Last updated on December 21st, 2022 at 04:00 pm

What is the Average Collection Period?

The average collection period is the amount of time passed before a company collects its accounts receivable. It refers to the time taken on average for the company to receive payments it is owed from clients or customers. The company ensures to monitor the average collection period so that they have enough cash available to take care of their financial responsibilities. In simple terms, the average collection period is a calculation of the average number of days between the date a sale is made and the date the buyer submits the payment or the date that the company receives the payment from the buyer. The average collection period is important as it helps the company handle their expenses more efficiently. The annual collection period is calculated by dividing a company’s yearly accounts balance by its yearly total sales. This figure is then multiplied by 365(no. of days) to generate a number of days.

Importance of the Average Collection Period

- Maintain liquidity:

Maintaining the liquidity of the company is a crucial task. It is important that the company receives payment for the goods and services offered in a timely manner. This allows the company to maintain a level of liquidity. This allows the company to pay for immediate expenses and to get a general idea of when it may be capable of making large expenses.

- Planning for potential expenditures and future expenditures:

Average collection period future is important to help a company prepare an effective plan for covering costs and scheduling potential future expenditures. As it is very obvious, the lower the average collection period, the better it is for the company. This means that the client will take less time to pay their bills. In this way, the company collects their payments in a faster way. However, this fast collection method may not always prove to be beneficial for the company. This can lead to some customers choosing other companies with the same goods and services that have more lenient payment rules or better payment options.

The average collection period is calculated in days. The company must include in days. The company must also calculate its average balance of accounts receivable for the year and divide it by total net sales for the year. The formula is:

Average Collection Period Formula

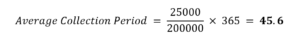

Let’s take an example. Company ABC recorded a yearly accounts receivable balance of $25,000. In the same year, the company logged $200,000 in total net sales.

Solution:

The first step to determining the company’s average collection period is to divide $25,000 by $200,000. The quotient, then, must be multiplied by 365 because the calculation is to determine the average collection period for the year. For our example, the average collection period calculation looks like the one below:

This means that the company’s average collection period for the year is about 46 days.