The CA exam known as the Chartered Accountancy examination administered by ICAI, is India’s leading professional assessment that qualifies individuals in accounting, auditing, taxation, and financial management. When individuals inquire about “What is CA exam,” they are referring to a challenging, multi-phase qualification (Foundation, Inter, Final) that equips candidates for senior positions in finance and corporate sectors. It is among the most esteemed and career-defining examinations in India.

In this article, let’s explore more about Chartered accountancy, its levels and how you can crack it to become the most valued and full of knowledge individual in the accounting field.

CA exam course structure

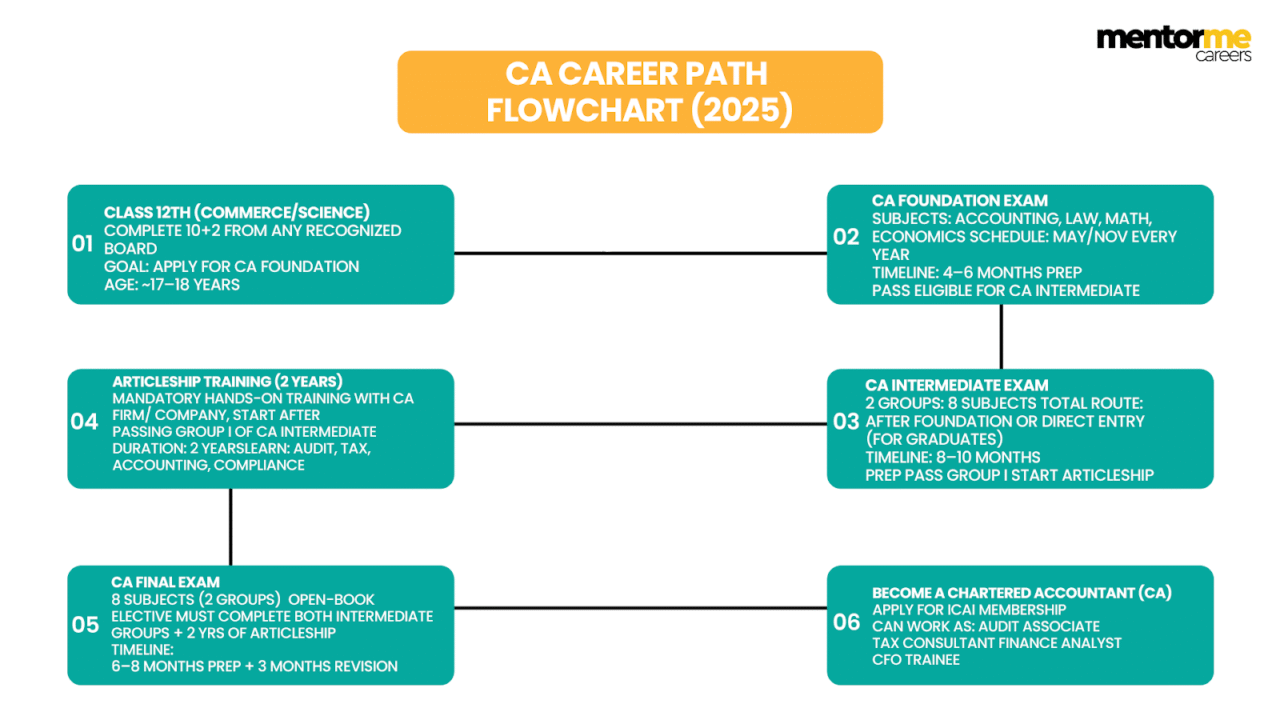

Chartered accountancy contains of 4 stages:

The CA foundation exam covers basics of accounting, law, maths, and business. Students can attempt it after Class 12. CA intermediate includes more advanced levels with subjects in accounting, taxation, law, audit, and costing. It can be attempted after clearing Foundation or through the Direct Entry route (after graduation). CA final, focusing on high-level topics like financial reporting, strategic financial management, advanced audit, and corporate laws. After intermediate group 1 or 2 is completed candidates opt for mandatory practical training period done after clearing either both groups of Intermediate or at least one group (as per ICAI rules). Articles gain real industry experience in audit, taxation, compliance, and accounting.

