Last updated on October 23rd, 2024 at 03:01 pm

Whenever you come across a role in finance, which says research analyst, then you are sure to get excited. In fact, these are designations that have become so common to the ear that, it rarely conveys the actual work done.

However, I will take you through specific in depth look at their work specifically in finance.

Research Analyst Meaning

So, if I look at the all possible roles which carry this term, then are three major work which is common.

- Collect Data

- Analyse Data

- Prepare some kind of reports

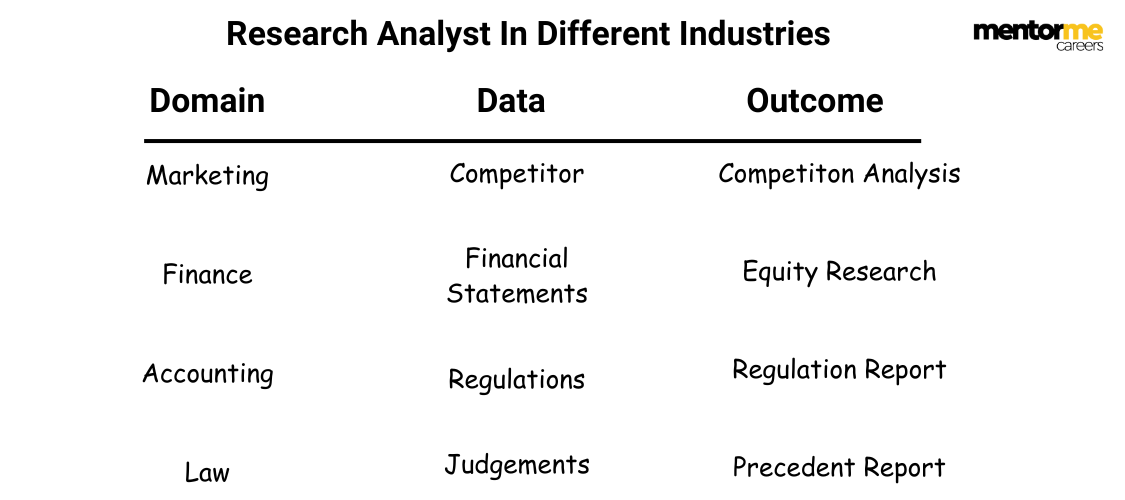

So, whether the analyst is in marketing, finance or corporate finance. In all of the cases, they will have something to do with collecting, sorting what they collecting. Finally then giving some inference or implications to the reader of that report.

Role of a Research Analyst in finance

Now let me take you through the detailed research analyst work in finance. So in finance majorly you will find the following kinds of designations.

- Equity Research Analyst

The name clearly suggests that you are expected to find gems in the stock market. Which is easier said than done but just to give you some context. In NSE alone there are around 2600 listed companies and the growing demand of equity investments. Ofc ourse demands that more research needs to be done.

However on a side note, these analysts are classified into two types;

- Buy Side Equity Research: Directly work with Asset management companies

- Sell Side Equity research: They do research for broking houses to generate commissions.

- Financial Research Analyst

A very common designation that you will often find when you google it out, is financial analyst. And the designation is very vague, because the financial analyst can be in any kind of process’s not just finance. So at the moment it is difficult to really discuss any specific things about this position.

- FP&A- Financial Planning & Analysis Analyst

Now, this would be more towards corporate finance. So, every company of some decent size, will need a plan of its budget and expenses. Also there needs to be analysis on return on investments on various projects. This in a nutshell is called as financial planning analyst.

- Project Finance Analyst

Project finance is a division of an investment bank that funds infrastructure projects. Here the analyst is expected to collect data from various sources regarding the business operations and viability of the business. Here the analyst needs to give valuable insights from a risk perspective to the bank. Which also lead the bank to a sound and informed decision on lending.

Research Analyst Qualifications

So, research analyst come in various shapes and sizes. From early graduates without any special degrees, to CFA charter holders, Chartered accountants etc. However, it really depends on the client requirements, so let me briefly shed some light here;

- General Qualifications

So for smaller firms a bachelors degree would suffice. Conversely for full scale inevestment banks, candidates would required to have either a Masters in business administration from ivy league colleges. Or hold prestigious finance charters like CFA, FRM or even CA from ICAI.

