Last updated on January 29th, 2025 at 10:15 am

So, you are getting ready for the final round of technical interview in an investment banking firm, and you don’t know what to expect? In this article I will try my best to cover all the important capital market interview questions with high probability of being asked.

Capital Market Interview Questions

Now, I will try divide these capital market interview questions into multiple sections so that you can test your self accordingly for different kinds of topics .

- Basic Capital Market Interview Questions

- Advance Questions

Basic Capital Market Interview Questions

First of all think of these basic capital market questions, like warm up questions. Something like, testing you whether it’s worth the interviewers time or not. While, the questions I am about to list might give you an impression that these are too easy. However, a word of caution for you, seventy percent will get rejected right here itself.

What do you understand by Capital Market?

Now, let me guess! You think its easy? Take a moment to frame your answer.

Now, I will frame the correct type on answer that would ensure success. So, here it goes! Capital market is a broad term is a market which includes you as an investor, the regulators like SEBI, Exchanges like NSE. Also, at the same time includes asset managers like mutual funds. While the underlying asset includes bonds, equities and instruments like derivatives.

What is a mutual fund?

Another easy Capital Market Interview Questions, Yet difficult.

The answer if done correctly should sound like this! A mutual fund is a pooled investment vehicle, structured as a trust with the asset management company providing it the fund management service. But in exchange for a asset management fee, usually one percent in case of equities.

What is a derivative?

Another place, where you might just answer very casually. So the answer to this Capital Market Interview Questions like this!

A derivative, is a hedging instrument deriving its price from an underlying like an index(NIFTY50), currency(USD/INR), or commodities like gold and silver.However, derivative instruments vary depending on the need. For example;

- Firstly, in case of customised contracts they are called as forwards

- Secondly, in case of standardised contracts you have futures traded in exchanges

- Thirdly, if you just want pay offs, its called as options

Also, there exists creative derivative instruments like CDO’s, MBS etc.

What is an Index?

So, make sure not to just run away in your Capital Market Interview Question answers with this one.

An, Index is the consolidated or collective representation of the performance of multiple stocks. Which is categorised according to either;

- Firstly, similar sectors

- Secondly, similar size or liquidity

- Thirdly, a specific region or country.

- Finally, a theme

Now, generally index is calculated using the following methods

- Price weighted

- Float adjusted market cap weighted

- Equal price weighted

What do you understand by a Bond?

So, I know a lot of you have never exposed yourself to fixed income, as much as equity. While, it is more easy than it looks.

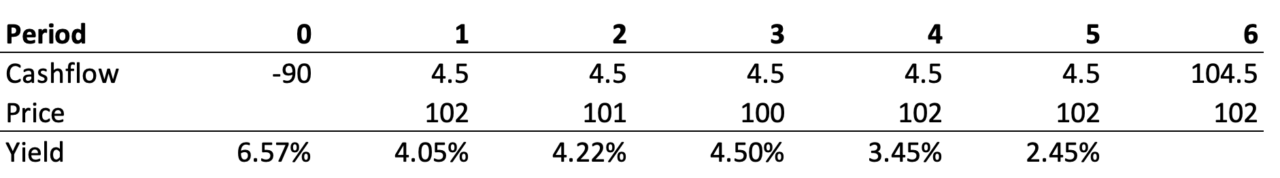

So, a fixed income security is a contract similar to a loan that you take. While, the only difference is that instead of you borrowing, it can be either a government or a corporation. For example; you can see below that the bond is of $100 and in return you as an investor earn $4.5 Periodically for 6 years. At the same time, you purchase the bond at a price lower than 100. Which means technically put, you are buying the bond at a discount.

Now, extending this discussion further, there are various types of bonds depending on how you get paid.

- Firstly, if you get paid just like above then it is a plain vanilla structure.

- Secondly, what if you get paid all the interest of 4.5 on year 6 itself and no payments in between. Then its called a bullet payment structure.

- Thirdly, if there is no coupon in between and the only appreciation you get is from -90 to 100. Well then its called a zero coupon bond.

And, that’s more than enough for the Capital Market Interview Questions to answer in the interview.

Trade Life Cyle RelatedQuestions

So,are you warmed up enough? And if you have answered or you somehow knew the Capital Market Interview Questions reasonably well, then you are ready for the next leg of advance capital market interview questions.

What is trade life cycle?

So, this question will never be the deciding factor for your interview. While, the reason is that this a process related question. So a basic brief answer is good enough here.

Now, trade life cycle is basically the entire journey from the point of initiation of the trade at the front office level. From there it moves to middle office for trade confirmation. Following on, once you confirm the trade, then it flows to trade matching and reconciliation.

If during a trade, the customer wants to borrow a stock? How would the broker approach it?

Now, this is a trick question. Even though you have never worked in IB operations but logic is necessary. So, I am talking about borrowing a security, so that means that stock and bonds can be borrowed. Yes! But from whom?

- Either, the broker himself can lend the security from his own inventory

- Secondly, from other customers of the broker.

- Finally, from the custodian who in fact holds securities of all.

What do you understand by SWIFT?

