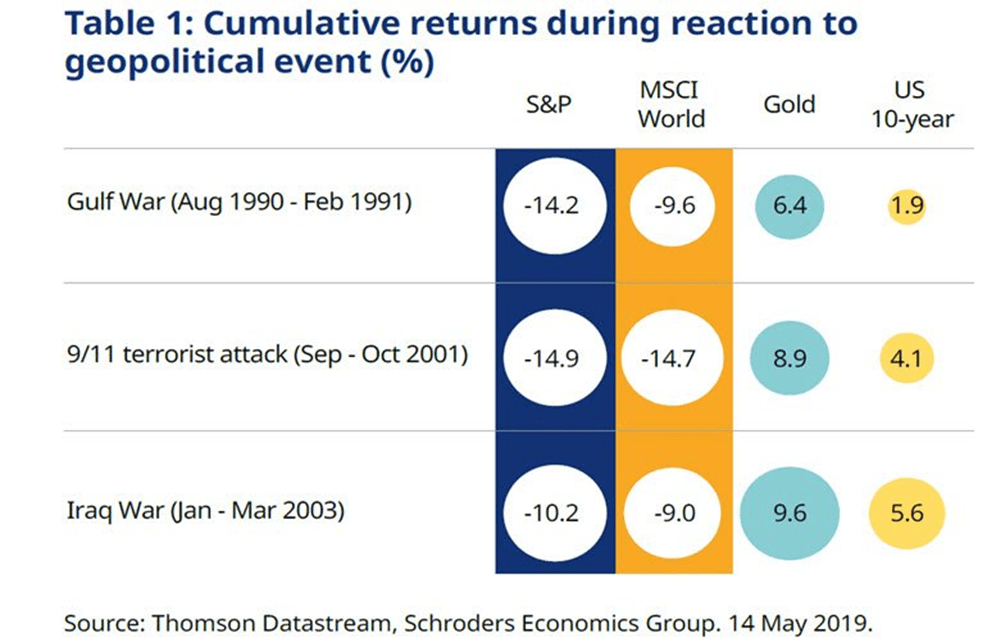

See the table to given by the Thomson data stream on how various wars affected returns.

Geopolitical Risks

Russia Ukraine Conflict: A case study

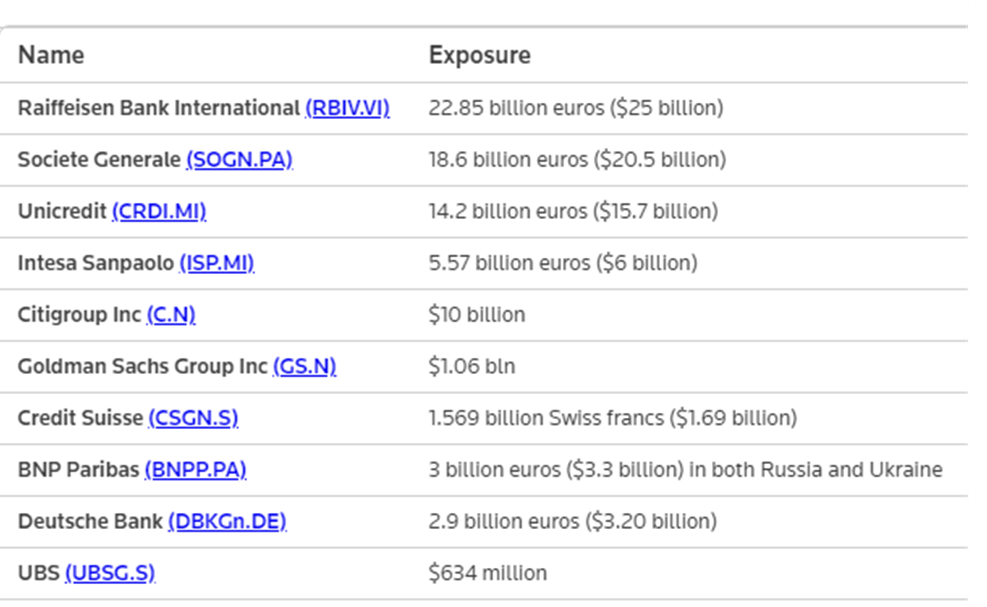

•Total of $139 Billion in assets are stuck in Russia

•$79 bn in Debt

•Companies leaving Russia are leaving 47% of the GDP Of Russia

Hence it’s important that Geopolitical risk be studied as a part of investments.

