Last updated on January 14th, 2026 at 01:06 pm

Reconciliation may have different meanings in different contexts, but in accounting and finance, it refers to one core idea — ensuring that two sets of records agree with each other.In a world of high-volume transactions, multiple systems, and strict regulatory requirements, reconciliation becomes critical to confirm that trades, cash, and positions recorded internally match those reported by external parties such as custodians, brokers, and depositories.In this guide, we’ll break down what investment banking reconciliation means specifically in investment banking, how it works in practice, and why it plays such a crucial role in post-trade operations.

What is Investment Banking Reconciliation?

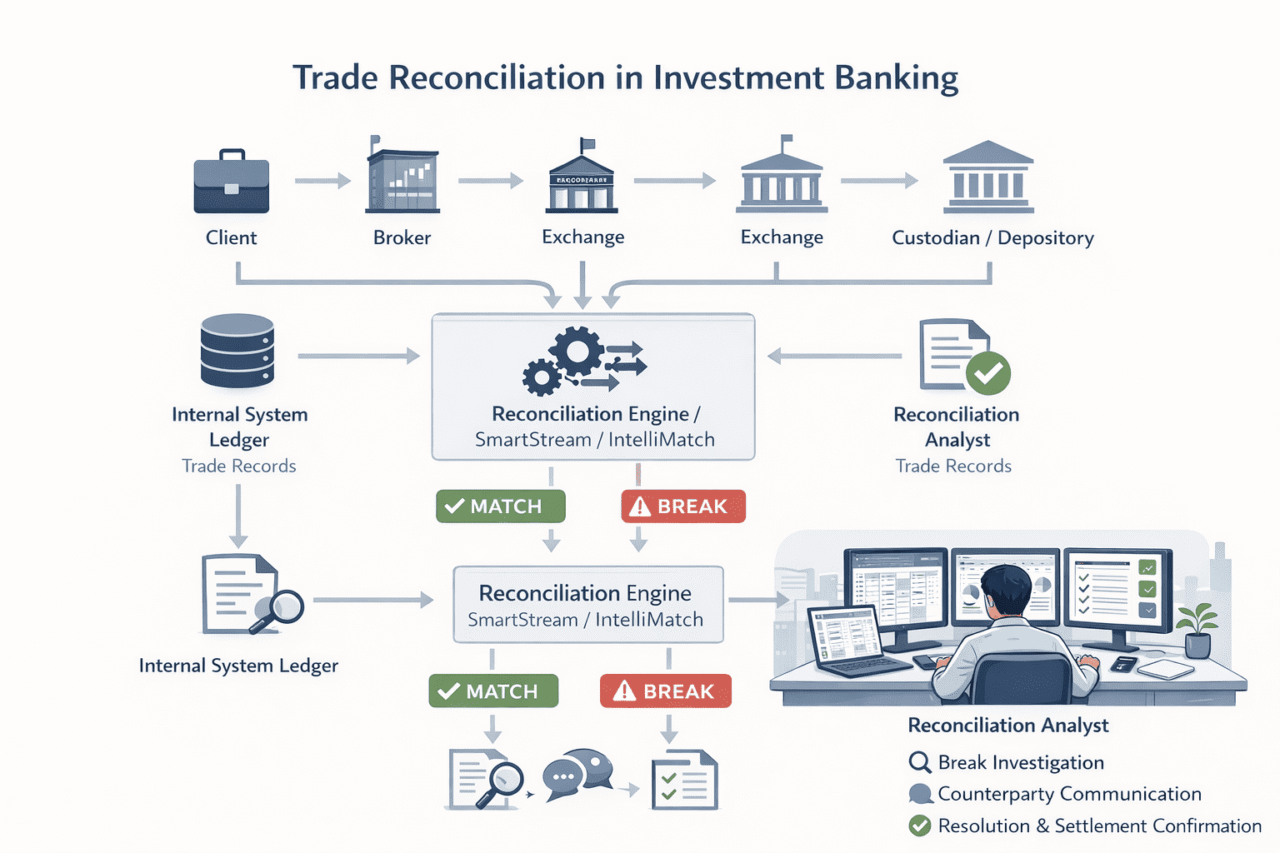

Refer to the image below and see what happens when a retail or institutional client puts a buy order for lets say a stock to buy, and this is where there are two simultaneous things happening, including the crucial step of investment banking reconciliation.