- Skills required for research analyst

What is more stringent and critical to work here, is the importance of research analyst skills. Which includes, genuine interest in buisiness, excel , valuation techniques etc. In short these skills can be clubbed to be called as financial modeling.

General Research Analyst Interview Questions

So, as I said in the previous section the basic qualifications and skills. However, the most challenging step in entering research is the entry level test. This entry level test is common across all qualifications, irrespective of your qualifications. So let me briefly list down the process of the interview for equity research companies.

- Screening Round- Basic Finance Aptitude Test

Now days there are no actual interviews, but a simple online test. Which can be a combination of case study with MCQ questions. Or it can also be related to making a financial model which becomes the base for the next round.

Now, generally the finance test would include questions from financial statements, valuation, Ratio analysis etc.

- Technical Round with Senior Analyst

Now once you manage to clear the first screening round, then you come face to face with senior analysts. Who would ask you questions related to market conditions, market trends. They might also pick your brains using abstract data and expect you to identify trends.

You can check our detailed blog on equity research interview questions.

How to Become A SEBI Registered Research Analyst

So, SEBI has its own specific regulations which was published in 2014 related to the certification of research analysts. Now you might wonder, what does SEBI have to do with research analyst ? Well the answer to that lies in the huge surge of unwarranted advices given by people in the stock market. So in order for you to ascertain the genuiness of the research, this becomes an important benchmark.

Let me list down the basic eligibility criteria For This;

- Firstly if you are a sole proprietar or a partnership firm, then your net worth needs to be at least 1 lac. However, if you are structured as an LLP then minimum net worth should be 25 lacs.

- Secondly, the analysts need to clear the NISM XV Research analyst certification exam conducted by NISM.

- The exam includes 92 MCQ questions and 2 case study based MCQ questions. Moreover, the exam also has a negative marking structure. And the exam duration is of 2 hrs.

- Once you finish the above requirements, then comes the membership fee which is around INR 500,000 Lacs for corporate bodies. And for individuals it will be around INR 10,000.

- Post becoming a member and getting the certificate of registration, you have to comply with SEBI rules of reporting.

Research Analyst Salary

This can be different for different category of companies, however let me categorise the approximate compensation that can be expected.

- Freshers Research Analyst Salary: As a graduate fresher, you can expect a minimum of INR 3.5- INR 4 LPA. Also, if you hold professional qualifications like CFA, FRM then your starting packages can be from 6 LPA.

- Experienced Research Analyst: The progression of compensation in research is highly correlated to experience in this field. Just to give you some fair idea, a research analyst with 4-5 years of experience would be in the 14-15 LPA bracket. This is irrespective of the qualifications.

You can read our detailed coverage of research associate salary here.

FAQ’s

- How to become a research analyst?

You can become a research analyst by first having a graduate degree and learn the financial modeling skill. Once you have learnt the basic skills, then you can apply for various graduate level jobs in research. Another important aspect which is frequently overlooked is the communication skills.

- What is research analyst job?

As a research analyst you are expected to do the following

- Collect historical financial statements of the company

- Analyse and understand the business .

- Create forecasted financial statements of the future

- Perform valuation and statistical analysis

- Create a summarised reports and presentations of the same.

All of this activities are done by you to aid in the investment decisions making process.

- What are the types of research analysts

There are various kinds of research analysts in different industries. For example, in marketing you have market research analyst, while in case general operations you have operations research analyst.

Market Research Analyst and Operations Research Analyst

Adding a section on Market Research Analysts and Operations Research Analysts provides a comprehensive understanding of the different types of research analysts. Market research analysts focus on interpreting data to understand market trends and consumer behavior. They collect and analyze data to help companies make informed business decisions. On the other hand, operations research analysts use mathematical models and analytical methods to help organizations solve complex problems and improve decision-making processes. Both roles are crucial for data-driven insights in various industries.