Last updated on June 9th, 2023 at 05:47 pm

Ever wondered how suddenly a currency drops is its value compared to USD or EUR? In this article, we cover the currency devaluation meaning in depth with some interest examples from the foreign exchange market.

Devaluation Meaning: Introduction

What is devaluing meaning when it comes to currency?

So Devaluation meaning can be simply understood that, If I have to put it means that your nation’s currency value compared to any other country is lower.

Many international bodies function and use set various strategies to devalue their currency.

Now, why should I be so interested in my currency value? Also is a strong currency always good? For eg; China doesn’t want its currency to be stronger, which would make their labour market as well as exports expensive.

However, at the same time, a weaker currency could mean that imports become expensive. So currency appreciation and depreciation is a two-edged swords. In fact, countries like china have fixed exchange rates or pegged their currency against the US dollar. Similarly, in the foreign exchange market, many countries like China have the intention to keep their currency slightly weaker, for eg India’s rate compared to the dollar has been constantly depreciating over the years.

So, In some cases, it does additionally take the alternative movement by growing the cost of its currency, that is revaluation. Devaluation isn’t like depreciation and deflation. Depreciation happens whilst the free-floating exchange rate of the currency loses cost within the worldwide foreign economic market. Deflation happens whilst the overall cost for domestic items falls.

Why does Devaluation Happen?

Now, devaluation occurs because of the following:

- To raise exports

- To cut back exchange deficits

- To decrease the value of the country’s debt

The important reason why nations devalue their currency is because of foreign exchange imbalances. The use of currency and devaluation could negatively impact, the value of a country’s export markets, which in the long run makes them more competitive on a worldwide scale.

Moreover, imports growth in value, inflicting home purchasers to be much less inclined to buy better-priced items from overseas companies and, as an alternative, buy items regionally at a lower price.

Next, the growth in home spending might then stimulate cash flow inside one’s economy. As exports start to grow because of less expensive costs and imports lower because of perceived better costs from home purchasers, in the long run, it decreases exchange deficits.

Therefore, the meaning of currency devaluation or domestic currency can lessen deficits thru a robust demand for much less luxurious exports and extra luxurious imports.

Governments can also purposefully, devalue its currency. Firstly, if they have huge sums of loans, that hampering the economy. Decreasing the value of the currency, it’s going to make debt bills less expensive over time.

Failed Currency Devaluation Meaning

Devaluation can bring about growth in the costs of services and products over time. The growth in the cost of imports makes purchasers buy their items from domestic manufacturers. The quantity of the cost increases depending on the rate of delivery.

So, Higher exports because of the devaluation in the forex will increase aggregate demand, which increases the gross domestic product (GDP) and inflation.

So, Inflation is factored in because the carriers are confronted with higher import charges, which causes them to increase charges and market charges as well.

Furthermore, devaluation also can grow uncertainty in the marketplace. The Marketplace uncertainty can negatively affect delivery and demand because of a loss of purchaser confidence, inflicting a potential recession over time. Moreover, devaluation may spark change wars.

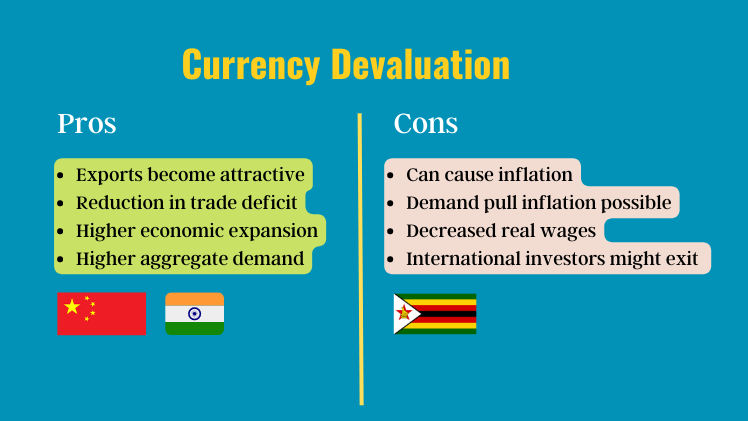

Pros and Cons of Devaluation of Currency

There have been several disinflation occurrences that have harmed not just the population of the nation involved but have also had an impact on people all over the world since currencies in the world abolished the gold benchmark and permitted their exchange values to fluctuate freely against one another. Here are some advantages and disadvantages after understanding the devaluing meaning of the currency.

Pros of currency devaluation

- Export markets then become more affordable and attractive to overseas customers. As a result, this increases domestic demand and may result in the development of jobs in the export industry.

