Last updated on January 28th, 2026 at 04:44 pm

CFA Vs ACCA

So, usually this question about comparing cfa Vs ACCA comes about from students. Because both the qualifications have some popularity in the Indian universities. Let me explain this by sharing some numbers with you which make it clear to you.

- During the year 2023 almost 1.1 Lac CFA candidates wrote exams world wide

- While at the same time 1.05 Lac students wrote the ACCA exam worldwide during the same period.

So, its no doubt that both these qualfications are well known in the student community. However, does that mean that you could choose anyone of these? Absolutely not.

On the one hand we have an accounting qualification- ACCA, which also competes with ICAI(CA) in India. While CFA is an investment management qualification.

CFA Vs ACCA – Job opportunities?

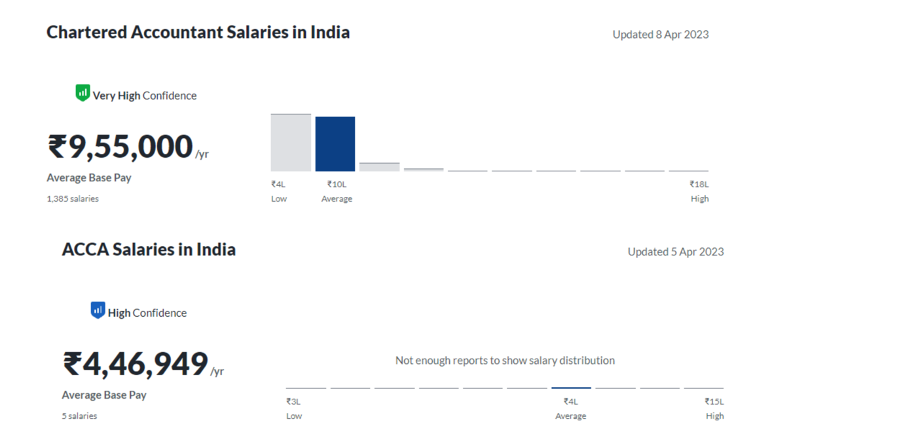

Now, let me discuss a little bit on the scope of job opportinties with CFA vs ACCA. As you know that since ACCA,is an accounting qualification. While the Indian accounting scenario is dominated by chartered accountants, hence salary command for ACCA is not comparable with CA.Below are some salaries which you can get as an ACCA fresher.

On the other hand let me also show you what is the same scenario with CFA candidates. If you see closely then even the worst case scenario with CFA is that you end up at a much higher salary than ACCA.

The Exam Perspective – CFA Vs ACCA

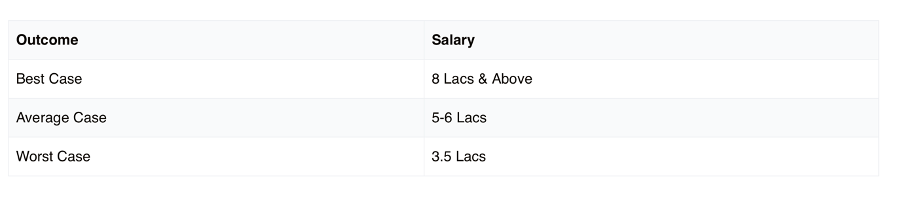

Now, let me compare what is the difference between CFA Vs ACCA in terms of the exam structure. On the one hand CFA is a very simple plain structure of 3 exams i.e Level 1 , Level 2 & Level 3. Whereas, compared to that ACCA has in total 13 papers, and array of exemptions depending upon your previous qualifications.

Below is the gist of the number of exams in acca.