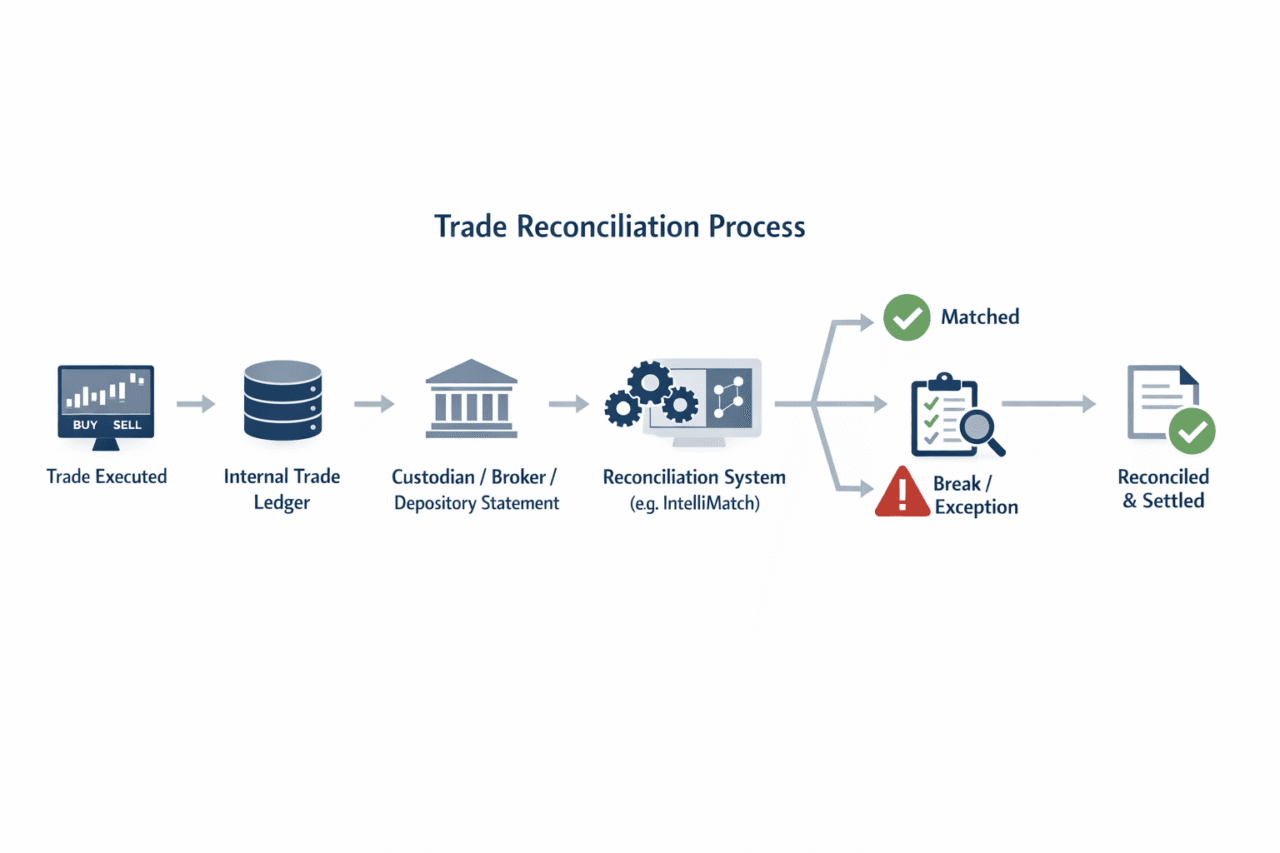

- Trade reconciliation is the process of matching internal trade records with external statements received from brokers, custodians, clearing houses, or depositories.

- It ensures that trade details such as quantity, price, settlement date, and counterparty are accurate and consistent across systems.

