Last updated on October 23rd, 2024 at 05:01 pm

In the realm of business and finance, the concept of liability plays a crucial role in determining the level of risk and responsibility for business owners. Two common forms of liability are unlimited liability and limited liability. Understanding the differences between these two structures is essential for entrepreneurs, investors, and anyone involved in business operations. This article explores the concept of Unlimited liability vs Limited liability, delving into their definitions, implications, and legal obligations. By gaining insights into these distinct forms of liability, individuals can make informed decisions and mitigate potential risks in their business endeavors.

What is Unlimited Liability?

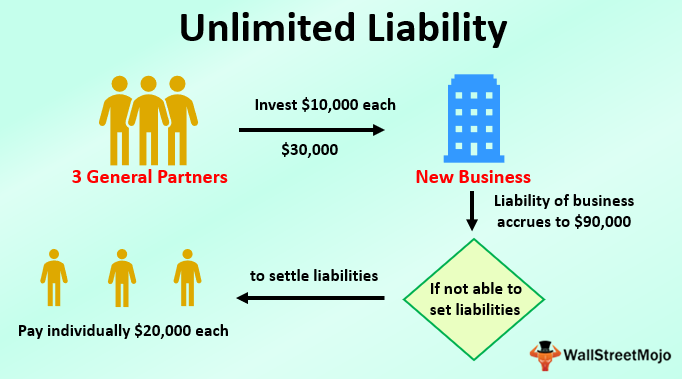

Unlimited Liability is the legal obligation of company founders and business owners to repay, in full, the debt and other financial obligations of their companies. This legal obligation generally exists in businesses that are proprietorships or general partnerships. Each company owner is equally responsible for repaying the business’ financial obligations. These obligations can be paid through the sale of owners’ personal assets. Most companies opt to form a limited partnership, where a partner’s liability cannot exceed their investment. For many companies, nondisclosure is a benefit of forming a foreign unlimited liability subsidiary.

Definition of Unlimited Liability Vs Limited Liability

Unlimited Liability

Unlimited liability refers to a legal structure in which business owners are personally liable for the debts and obligations of the business. In other words, if the business cannot meet its financial obligations, the owners’ personal assets can be used to settle those debts. This structure is typically associated with sole proprietorships and partnerships.

Limited Liability

Limited liability is a legal structure that provides a separation between personal and business liabilities. In this structure, the owners’ personal assets are generally protected from being used to settle business debts. Limited liability is commonly seen in corporations and limited liability companies (LLCs). The owners’ liability is usually limited to the amount they have invested in the business or the value of their shares in the company.

Key Differences

The key differences between Unlimited Liability and Limited Liability can be seen as below:

| Unlimited Liability | Limited Liability |

| Business owners are legally obligated to repay the debt obligations of their companies | Business owners are not legally obligated to repay the debt obligations of their companies |

| The financial assets of the owners can be seized to repay the obligations | The financial assets of the owners cannot be seized to repay the obligations |

| Unlimited Liability exists in sole proprietorship and general partnerships | Limited Liability exists in limited liability companies and partnerships. |

Example of Unlimited Liability

Let us assume two partners manage a business in which they invested $20,000 each. The business also took out a loan of $100,000 that needs to be repaid. If the business is unable to pay back the loan, the two partners will be equally liable to settle the obligation.

In such an event, the personal assets of the partners can be seized against the claims. If one partner does not own any assets, the second partner’s assets will be seized to recover the full $100,000. If the business were structured as a limited liability corporation or limited partnership, the two partners would only lose their initial investment of $20,000 each. This example illustrates the benefit of adopting limited liability structures. With limited liability, the personal wealth of the business owners are not at risk. Only their initial capital is lost.

Personal Financial Responsibility: Unlimited liability vs Limited liability

Unlimited Liability: With unlimited liability, business owners have a high level of personal financial responsibility. They are personally liable for all debts and obligations of the business, meaning their personal assets are at risk if the business fails to meet its financial obligations. This can include personal savings, investments, and even property.

Limited Liability: Limited liability provides a degree of protection for business owners. Their personal assets are generally shielded from being used to settle business debts. As a result, personal financial responsibility is limited to the amount invested in the business or the value of their shares. This separation of personal and business liabilities helps protect personal assets from being affected by the financial difficulties of the business.

Legal Protection:Unlimited liability vs Limited liability

Unlimited Liability: In terms of legal protection, unlimited liability structures offer little to no protection for business owners. Since there is no legal separation between the business and the owners’ personal finances, creditors have the right to pursue the owners’ personal assets to satisfy the business debts. This can pose significant risks to personal financial well-being.

Limited Liability: Limited liability structures provide legal protection for business owners. The separation between personal and business liabilities shields personal assets from being seized to settle business debts. In most cases, the owners’ personal assets are safe, even if the business faces financial difficulties or legal action. This protection allows business owners to mitigate personal financial risks associated with the business.

Taxation

Unlimited Liability: In terms of taxation, unlimited liability structures such as sole proprietorships and partnerships generally do not have separate tax identities. Profits and losses are reported on the individual owners’ personal tax returns. The owners are personally responsible for paying taxes on the business income.

Limited Liability: Limited liability structures, such as corporations and LLCs, often have separate tax identities from their owners. These structures are typically subject to corporate taxation. The business income is taxed separately from the owners’ personal income. This can have implications for tax planning and strategies for business owners.

Considerations for Business Owners

Choosing the Right Structure: When deciding between unlimited liability and limited liability structures, business owners must consider their personal financial situation, risk tolerance, and long-term goals. Sole proprietors and partners should carefully assess the potential risks associated with unlimited liability, while those looking for personal asset protection may opt for limited liability structures.

Investor Attraction and Funding: Limited liability structures are often more attractive to investors since they offer greater protection and limit the investors’ liability to their investment in the company. This can facilitate raising capital and securing funding