Last updated on August 19th, 2025 at 03:46 pm

Are you confused on what to do after b.com?

This period after graduation can be be a very frustrating period, contributed by but limited to

- Plethora of Options- Degrees

- Buzz words like data science, digital marketing, Investment banking, Taxation, audit etc

- No clear process to find the right path

- No clear way, on discovering your interest.

If these are problems which ring a bell! Then you are in the right place. Read along, and I promise at the end you should be able to get a fair idea on the technique to find your way forward !

I have tried to break up this entire decision making process for careers after b.com in 13 simple segregation.

What to do after b.com?- List of options

Finding Your Interest-The 1st Step for what to do after b.com

Most of the blogs would talk about qualifications directly and that would infact defeat the purpose. I like to see career options, more from a very personal approach on interest and ability. You see you can’t expect some one to take up data science, unless the person is really interested in data, coding or technology!

Look at the matrix given below, and find out which one of the 5 interest areas is you (1-5), and a word of advice while selecting, don’t select the interest just because its trending.

How to distinguish Interest From Excitement

- Interest will have some history ( I started trading in Class XI)

- Interest will have hobby associated with it ( I loved reading business and trading books)

- Excitement or infatuations have a gossipy nature

- Excitement is not sustainable- You started watching the stock markets and then discontinued in one week

- Excitement doesn’t really lead you to be curious

So Choose your interest, it doesn’t have to be just one but set it in the order of its priority

Match Your Abilities-The Second step for what to do after b.com

Take your interests and rank your abilities against the interests. For eg. If you have high interest in numbers, business and you are good in maths then finance would make a lot of sense. Below is a simple example of the same, the match of interest and ability are critical. This is the major reason, why students generally mever find their career path and end up wasting a lot of money .

