Last updated on October 23rd, 2024 at 04:49 pm

You are free to use this image on your site, template etc. Just provide us the attribution link

What is Prepaid Expense?

Prepaid expenses represent expenditures that have been paid for in advance but not yet recorded as expenses. These are listed as assets on the balance sheet because they provide future economic benefits to the company. Common examples include prepaid rent and prepaid insurance.

Prepaid expenses entry

So, Prepaid expenses entry, represent expenditures that have not been recorded by a company as an expense but have been paid for in advance. While, a prepaid expense is a type of asset on the balance sheet For you that results from a business making advanced payment for the provided goods and services that you would be receive in the future.

Also,Prepaid expenses are expenditures in one accounting period, and they you will not recogniz until a later accounting period. Hence, the value of prepaid expenses is expensed over time onto the balance sheet. So, the most common examples of prepaid expenses are prepaid rent and prepaid insurance.

Also, the Pre Paid expenses you always shown in the asset side, because the other party who we have paid in advance is liable to provide us the service in the future. Hence its liability for the other party and asset for us

Types of Pre-Paid Expenses

| types of Prepaid Expense | Description | Example |

| Prepaid Rent | Payment made in advance for future rent periods. | A company pays a year’s worth of rent upfront to secure a favorable rate. |

| Prepaid Insurance | Upfront payment for insurance coverage over a specified period. | A car owner pays the full year’s premium at the beginning of the policy term. |

| Prepaid Subscriptions | Lump sum payment made in advance for services like magazines, newspapers, or streaming platforms. | Subscribing to a yearly magazine ensures regular issues without monthly payments. |

| Prepaid Maintenance | Upfront payment for maintenance contracts or service agreements. | A manufacturing plant pre-pays for equipment servicing throughout the year. |

| Prepaid Advertising | Upfront payment for advertising campaigns and media placement. | A company pre-pays for TV commercials or digital ads to run over a specific period. |

Meaning of Prepaid Expenses Journal Entry

According to GAAP (Generally Accepted Accounting Principles), prepaid expenses should be recorded in the same period as the benefit generated. For example, if a company leases a large copying machine for 12 months, the payment is recorded as a prepaid expense and expensed monthly over the lease period.

Example

For example, if you had a large copying machine that you leased by a company for a period of 12 months, the company benefits from its use over the full-time period. So, Recording an advanced payment made for the lease as an expense in the first month would not adequately match expenses with revenues generated from its use. Therefore, you should be recorded as a prepaid expense and allocated out to expenses over the full twelve months.

Now, Due to the nature of certain goods and services, prepaid expenses will always exist. For example, insurance premiums will always be a prepaid expense as it provides financial protection in the event of any unfortunate incident in the future. Also, No insurance company would sell you insurance that covers all the expenses after the unfortunate incident, so expenses must be prepaid.

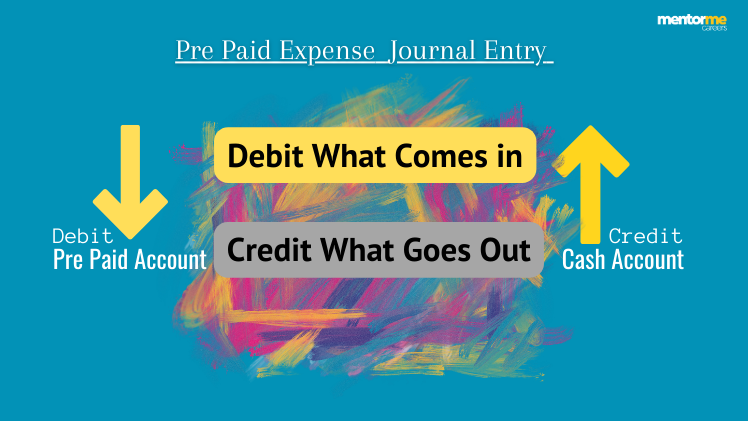

Journal Entry for Prepaid Expenses: Detailed Overview

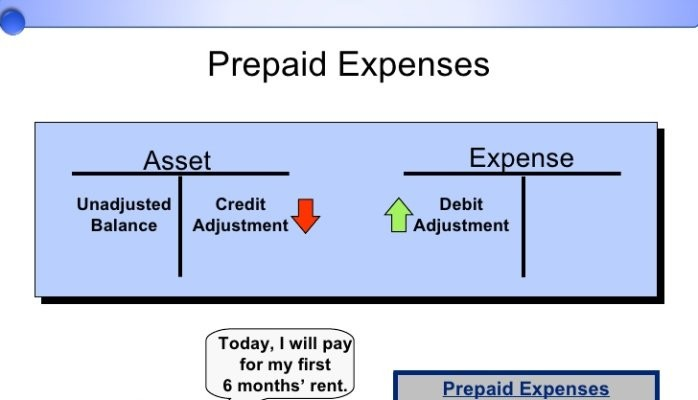

When recording the journal entry for prepaid expenses, it’s essential to recognize that these entries involve both the initial payment and subsequent adjustments. Initially, the prepaid expense is recorded as an asset, which reflects a future economic benefit for the company. The entry for prepaid expenses is made by debiting the prepaid expense account and crediting the cash account, indicating that payment has been made upfront. Over time, as the benefit of the prepaid expense is realized, it is gradually expensed. This means that the expense is spread out, aligning with the period in which it provides benefits. The adjusting journal entries reflect this allocation, ensuring that expenses are recognized in the correct accounting periods. For instance, a prepaid rent payment recorded as an asset is expensed monthly to match the benefit received during each month.

