Last updated on August 16th, 2025 at 04:47 pm

So, how what is the meaning of valuation of shares? Well, think off it this way. You see that perfect diamond ring for your spouse, how do you validate the price? Ofcourse by the global or local diamond rates, with the making charges separately.

Essentially what I am saying is, value of anything depends on its valuableness? For example Apple computers (company), is more valuable than Research in motion (Blackberry).

But why? For many reasons, firstly apple company has a consistent product line, its reliable, they have a huge market share. Moreover they also command premium pricing.

Let me now briefly discuss with examples, the major equity valuation methods.

I use the NAV method is used when analysing companies, which has a capex intensive business.

Let me give you an overview of the application of this method

- Firstly deduct all the liabilities from the assets which gives you net assets

- So what I am left is the book value of company.

Can you think of any type of industry which you should valuate their stock price using this method?

Let me give you a few examples;

In case of energy companies and banks, the business is well represented In assets. For example banks have cash as the raw material.

Discounted Cash Flow DCF Method

Look and pay attention to the name of this method. The keyword is cash flow, which means the ability of the business to generate cash. However note that I said cash, not profits. Because profits can be manipulated to show a rosy picture but cash is king.

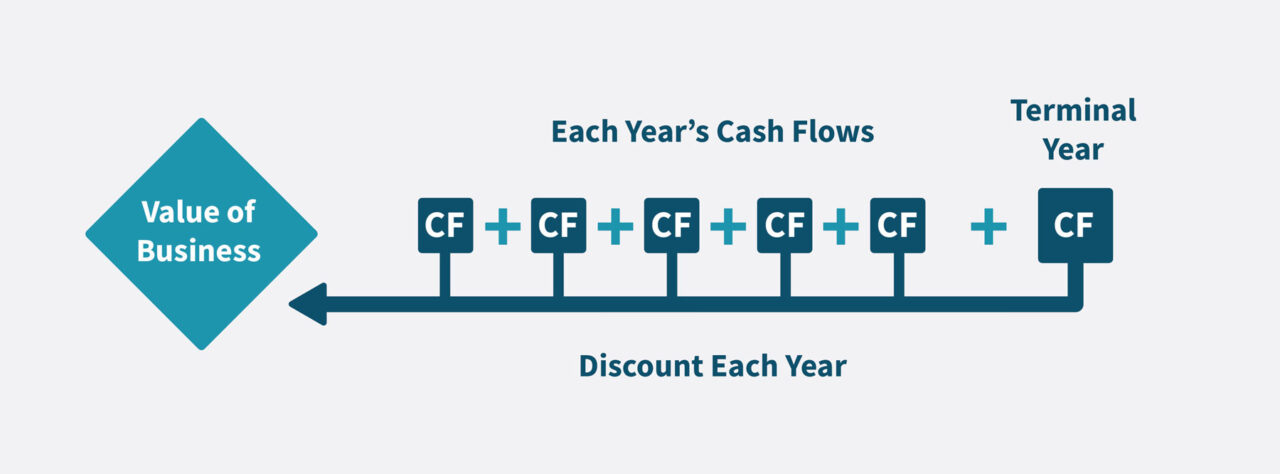

Now the basic principle behind the discounted cash flow method is as follows;

- Analyse the historical capacity of a company to generate cash flow.

- Using the insights from above and also other secondary data , you find the probable future cash flow

- Finally,since these cash flows are in the future, you need to make it relevant for today. Which is also called as discounting of cash flow.

DCF Formula

So I can summarise this process of brining future cashflows to present in the form of the following equation.

PV of companies shares = Future Cashflow/ (1+ Discount rate)^n

Now hold your horses before you get confused. So what is discount rate? And what is this terminal year. let me go to the basics of a company.

- Firstly, whenever we say discount in a plain simple language, What do we understand?. So in simple terms it means reduced value right?.

- Just like that, what is worth $100 today, won’t be worth the same next year? So what if it is $90, then you would have discounted by 10%.

Factors Affecting Discount Rate

So, in simple terms the process of determining a discount rate depends on three factors;

- Quality of the company

- Stability of the company’s revenues

- General government risk free interest rates.

Hence, although the government risk free remains constant, the discounting will vary significantly across companies. For example; APPL (Company) and Tesla Motors are not going to have the same level of risk. Tesla is a more cyclical company with nascent technologies. Whereas APPL is an established stable company.

In the form of an equation I can summarise this process as;

Ke (Cost of equity or discount rate)= Risk free rate + Beta( Riskiness of the company){ Return on Broader index(RM)- Risk free rate{Government bond rate}.

Value Beyond Forecasted Period

Do you remember, the definition of a company? It says a company is a going concern. What does that mean?

It means that the company has infinite life. But think about this, if we only discount the cashflow for the forecasted period. Then we are essentially saying that, the company shuts down after that. But while valuing a company, the value should include;

- The forecasted period

- Indefinite period

Here the indefinite period is basically called the terminal value.

And company valuation will depend heavily on the perpetual cashflow. Why? Because a company’s present stock market price has a lot to with its ability to sustain in the longer period.

How do we calculate terminal value?

For this concept, I am going to give you a very simple example;

Let’s say I tell you, that I am going to give $100 every year forever. In return how much are you ready to pay me today for this deal?

Now, notice a strange situation here when you make this investment decision. I Said $100 forever, but how can you count forever?

