Last updated on January 11th, 2024 at 06:33 pm

CFA Vs ACCA

So, usually this question about comparing cfa Vs ACCA comes about from students. Because both the qualifications have some popularity in the Indian universities. Let me explain this by sharing some numbers with you which make it clear to you.

- During the year 2023 almost 1.1 Lac CFA candidates wrote exams world wide

- While at the same time 1.05 Lac students wrote the ACCA exam worldwide during the same period.

So, its no doubt that both these qualfications are well known in the student community. However, does that mean that you could choose anyone of these? Absolutely not.

On the one hand we have an accounting qualification- ACCA, which also competes with ICAI(CA) in India. While CFA is an investment management qualification.

CFA Vs ACCA – Job opportunities?

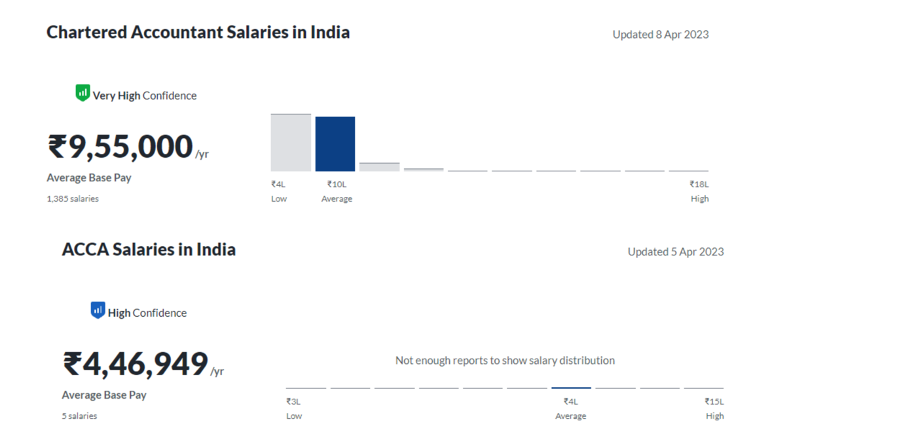

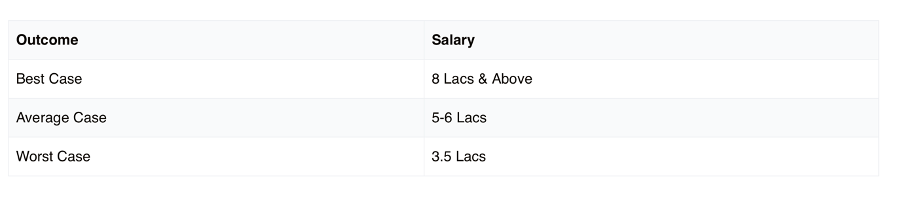

Now, let me discuss a little bit on the scope of job opportinties with CFA vs ACCA. As you know that since ACCA,is an accounting qualification. While the Indian accounting scenario is dominated by chartered accountants, hence salary command for ACCA is not comparable with CA.Below are some salaries which you can get as an ACCA fresher.

On the other hand let me also show you what is the same scenario with CFA candidates. If you see closely then even the worst case scenario with CFA is that you end up at a much higher salary than ACCA.

