Last updated on October 23rd, 2024 at 04:28 pm

So think of a custodian like a warehouse manager, he needs to keep the stocks in place. While keeping it safe and accessible when demanded. So without the custodian, you wouldn’t come to know whether the other party getting into a transaction actually has what he claims to have while at the same time there would be no guarantees that the securities itself would not be lost. Hence the role of custodian in the capital market has over the years changed and evolved to be more and more important.

What is a Custodian?

A custodian is a crucial entity in the financial landscape that plays a pivotal role in safeguarding and managing clients’ financial assets. In essence, a custodian acts as a secure guardian for various types of investments, ensuring their protection and smooth operational handling.

For instance, in the securities market,

- custodians hold stocks, bonds, and other securities on behalf of investors, preventing theft or loss.

- They facilitate the settlement of transactions, ensuring that ownership changes are accurately recorded and executed.

- Moreover, custodians maintain comprehensive records of clients’ holdings and transactions, providing clients with clear insights into their investment portfolios.

- Additionally, they manage complex corporate actions like mergers or dividends, ensuring that clients’ interests are well-represented and executed.

In all these facets, custodians act as reliable custodians of financial assets, ensuring the security and effective management of investments.

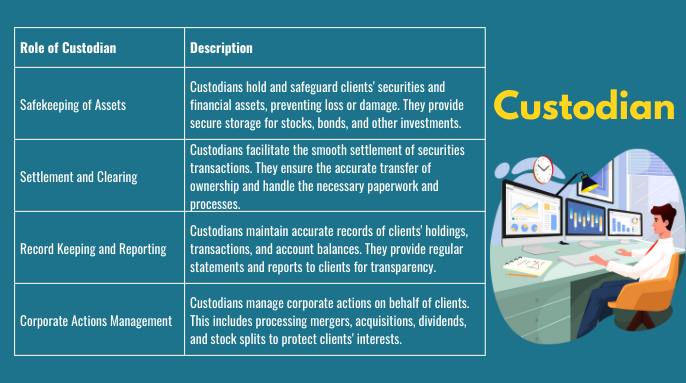

Roles of Custodians in Detail

A custodian holds a critical role in the financial world, responsible for safeguarding and managing various assets on behalf of investors and organizations. They serve as trusted guardians of these assets, ensuring their security, proper handling, and efficient management. Let’s delve into the essential roles custodians play and understand their significance with simple explanations and examples.

1. Safekeeping Role of Custodian

Custodians are like security guards for financial assets. They protect valuable items like stocks, bonds, and other investments from theft, damage, or loss. Imagine you own a rare painting. To keep it safe, you might store it in a secure art gallery. Similarly, custodians keep your stocks and bonds secure in their custody. If you own shares in a company, the custodian ensures these shares are safe until you decide to sell or transfer them.

2. Settlement and Clearing Role of Custodian

When you buy or sell investments, there’s a process to transfer ownership from one person to another. Custodians manage this process to make sure it’s smooth and accurate. Think of it like transferring ownership of a car. You need proper paperwork to show the change of ownership. Custodians handle the paperwork and ensure that ownership of your investments changes correctly. For example, if you sell your shares, the custodian ensures the buyer gets the ownership and you receive the money.

3. Record Keeping and Reporting Role of custodian

Custodians keep detailed records of your investments and transactions, just like a financial diary. They note down what you own, what you buy or sell, and how much money you make from dividends. This helps you keep track of your money and investments. Think of it as a shopping list where you write down everything you buy, so you know what you have. The custodian sends you reports regularly, like a summary of your shopping list, so you can see how your investments are doing.

4. Corporate Actions Management Role of Custodian

Sometimes, companies make changes that affect their shareholders, like giving out dividends or merging with another company. Custodians make sure you’re not left out. Imagine you’re part of a club, and they’re deciding what activities to do next. Custodians make sure you get your share of the fun. If a company you’ve invested in decides to give dividends, the custodian ensures you receive your portion.

5. Proxy Voting Role of Custodian

Custodians also give you a voice in important decisions of the companies you’ve invested in. It’s like being part of a team and getting a say in team decisions. When companies hold meetings and ask for votes, custodians make sure your vote is counted. If a company wants to change something major, like its board members, you can vote through the custodian to express your opinion.

