Last updated on January 24th, 2026 at 02:17 pm

Introduction

B. Com, or Bachelor of Commerce, is one of the most popular undergraduate courses in India. It is a three-year degree course that focuses on subjects related to business and commerce. Moreover, BCom offers a wide range of job opportunities for students who want to build a career in accounting, finance, management, banking, insurance, and government services. In this blog, we will discuss the job opportunities after Bcom as well as how to choose the right career path after graduation.

Jobs Options after B. Com:

Accounting and Finance

Accounting and Finance are two of the most sought-after job options for BCom graduates. These career paths involve managing financial data, analysing financial statements, and making strategic financial decisions. Some of the job roles available in this field are:

- Chartered Accountant: A Chartered Accountant (CA) is a professional who is trained in accounting, auditing, and taxation. They help companies manage their financial operations and comply with legal and regulatory requirements.

- Financial Analyst: A Financial Analyst is responsible for analysing financial data and providing insights that help businesses make informed financial decisions.

- Investment Banker: Investment Bankers help companies raise capital by issuing stocks and bonds. They also provide financial advice to clients and help them execute mergers and acquisitions.

Management

Management is another popular job option for BCom graduates. This field involves managing people, resources, and processes to achieve organizational goals. Some of the job roles available in this field are:

- Business Development Manager: A Business Development Manager is responsible for identifying new business opportunities and developing strategies to increase revenue.

- Human Resource Manager: A Human Resource Manager is responsible for managing the workforce of an organization. They hire new employees, manage employee benefits, and ensure compliance with labour laws.

- Marketing Manager: A Marketing Manager is responsible for developing marketing strategies and campaigns that help companies reach their target audience.

Banking and Insurance

Banking and Insurance are two sectors that offer promising job options for BCom graduates. These fields involve managing financial transactions and mitigating risks. Some of the job roles available in this field are:

- Bank PO: A Bank Probationary Officer (PO) is responsible for managing various banking operations such as customer service, cash management, and loan processing.

- Insurance Agent: An Insurance Agent is responsible for selling insurance policies to individuals and businesses. They also provide advice on risk management and financial planning.

- Loan Officer: A Loan Officer is responsible for assessing loan applications and making recommendations on loan approvals.

Government Jobs

Government jobs are another career option for BCom graduates. These jobs offer stability, job security, and a chance to serve the country. Some of the job roles available in this field are:

- Civil Services: The Civil Services Examination is conducted by the Union Public Service Commission (UPSC) to recruit candidates for various government services such as Indian Administrative Service (IAS), Indian Police Service (IPS), and Indian Revenue Service (IRS).

- Banking Exams: Various banks such as the State Bank of India (SBI), Reserve Bank of India (RBI), and Institute of Banking Personnel Selection (IBPS) conduct exams for the recruitment of Probationary Officers (PO) and Clerks.

CFA (Chartered Financial Analyst)

CFA an internationally recognized professional qualification offered by the CFA Institute (USA) that focuses on investment management, financial analysis, and portfolio management. Students usually start studying for this qualification in their 1st year of college.

Credit analyst

A credit analyst checks the credit-worthiness of financial for financial health and security of individuals or companies. Analyst work across financial institutes.

Fund accounting

Method financial management used to track the money allocated to various operations at organizations. This ensures the fund used are allocated securely.

Business Development analyst

Analyst who identifies new opportunities in the market to create strategies for company’s growth and value. Business development analyst analyzes trends do market research and develop plans for growth.