- Increased exports should result in a reduction in the trade deficit. This is crucial if the nation suffers from a sizable current account deficit as a result of its low level of competitiveness.

- Higher Aggregate Demand (AD) and export levels can result in faster rates of economic expansion.

- A less harmful method of regaining competitiveness than “internal devaluation” is devaluation. Deflationary measures used in internal devaluation to lower prices by lowering aggregate demand. Devaluation might increase competition while maintaining total demand.

- The Monetary Authority can lower interest rates after deciding to create inflation since it is no longer necessary to “prop up” the economy with high interest.

Cons of currency devaluation

- Depreciation will lead to result in inflation because Imported goods and services would be more pricey.

- Also, any imported item or intermediate goods will increase in price).Hence, Aggregate Demand (AD) will increase, resulting in demand-pull inflation.

- Decreases the buying power of foreign nationals. For instance, travelling overseas for vacation is more expensive.

- Decreased real wages. Many consumers would feel worse off as a result of a devaluation. The reason is, it drives up import costs during a time of poor wage growth. Between 2007 and 2018, this was a problem in the UK.

- International investors could flee if there is a significant and swift depreciation. Due to the devaluation’s influence on their assets’ actual worth, investors become less inclined to keep government debt. Rapid depreciation may occasionally result in capital flight.

Why would a government devaluate its currency?

There are many reasons behind currency devaluation. As an instrument, its foremost goal is to lessen a trade deficit via the merchandising of exports. Another direct impact of currency devaluation is that it every so often ends in better wages.

Russian Currency Devaluation

In 1998, Russia’s growing interest rate and expanded capital outflow stoked fears of a devaluation of the currency. Which led to the rubble tumbling. Also, this resulted in the default on the country’s debt. In August of the very same year, Russia’s stock, bond and foreign money markets collapsed. To restrict the damage, the authorities undertook a sequence of measures, along with the devaluation of the currency rouble. As a result, the inflation charge reached 27.6% in 1998, before growing to 85.7% in 1999.

Ukraine Currency Devaluation

Ukraine’s central bank has depreciated the hryvnya by 25%, citing the substantial economic repercussions on Russia.

As per a statement issued by the bank on July 21, the latest updated currency rate is 36.5686 compared to the US dollar.

The decision was made due to the change in basic aspects of Ukraine’s currency during the conflict, as well as the rise of the US dollar versus other currencies.

The depreciation came just after Ukraine requested a two-year payment suspension on its international debts in an effort to focus its depleting financial resources on resisting Russia.

INR Currency Devaluation

The Indian stock exchange has had a difficult few days. And now we have an explanation for the jerky performance. bank of China declared a 2% depreciation of its yuan on Tuesday. Its unit, the Renminbi, soon dropped to a 3 low. It was the most significant one-day drop in a decade. The Renminbi is the currency’s name, although it is valued in yuan. As a result, the yuan is employed for exchange rate reasons.

In a worldwide society, such a large drop in the market of a big economy inevitably has repercussions. The revelation also had a detrimental effect on the Indian rupee as well as the share market. This is because the devaluation of the currency has the possibility of damaging the Indian economy.

Is Currency devaluation and currency depreciation the Same?

Contrary to forex devaluation, depreciation isn’t always intentional. Instead, depreciation refers to a decline in a currency’s value because of unfavourable monetary developments that could typically be reflected by monitoring monetary indicators. Its consequences are pretty virtually after the management of the State or monetary authority concerned.

On the other side, devaluation is an economical coverage device intentionally utilised in constant or semi-constant change price systems. Under such systems, the change price is pegged to a reference or pivot of a few kinds, typically made of currency, a basket of currencies or a commodity, like gold, for example.

In floating (or flexible) change charge systems, the value of the currency fluctuates freely according to delivery and calls for at the forex market, and intervention is limited.

Conclusion:

Hence in contrast to depreciation, is a voluntary lower in the price of foreign money relative to others. It is a famous economic coverage tool; however, the number of its benefits and downsides are every so often glossed over. The important advantage of devaluation is to make the exports of a domestic or foreign money area more competitive; as a result, they become less expensive to buy. This can grow outside demand and decrease the trade deficit. China, for example, is a clear example of foreign money devaluation for this reason. Conversely, devaluation makes imported merchandise more expensive and stimulates inflation. Purchasing energy and domestic food might also additionally suffer.

It is crucial to observe that devaluation is a way followed by esteemed banks or central economic authorities in constant or semi-constant trade exchange systems. In floating (or flexible) alternate charge systems, those institutions generally tend to restrict their interventions because the price in their currencies fluctuates in the forex marketplace according to delivery and demand.