Finance

Ability-Maths Skills

94%

Business

Interest-Business Ideas|

76%

Creative

Ability-Innovation

57%

Careers List- what to do after b.com

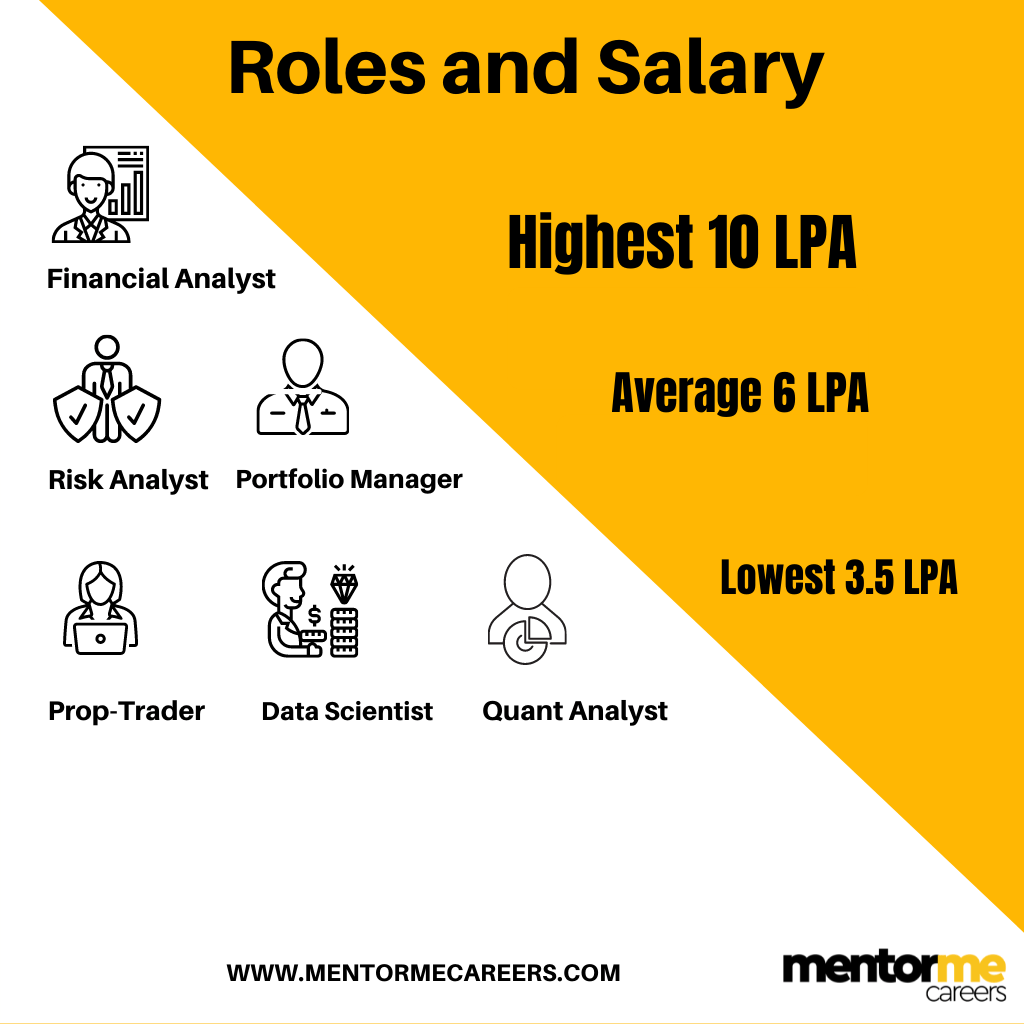

Investment Banking- What to do after b.com option 1

Investment banking can be a very exciting filed to be in, especially if your interest and ability is taken care off. There are many ways to get into investment banking but before that who is it for?

- Interest: Business, numbers

- ability: Maths, Creative

Career Paths to Investment Banking

- Right after graduation( Any)- Junior Analyst/ Intern

- After MBA( Premium)- Research Associate

- After CFA Level 1 ( Chartered Financial Analyst) – Research Associate

- After CA-IPCC- Junior Analyst

- After CA/CIMA- Research Associate

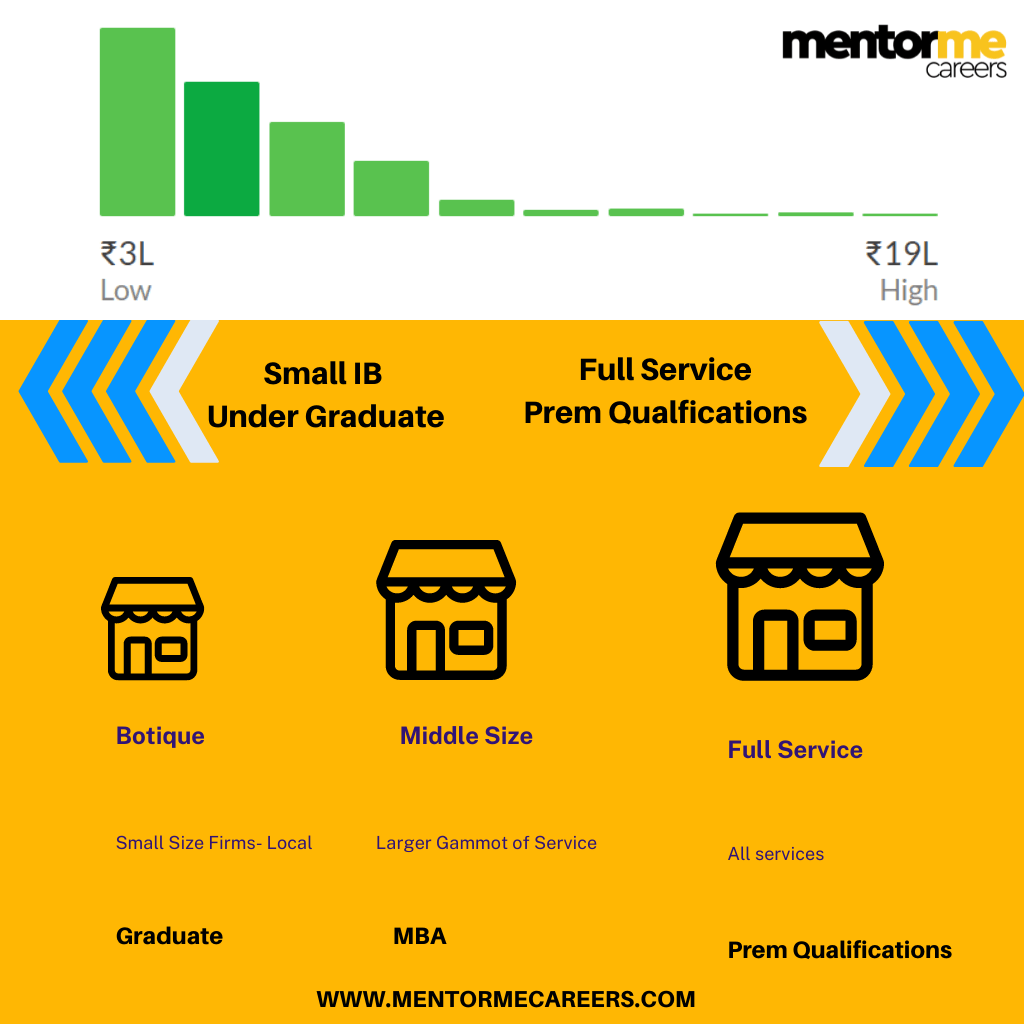

Having said that, the compensation and base package depends on your education, skills and experience. If you are still in college, then it’s highly recommended that you take up internships and start preparing for programs like CFA Level 1.On the other hand if you have completed post graduation, then you could start getting skills like Financial modeling and start looking for opportunities in either Tier 1 investment banks, Tier II or even Boutuque, where you land up depends on your post graduation college.