Top 10 high paying jobs after Bcom

There are plenty of courses you can do after Bcom. There is time for researching and studying what suits and who doesn’t. Let’s see which courses are those.

| Job Role | Average Salary (INR/year) | Skills Required | Suggested Course |

| Investment Banker | ₹6–12 LPA | Excel, Valuation, Financial Modelling | Financial Modelling Course |

| Financial Analyst | ₹4–8 LPA | Data Analysis, Ratios, Excel | Excel & Finance Analytics |

| Accountant | ₹3–6 LPA | Tally, GST, Taxation | Accounting & Taxation |

| Equity Research Analyst | ₹5–10 LPA | Markets, Excel, Reporting | Equity Research Course |

| Risk Manager | ₹8–15 LPA | Quant, Derivatives, Risk Mgmt | Risk Management |

| Data Analyst | ₹4–9 LPA | Power BI, SQL | Data Analytics Course |

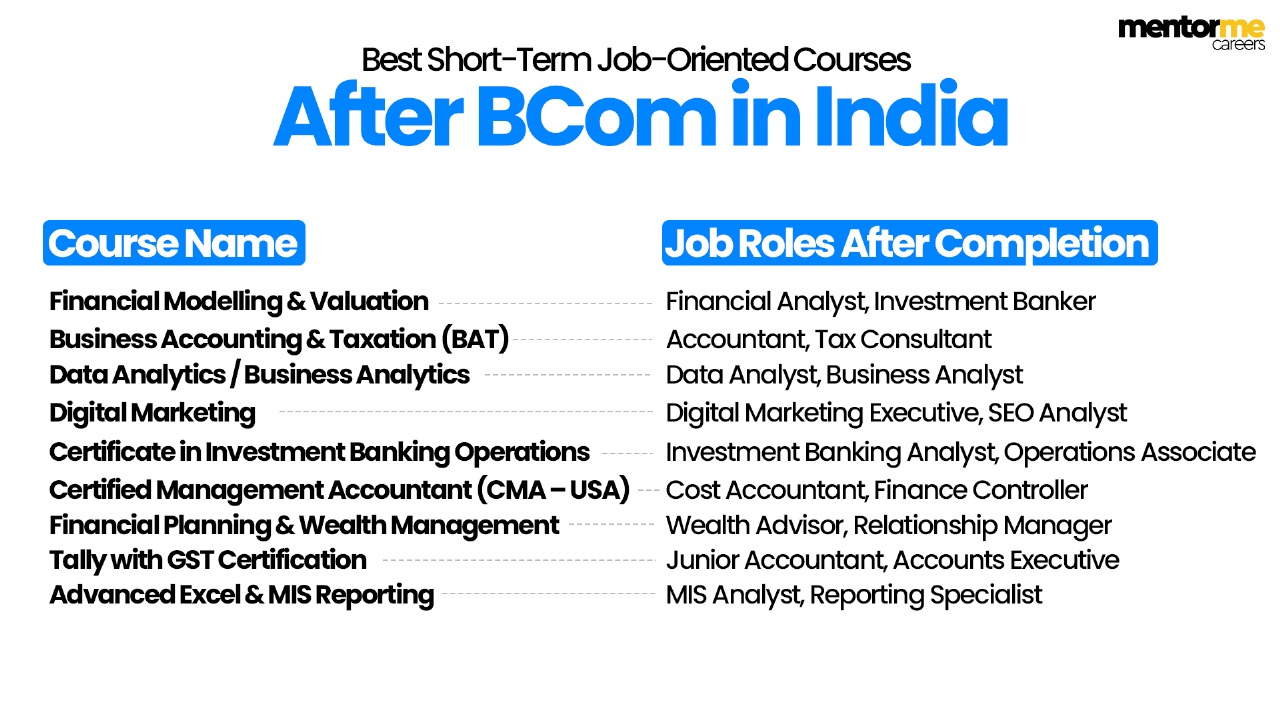

Short term courses after Bcom

Short-term courses are ideal for BCom graduates who want to bridge the gap between theoretical knowledge and real-world skills. These programs typically last 2 to 6 months and are designed with a focus on immediate employability.

Here’s what makes them valuable:

- Quick learning curve – gain in-demand skills in less than half a year.

- Practical exposure – includes live projects, case studies, and tools.