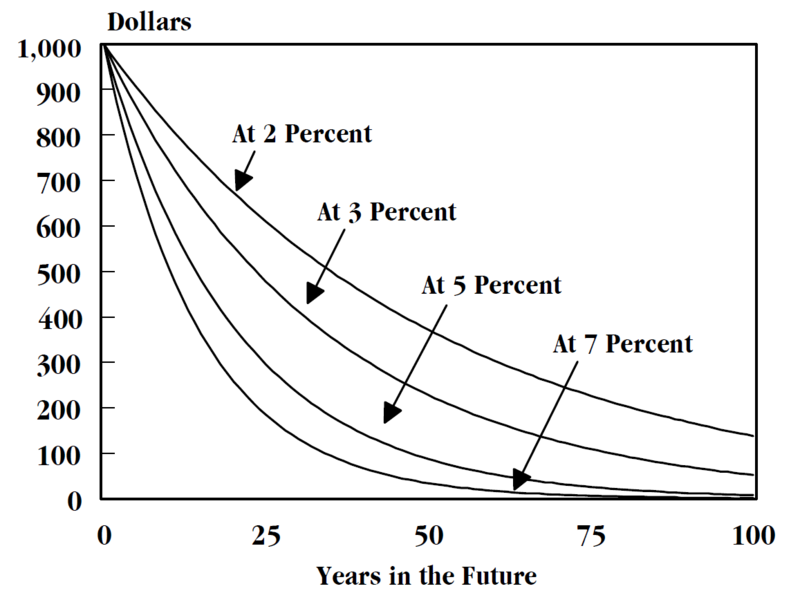

Well in order to understand this you need to understand that value of money keeps decreasing as time passes. Notice the graph below, as we progress from 0 years to 100 years, the value of money approaches zero.

Another thing that matters is, the rate of value of money going down. So if the discount rate is high, then value of money will dip faster. And vice versa.

So we can again summarise the perpetual value of anything using the basic perpetuity formula i.e

Present value of perpetuity = Perpetual Cashflow( In our case $100)/ Discount rate

Hence, if I consider government bond interest rates as a proxy for discount rate at 6%.

The present value of perpetually getting $100 = $100/ 6%= $1666. So, no matter how lucrative this might sound but getting this cash flow is only worth $1666.

Terminal Value Calculation in DCF

So now, if you understood the perpetual cashflow example above, then this will be a cake walk. So Instead of $100 of cash flow, if now we are talking about a company who’s cashflow won’t be static at $100 . But Instead grow at 10%. Then How much would you pay for perpetual cash flow?

Some important change from the previous cashflow is growth. And remember our previous perpetuity formula did not consider growth.

So the same formula but we adjust the formula for growth.

Hence terminal value= Cashflow (1+g)/(R-G),

So the numerator increases by the growth rate but notice what happens in the denominator. The discount rate which basically reduces the present value, reduces. Which leads the terminal value to increase. So the implication is that, if you are analysing a company and doing the valuation of equity shares.

Then the company which has a sustainable growing business with high barriers to entry will lead the share valuation model to show high value.

Comparable Companies or Relative Valuation Model

Now, this is a method of finding the value of a company comparing your target company with others. For example, If there are 4 students in class John, Luke, Mathew & Peter. Also, out of these four let’s say Peter has been most consistent in academics for the past 5 years . And his average score has been 85%.

Now John has just joined the school or class recently. So we don’t have his average score. But he studies almost 2 hours everyday. At the same time when I check how much Peter studies annually it comes to 800 Hrs.

So what could be the average score of John?

Now we can calculate 2 Hours x 300 days= 600 hrs annually. Now 800 Hrs of Peter gives 85%, so 600 hrs of John would get us?

Or in other words 600/800 x 85%=63.75% . That is the idea behind comparable company analysis or relative valuation models.

Parameters Used in Relative Equity Valuation Models

Now, let see what are the various things we can compare for a company using this valuation technique.

We could essential use;

- Earning per share

- Cashflow per share

- Use the current market price per share and divide by the number eps givings us earnings p e ratio.

Moreover, we could use other line items from assets and liabilities and balance sheet items.

Conclusion

Now, the proper of definition of valuation of shares really depends on the type of business. For example; You come across a business which has negative profits and cashflows. So in this case it’s impossible to use the P/E ratio, because earnings is negative. Similarly when I am trying to analyse a start up company, with a small history of cashflow.

So, the method really depends on the kind of business, status of cashflows, profitability etc. Do consider reading or top valuation question and answers. Also consider checking our equity research course with NSE & BSE Certification

FAQ

1. Discounted Cash Flow (DCF) Analysis

2. Comparable Company Analysis (CCA, or “Market Multiples” Method)

3. Precedent Transaction Analysis

4. Asset-Based Valuation (or Net Asset Value)

7. Earnings (or Price/Earnings, P/E) Multiple

8. Leveraged Buyout (LBO) Valuation

The value of equity shares can be calculated using several methods, each with different formulas and approaches as given above in this article.

Valuation of shares is the process of determining the fair or intrinsic value of a company’s stock. This involves using quantitative techniques and financial data to assess the company’s current performance, growth potential, assets, earnings, risk profile, and market outlook. The main goal is to estimate what a share is truly worth, not just its market price, so investors, companies, and stakeholders can make informed financial decisions

What is Valuation Equity?

Valuation equity, or equity valuation, is the process of determining the fair market value of a company’s equity meaning its shares or ownership stake. This estimation helps investors, analysts, and companies decide whether a stock is undervalued, overvalued, or fairly priced compared to its intrinsic worth and market price.