The Exam Perspective – CFA Vs ACCA

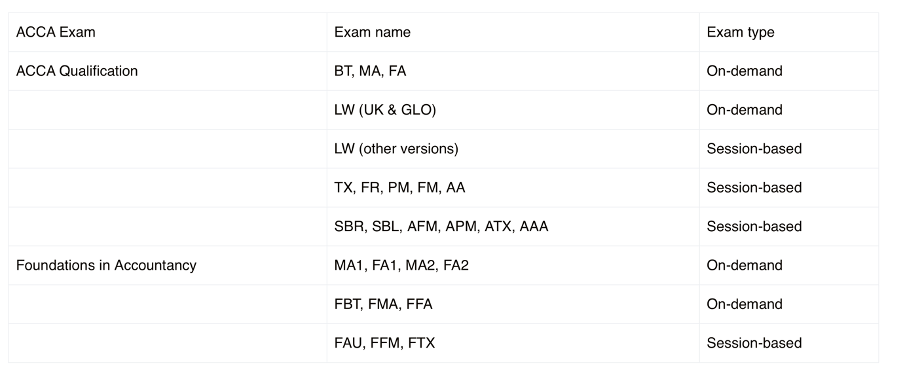

Now, let me compare what is the difference between CFA Vs ACCA in terms of the exam structure. On the one hand CFA is a very simple plain structure of 3 exams i.e Level 1 , Level 2 & Level 3. Whereas, compared to that ACCA has in total 13 papers, and array of exemptions depending upon your previous qualifications.

Below is the gist of the number of exams in acca.

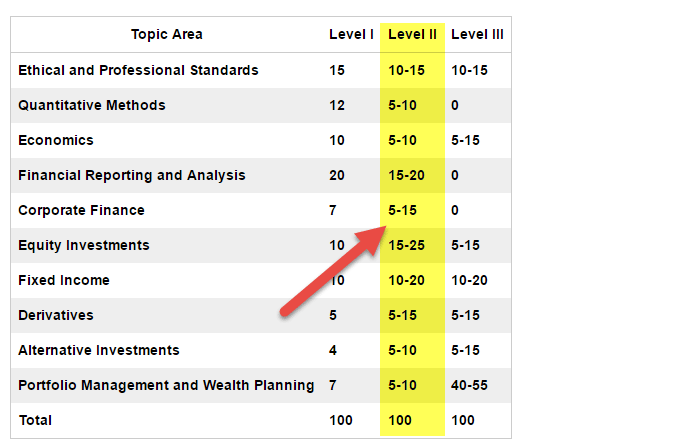

Compared to that below is a gist of the CFA syllabus

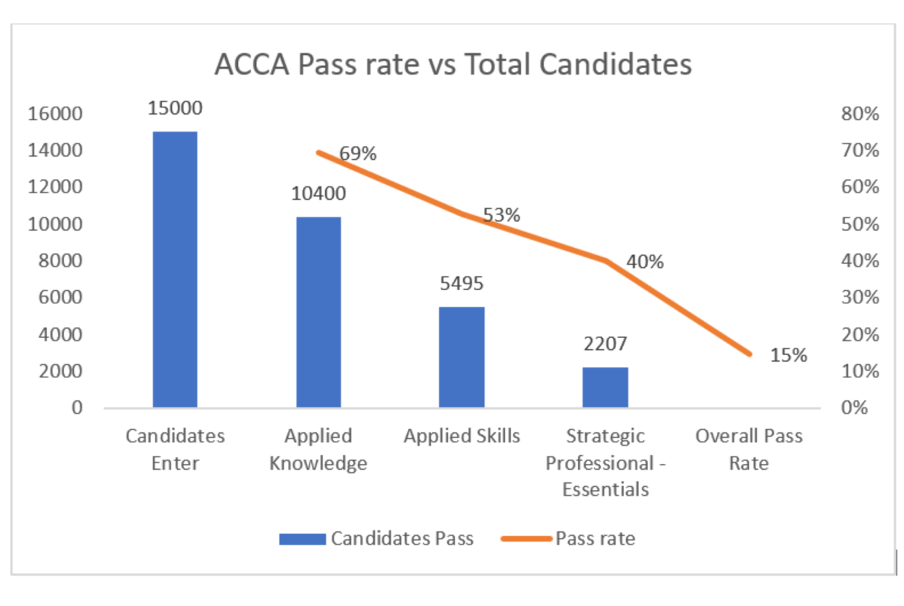

The Pass Rate Comparison

Now if I look at the pass rate comparison CFA Vs ACCA, then we clearly see that the overall pass rate for ACCA is 15%. Which means that if 100 students start the program, you can expect 15 to successfully complete the ACCA program.