- Reconciliation typically occurs post-trade and pre-settlement, but also continues on an end-of-day basis.

To know more about the steps before trade reconciliation, please also read trade life cycle.

Types of Trade Investment Banking Reconciliation

These are the four types of trade reconciliations that can take place in case of securities.

One-to-One Stock Reconciliation

- This process involves matching each individual securities trade recorded internally with the corresponding trade reported by the broker, custodian, or depository.

- Key fields compared include ISIN, quantity, trade date, settlement date, and counterparty.

- It is primarily used to identify trade-level mismatches, such as duplicate bookings, missing trades, or incorrect quantities.

- One-to-one stock reconciliation is critical for high-value or high-risk trades where accuracy at the transaction level is required.

End-of-Day Stock Position Reconciliation

- End-of-day (EOD) stock reconciliation compares the total securities position at the close of the day between internal systems and external custodians or depositories.

- Instead of matching individual trades, it focuses on net positions by security.

- This reconciliation helps ensure that ownership records are accurate and that no positions are overstated or understated.

- It is especially important for regulatory reporting, risk management, and portfolio valuation.

One-to-One Cash Reconciliation

- One-to-one cash reconciliation matches individual cash movements (trade settlements, fees, dividends, interest) between internal cash ledgers and bank or custodian statements.

- Each debit or credit entry is compared based on amount, value date, currency, and transaction reference.

- This process helps identify missing payments, duplicate settlements, or incorrect charges.

- It is essential for preventing cash shortages or unexpected overdrafts.

End-of-Day Cash Reconciliation

- End-of-day cash reconciliation compares the closing cash balance in internal systems with the balance reported by the bank or custodian.

- The focus is on the net cash position, rather than individual transactions.

- Any difference is investigated to determine whether it is due to timing differences, unsettled trades, fees, or posting delays.

- This reconciliation ensures liquidity accuracy and supports effective cash management and regulatory compliance.

