Last updated on July 30th, 2025 at 02:53 pm

So, Mumbai is home to anything and everything related finance and its use. That includes large investment bank MNC head quarters, or small boutique firms. In this article, I will discuss the Top 28 Private Equity firms in Mumbai.

List of Private Equity Firms in Mumbai

So, with no time wasted below are the Top 28 Private Equity Firms in Mumbai, which are SEBI Registered.

| Ser | Private Equity Firms in Mumbai | Type | Website |

|---|---|---|---|

| 1 | Aavishkaar India Micro Venture Capital Fund | Domestic | https://aavishkaarcapital.in |

| 2 | ACCESS INDIA FUND | Domestic | https://www.accesspe.in |

| 3 | ADITYA BIRLA REAL ESTATE FUND | Domestic | http://realestateinvestment.adityabirlacapital.com |

| 4 | AKRUTI CITY VENTURE CAPITAL FUND | Domestic | https://astarcventures.com |

| 5 | AMBIT PRAGMA FUND II | Domestic | https://www.ambit.co |

| 6 | ARISTON IET FUND | Domestic | http://www.ariscap.com |

| 7 | ASHMORE CENTRUM INDIA RECAP FUND | Global | https://www.ashmoregroup.com |

| 8 | ASK PRAVI PRIVATE EQUITY OPPORTUNITIES FUND | Domestic | http://www.askpravi.com |

| 9 | ASK REAL ESTATE SPECIAL OPPORTUNITIES FUND | Domestic | http://www.askpravi.com |

| 10 | BLUME VENTURES FUND I | Global | https://blume.vc |

| 11 | BUSINESS EXCELLENCE TRUST | Domestic | https://aifpms.com |

| 12 | BUSINESS EXCELLENCE TRUST II (MOTILAL OSWAL) | Domestic | https://aifpms.com/ |

| 13 | EMERGING INDIA FUND- Avendus capital | Domestic | https://www.avendus.com |

| 14 | ENAM INDIA INFRASTRUCTURE FUND | Domestic | https://www.enam.com |

| 15 | FAERING CAPITAL INDIA EVOLVING FUND | Domestic | https://www.faeringcapital.com |

| 16 | HVTCL | Global | https://unitus.vc/meet-us |

| 17 | ICICI PRUDENTIAL VENTURE CAPITAL FUND | Domestic | https://www.iciciventure.com |

| 18 | IDFC S.P.I.C.E. FUND | Domestic | https://www.idfcfirstbank.com |

| 19 | IL&FS ORIX TRUST | Domestic | https://www.ilfsindia.com |

| 20 | INDIA ALTERNATIVES PRIVATE EQUITY FUND | Domestic | https://www.india-alt.com |

| 21 | INDIA PLUS TRUST | Domestic | https://plustrust.org |

| 22 | IPRO CAPITAL PRIVATE EQUITY TRUST | Global | https://ipro.mu/asset-management |

| 23 | IVY CAP VENTURES TRUST | Global | https://ivycapventures.com |

| 24 | JM FINANCIAL INDIA FUND | Domestic | https://jmfpe.com |

| 25 | KOTAK INDIA VENTURE FUND I | Domestic | https://alternateassets.kotak.com |

| 26 | RELIANCE ALTERNATIVE INVESTMENTS FUNDS | Domestic | https://reliance.dk/alternative-investment-firms |

| 27 | SBI MACQUARIE INFRASTRUCTURE TRUST | Global | https://www.macquarie.com |

| 28 | TATA CAPITAL GROWTH FUND I | Global | https://www.tatacapital.com |

Private Equity Jobs in Mumbai

Now, I have written extensively on the reality of private Equity salary in India. Which, you can read to understand the various types of opportunities in this field. However, in this article I am going to be focused on the various core finance jobs in private equity firms in Mumbai.

Avendus Capital Private Equity Firm in Mumbai

So, avendus is a home grown name in the alternative investment space in India. In fact, it is one of the largest investment banks in Asia by deal volume.

Jobs Available at Avendus Capital in Mumbai

- Associate – Front End Investment Banking – IIM/ISB/MDI/FMS (1-3 yrs)

- Avendus – AVP – Frontend Investment Banking – CA/IIM/ISB/MDI/FMS (3-9 yrs)

- Avendus – Manager – Marketing & Corporate Communication (2-6 yrs)

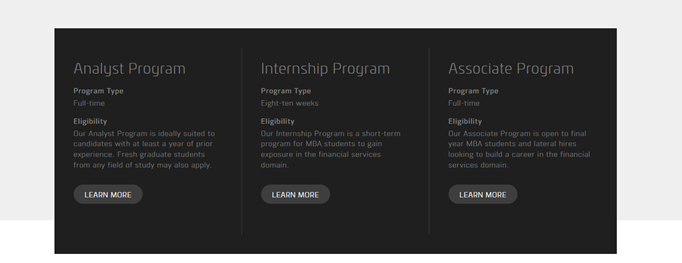

So apart from these live jobs posted, at the time of this article being written. Avendus, also has its own anaylst program for hiring

Ambit Private Equity Mumbai- Research Associate

Ambit capital is again, a big name in the institutional equities space. Now, this might not be a direct private equity job. But, since ambit has a private equity fund, this job might be your indirect entry into the PE space.