- High placement potential – many institutes offer guaranteed or assisted placement support.

- Career flexibility – you can move into finance, analytics, marketing, or consulting roles.

| Course Name | Duration | Key Skills Learned | Job Roles After Completion | Average Salary (INR/year) |

|---|---|---|---|---|

| Financial Modelling & Valuation | 3–6 Months | Excel, Valuation, Forecasting | Financial Analyst, Investment Banker | ₹5–12 LPA |

| Business Accounting & Taxation (BAT) | 4–6 Months | GST, TDS, Tally, Income Tax | Accountant, Tax Consultant | ₹4–8 LPA |

| Data Analytics / Business Analytics | 4–6 Months | Power BI, SQL, Excel, Python (Basics) | Data Analyst, Business Analyst | ₹5–10 LPA |

| Digital Marketing | 3–5 Months | SEO, Google Ads, Social Media Marketing | Digital Marketing Executive, SEO Analyst | ₹3–8 LPA |

| Certificate in Investment Banking Operations | 4–6 Months | Trade Lifecycle, Risk, Derivatives | Investment Banking Analyst, Operations Associate | ₹6–10 LPA |

| Certified Management Accountant (CMA – USA) | 6–9 Months | Cost Control, Budgeting, Strategic Analysis | Cost Accountant, Finance Controller | ₹7–15 LPA |

| Financial Planning & Wealth Management | 3–6 Months | Mutual Funds, Insurance, Portfolio Management | Wealth Advisor, Relationship Manager | ₹5–9 LPA |

| Tally with GST Certification | 2–3 Months | Tally ERP, GST Filing, Ledger Accounting | Junior Accountant, Accounts Executive | ₹3–5 LPA |

| Advanced Excel & MIS Reporting | 2–3 Months | Formulas, Dashboards, Data Visualization | MIS Analyst, Reporting Specialist | ₹4–7 LPA |

Why short term courses matter

After completing your Bachelor of Commerce (BCom), you already have a foundational degree. But in today’s competitive job market, a short-term certification can help you:

- Acquire job-ready skills in 3-6 months.

2. Stand out among other BCom grads.

3. Get placed faster, especially in roles needing specific tools or platforms.

Placement-Focused Features to Look For

When choosing a short-term course, ensure it offers:

1.Real-life projects & case studies (not just theory)

2.Placement or internship support (or at least strong industry tie-ups)

3.Skills aligned with job listings (e.g., Excel, Power BI, digital tools)

What Is the Scope of a BCom Degree Today?

A BCom gives you a broad base in commerce, accounting, business and finance. It opens doors in multiple domains: finance, marketing, HR, operations and more.

In terms of salary: Entry-level BCom roles in India typically start around ₹3-6 lakh per annum and grow with experience and specialisation.

| Experience | Role / Titles You Might Get | Typical Salary | Skills to Focus On |

| 0-2 years | Accounts Executive, Banking Associate, Junior Financial Analyst | ~₹3-6 LPA | Core accounting, Excel, basic industry knowledge |

| 2-5 years | Senior Analyst, Credit Analyst, Tax Specialist, Business Analyst | ~₹6-12 LPA | Industry tools, analytics, client interaction, domain specialisation |

| 5+ years | Manager, Senior Finance Specialist, Strategic Planner, Wealth Manager | ₹12 LPA+ (varies widely) | Leadership, domain expertise, certifications, team management |

Faster Growth after Bcom

Getting certified (short-term or professional) to lift your profile.

Gaining specialised skills in high-demand areas like financial modelling, risk management, analytics.

Switching to high-growth sectors (FinTech, digital commerce, consulting).

Pursuing higher studies or professional courses (MBA, CA, CFA) for managerial roles.