So, then what about CFA? So compared to ACCA the pass rates are lower for CFA, because the exam is ofcourse very detailed and comprehensive.

- At level 1 the pass rate is around 40%

- At CFA level 2 the pass rate is at around 46%

- While at Level 3 the pass rate is around 54%

Which means if 100 students start the CFA program at level 1 then, 7-8 students will pass. So the conclusion is that In the CFA vs ACCA comparison, CFA is twice as tough compared to ACCA.

Cost Comparison between ACCA & CFA

Now if I compare these qualifications from a cost perspective then ACCA can be a little more costly, if you start from the foundation level exams. However at a very broad level

- CFA cost around 2.5 Lacs

- While ACCA total pursuing cost will be somewhere around 4.5 Lacs

So if I just look at the cost, obviously then ACCA is more expensive program. However I am assuming that you will not discredit a program just on the basis of its cost. After all its impossible to measure the return on investment on education.

Global Recognition CFA Vs ACCA

Now, let me also touch upon the overall recognition of these two programs worldwide. And No! I am not going to just talk about how many countries they are recognized in. Because that kind of data is really not helpful in deciding. However, what I will do certainly is to see how these qualifications have progressed world wide in terms of competitive qualifications. Or May be employability.

- ACCA qualification does not have any signing authority except in Dubai, which is the primary requirement to assess a programs application.

- Whereas if I compare the same statistic with CPA, CPA’s have signing authority across most of the countries world wide.

- Compare that to CFA, but we aren’t really going to compare the signing authority because they don’t sign. However if you see in the investment management industry, CFA qualification has been officially recognized in a country like India as equivalent to a tier 1 post graduate program.

- Which also means that no more will CFA candidates have to negotiate their salaries on the basis of graduation.

Conclusion

Overall in my opinion CFA is a much better option for graduates if they are seeking a career in finance and investments. However if this is not the case then I would still recommend candidates to pursue the standard CA qualification. While the main reason for recommending it is because, even if you do not clear the entire CA program. You are still better placed in terms of job opportunities in finance.

Read More

Best Extra Courses for Commerce Students

So, you have limited time? May be you have a semester break or may be you are waiting for the placements week to start. And you are confused as to what are the best 3 months extra courses for commerce students? So, I have some good news for you! I have curated the best list…

Advanced Excel Course Syllabus-Designed For Industry

Last updated on October 21st, 2024 at 11:18 amAccording to a 2023 survey conducted more than 80% of the job postings in data analysis, financial modeling, project management require high proficiency in Microsoft excel. However, excel is so wide and so is its application that having a clearly defined advanced excel course syllabus is important.…

Gumbel Copula in Financial Modeling

The Gumbel copula is a popular tool for modeling dependencies between variables, particularly in the context of financial modeling where extreme events (tail dependencies) are of interest. This copula belongs to the Archimedean family and is characterized by its ability to capture asymmetric tail dependence, especially for extreme right tail events, meaning it is adept…

Example of A/D Analysis (Accumulation/Distribution Analysis)

Accumulation/Distribution (A/D) Analysis is a technical indicator used in financial markets to assess the relationship between stock prices and trading volume. It helps determine whether a stock is being accumulated (bought) or distributed (sold). The indicator calculates the “money flow” based on the price movement and volume. When the A/D line trends upwards, it indicates…

Prototyping Stage in Financial Models Development

The prototyping stage forms an integral component of the financial modeler’s approach and is even more apparent in sophisticated environments like mergers, acquisitions or even capital budgeting. The focus of this stage is on the preparation of a first basic outline of the financial model, in order to test the concept, the logic and the…

Can i earn money by excel? The Excel Guide

Excel is a dynamic software that can open many avenues for making money. Here are some ways you could end up earning money by excel. Also I would include some real world testimonials and suggestions from experts who have actually done this. Broader Areas of Earning Money By Excel Freelancing: Use your knowledge of Excel…