What is CA Foundation exam?

Chartered accountancy includes 3 three levels from which foundation level first, The CA exam, known as the Chartered Accountancy examination administered by ICAI, is India’s leading professional assessment that qualifies individuals in accounting, auditing, taxation, and financial management. It is among the most esteemed and career-defining examinations in India.

Eligibility for CA Foundation

1.Completed Class 12 (10+2) from a recognised board.

2.You have registered with ICAI for the CA Foundation course.

3. Complete the minimum study period of 4 months before the exam attempt.

CA Foundation exam pattern & subjects

| Paper | Subject Name | Type | Marks |

| Paper 1 | Principles & Practice of Accounting | Subjective | 100 |

| Paper 2 | Business Laws & Business Correspondence | Subjective | 100 |

| Paper 3 | Business Mathematics, Logical Reasoning & Statistics | Objective (MCQ) | 100 |

| Paper 4 | Business Economics & Business & Commercial Knowledge | Objective (MCQ) | 100 |

CA foundation highlight:

Total marks: 400

Passing criteria: 40% in each paper and 50% overall

Mode: Offline, pen-paper

MCQ papers include negative marking (0.25 marks per wrong answer)

What is the CA Intermediate exam?

The CA Intermediate exam is the second level of the Chartered Accountancy course run by ICAI. It develops essential knowledge in accounting, taxation, law, audit, and financial management. Students must pass both Groups to move on to the CA Final level. CA Inter is seen as a significant advancement from Foundation, as it presents application-based and analytical questions that are relevant to real finance and audit jobs.

CA intermediate exam eligibility & route

1. Foundation Route (Regular Path)

You are eligible for CA Intermediate if you have:

1.Cleared the CA Foundation exam, and

2.Completed the required study period as per ICAI guidelines.

2. Direct Entry Route (No Foundation required)

Graduates and postgraduates can directly register for CA Intermediate if they meet these criteria:

1.Commerce graduates with 55% or above

2.Non-commerce graduates with 60% or above

3.ICSI (Institute of Company Secretaries of India) / ICMAI (Institute of Cost Accountants of India) Intermediate-passed students also qualify

Direct-entry students must complete ICITSS and a 9-month practical training (articleship) before appearing for the exams.

CA intermediate exam pattern & subjects

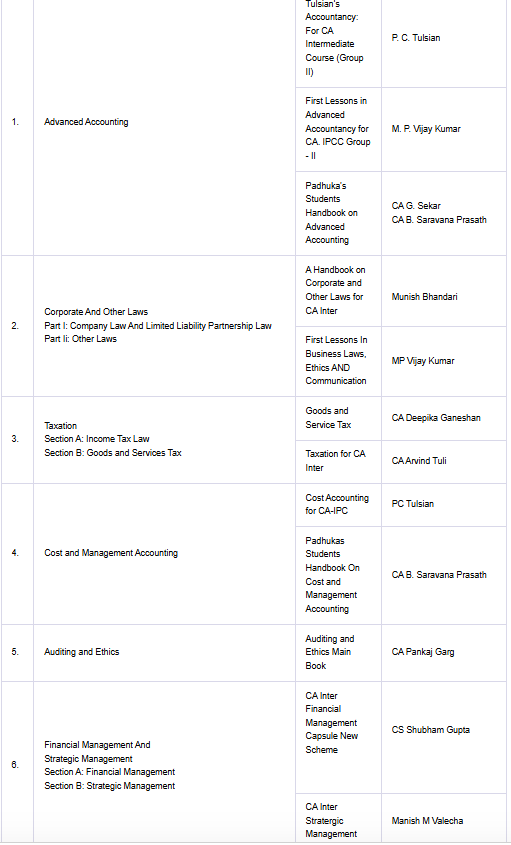

CA intermediate level includes:

Mode: Offline (pen-paper)