Skill Sets Required:

- · Keen interest in the automotive space

- · Understanding of various drivers in the auto sector, especially the changing powertrain aspects

- · Ability to build and maintain complex excel databases, decipher a wide plethora of data from arious industry sources

- · Perform secondary and primary research through channel checks, etc. to gather information about market size, key players, their management teams, suppliers, customers, products, etc.

- · Strong analytical and quantitative aptitude, keen attention to detail.

- · Hands-on knowledge of Excel and Word and market databases like Bloomberg etc.

- · Excellent communication skills, both verbal and written.

- · Ability to multi-task and work in a high pressure environment.

Motilal Oswal- Associate Private Equity Job Mumbai

MOSL, along with broking and fund management also has legs in private equity space. So, let me show you the job responsibilities.

Experience

- 1-4 years of experience after post-graduation in a private equity, investment banking firm and/or equity research

- Understanding of accounting and various valuation techniques

- Well versed with financial modelling and demonstrated experience in building financial models from scratch

- Prior experience in Life Sciences & Healthcare sector (will be a plus) Qualification: MBA Finance from a premier business school and/ or CA Other Qualification: Bachelors / Master’s in Pharmaceuticals / Chemical or a MBBS degree (not mandatory)

Pantomath Capital- Associate- IB

So, pantomath is a mid service investment bank in Mumbai, with presence across 12 countries.

Description :

Work on Execution / diligently on all deal or mandates assigned and ensure timely completion of all work :

a) Preparation of collaterals

b) Coordination with various stakeholders for seamless execution of the Transaction (due diligence and documentation)

c) Contribute towards negotiation and closing.

- Identifying opportunities in the industry assigned and conducting prospective meetings.

- Ideate leads in the focus sectors which should potentially translate to mandates and revenue. The leads could be buyside, sell side, PE raise or capital markets related; Oversee research for business development; Preparation of collaterals for business development.

- Work area includes preparation of deal documents (IM, Financial model, pitches etc), assisting in DD process thus leading to successful completion of the transaction.

- Working on building further understanding of the Consumer sector, and building network in the assigned sub sector.

- Assist in landscaping and ideation for creation of leads/mandates; Creation of collaterals for business development; Support the team in getting mandates.

Qualifications:

- CA or MBA with 2 – 5 years of cumulative work experience preferable in investment banking domain

- Strong knowledge of markets & experience with handling growth transactions

- Superior analytical skills, must be able to think creatively and achieve results quickly.

Private Equity Firm job market in Mumbai

Mumbai has over 550 private equity job opportunities as of July 2025. Due to robust GDP growth, continued deal flow, the outlook for private equity jobs in Mumbai remains strongly positive into late 2025. Despite possible volatility in fund-raising, the city’s role as India’s financial hub ensures it remains the center for new hiring and career advancement in PE/VC. Mumbai features a concentration of global and domestic PE leaders including Kotak, IIFL, Avendus, Motilal Oswal, and others who routinely recruit for analyst, investing, and operational roles across their platforms and portfolio companies. The Mumbai private equity job market in 2025 is dynamic, high-paying, and increasingly diverse, with expanding opportunities both in deal teams and operational/tech roles, as global and domestic capital continues to fuel growth and talent competition in the industry.

Recommended Pathway to Private Equity

Now, I am going to also give you a framework to understand, how to get into private equity firms in Mumbai. First of all understand, that an investment bank, equity research or private equity is very similar because the technical skills are common.

So I’ll first list out the common technical skills

- Firstly, financial statements analysis.

- Secondly, Business understanding and research( By far the most important skill required in Private equity).

- Thirdly, valuation and not just DCF valuation but all kinds of valuation.

- Finally, excellent writing skills.

Unique Skills for Private Equity

Now, just for private equity, things can become very real because in private equity we are investing in mid size and sometimes start ups.

So, the interation level with the owners of business and investors is quicker than it would take you in a typical IB set up doing IPO’s.

So the typical unique skills to private equity are;

- Sales skills

- Listening skills

- Story telling

While, these skills might sound like over simple but they are not. Sales skills, take time to become comfortable. Hence, people who are very keen on private equity, should never run away from sales.

FAQ

What is private equity firm?

Private equity firm is a financial organization from investors to create a pooled fund which is used to invest in organization or while acquiring the company.

Is 2025 a good year for private equity?

Yes a strong year for private equity firms as we see more hiring in 2025 from the firm's side. New capital inflows are seen along with economics growth

What is a salary of private equity firm employees in Mumbai?

Salary in Mumbai ranges from 15-25LPA and can be more for working in well known private equity firm.