Well, most of the articles or opinions are always a refined combination of the same opinion. But if you want to really explore if ACCA after CA, will make any sense? Then Read along! At the end of this article you should be either convinced to do ACCA. Or Park it on back seat, while moving forward.

So let’s get started.

Why Does ACCA exist?

Doesn’t it bother you to think, that whether ACCA should really be there? Why do I say that?

- ACCA qualification originates from UK right? but yet just like India there is the standard accounting qualification which is called as ACA.

- However if you look at the ACA qualifcation, it hasn’t really evolved into global coverage. Thats where ACCA came in as a qualification which fulfills the gap.

Difference Between CA & ACCA

So it’s important to understand the key differences between CA( ICAIhttps://www.icai.org/) Program and ACCA( UK) which is a UK based global qualification.

- CA is a Indian Accounting regulation specific enacted by law, whereas ACCA is not related to Indian accounting regulations.

- CA focusses more on compliance based content faced by Indian business’s. However ACCA handles more global accounting based challenges.

- ACCA gives you more exposure towards application based accounting content. CA is more exam oriented program based on merit majorly.

- ACCA doesn’t have signing authority in India but globally many countries now allow ACCA to get a practice certificate.

Key Benefits of Pursuing ACCA after CA

Now based on the various interviews an interaction with CA candidates who also are ACCA members. These are the primary benefits of pursuing ACC after CA.

Overall Career Progression Benefits

- You get recognition especially working with global clients.

- Jobs quality with global MNC’s improve significantly.

- CV gets highlighted because of a global qualification

- Communication skills improve because, of case study based format of the exam.

- More application based exposure in accounting

Updated Content & Global Trends

As a CA(ICAI), you would have no exposure towards global trends in accounting. For example;

- Impact of cryto currency in accounting and regulation

- Relating economic trends on accounting

- Sustainbility Standards and impact on valuation

- Topics like AI & Block chain in ACCA

All of these content and exposure helps you becoming more a globally trained accounting professionals.