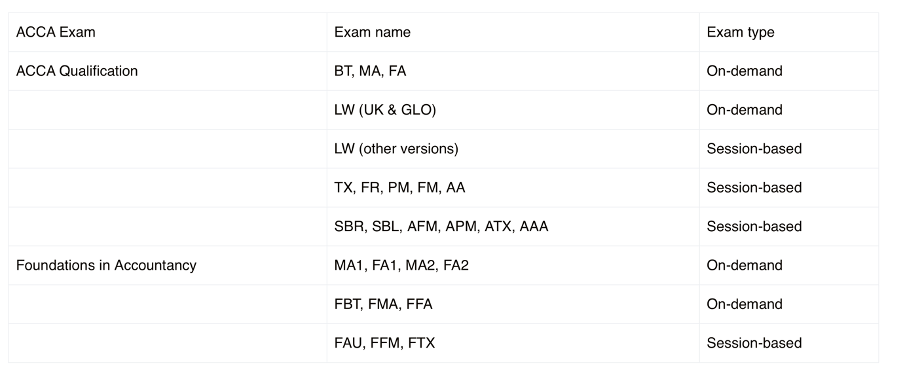

Compared to that below is a gist of the CFA syllabus

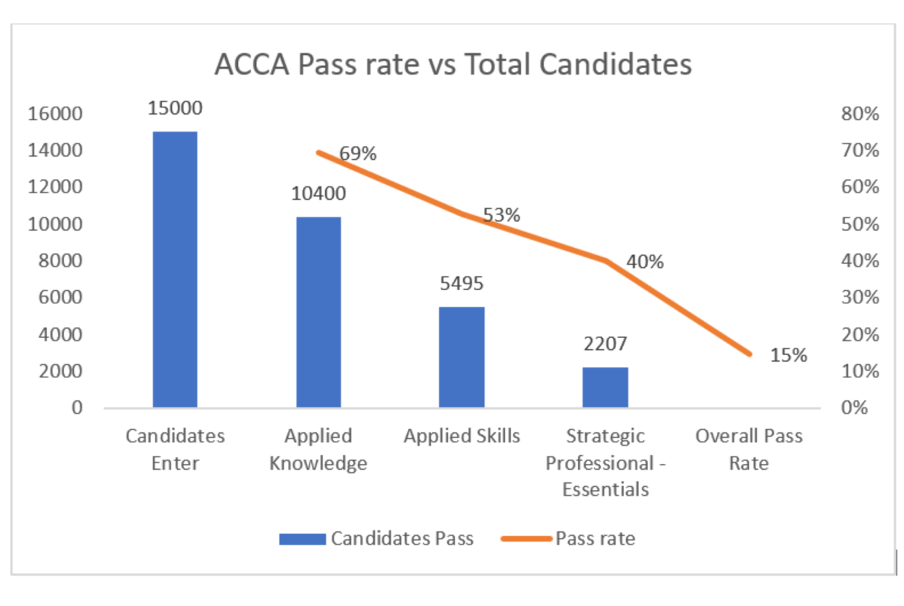

The Pass Rate Comparison

Now if I look at the pass rate comparison CFA Vs ACCA, then we clearly see that the overall pass rate for ACCA is 15%. Which means that if 100 students start the program, you can expect 15 to successfully complete the ACCA program.

So, then what about CFA? So compared to ACCA the pass rates are lower for CFA, because the exam is ofcourse very detailed and comprehensive.

- At level 1 the pass rate is around 40%

- At CFA level 2 the pass rate is at around 46%

- While at Level 3 the pass rate is around 54%

Which means if 100 students start the CFA program at level 1 then, 7-8 students will pass. So the conclusion is that In the CFA vs ACCA comparison, CFA is twice as tough compared to ACCA.

Cost Comparison between ACCA & CFA

Now if I compare these qualifications from a cost perspective then ACCA can be a little more costly, if you start from the foundation level exams. However at a very broad level

- CFA cost around 2.5 Lacs

- While ACCA total pursuing cost will be somewhere around 4.5 Lacs

So if I just look at the cost, obviously then ACCA is more expensive program. However I am assuming that you will not discredit a program just on the basis of its cost. After all its impossible to measure the return on investment on education.

Global Recognition CFA Vs ACCA

Now, let me also touch upon the overall recognition of these two programs worldwide. And No! I am not going to just talk about how many countries they are recognized in. Because that kind of data is really not helpful in deciding. However, what I will do certainly is to see how these qualifications have progressed world wide in terms of competitive qualifications. Or May be employability.

- ACCA qualification does not have any signing authority except in Dubai, which is the primary requirement to assess a programs application.

- Whereas if I compare the same statistic with CPA, CPA’s have signing authority across most of the countries world wide.