Relationship Between Nations

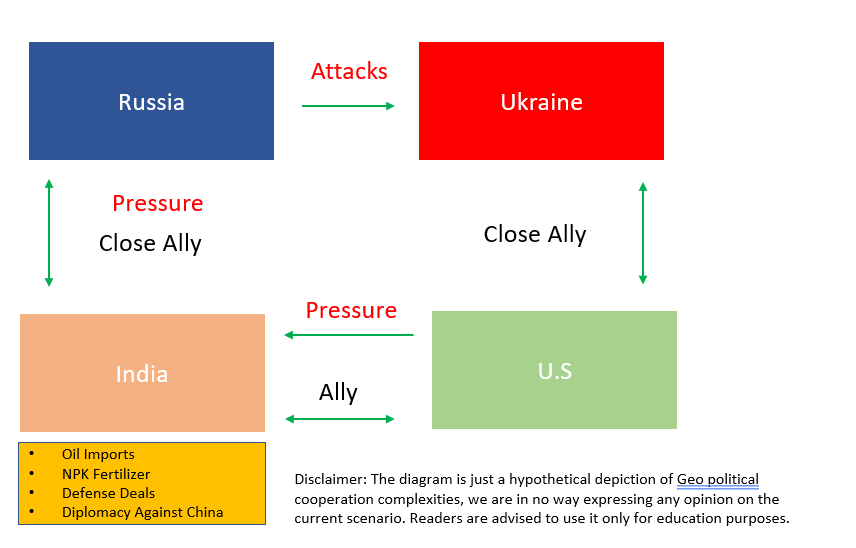

It’s a funny, complex relationship due to the cost versus returns, just like any relationship. Consider the above situation, where Russia and India have been close allies for ages.

At the same time, India and U.S are also allies, although not as close as Russia. More Ukraine is a partner of the U.S for obvious military reasons.

However, complexities arose for India when Russia attacked Ukraine and India had to choose sides. So how does a country like India decide sides? So, for starters, weigh their options.

- Oil Imports are essential for India from Russia.

- NPK fertilizer which is used in agriculture, was a direct factor for inflation in the U.S when Russia stopped supplying it.

- Defence deals, where India has long-standing projects and orders at a discounted rate

- Partner in keeping a check against China.

So what was the outcome in this case? Firstly India condemned the attacks but didn’t sanction Russia. Secondly, India focussed on settling business in their own currency rather than dollars.

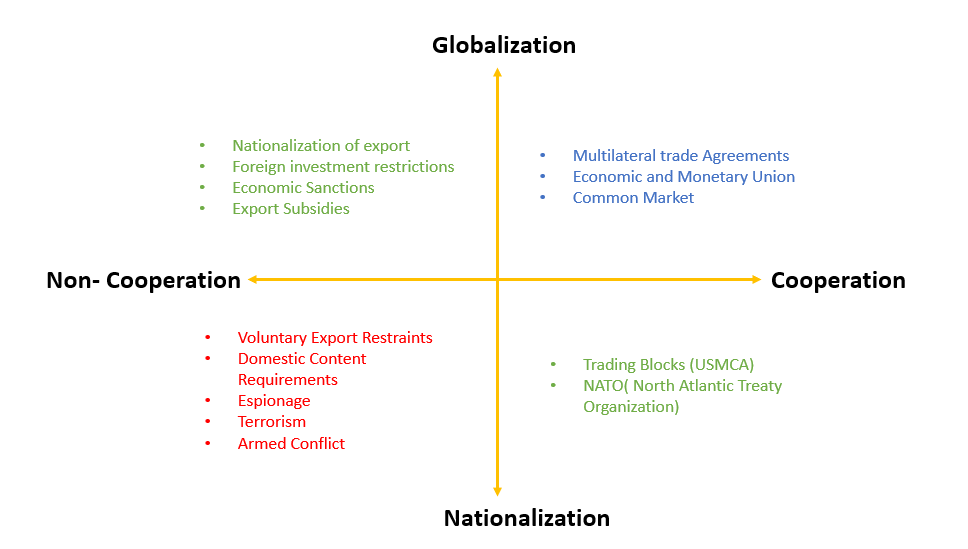

Features of Geopolitical Stance

There are only two major stances that any nation can take;

- Cooperation

- Non-Cooperation

The most common actions of cooperation are:

•Tech Exchange

•Free movement

•Harmonization of Tariffs

•Standard Rules

Similarly, the exact opposite is true for Non – Cooperation.