So, very low chance of this question being asked, but just remember all it means is an identification number. Every bank account globally gets identified using a bank and customer code.

What is an asset and type of assets?

An asset is anything owned by a person or company that has economic value and provides future benefits.

Types of Assets:

1. Based on Convertibility:

• Current Assets: Cash, Inventory (convertible within a year).

• Non-Current Assets: Buildings, Machinery (long-term use).

2. Based on Physical Existence:

• Tangible Assets: Physical (Land, Equipment).

• Intangible Assets: Non-physical (Patents, Trademarks).

3. Based on Usage:

• Operating Assets: Used in daily business (Cash, Accounts Receivable).

• Non-Operating Assets: Not essential for operations but generate income (Investments).

4. Based on Ownership:

• Personal Assets: Owned by individuals (House, Jewelry).

• Business Assets: Owned by companies (Factories, Office Equipment).

What do you understand by ex dividend date?

Now, that’s not a very difficult question but mostly a lot of candidates are not aware of its practically meaning. So, to understand ex dividend date, you also need to understand cut off date. A cut off date is the date before which you need to invested in the stock in order to be eligible for getting dividends. While ex dividend is that date on which dividend gets paid, and the stock stars trading without the dividend.

State the Different Types of Corporate Actions?

Types of Corporate Actions (Summary for Interviews):

1. Mandatory Corporate Actions – Occur automatically, no shareholder choice.

• Examples: Dividends, Stock Splits, Bonus Shares, Mergers & Acquisitions, Delisting.

2. Mandatory with Choice – Executed automatically but shareholders have options.

• Examples: Cash or Stock Dividends, Election-Based Mergers, Dividend Reinvestment Plans (DRIPs).

3. Voluntary Corporate Actions – Require shareholder participation.

• Examples: Buybacks, Tender Offers, Rights Issues, Exchange Offers.

What is AML & KYC?

Again, not a fate deciding question but you must understand the basics. So, with the growth of digital transactions, including cryptocurrencies knowing and mapping customers has become very very important. Hence, Anti Money laundering and know your customer process getting strictly followed.

How to Prepare for a Capital Market Interview: Overall Tips

Here’s an enriched section for the article “Capital Market Interview Questions” using the provided semantic words to boost SEO relevance and user engagement:

Preparing for a capital market interview requires a strong understanding of core financial concepts, industry practices, and the ability to analyze various financial instruments. Here’s a comprehensive guide to help you ace your interview:

1. Understand the Basics of Capital Markets

Capital markets play a vital role in the economy as they are where securities are bought and sold in both the primary and secondary markets. These markets allow companies to raise capital and investors to make investment decisions. Knowing the difference between equity and debt instruments is essential, as well as understanding how companies borrow money to fund operations or expansion.

2. Master Financial Analysis

Interviewers often test your knowledge of analyzing financial statements, particularly balance sheets and cash flow statements. You should know how to evaluate working capital, calculate the weighted average cost of capital (WACC), and assess a company’s cost of debt to determine its financial health and ability to fund long-term growth.

3. Forecast Future Cash Flows

One of the key skills in capital markets is the ability to forecast future cash flows. This requires an understanding of interest rates, economic growth, and industry trends. Be prepared to explain how these factors impact company valuations, investment returns, and risk management strategies.

4. Showcase Your Knowledge of Mergers and Acquisitions

In capital markets, mergers and acquisitions (M&A) are common strategies companies use to achieve growth or gain a competitive edge. Familiarize yourself with how M&A activities impact financial statements, affect shareholder value, and influence decisions in the secondary market.

5. Be Ready to Discuss Investment Strategies

Capital markets interviews often involve questions about investment decisions and strategies. You may be asked about scenarios involving whether to buy and sell particular securities, how companies use the capital markets to raise capital, and how external factors like regulatory policies or global market trends influence these decisions.

6. Highlight Your Understanding of Key Metrics

Demonstrate your knowledge of important metrics such as the cost of debt, working capital, and WACC, as these are critical for evaluating a company’s ability to operate efficiently and fund long-term projects. Ensure you can explain these concepts in relation to financial statements and cash flow management.

Tips for Success

• Stay Updated: Keep yourself informed about current trends in capital markets, including movements in interest rates, shifts in economic growth, and major mergers and acquisitions in the industry.

• Practice Case Studies: Be prepared to analyze real-world scenarios, such as assessing a company’s ability to raise capital or evaluating the feasibility of an M&A deal.

• Demonstrate Practical Knowledge: Show that you understand how securities are traded in the secondary market and how investment banks assist companies in accessing capital markets.

By focusing on these areas and demonstrating your expertise in analyzing and interpreting financial statements, you can position yourself as a strong candidate for a capital market role.

This enriched section is designed to provide actionable insights while seamlessly incorporating the target semantic words, boosting the SEO value of your article. Let me know if you’d like further adjustments!

Conclusion

So, I hope you found these Capital Market Interview Questions useful for your preparation. Remember interviews are lost due to basic questions and never advance questions. If you need any more assistance with your investment banking preparation then feel free to reach us out.

Related