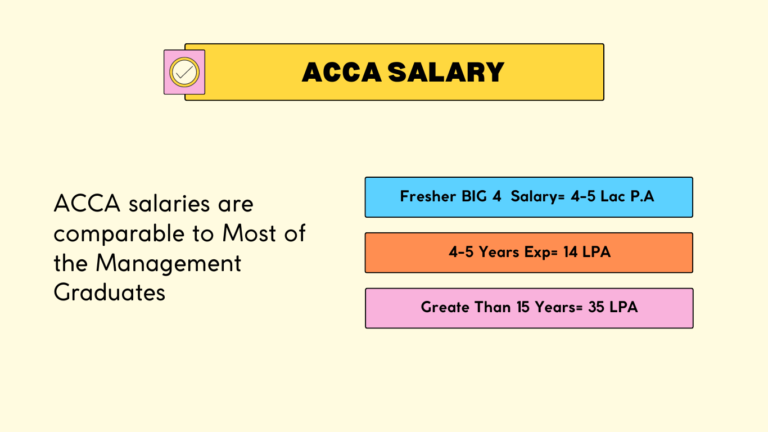

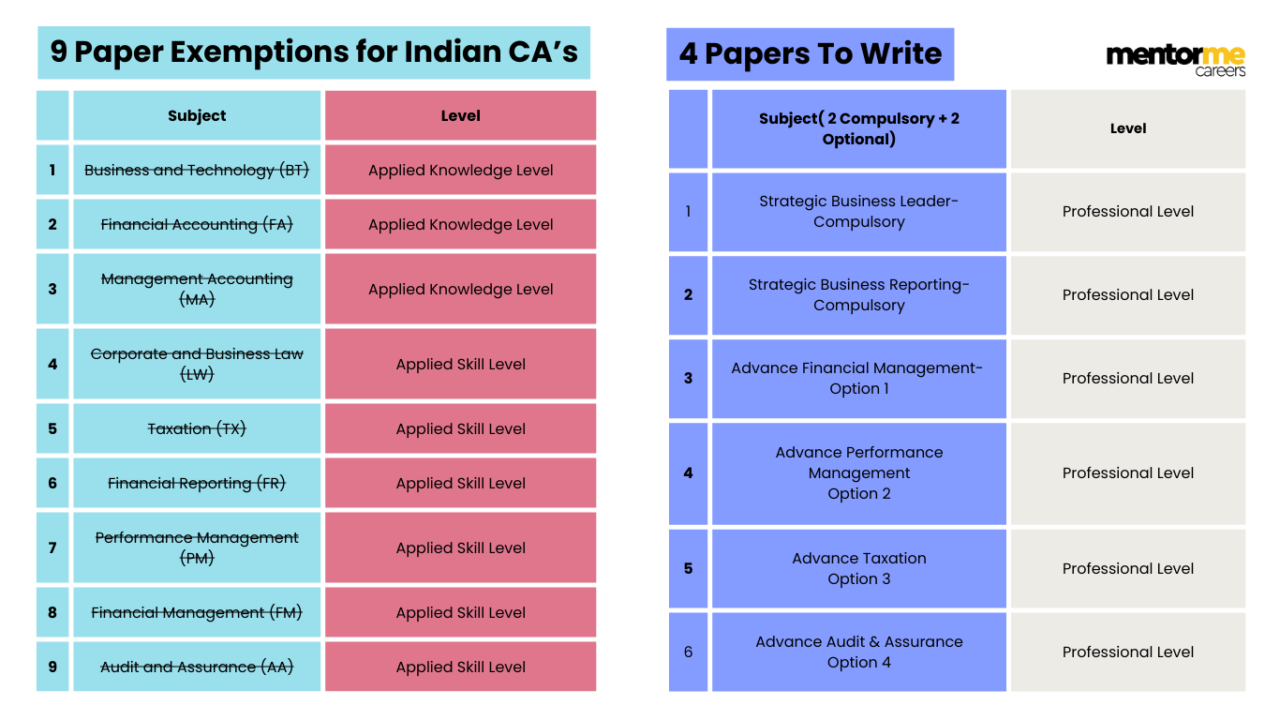

ACCA Exemptions for CAs

IPCC + B.Com

- 6 papers exemptions

- BT, FA, MA, LW, TX, and AA

ICAI Members (Completed Post-2003)

- 9 papers exemptions

- BT, FA, MA, TX, PM, FM, LW, FR, and AA

- Membership mandatory

IPCC Passed (Both Groups)

- 5 papers exemptions

- BT, FA, MA, TX, and AA

- Paper-to-paper exemptions based on CA Final exam:

- FR, LW, PM, and FM

So officially there is no mutual recognition by Institute of Chartered accountants( India) of the ACCA qualification. However, the Institute of cost accountants does recognise ACCA as a valid global accounting qualifications.

CA Completed Course (From 1st January 2023)

Below is the authenticated and verified complete exemption list for ICAI students of India. Total of 9 paper exemptions. Which means in a nut shell, an Indian CA completed professional needs to write only the professional level.

Just a side note, all the chartered accountants who have graduated before 2023 will have to check their marksheets evaluated by ACCA for exact exemptions. Since exemptions depend on the previous qualifications

ACCA exemptions for CA Inter-mediate

Now let me discuss the exemptions offering for CA inter mediate students. However let me first list out the the exact category of inter mediate students who can claim this

IPCC Passed Both Groups Exemptions in ACCA

All the CA candiates who have successfully completed IPCC both groups are elgible for exemptions of 5 Papers. Morever, paper to paper exemptions are availble based on subjects in CA final.

- IPCC+ B.com Exemptions in ACCA

If you have completed Bcom and IPCC then you are eligible for 6 paper exemptions(BT,FA,MA,LW,TX & AA)

How to Claim an Exemption

Below I have summarized on the process of claiming an exemption with ACCA On the ACCA website.