•Restricted Movements

•Restricted Trade

•Arbitrary Rules

•Inconsistent Rules

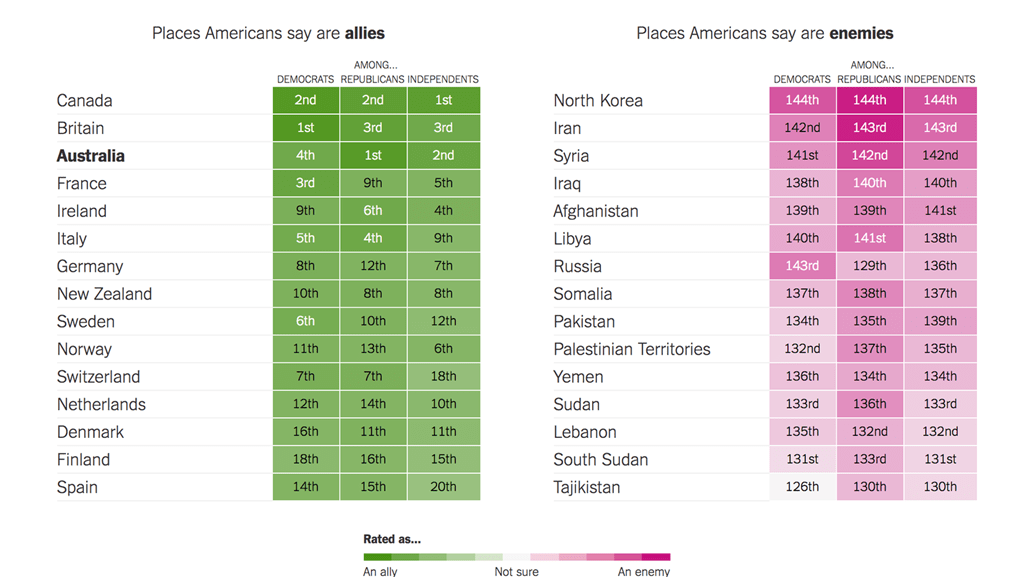

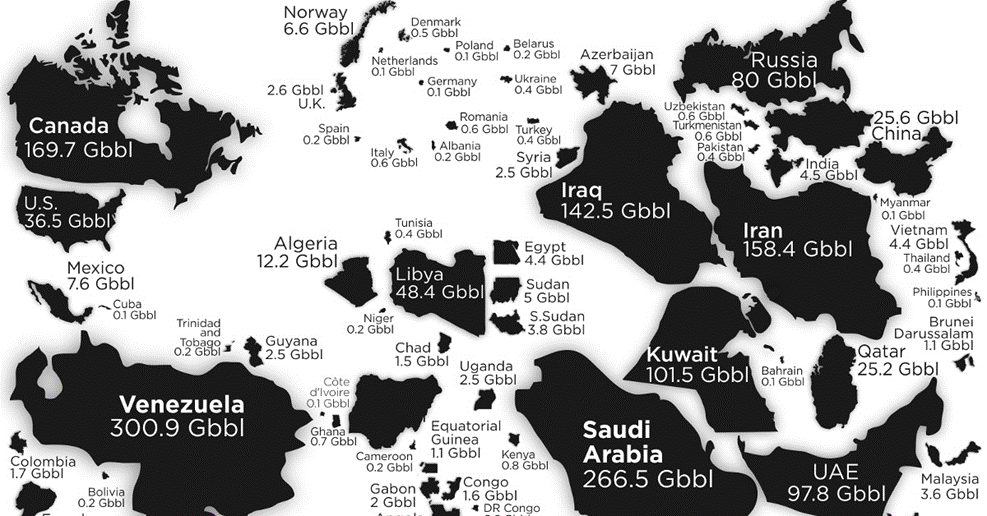

As you can see in the case of the U.S, the green-coloured countries are close allies of U.s, and the pink ones are enemies. However, it’s kind of funny to see IRAQ and Libya in this list where the U.S imports heavy oil minerals.

We can dig this further;

•U.S sanctions against Venezuela for 15 years

• the U.S primarily stated the disbanding of Saddam Hussain as the primary reason for conflict.

•Today U.S imports $3.8 Bn in crude Oil from Iraq

•In March 2022 U.S .S. officials demanded Venezuela supply at least a portion of oil exports to the United States as part of any agreement to ease oil trading sanctions on the OPEC member nation, two people close to the matter said.