Documents / Statements Used in Reconciliation

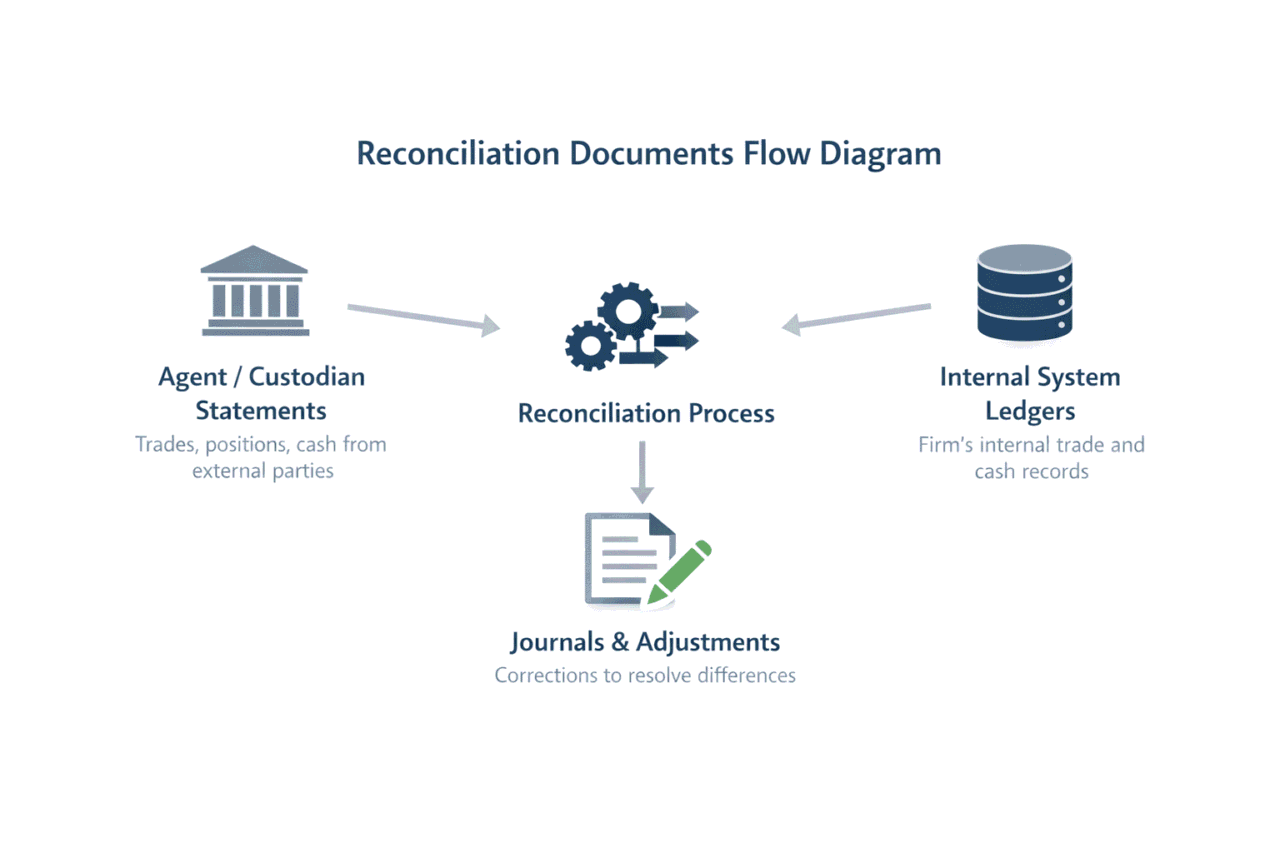

To understand reconciliation clearly, it helps to know which documents are compared. Reconciliation is not guesswork — it is a structured process where internal records are matched with official statements received from external parties.

The three most commonly used documents are agent or custodian statements, internal system ledgers, and journals.

Agent or Custodian Statements

Agent or custodian statements are external records received from third parties such as brokers, custodians, clearing members, or depositories.

These statements show:

- Trades executed on behalf of the client

- Securities held with the custodian

- Cash movements related to settlements

- Corporate actions such as dividends or splits

Because these statements come from independent external sources, they are treated as a key reference point during reconciliation. Any mismatch between internal records and custodian statements is flagged as a reconciliation break and must be investigated.

Internal System Ledgers

Internal system ledgers are records generated within the firm’s own systems. These systems capture trade activity as soon as orders are executed.

Internal ledgers typically include:

- Trade booking details

- Cash and securities balances

- Settlement status

- Fees, taxes, and charges

These ledgers reflect how the firm believes trades and cash movements have occurred. Reconciliation ensures that these internal records accurately match what external agents report.

Journals and Adjustments

Journals are manual or system-generated accounting entries used to correct or adjust differences identified during reconciliation.

Journals may be posted when:

- Timing differences exist between systems

- Fees or charges were booked late

- Minor rounding differences fall within tolerance limits

- Corrections are required due to operational errors

Once journals are posted, the reconciliation system updates the balances and clears the break. Journals play an important role in ensuring that final books and records remain accurate and complete.

Three major statements used in reconciliation

- Agent Statements: These are transaction statements sent by agents or custodians during the day

- System Ledgers: These are system generated entries on transactions

- Journals: These are entries in case of manual adjustments

There might be scenarios in which the statements provided by the agent and custodian might not match exactly, hence there might be a need to post journals in such cases. The journal entry clears that from the reconciliation system also called tolerance cash

How the Reconciliation Team Works and their need

More so the trade reconciliation team needs to identify breaks, duplication in trades, then they might have to contact and agree on the reversals in such cases.

Examples of Breaks

Lets say we were planning to sell Infosys shares to a counter party but by the time swift or the transaction reached the agent, the trade was already settled, which means we would have delivered the shares twice to the counter party. This would appear as breaks to the reconciliation team and the they would have to agree with counter party on reversal.

Trade Reconciliation Issues to be handled

The reconciliiation and settlement team, manage very important functions for the smooth running of transactions and to avoid mistakes

- Resolve exceptions or unmatched trades

- Liaise with local agent

- Ensure sufficient cash and stock

- Move positions across depositories

- Agree trade splits or pair off with counter parties

- Manual payments in case of net zero pair of

- Ask for coverage in case of buy in risks

Tools Used in Trade Reconciliation

Trade reconciliation in investment banking is largely system-driven, supported by automation, data tools, and workflow platforms. While technology handles most matching at scale, human intervention is still essential for investigating and resolving breaks.

