Last updated on January 19th, 2026 at 11:14 am

The equity research analyst salary in India (2026) generally starts at ₹4–7 LPA for freshers, depending on the firm type and location. Entry-level roles at boutique brokerages or research KPOs tend to be at the lower end, while global banks and large domestic brokerages pay closer to the upper range. As analysts gain experience and build sector expertise, salaries rise steadily, mid-level analysts (3–6 years) often earn ₹10–18 LPA, and senior or lead analysts at top firms can cross ₹25–40 LPA+, including bonuses.

Salary growth in equity research depends more on skill depth and performance than tenure alone. Analysts who master financial modeling, valuation, and industry coverage progress faster and earn more. Higher pay is common in finance hubs like Mumbai and Bengaluru, and in roles serving institutional clients or the buy-side. Other factors that influence pay include accuracy of research calls, client impact, certifications (CFA, MBA), firm type (sell-side vs buy-side), and bonus structures tied to performance.

From city-wise salary differences to sector-specific pay and long-term career growth including buy-side moves into hedge funds, asset management, and private equity this is your complete roadmap to understanding the real earning potential in equity research today.

Equity research analyst salary in India

On average, an equity research analyst salary can expect ₹6–10 LPA, but growth to ₹15–20 LPA+ in 4–6 years is common for those who perform well. Experienced analysts at leading firms can cross ₹25–30 LPA+ (base + bonus), especially if they handle lead-research reports or sector coverage, with increasing financial market activity and demand for equity research across mutual funds, broking houses, and institutional investors, equity research remains a strong career path with steady salary growth.

| Experience / Role Level | Typical Salary Range (Annual, INR) | Notes |

| Entry / Junior Analyst (0–1 yr) | ₹4 L – ₹6 L | Often from smaller brokerages, boutique firms or as interns. |

| Early-Career (1–3 yrs) | ₹6 L – ₹10 L | Much variation depending on location, firm size, and skillset. |

| Mid-Level Analyst (3–5 yrs) | ₹10 L – ₹16 L | Includes base salary + performance bonus; skill in financial modelling/valuation raises pay. |

| Senior Analyst / Associate (5–8 yrs) | ₹14 L – ₹22 L | Seniority, research report quality & industry coverage drive higher pay. |

| Top Equity Research Analyst / Lead (8+ yrs) | ₹20 L – ₹30 L+ (top 90th percentile: ₹25–30 L or more) | Senior roles in major brokerages or buy-side funds, includes bonuses, perhaps profit sharing. |

Equity research analyst salary by experience level

In India, equity research salary in 2025 begin at approximately ₹4–6 LPA for entry-level positions, increase to between ₹10–25 LPA for senior and VP roles, and can surpass ₹1.5 Cr (total compensation) at the MD or buy-side leader level. The main drivers for significant pay increases are bonuses and profit-sharing (variable compensation), meaning that possessing strong technical skills (such as modeling and valuation), having solid coverage, and generating revenue are effective pathways to higher earnings.

| Level | Typical Base (₹/yr) | Typical Bonus Range (% of base) | Median Total Comp (₹/yr) | 25th / 75th Percentile Total (₹/yr) |

| Entry / Junior Analyst (0–1 yr) | ₹4LPA – ₹6LPA | 0% – 20% | ₹5.5LPA | ₹4.4Lakh / ₹6.6Lakh |

| Associate (1–3 yrs) | ₹6LPA – ₹10LPA | 5% – 35% | ₹9.6LPA | ₹7.2 Lakh / ₹12 Lakh |

| Senior Associate (3–5 yrs) | ₹10LPA – ₹16LPA | 15% – 50% | ₹16.9LPA | ₹12.5Lakh / ₹20.8Lakh |

| VP / Principal (5–8 yrs) | ₹14LPA – ₹25LPA | 30% – 100% | ₹31.2LPA | ₹22Lakh / ₹40Lakh |

| Director / Head of Research (8–12 yrs) | ₹25LPA – ₹45LPA | 50% – 150% | ₹70.LPA | ₹50 Lakh / ₹1.2 Cr |

| MD / Senior Fund/Buy-Side Lead (12+ yrs) | ₹40LPA – ₹80LPA | 80% – 300% | ₹1.5Cr | ₹1 Cr / ₹2.5 Cr |

Equity research analyst salary by city & sector (India)

Equity research salaries in India (2025) vary widely: entry roles typically ₹3–6 LPA, mid-level ₹9–16 LPA, and senior/lead roles ₹20–40 LPA+ with top MDs far higher. Location (Mumbai/Bengaluru), firm type (buy-side vs sell-side), and performance bonuses drive the biggest differences. Goldman Sachs typically pays above sell-side averages, with significant bonus upside for strong performers.