Source: Reuters

• the U.S Defended Kuwait during the Gulf War

• Imports $1.2 Bn In Oil minerals

•U.S Imports $1.5 Bn in oil from Libya( U.S armed conflict in 2015-19 against ISIL)

•U.S & Saudi Arabia have been long-standing partners for mutual benefits

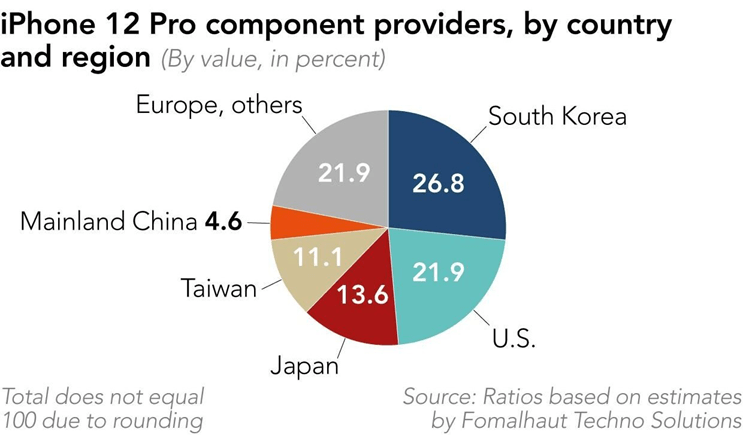

Participants in Geo-politics & Globalisation

The writing is on the wall! There can be two actors in this play

- State Actors- Leaders, Government, Military

- Non-State Factors- Companies and Globalisation

The second factor can be more challenging than the first because of its multi-facet effect.

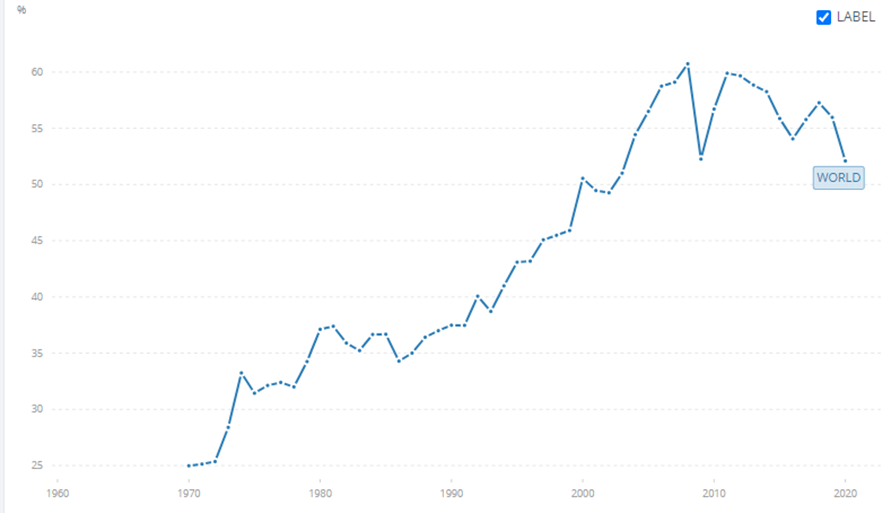

The proof of globalisation is given in this graph given by World Bank, it’s amazing to see how we are interconnected beyond physical borders.