Below are the key tools commonly used by reconciliation teams in real-world banking operations.

Automated Reconciliation Systems

(e.g., SmartStream, IntelliMatch)

Automated reconciliation platforms form the core of reconciliation operations. These systems compare internal trade and cash records with external statements received from custodians, brokers, exchanges, or clearing houses.

What these systems do:

- Match trades, positions, and cash automatically based on predefined rules

- Flag breaks or exceptions where records do not align

- Apply tolerance levels for small differences

- Maintain audit trails for regulatory and compliance purposes

These tools are designed to handle high transaction volumes, especially for global banks dealing with thousands of trades daily across multiple markets and asset classes.

Most reconciliation analysts spend a significant part of their day reviewing breaks generated by these systems.

Excel for Manual Checks and Validations

Despite automation, Excel remains a critical tool in reconciliation roles.

Excel is commonly used for:

- Investigating reconciliation breaks

- Comparing system data with external statements

- Performing manual calculations and validations

- Tracking unresolved breaks and follow-ups

Analysts often export data from reconciliation systems into Excel to analyze mismatches line-by-line. Strong Excel skills — such as formulas, lookups, pivot tables, and data filtering — are essential in day-to-day reconciliation work.

In practice, Excel acts as the bridge between automated systems and human judgment.

SQL and Reporting Tools for Data Extraction

In larger banks and KPOs, reconciliation teams often rely on SQL or reporting tools to pull data directly from internal systems.

These tools help in:

- Extracting trade, cash, and position data

- Generating reconciliation reports

- Investigating recurring or aged breaks

- Supporting audits and management reporting

While deep programming knowledge is not expected, basic SQL understanding can significantly improve an analyst’s efficiency and problem-solving ability.

Workflow and Ticketing Systems for Break Tracking

Once a break is identified, it needs to be tracked, escalated, and resolved in a controlled manner. Workflow and ticketing systems support this process.

These systems are used to:

- Log and assign reconciliation breaks

- Track communication with custodians, brokers, or internal teams

- Monitor turnaround time and ageing of breaks

- Maintain documentation for audit and compliance

They ensure accountability and transparency, especially when multiple teams and external parties are involved.

Why Tools Matter in Reconciliation

While tools automate matching and reporting, reconciliation is not a “set-and-forget” process. Analysts must understand:

- Why a break occurred

- Whether it poses financial or operational risk

- How and when it should be resolved

Technology improves speed and scale, but accuracy, judgment, and controls still depend on people.

What Are the Jobs in Trade Reconciliation? (India-Focused)

Trade reconciliation roles are widely available in India, especially within global investment banks, custody operations, and financial services KPOs. These roles are a key part of post-trade operations, supporting global trading desks across equities, derivatives, and fixed income.

In India, reconciliation jobs are typically based in Mumbai, Pune, Bengaluru, Chennai, Hyderabad, and Gurgaon, and serve international markets such as the US, UK, and Europe.

Common Job Titles You’ll See in India

You may find these roles listed under different titles, even though the core work remains reconciliation-focused:

- Trade Reconciliation Analyst

- Investment Banking Operations Analyst

- Post-Trade Operations Analyst

- Settlements & Reconciliation Analyst

- Custody Operations Analyst

- Middle Office / Back Office Analyst

For freshers, these are often entry-level analyst roles with structured training provided on the job.

Top Companies Hiring for Reconciliation Roles in India

Some of the major employers actively hiring for reconciliation and post-trade roles include:

- JPMorgan Chase

- Bank of America

- BNY Mellon

- Standard Chartered

- Citi

- HSBC

- Goldman Sachs (operations roles)

- eClerx

- Accenture (Capital Markets / Banking Ops)

- Genpact

- TCS / Infosys (banking operations projects)

These firms typically handle reconciliation for global clients and trading desks, making the exposure valuable early in a finance career.