City / Sector | Entry (0–2 yrs) | Mid (2–5 yrs) | Senior (5+ yrs) | Typical Employers |

| Mumbai- Broking / Sell-side | ₹5–8L | ₹8–15L | ₹15–30L+ | Large brokerages, bulge-bracket research houses |

| Mumbai- Buy-side / AM / PMS | ₹6–10L | ₹12–25L | ₹25–50L+ | Mutual funds, AMCs, PMS firms |

| Bengaluru- Tech / TMT coverage | ₹5–8L | ₹9–16L | ₹15–30L | Research boutiques, tech-focused funds |

| Delhi NCR- Generalist / Mid-caps | ₹4–7L | ₹7–12L | ₹12–22L | Regional brokerages, small funds |

| Hyderabad / Pune | ₹4–6L | ₹7–12L | ₹12–20L | Mid-sized brokers, corporate research |

| Smaller cities / regional | ₹3.5–5.5L | ₹6–9L | ₹8–14L | Local brokerages, research service firms |

| Sectors that pay premium | — | — | — | Buy-side / Hedge funds > Investment banks > Large broking houses > Boutiques > Retail research |

| High-pay sectors (specialties) | Quant/Prop trading | Quant/prop & algo: ₹12–30L+ | Senior quant leads: ₹30–100L+ | Proprietary trading firms, quant funds |

Equity research analyst salary provided by top companies in India

Lets discover options in India, the salary provided so you will have a clear idea what to expect from the companies and next step would be to look after what exactly the companies expect from you!

| Company | Typical Base Range (INR/yr) | Typical Bonus / Variable | Typical Total (median range) |

| Goldman Sachs | ₹3.5L – ₹12L | 0–50% (varies by level) | ₹4L – ₹18L (median ₹7L) |

| J.P. Morgan | ₹4L – ₹13L | 5–60% | ₹5L – ₹18L (median ₹7.4L) |

| Morgan Stanley | ₹4L – ₹8L (entry) → higher at senior levels | 10–60%+ | ₹5L – ₹20L (depending on level) |

| Citi | ₹4L – ₹13L | 5–50% | ₹5L – ₹16L (median ₹7.2L) |

| ICICI Securities | ₹4L – ₹13L | 5–40% | ₹5L – ₹16L (median ₹7.4L) |

| Motilal Oswal | ₹4L – ₹18L (wide spread by seniority) | 10–60% (performance linked) | ₹5L – ₹20L+ |