Marks per paper: 100

Passing criteria: 40% per paper and 50% aggregate per Group

Frequency: Held twice a year (May & November)

| Group | Paper | Subject |

| Group 1 | Paper 1 | Advanced Accounting |

| Paper 2 | Corporate & Other Laws | |

| Paper 3 | Taxation (Income Tax + GST) | |

| Group 2 | Paper 4 | Cost and Management Accounting |

| Paper 5 | Auditing and Ethics | |

| Paper 6 | Financial Management & Strategic Management |

CA Foundation exam vs CA Intermediate exam

Deciding between CA Foundation and CA Intermediate depends on your educational background, current qualifications, and career goals. The CA Foundation is the starting point for those finishing school. CA Intermediate is the next technical level for individuals who have completed the Foundation or who are graduates. Below is a short comparison chart and a brief overview to help students choose the right path.

| Feature | CA Foundation | CA Intermediate |

| Level | Entry-level exam | Mid-level professional exam |

| Eligibility | Class 12 passed | Foundation pass or Direct Entry (Graduates) |

| Focus | Basics of accounting, law, maths | Advanced accounting, taxation, audit, finance |

| Difficulty | Moderate | Significantly higher |

| Groups | No groups | 2 Groups (Group 1 & 2) |

| Subjects | 4 papers | 6 papers (new scheme) |

| Exam Type | Mostly objective + descriptive | Fully descriptive |

| Purpose | Tests fundamentals | Prepares for articleship + practical work |

| Pass Rate | Higher (20–30% typical) | Lower (10–15% typical) |

| Next Step | CA Intermediate | Articleship + CA Final |

CA exam schedule, registration & fees

1.Main exam windows: May and September each year (ICAI publishes timetables for both sessions).

2.Typical pattern: Foundation / Intermediate / Final papers spread across several days in the chosen month; ICAI posts exact dates and city masters well before the exam.

3.Note: Occasionally ICAI issues postponements/rescheduling for specific centers or regions for security/logistical reasons, always check the Announcements page before the exam.

How to register (step-by-step)

- Create an ICAI student account on the Self Service Portal (SSP) at ICAI and complete student registration (new students).

- Check eligibility for the level you want to appear in (Foundation / Intermediate / Final) ICAI posts “Requirements for Applying” for each session.

- Fill the exam application form when ICAI opens the exam form window for the respective session (links appear on the “Examinations” page). Upload documents if required.

- Pay exam fees online (the portal accepts fee + any late fee if applicable). Note: do not register for the exam before you have applied for the scholarship (if applying) or before meeting pre-reqs.

- Download admit card from the SSP when released (ICAI announces admit card availability).

Fee structure & where to find exact charges

1.ICAI publishes a session-specific “Fee Chart” (Foundation / Intermediate / Final fees, foreign center fees, late fees, correction charges) on the Examinations page for every cycle, consult the current fee chart for the exact amounts for May / Sept 2025.

2.Important: Fees vary by level (Foundation vs Inter vs Final), by center (India vs overseas), and whether you pay during the regular window or with a late fee. Always use the ICAI fee chart for authoritative numbers.

CA exam key dates & timelines you should track

Registration window

Watch announcements

Admit card is release before 1-3 week

Result are declared within 6-10 weeks after exam

Check out guidance for CA exam applicants:

Requirements for CA exam 2026:

January 2026 Foundation and intermediate

How to prepare for each CA exam level

CA preparation takes a lot of dedication and planning and passion for the learning you have opted for having patience on this. Make a plan on how you are going to study and what to prioritize and what not. We have provided you with a full plan and way of study.