Educational Background Required

Most reconciliation roles in India are open to commerce and non-commerce graduates, especially at the fresher level.

Typical eligibility includes:

- Graduation: B.Com, BBA, BBM, BCA, BA (Economics)

- Post-Graduation (preferred, not mandatory): M.Com, MBA, PGDM

A finance degree helps, but it is not mandatory for entry-level roles.

Knowledge & Skills Required (Practical Reality)

What employers actually expect:

- Basic understanding of financial markets

- Knowledge of the trade life cycle (order → execution → settlement)

- Familiarity with equities, derivatives, or fixed income (basic level)

- Strong logical reasoning and attention to detail

- Ability to work with data, statements, and system reports

Advanced finance theory is not required for reconciliation roles.

Do You Need Expensive Courses?

No.

Most professionals enter reconciliation roles by:

- Learning the trade life cycle

- Understanding basic market structure

- Practicing reconciliation concepts through examples

- Gaining hands-on exposure during training or on the job

Employers focus more on process understanding and accuracy than certificates. Over-investing in expensive courses for reconciliation roles is usually unnecessary. You can check our the certificate in investment banking course, where we provide extensive learning and offer placements in India.

How the Reconciliation Team Works and Why They Are Critical

The reconciliation team plays a crucial role in ensuring that all trades executed by the firm are accurately recorded, matched, and settled. Their primary responsibility is to identify and resolve breaks — differences between internal records and external statements received from brokers, custodians, or depositories.

Because investment banking operations involve high trade volumes and multiple systems, mismatches are inevitable. The reconciliation team acts as a control function, ensuring that these mismatches are detected early and corrected before they lead to financial loss or regulatory issues.

What Are Reconciliation Breaks?

A reconciliation break occurs when trade or cash details do not match between internal systems and external confirmations.

Example of a Trade Break

Consider a scenario where a firm executes a sell trade in Infosys shares. Due to a delay in transaction messaging or settlement confirmation, the trade is mistakenly settled twice with the counterparty.

As a result:

- Internal systems show one delivery of shares

- The custodian or depository reflects two deliveries

This mismatch appears as a break in the reconciliation system. The reconciliation team must investigate the issue and coordinate with the counterparty to reverse the duplicate settlement.

Key Responsibilities of the Trade Reconciliation Team

The reconciliation and settlement teams manage several critical operational tasks to ensure smooth trade processing and risk control:

- Identify and resolve unmatched or duplicate trades

- Investigate reconciliation breaks and coordinate with brokers, custodians, and counterparties

- Ensure sufficient cash and securities are available for settlements

- Facilitate the movement of positions across depositories

- Agree on trade splits, pair-offs, or netting arrangements with counterparties

- Process manual payments or adjustments in exceptional cases

- Request additional coverage in buy-in or settlement risk scenarios

Why reconciliation in investment banking is important

Controls financial and operational risk

Reconciliation makes sure the trades that happen does not duplicates, the pricing is correct. The settlements happen should be right and not mismatched, should not be failed.

Ensures Compliance with Regulators and Audit Readiness

There should be complete transparency in the trading activities. Accurate reports are needed by the financial bodies like SEBI and RBI. Audits of every reports are done to ensure no mismatches happens. If these tasks are not performed heavy fines might be imposed on the companies, license migh get suspended also the reputation of company is damaged.

Prevents Fraud and Financial Loss

Crosschecking the records makes sure the trades are right. There is no missing funds, rogue trading activity if we follow the steps of reconciliation process. To prevent frauds and loss make sure to automate data transformation, leverage AI and perform audits monthly

Conclusion

My advice is that trade reconciliation is one of the very important functions of the finance industry, and although a lot automation is happening but just because the ATM’s came, didn’t mean that the bank jobs were lost. Reconciliation will still need human intervention, since there are still areas where systems is not integrated to be fully reliant.

FAQ

What is reconciliation process in Investment Banking?

Reconciliation in Investment Banking is a process of ensuring the financial records for accuracy and consistency.

What are three R’s of reconciliation?

Record: All financial transactions to be recorded from internal and external parties.

Review: Compare and examine

Resolve: Solve the mismatches and ensure accuracy.