| Edelweiss | ₹4L – ₹13L | 5–50% | ₹5L – ₹16L |

| Nomura | ₹4L – ₹15L (varies) | 5–50% | ₹5L – ₹18L |

| Axis / Axis Capital | ₹4L – ₹20L (role dependent) | 10–80% | ₹6L – ₹25L |

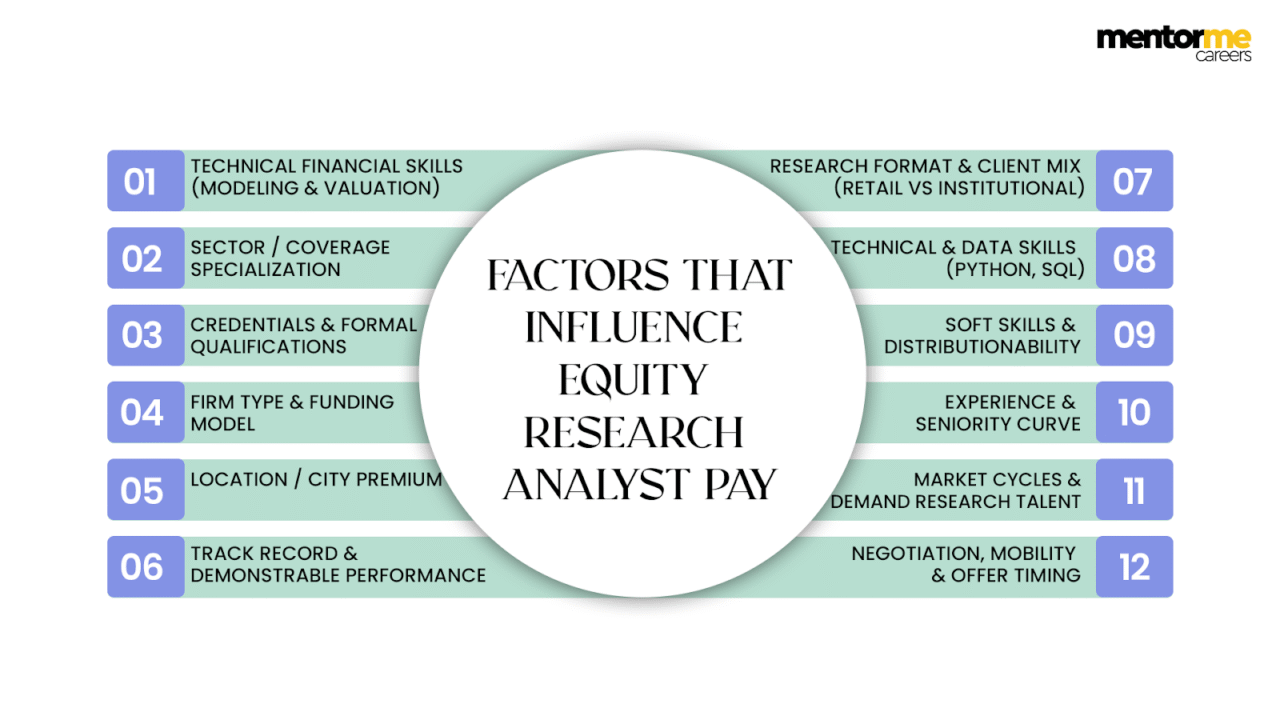

Factors that influence Equity research analyst pay

1. Technical financial skills (modeling & valuation)

Mastery of DCF, LBO, comps, financial modelling, forecasting and Excel/VBA directly increases market value, firms pay a premium for analysts who can build robust models and produce actionable valuations.

2. Sector / Coverage specialization

Coverage matters: niche sectors (pharma, tech, infra, NBFCs) or high-growth themes often pay more because domain expertise drives tradeable investment calls and client demand. Deep sector knowledge = higher billable value.

3. Credentials & formal qualifications (CFA, MBA, CA)

Certifications like the CFA and top-tier MBA remain strong signals of technical credibility and improve pay prospects, especially for buy-side or senior roles. Recruiters frequently shortlist charterholders for mid/senior roles.

4. Firm type & funding model (sell-side vs buy-side vs boutique)

Buy-side funds, HF/asset managers and large bulge-bracket firms generally offer higher base + bonus packages than small brokerages or regional boutiques. Compensation at global banks may also include stock/RSUs.

Financial hubs (Mumbai, Bengaluru) pay noticeably more due to concentration of HQs, AMCs and brokerages, city premium influences base and bonus potential.

6. Track record & demonstrable performance

Past accuracy of calls, quality of reports, and tangible revenue/asset flows driven by your research directly influence bonuses and promotion speed. Performance metrics are often decisive for large bonus pools.

7. Research format & client mix (retail vs institutional)

Analysts covering institutional accounts, large buy-side clients or producing sell-side flagship research garner higher compensation than those focused on small retail reports.

8. Technical & data skills (Python, SQL, alternative data)

Ability to use Python/R, query large datasets, build alpha signals or work with alternative data (web scraping, satellite, sentiment) is increasingly rewarded, especially for quant-oriented research roles.

9. Soft skills & distribution ability

Communication, institutional sales support, investor presentations and media visibility help monetize research, the better you can distribute and defend ideas, the higher your pay upside.

10. Experience & seniority curve

As usual: junior → associate → senior → lead → head. Each promotion step typically brings significant base and bonus uplift, 4–7 years of strong performance often moves analysts into high-pay bands.

11. Market cycles & demand for research talent

Bull markets, IPO waves, and rising AUM increase demand (and pay) for quality analysts; downturns compress bonus pools and hiring. The macro environment affects short-term compensation swings.

12. Negotiation, mobility & offer timing

Smart job moves (timed after a strong result) and negotiation of bonus structure, sign-on and RSU components can materially affect total comp.