Author: Shrishti Harchandani, CA

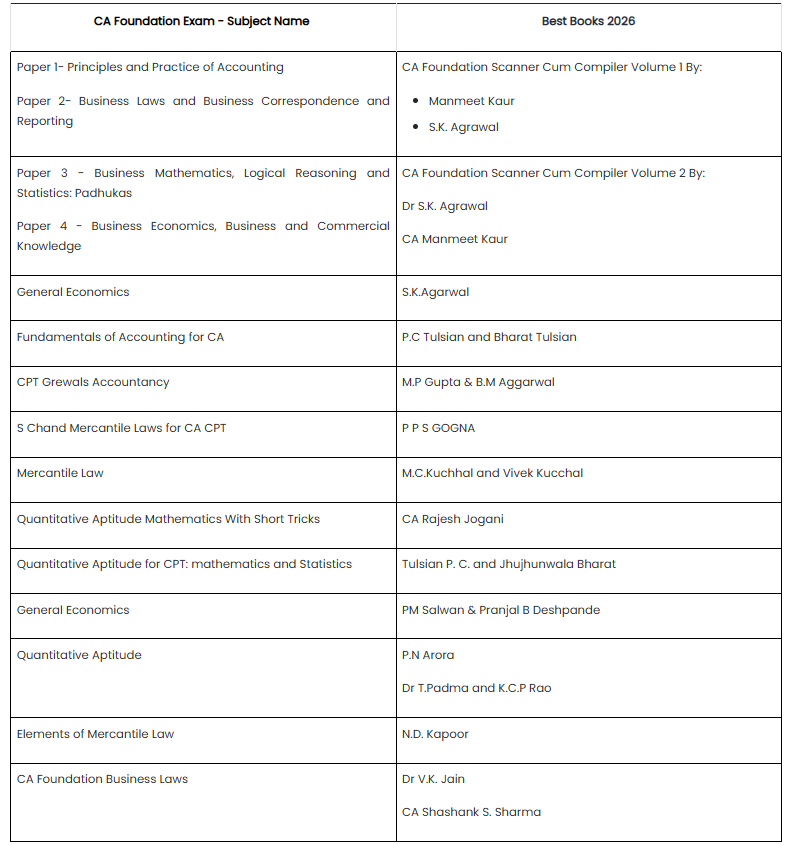

“The most important thing is to have clarity about which books to refer to and the amount of time to be devoted to each topic. CA demands a lot of hard work and smart work at the same time. The syllabus is quite vast. You should know the topics technicality level as well as relevance (in terms of marks) . Various authors like Pankaj garg have given weightage of marks from each topic”

Recommended resources (books)

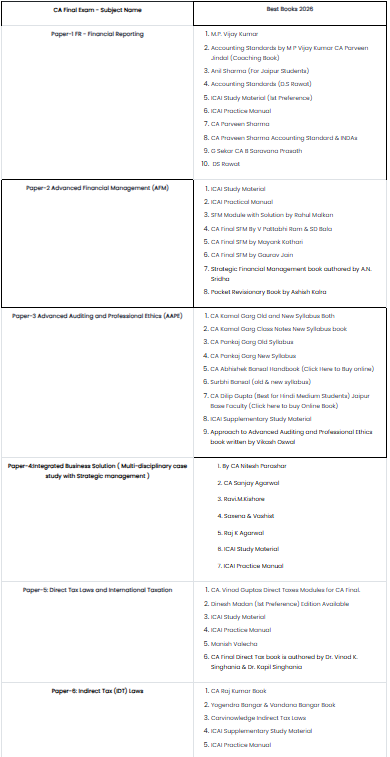

Final Exam

CA exam passing & difficulty

Check this article out for CA passing and difficulty:

Conclusion

The Chartered Accountancy examination in India is seen as one of the most respected and rewarding professional credentials. It offers a clear path that includes Foundation, Intermediate, Articleship, and Final stages. This journey demands hard work and dedication. However, the long-term benefits, such as job security, high income potential, and opportunities in audit, taxation, finance, consulting, and corporate fields, make it very worthwhile for motivated students.

The eligibility requirements, updated exam formats, and predictable schedules provided by the ICAI make the CA route in 2025 more organized and supportive for students than ever. Whether you start right after completing Class 12 or choose the Direct Entry option, the key to success is planning ahead, understanding the syllabus, and following a smart study plan.

If you aim to build a strong career in finance, the CA qualification remains one of the best professional options available in India.

FAQ

The CA exam qualifies candidates to become Chartered Accountants who can work in audit, taxation, accounting, finance, compliance, and consulting. It enables careers in Big 4 firms, corporates, banking, and independent practice.

Students who have passed Class 12 from a recognized board are eligible for CA Foundation. Graduates (commerce with 55%, others with 60%) can enter directly through CA Intermediate via the Direct Entry Route.

CA is challenging due to its vast syllabus and low pass percentages, but it is achievable with consistent study, strong concepts, and regular revision. Strategy matters more than intelligence.

Many students find Advanced Accounting, Taxation, and Audit the most difficult because they require depth, conceptual clarity, and strong application skills, especially under time pressure.