Prepare Documents:

• Proof of studies (qualification details, transcripts, marks, and results).

• Proof of identity (e.g., driver’s licence, passport, or birth certificate).

Ensure Documents Are Complete:

• Include qualification name, awarding body’s stamp/logo, and completion date.

• Provide award certificates or official letters confirming completion.

Apply During Registration:

• Calculate your exemptions and register online.

• Upload all required documents, including proof of identity.

Handle Name Changes (If Applicable):

• Submit an official document for any name changes after qualification.

Exemption Fee Cost Summary for ICAI Candidates

CA Completed

Exemptions: 3 Knowledge Level, 6 Applied Skills Level

Knowledge Level (3 Papers): 3 × 84 GBP = 252 GBP

Applied Skills Level (6 Papers): 6 × 101 GBP = 606 GBP

IPCC Both Groups

Exemptions: 3 Knowledge Level, 2 Applied Skills Level

Knowledge Level (3 Papers): 3 × 84 GBP = 252 GBP

Applied Skills Level (2 Papers): 2 × 101 GBP = 202 GBP

IPCC + B.Com

Exemptions: 3 Knowledge Level, 3 Applied Skills Level

Knowledge Level (3 Papers): 3 × 84 GBP = 252 GBP

Applied Skills Level (3 Papers): 3 × 101 GBP = 303 GBP

Preparation Tips for CA-Completed Students for ACCA Papers

Focus on Application Over Theory:

• Unlike CA exams, ACCA P-level papers emphasize applying concepts rather than rote learning. Understand scenarios and tailor your responses accordingly.

Start Practicing Past Papers Early:

• Allocate at least 3–4 weeks for solving past exam papers under timed conditions.

• Use the Computer-Based Exam (CBE) practice platform to familiarize yourself with the digital format.

Review Weak Areas:

• Identify challenging topics during practice and revisit them with a focus on understanding practical applications.

Effective Time Management:

• Cover theoretical concepts within 2–3 weeks and dedicate the remaining time to question practice and mock exams.

Leverage Revision Kits:

• Use ACCA-approved materials like BPP and Kaplan revision kits for structured practice and topic-wise questions.

Mock Exams Are Crucial:

• Simulate exam conditions with full-length mock exams to enhance time management and build confidence.

Consistency is Key:

• Break down your study sessions into manageable tasks and maintain a regular schedule to avoid last-minute cramming.

By following these strategies, CA-completed students can leverage, their existing knowledge and align their preparation with ACCA’s exam expectations.

•How ACCA integrates work experience with certification.

•Leveraging your CA articleship as part of ACCA’s requirements.

Costs of Pursuing ACCA After CA

Let me break down the cost of pursuing ACCA into three broad areas

- Registration:

- Exemption Fees

- Exam Fees

- Coaching Fees

- CA.

ACCA Cost Calculator

For CA, IPCC Both Groups, and IPCC + B.Com Candidates

Conclusion

So basically if I have to summarize the benefits of doing ACCA after CA, then the major benefit is the adding a global dimension. In the long term especially working with global clients, it will be much easier to establish better credibility. I would highly encourage to join our weekly sessions where you can interact with industry trainers with similar background and understand the benefits.

FAQs About ACCA After CA

There are two scenarios, the first is that you have completed the entire CA program and now you plan to either work for global clients or get global clients. Or even more extreme move out of India to other countries to work, then ACCA definately is recommended. However, the second scenario is that you are stuck at some level of CA, and you don’t plan to really have a local practice in India. Then pursuing ACCA might be a good alternative risk management strategy.

To a certain extent, the answer is yes. Because the exemptions are not a complete over lap of subjects and content. So its a good idea to still revise content of skill level subjects which probably you have less depth in CA.

In a single answer, it is consistency. If you are consistent through from the start and don’t be over confident then clearing it should be a breeze.