Summing up the direct qualification options for investment banking careers:

- CFA – For Undergraduates| Tier II MBA

- MBA Tier I- For Undergraduates

- Common skill( Short term courses): Financial modeling

Corporate Finance-What to do after b.com option 2

In this section we will explore various types of corporate finance jobs in large companies, from a corporate finance perspective. These profiles are related to decision making in relation to capital allocation, budgeting and forecasting, managing surplus capitals- treasury & investor relations.

Who is it for?

- Interest: Business

- Ability: Maths

Areas in Corporate Finance

- Corporate Development

This is nothing but the team that works on acquisitions, mergers and takeovers of target companies. This team can also be called as the strategy team

- Financial planning and analysis( FP&A)

This team in a corporate structure is responsible for budgeting, forecasting, defining key metrics of performance( KPI’S). They collaborate with different teams of an organisation, including accounting, operations and strategy.

- Treasury:

Cash management, short term investments, working capital management , hedging, currency management etc are functions of the treasury department. This team plays a very important role in keeping the companies financial situation in optimum shape.

- Investor Relations

Any activities in a company related capital governance, corporate action, share buy backs, dividend policies are all under the ambit of investor relations.

Here is a Glass door survey on the same

Recommended Qualifications

- CFA Level I- Start at Final year graduation

- MBA( Tier I)

- CIMA- Global Qualification – Can start after Class 12th

Recommended Skills:

Salary Ranges: Corporate Finance

- Freshers: 3.5 to 4 LPA

- With At least 2 Years work experience: 5-7 LPA

Digital Marketing-What to do after b.com option 3

Marketing has changed over the last decade, with the influx of digital products like mobile phones, laptops and growth of social media. There has been a dramatic shift in entertainment, changing from television and newspapers to social media platforms.

There are about 1.2 Billion people on Instagram, 2.85 billion people on Facebook. That’s almost 1/3rd of the worlds population on social media, making it -” Marketing heaven” for marketers.

Along with this marketing has become more and more tech oriented. Forr eg.

- User behaviour

- Demographic analysis

- Purchase patter

- Religious affinity

- Political orientation

Marketers now have the option of reaching their customers in the most sophisticated manner , control their cost and at the same maintain return on spent. However the kind of jobs in digital marketing are very similar to the old days

Who is it for?

- The creative types– Content

- The analytical types– SEO & Lead generation

MBA program doesn’t make a lot of sense in digital marketing roles, due to its specialist nature of role

Lead Generation & SEO: Google and Facebook short term digital marketing certifications are enough.

Recommended qualification

- Content : Mass Media Qualification

Average Salary Ranges: Digital Marketing

Taxation & Audit

Taxation and audit is a field more related law, regulations i.e compliance. The only reason this field is slightly different than LAW, is because it deals with numbers, and a lot of them.

Hence, anyone with an interest in law with numbers, can consider this field, considering also their ability- Good memory and basic maths.

Fields in accounting

- Taxation: All the 2 lac companies in India, need to pay taxes, pay gst and get their books in place. So this is the reason, why demand for CA’s, ain’t going down for as long as it matters.

- Auditing: While a lot of companies will create their books and pay taxes. A certain types of companies fitting in the turnover structure, will also have to get their books audited. Hence roles like internal auditor and external auditor, both are the most common roles after CA.

- Advisory: Well everything else, which does not fit, or can be considered an extension of the places where a chartered accountant can apply, would fall under this section. Including investment banking, corporate finance, tax consultant, GST advisory etc

This is a no brainer, that career path to accounting in India, there is a clear winner

You guessed it right!

Takes about 5 years to complete, with the article ship and all the failed attempts combined.The Indian recruitment market, still considers CA, as a very prestigious qualification to have. I couldn’t agree more, mainly due to the rigorous exams and article ship which comes with it.

Wealth Management Careers-What to do after b.com option 4

Wealth Mangement is a bigger industry, growing at a great pace, especially in India. The wealth management industry is growing at about 20% YOY, with value of 486.8 Billion dollars.

The need is very simple

- The ultra rich

- The retirees

- All of the rest

All need planning, all are moving from traditional assets to equity, fixed income and alternative investments. Who is their advisor?

Read this article published by financial express on the growth: India’s wealth

Who Should Consider this Career Path

- Interest- Business, Numbers

- Ability: Maths

Recommended Qualification & Skills

- CFA ( I don’t advise CFP, mainly due to it being already covered in CFA)- 70% of the CFA Charterholders are in wealth management

- Skills: Learn Financial Modeling

Education-What to do after b.com option 5

Often thought to be a very laid back and unexciting, Education industry now has become the India’s and worlds favourate. Reasons are very simple

- Government of India pushing Gross enrolment ratio-( Basically trying to get more students to take graduation after HSC)

- Focus on improving school education

- Influx of private players- Likes of Byju’s, Akash and the entire outburst of companies in this space.