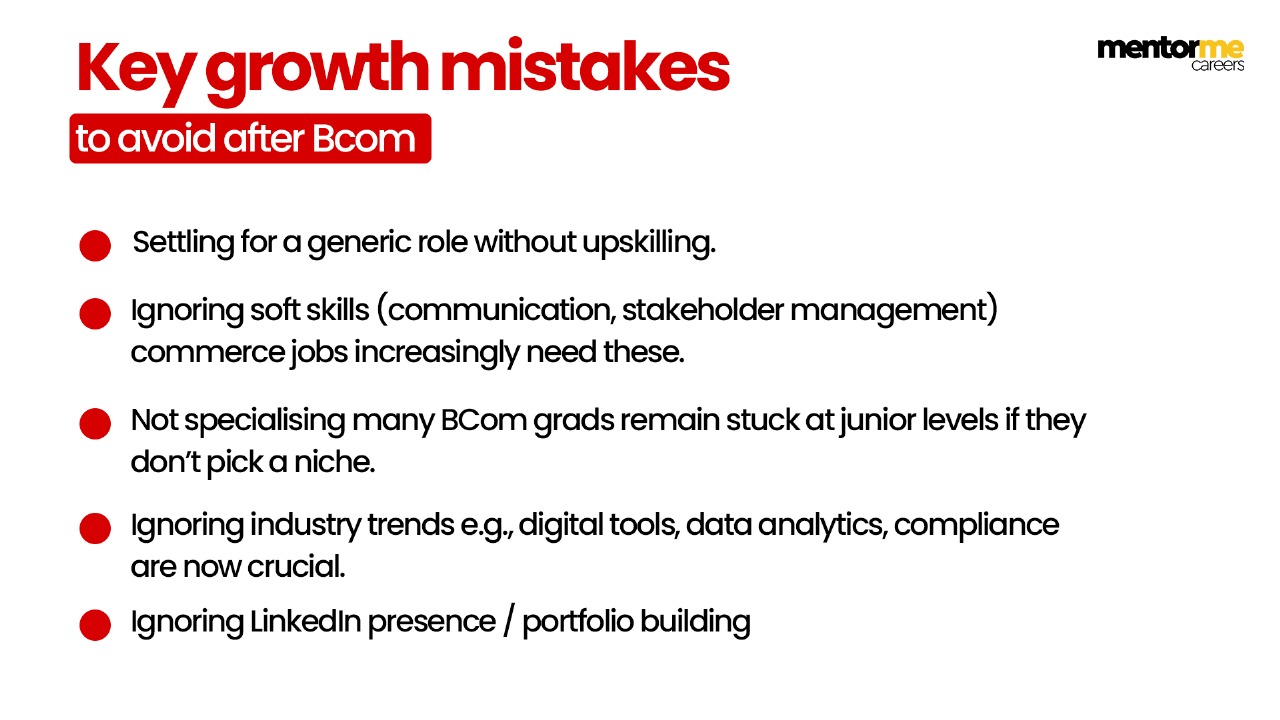

Key growth mistakes to avoid after Bcom

- Settling for a generic role without upskilling.

- Ignoring soft skills (communication, stakeholder management) commerce jobs increasingly need these.

- Not specialising many BCom grads remain stuck at junior levels if they don’t pick a niche.

- Ignoring industry trends e.g., digital tools, data analytics, compliance are now crucial.

- Ignoring LinkedIn presence / portfolio building

Job Opportunities After BCom: How to Choose?

Choosing the right career path after BCom is crucial for long-term success and job satisfaction. Here are some tips to help you make an informed decision:

- Self-assessment of skills and interests: Take time to reflect on your skills, interests, and values. Moreover, identify your strengths and weaknesses and choose a career path that aligns with your personal goals and interests.

- Researching job opportunities and growth chances: Research the job market and the growth prospects of various industries. Additionally, look for information on job profiles, salaries, and career growth opportunities. Check out job portals, industry reports, as well as company websites to get a better understanding of the job market.

- Seeking advice from career advisors and industry experts: Talk to career advisors and industry experts to get insights into different career paths. Since they can help you understand various industries’ job requirements, skill sets, and career growth chances.