Geo-Political Strategies

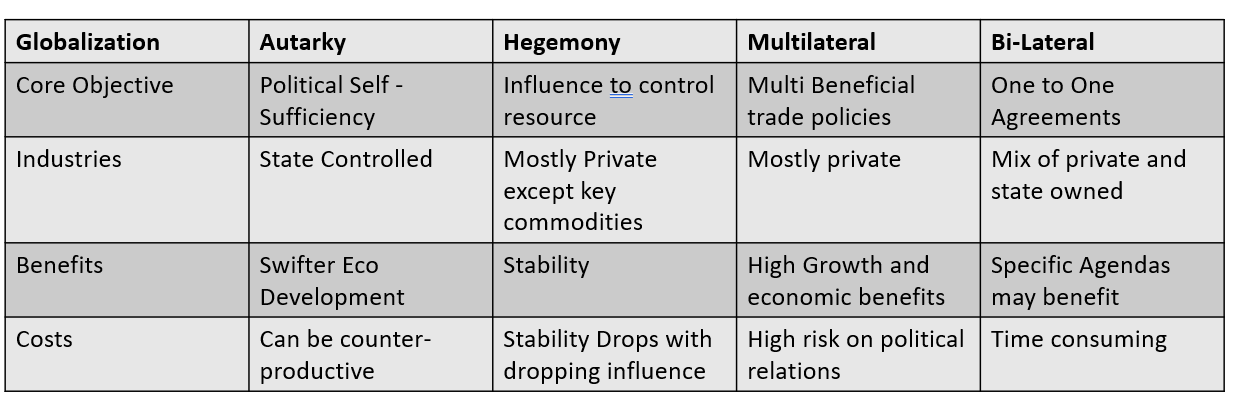

Unlike the prevalent mindset of criticism that is often seen when a country takes a stance against or for a cause. I think a thought needs to be given to the four kinds of strategies used in geopolitics.

- Hegemony- Influence a region with military and economic power

- Autarky-Nationalism and protection of domestic industries

- Multilateral ties- a blanket approach to harmonising trade

- Bi-lateral- a one-on-one deals with countries on trade

So, you can clearly see and put a name in the category when you see a country act in a certain way in the world policies.

Tools for Geo-Politics

German Syrian Crisis Case Study

The Syrian crisis started in 2011 with post violent government crackdown on public demonstrations that resulted in the civil war.

- As a result of ongoing conflicts, 6.6 million Syrians fled the country

- Germany announced that it would admit 1.1 million refugees

- It was not supported by neighbouring countries

- Germany benefited in the long run-lower labour costs

- Improved demographic balance of the young population

So, we can clearly see that geo-political strategies are not always used by military power use but can also be used to benefit a crisis and also effect change in a country’s demography.

Effect of Geo-Politics on Investments

By now, I guess you have seen most geo-political events have an effect on investments. However, we can categorise this event as;

- Exogenous: No control like earthquakes in Japan in 2003

- Black Swan Events: Like the covid 19 pandemic

- Events: Re-election, change of regulations like the privacy rights for Facebook.

Firstly, it’s important to note that predicting events is near impossible rather, understanding its impact and the speed of its impact is more predictable.

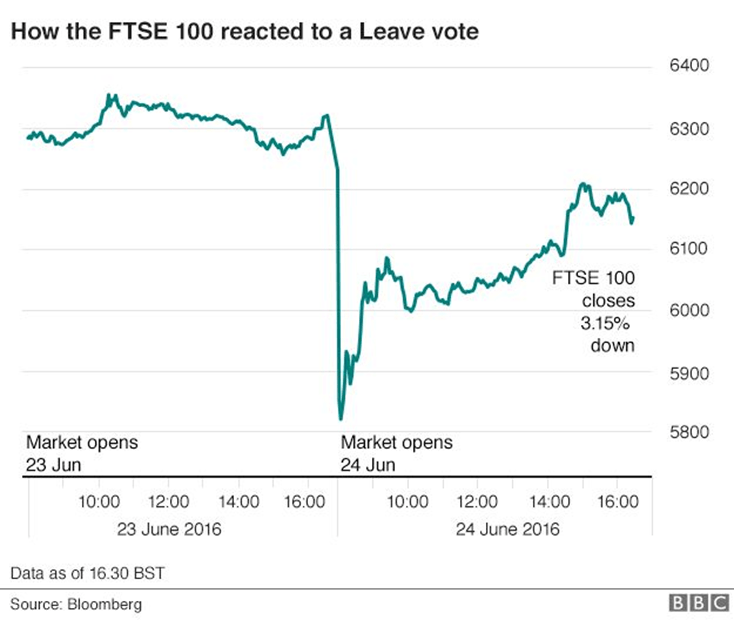

Also, during Brexit, this is how the bond markets reacted

10 Year Govt Bonds dropped

•1ST Day -21%

•30 days -42%

•1 Year -25%

Now, no one could have predicted the Brexit proposition nor the outcome with certainty.

However, the impact of the worst-case scenario was available when the phone survey showed that most people wanted to vote for the exit. Many smart portfolio managers used this “Sign-Post”, and made tactical changes immediately and were able to contain the losses.

Reading Material

Conclusion

Geopolitics made its way into the CFA syllabus pretty late, according to my judgement. This should have been included long back, because of its imminent effect on long term portfolio management. However its a welcome introduction, even though it is very basic introduction, nevertheless something better than nothing.