6. Income Collection Role of Custodian

Custodians help you get the money you earn from your investments. If you own stocks, you might get money from the company as dividends. Just like a piggy bank, custodians collect this money for you and add it to your account. They make sure you get paid what you’re owed.

7. Global Custody Role of Custodian

If you invest in different countries, custodians can help manage the complexities. It’s like having friends in different parts of the world who help you navigate new places. If you buy stocks from companies in other countries, custodians ensure that all the rules and paperwork of different countries are followed correctly.

In a nutshell, custodians are the protectors, organizers, and managers of your financial treasures. They ensure that your investments are safe, well-organized, and handled correctly. Just like having a reliable friend who takes care of your belongings, custodians offer a vital service in the financial world that gives you peace of mind about your investments.

Types of Custodians

Custodians come in different types, each specializing in various areas of financial management. These distinct types serve unique purposes and cater to specific needs. Let’s explore these types and understand their roles with simple explanations and examples.

Global Custodian

Firstly, we have Global Custodians. These are like international managers for investments. They handle assets across different countries, making sure all rules and regulations are followed. For instance, if you invest in stocks from multiple countries, a global custodian ensures that the right taxes and laws are applied to each investment.

Securities Custodians

Secondly, there are Securities Custodians. Their focus is on keeping your investments safe and organized. They ensure your stocks, bonds, and other securities are stored securely. Think of them as responsible librarians for your financial library, making sure each item is protected and easily accessible.

Mutual Fund Custodians

In addition, we have Mutual Fund Custodians. If you invest in mutual funds, these custodians manage the behind-the-scenes work. They process your transactions and handle the paperwork, just like the gears in a machine that make it run smoothly.

Pension Custodians

Similarly, Pension Custodians play a role in managing retirement funds. They ensure that the money you put away for your retirement grows over time and is ready for you when you stop working. It’s like having a personal financial planner for your golden years.

Custodians for Alternative Investments

Furthermore, there are Custodians for Alternative Investments. Some investments, like real estate or private equity, need special care. Custodians for alternative investments make sure these unique assets are secure and properly managed. They’re like specialized caretakers for your valuable collections.

Sub Custodians

Lastly, we have Sub-Custodians. These custodians work under larger custodians, especially in international investments. They handle the nitty-gritty details in specific regions or countries. Think of them as local experts who help the global custodian navigate unfamiliar territories.

Transition words like “firstly,” “secondly,” “in addition,” “similarly,” “furthermore,” and “lastly” help guide readers through the various types of custodians and their respective roles. Each type plays a crucial role in the financial world, contributing to the overall safety, management, and growth of different types of investments.

Custodian Risks

Custodian risks are inherent challenges associated with safeguarding and managing valuable assets, demanding proactive mitigation strategies.

Theft Prevention: Safeguarding Valuables

The risk of theft poses a significant threat to custodianship. Employing effective security measures, such as surveillance systems and security personnel, is crucial to deterring potential thieves.

Mitigating Mishandling Risks

Improper handling and storage can lead to asset damage. Implementing proper training for custodial staff, defining handling protocols, and providing suitable storage environments can minimize this risk.

Documenting Accurately: Avoiding Documentation Errors

Accurate documentation is vital in custodianship. Errors in recording transactions and misplacing records can result in legal disputes and financial losses. Establishing rigorous record-keeping practices and conducting regular audits can prevent such issues.

Staying Ahead of Obsolescence

In industries with evolving technology, obsolescence poses a custodian risk. Regularly assessing asset relevance and value and making informed decisions regarding upgrades are essential to mitigate this risk.

Strategies for Mitigation

Comprehensive security, staff training, meticulous record-keeping, and strategic asset planning are key strategies in mitigating custodian risks.

Conclusion: Proactive Custodianship for Risk Mitigation

Custodians play a crucial role in managing assets while navigating various risks. By understanding and addressing potential challenges like theft, mishandling, documentation errors, and obsolescence, custodians can ensure the protection and longevity of valuable assets under their care.

Conclusions:Role of Custodian

Custodians play a crucial role in managing assets while navigating various risks. By understanding and addressing potential challenges like theft, mishandling, documentation errors, and obsolescence, custodians can ensure the protection and longevity of valuable assets under their care.