- Pursue further studies: If you are unsure about your career path, you can pursue further studies such as a Master of Business Administration (MBA) or a professional certificate course. These courses will help you gain specialized skills and knowledge in addition to making you more employable.

The Importance of Skill Development in BCom Graduates

As the job market becomes increasingly competitive, BCom graduates must focus on skill development to stand out. Essential skills such as analytical thinking, communication, and problem-solving are highly valued by employers. Additionally, proficiency in financial software and an understanding of market trends can significantly boost your employability. Regularly updating your skill set through workshops, online courses, and certifications will ensure you remain relevant in your chosen field.

Conclusion

In conclusion, BCom graduates have a wide range of career options to choose from. Accounting and finance, management, banking and insurance, as well as government services are some of the popular career paths for BCom graduates. However, it is important to choose a career path that aligns with your personal goals and interests. Self-assessment, research, and seeking advice from career counsellors and industry experts can help you make an informed decision. Pursuing further studies can also enhance your career options and help you achieve long-term success. Remember, choosing the right career path is crucial for job satisfaction, personal growth, and financial stability.

FAQs

BCom graduates can pursue careers in various fields such as accounting and finance, management, banking and insurance, and government services. Some of the job roles available in these fields are chartered accountant, financial analyst, business development manager, bank probationary officer, and civil services.

It is not necessary to pursue further studies after completing a BCom degree. However, pursuing further studies such as a Master of Business Administration (MBA) or a professional certification course can enhance your career options and help you gain specialized skills and knowledge.

The field that offers the best career prospects for BCom graduates depends on individual interests and career goals. However, accounting and finance, management, and banking and insurance are some of the popular fields that offer promising career opportunities for BCom graduates.

BCom graduates need a range of skills such as analytical and problem-solving skills, communication and interpersonal skills, and time management and organizational skills. They also need to have a good understanding of business and finance and be proficient in accounting and financial software.

BCom graduates can prepare for job interviews by researching the company and the job profile, practising common interview questions, and highlighting their skills and achievements. They should also dress professionally and be confident and enthusiastic during the interview.

Business Accounting & Taxation (BAT), Tally with GST, Advanced Excel for Finance

These short-term practical courses can get you placed faster, and later you can pursue CA, CMA, or ACCA for higher growth.

Pursue Professional Certifications

Enroll in Job-Oriented Finance Courses

Go Global with International Qualifications

Combine Commerce with Analytics or Tech

Go for MBA in Finance or Strategy

1. Certificate in Financial Modelling

2. Certification in Business Accounting & Taxation (BAT) / GST

4. Digital Marketing Certification

5. Certificate in Data Analytics / Business Analytics

Diploma in Banking & Finance / E-commerce

Some Helpful Site Links Related To “What Are The Jobs After BCom”:

- National Career Service: https://www.ncs.gov.in/

The National Career Service is a government portal that offers career-related services and information to job seekers. It provides information on job vacancies, career guidance, and skill development programs.

- Ministry of Skill Development and Entrepreneurship: https://www.msde.gov.in/

The Ministry of Skill Development and Entrepreneurship is a government department that works towards creating a skilled workforce in India. The website provides information on skill development programs, apprenticeships, and job opportunities.

- Reserve Bank of India: https://www.rbi.org.in/

The Reserve Bank of India is India’s central bank, responsible for regulating the banking and financial sector in the country. The website provides information on job vacancies and career options in the banking sector.

- Staff Selection Commission: https://ssc.nic.in/

The Staff Selection Commission is a government organization that conducts recruitment exams for various government departments and ministries. The website provides information on job vacancies, exam dates, and eligibility criteria.

- Union Public Service Commission: https://www.upsc.gov.in/

The Union Public Service Commission is a government organization that conducts recruitment exams for various civil services and government jobs. The website provides information on job vacancies, exam dates, and eligibility criteria.