Equity research analyst career ladder

Entry / Junior Analyst (0–2 years)

Focus: modeling, data collection, writing notes.

Timeline: 12–24 months before first promotion.

Associate / Senior Analyst (2–4 years)

Focus: lead models, draft reports, client calls; begin coverage responsibility.

Timeline: promoted after consistent delivery & coverage ownership (usually 2–3 years).

Vice-President / Research Lead (4–7 years)

Focus: manage junior team, client relationships, larger reports, mentoring.

Timeline: 3–4 years in senior role before moving to VP-level responsibilities.

Director / Head of Research (7–12 years)

Focus: strategy, major client sales, overall research quality, deal origination.

Timeline: typically 7–10+ years from entry.

Managing Director / Partner (10+ years)

Focus: firm leadership, business development, large client mandates, P&L.

Timeline: 10–15 years to reach senior leadership in large firms.

Optimal window: 2–6 years (post-associate to early-VP) is the most common window for lateral moves into buy-side (asset managers, long/short funds) or PE/VC.

Why that window? Candidates then have strong modelling/valuation experience, sector expertise, and analyst track record (research notes, calls).

Comp delta: Moving to buy-side/PE typically yields higher base + larger performance compensation (20–100%+ uplift depending on fund size and role). PE/HF roles pay best but are most selective.

Equity Research analyst Salary forecast 2026-30

Baseline (Market) scenario: 9% annual growth (Aon outlook + normal market inflation)

Conservative scenario: 6% annual growth (soft market / slower hiring)

Optimistic scenario: 12% annual growth (strong hiring, buoyant markets, buy-side demand)

Projections show base pay only (excludes large bonuses, sign-on, or ESOPs). City premiums (Mumbai/Bengaluru) add 10–25% to the base shown below.

| Year | Conservative (6% CAGR) | Baseline (9% CAGR) | Optimistic (12% CAGR) |

| 2025 (baseline) | ₹5.5lakh (actual) | ₹5.5 lakh (actual) | ₹5.5 lakh (actual) |

| 2026 | ₹5.83 lakh | ₹5,99,500 lakh | ₹6.16 lakh |

| 2027 | ₹6,18,980 lakh | ₹6,53,455 lakh | ₹6,899,000 lakh |

| 2028 | ₹6,55,119 lakh | ₹7,12,266 lakh | ₹7,726,880 lakh |

| 2029 | ₹6,94,416 lakh | ₹7,76,370 lakh | ₹8,658,145 lakh |

| 2030 | ₹7,35,081 lakh | ₹8,45,744 lakh | ₹9,701,122 lakh |

Conclusion

What truly sets high earners apart is not just the firm they join, but their ability to build accurate models, produce actionable insights, develop sector depth, and add measurable value to clients and fund managers. With increasing demand across sell-side, buy-side, AMCs, PMS firms, and quant-driven strategies, the long-term outlook for equity research careers remains exceptionally strong.

Whether you’re a fresher exploring finance or a professional aiming for a switch, this guide has shown you the complete earning roadmap from base salaries to bonuses, city-wise pay, firm-level differences, and lifetime career progression.

If you want to accelerate your journey whether through resume support, interview prep, or personalised salary benchmarking feel free to explore our advanced resources and career coaching modules designed specifically for research analysts.

Want to break into equity research? Take a look at our financial modelling course which provides you placement opportunities

FAQ

Typical equity research analyst pay in India ranges ₹4–10 LPA for junior/early-career roles, ₹10–20 LPA for mid-level analysts, and ₹20–30 LPA+ for senior leads, total comp varies widely with bonuses and firm type.

At Goldman Sachs (India) compensation is above sell-side averages: entry-level total comp ≈ ₹4–8 LPA, mid-level ₹8–25 LPA, and senior/lead roles ₹20–80 LPA+ depending on bonus, stock/RSU and level.

Globally (US/UK/SG), top firms pay substantially more, entry US roles ~$60k–$120k, mid/senior roles $120k–$300k+ (base + bonus/stock), with buy-side/hedge funds often paying the most.

No, CFA is not mandatory, but it’s highly valued. A CFA charter improves technical credibility, hiring prospects and bonus potential, especially for buy-side roles.

Freshers typically start at ₹4–6 LPA (base), total first-year compensation including small bonuses may be ₹4–8 LPA, higher at boutique or buy-side internships→offers.