- Compare that to CFA, but we aren’t really going to compare the signing authority because they don’t sign. However if you see in the investment management industry, CFA qualification has been officially recognized in a country like India as equivalent to a tier 1 post graduate program.

- Which also means that no more will CFA candidates have to negotiate their salaries on the basis of graduation.

Conclusion

Overall in my opinion CFA is a much better option for graduates if they are seeking a career in finance and investments. However if this is not the case then I would still recommend candidates to pursue the standard CA qualification. While the main reason for recommending it is because, even if you do not clear the entire CA program. You are still better placed in terms of job opportunities in finance. Check out our CFA Classes in Pune.

FAQ

Which is tougher ACCA or CFA ?

ACCA covers a broader range of accounting and finance topics, has more exams with relatively higher pass rates as compared to CFA. CFA is tougher taking the 45% passing rate also CFA has broader syllabus which demands more study time also for Chartered Financial Analyst case studies are more important.

Which is more expensive ACCA or CFA?

CFA total cost in India is approximately ₹3.1 lakhs for early registration and can go up to ₹4 lakhs or more if registering late, covering enrollment fees and exam fees for all three levels. ACCA total cost typically ranges between ₹2.7 lakhs to ₹4 lakhs, including registration, exam fees, annual subscriptions, and study materials. Both take almost same amount this number can vary by coaching and training you take and also if you apply late you will have to pay more as late fee.

Will ACCA provide me better package or CFA?

As a fresher the package you get as a CFA level 1 candidate and ACCA candidate gets is the same which ranges from 5LPA to 8LPA. When you enter into the market as a fresher the skill matters but the salary range is standard after you have gained experience your growth is exponential.

Should i pursue ACCA or CFA?

ACCA is for accounting as it says on their website ACCA is number one choice for accountancy students. If auditing, accounting also taxation is something you feel passionate about you should go for ACCA. CFA focuses on core finance side which includes analyst position and portfolio management also wealth management.

Is there any major update in ACCA or CFA?

The major update is ACCA and CFA are implementing more sustainability into Finance and also more real world case studies will be emphasized.

Read More

JP Morgan Interview Questions- Detailed Tutorial with Template

If you’re preparing forJP Morgan interview questions or other roles at Corporate Finance roles at JP Morgan, understand this clearly: The spreadsheet test is where most candidates get eliminated. This isn’t just an Excel test. It’s a structured thinking test under pressure. Crack the JP Morgan Investment Banking Spreadsheet Round Master NPV | 3-Statement Linkages | DCF…

Last updated on March 5th, 2026 at 03:14 pmIf you’ve landed on this page from my YouTube tutorial on Tesla financial model then you’re in the right place. This article is the written companion to Part 1 of the Tesla financial modeling series, where we build the core revenue engine of a Tesla model from scratch. The Excel…

CAIA vs CFA: Key Differences & Which is Best?

The demand for finance certifications in India is rising fast as students and professionals look for specialized, global credentials to stand out in competitive finance roles. This growth has increased comparisons between CFA and CAIA, especially among candidates targeting investment-focused careers. Reason being certifications and qualifications can be a benchmark to get higher salary in…

CFA vs MBA: Which is Better for Your Finance Career?

Last updated on February 13th, 2026 at 06:02 pmChoosing between a CFA and an MBA has become one of the biggest dilemmas for finance career aspirants in India. Students, fresh graduates, and working professionals often struggle to decide which path offers better career growth, higher return on investment, and long-term stability. The confusion is growing…

Leveraged Buyout Model (LBO Model): Step-by-Step Excel Guide + Template Workflow

If you’re learning private equity modeling, the Leveraged Buy Out Model (LBO Model) is the one framework almost every finance student is curious about — and it’s also one of the most tested models in interviews. If you’re learning modeling for interviews and placements, start with our complete Financial Modeling Course with Placement But here’s the truth: an LBO…

How to Build a Financial Model: A Practical Step‑by‑Step Guide

Learning how to build a financial model isn’t just about entering numbers into Excel — it’s about structuring information so you can make better business and investment decisions.A financial model turns business drivers and assumptions into a logical framework that helps you forecast outcomes and evaluate choices. Whether you’re an investor, entrepreneur, or finance professional, this guide…