Who should Consider it as a career path

- Interest: Technology( You might be surprised I say technology but you will get it why, just give me some time)

- Ability: Creative ( Oh yes)

Recommended Qualification:

- Traditional Approach: Complete your masters in any field, Apply for B.ED or PHD, depending on whether you want to get into schools or colleges respectively

- Non Traditional: Work in the field listed above of your choice for at least 3-4 Years, then get into private education space or colleges . There are more chance for you to succeed this way, with good compensation and opportunities.

Data Science-What to do after b.com option 6

Data science is one of the most talked about fields, but it needs to be looked at more carefully. Sometimes things look more simple than they actually are.

Who is for?

- Interest: Numbers, Tech and Business

- Ability: Maths, Creative

As you can see, data science is not a tech role but actually a business role, using data science and techniques to aid business for profits.

Recommended Career Pathway:

- Build Core Domain : This should be your choice of domain and get expereince here. For eg Investment banking, Financial planning, marketing, etc

- Train for Tech: Learn programming skills like python, java- Consider this like your hobby. Its not about which language you learn, but you keep learning

- Data Science Short Courses: I like youtube videos more, since most of it is already free.

- GIT hub projects: Practice GIT Hub projects, get a mentor to work with on linked in

- Apply for data science Jobs.

You can see I did not give any qualification recommendation, because in reality there is none.

Risk Management

Risk Management needs to be looked at holistically and not from a popular belief that its a finance only function. RM in finance specifically took off as a role, after the 2008 market fall, having said that risk management is not just limited to banks. Let me list out some of the areas of risk management application:

- Credit Risk: This would fall under banks, the possibility of the other party not honouring the payments

- Market Risk: The skill to manage market events, which can put the business out of the market

- Operational Risk: People, their skills and all the factors affecting daily operations of the business

- Liquidity Risk: Managing financial resources, to make sure that company has enough liquidity to sail through rough times

Who is it For?

- Interest: Numbers and Business

- Ability: Maths, Memory

Recommended Career Path:

- Get a formal education in finance: CFA/ MBA Finance ( Tier I)/ CIMA/ CA with experience of 2 years

- Get a specialised qualification: FRM- GAARP

- Hone your skills- Financial Modelling

LAW

Career in law can be very interesting and specialised, with so many people and business. Conflicts, suits and settlements is a daily problem, and hence a fantastic career opportunity, If you fall under the below category

- Interest: Regulation and law

- Ability: Memory and Creative

There are basically many areas of practicing law

- With a Law Firm: crime, corporate, insurance, mediator etc

- With Business: As a legal counsel

- Personal Practice: Marriage, Crime, Corporate and everything under the son where people have issues

Recommended Pathway

- Get a graduation degree of your choice: Commerce, Arts. Doesn’t MATTER. As you might have noticed, I didn’t recommend LLB 5 Years, because you need domain again

- Pursue: 3 Year LLB After graduation , while you work or are self employed

- Get Internship with an advocate or a firm

- Give the BAR exam

- Apply for full time or private practice

I am skipping government opportunities, because I think that’s a personal choice. There are ample opportunities in Government sector, so the pathway doesn’t change still.

Qualifications to pursue after B.com

| Designation | Focus | Duration | Recognition | Ideal For |

|---|---|---|---|---|

| CFA | Investments & Finance | 2.5–4 yrs | Global | Portfolio Mgmt, Equity Research |

| CPA | Accounting & Audit | 1–2 yrs | US + Intl Firms | Public Accounting, Tax, Audit |

| ACCA | Global Accounting | 3–4 yrs | Worldwide | Multinational Firms, Audit, Finance |

| CA | Accounting & Tax | 3–5 yrs | Country-specific | Audit, Tax, Corporate Finance |

Conclusion

That’s a long read but hopefully it answers, “What to do after B.com?”

Last words. I think career choices needs to be made with a lot of thinking and exploring. Parents, teachers and colleagues need to support the candidate in this process, instead of pressurising to take up something which is just trendy.

You will spend 89 K Hrs at work from 1.39 Lac Hs, you can’t choose a career based on what is trendy, thats for sure.

FAQ

Is there a demand for commerce students in India?

Yes, there very much demand of commerce students in the market. There is good level of market growth. Also global opportunities.

Which qualification should i go for after B.com?

Depending on your goals, if you want to have a global opportunity in your career go for CFA. If accounting is something you love and want to pursue for life go for CPA. CA works too if you want to work in India.

Which sector hires B.com students?

IT sector, Firms, Consultancy hires B.com students. You will mostly get hired as a accountant as a fresher then after skills are gained also experience then you can switch.