Prepaid Expenses Accounting: Detailed Insight

Prepaid expenses accounting involves recognizing and allocating expenses over the period they provide benefits. Companies must debit the prepaid expense account when making an upfront payment. This approach ensures that expenses are matched with the revenues they help generate, adhering to the matching principle. Journal entries for prepaid expenses are crucial in maintaining accurate financial records, impacting both the balance sheet and the income statement.

Recognizing Expenses Over Time: Accounting for Prepaid Items

Expenses over time need to be managed carefully to ensure accurate financial reporting. For prepaid items, such as insurance or rent, the cost is initially recorded as an asset. This approach ensures that the expense is recognized progressively throughout the benefit period. As time passes, the prepaid expense is systematically transferred from the asset account to the expense account through adjusting journal entries. This method aligns the cost with the periods that benefit from the payment, adhering to the matching principle. For example, if a company pays $12,000 for a one-year insurance policy, it will record $1,000 each month as an expense, reflecting the insurance coverage used in that month and maintaining accurate financial statements.

Prepaid rent journal entry

Firstly, As I told you that it is the cash paid in advance for a particular period like a quarter, year, month etc. So, The pre paid rent journal entry would be as follows:

| Date | Account | Debt | Credit |

| 31/03/2021 | Pre Paid Rent | 5000 | |

| 31/03/2021 | Cash | 5000 |

So, the adjustment entry after the rent period actually becomes current period will be

| Date | Account | Debt | Credit |

| 31/06/2021 | Rent Expense | 5000 | |

| 31/06/2021 | Pre Paid Rent | 5000 |

Prepaid Insurance Journal Entry

Similarly, pre-paid insurance would be dealt with, however, you would charge the insurance in the statements on a straight line amortization. Also, When you pay the pre-paid insurance, you would credit your expense account and the pre paid insurance account is debited.

| Date | Account | Debt | Credit |

| 31/03/2021 | Insurance expense account | 2000 | |

| 31/03/2021 | Pre paid insurance account | 2000 |

Effect of on Financial Statements

Also, Initial journal entries do not affect the company’s financial statements. However,Prepaid rent and credit to cash are asset accounts and do not increase or decrease a company’s balance sheet. While,Prepaid expenses provide future economic benefits to the company. For example,you paid a rent of $120,000 rent for a warehouse and showed an expense of $10,000 monthly on a balance sheet.

Prepaid expenses in the balance sheet

Firstly, let’s Assume a company ABC purchases insurance premium for the upcoming 12-month period and pays $180,000 upfront for it. So, ABC Company will initially book the full $180,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash. Also, Each month, you would make an adjusting entry to expense $15,000 (1/12 of the prepaid amount) to the income statement through a credit to prepaid insurance and a debit to insurance expense. Finally, In the 12th month, the final $15,000 will be fully expensed and the prepaid account will be zero.

Frequently Asked Questions on Prepaid Expenses Journal Entry?

What are the advantages of Pre paid expenses?

Prepaid expenses offer several key advantages. They enable better budgeting and expense management by allowing businesses to pay for future services or goods at current prices. This shields them from potential price increases. Prepayments can also improve cash flow management, as upfront payments might come with discounts or favorable terms. Additionally, they streamline accounting by simplifying expense recognition over time, reducing monthly fluctuations. Businesses can leverage prepaid expenses to enhance financial stability, negotiate better terms with suppliers, and allocate resources more efficiently. Overall, prepaid expenses contribute to smoother operations, cost savings, and improved financial planning in various industries.

Are prepaid insurance a current assets?

Yes, prepaid insurance is considered a current asset on a company’s balance sheet. This is because prepaid insurance represents an expense that the company has already paid for but has not yet consumed or used. Since it’s expected to be utilized within the upcoming accounting period (usually one year), it falls under the category of current assets, which are resources that are expected to be converted into cash or used up within a relatively short period of time. As the prepaid insurance gets consumed over time, it gets gradually recognized as an expense on the income statement.

What are some examples of Pre Paid Insurance?

Here are some examples of prepaid insurance:

- Auto Insurance: A company pays its annual auto insurance premium in advance. The portion of the premium that covers the current accounting period is recorded as a prepaid insurance asset.

- Property Insurance: A business pays for property insurance coverage for the next six months at the beginning of the year. The amount paid in advance is recorded as a prepaid insurance asset on the balance sheet.

- Health Insurance: An employer pre-pays health insurance premiums for its employees for the upcoming quarter. The prepaid portion is considered an asset until the coverage period is reached.

- Liability Insurance: A company pays for liability insurance coverage for the year ahead. The portion applicable to the current year is recognized as a prepaid insurance asset.

- Travel Insurance: A travel agency buys travel insurance to cover its tour packages for the next six months. The unutilized portion is classified as prepaid insurance.

- Professional Liability Insurance: A consulting firm pays for professional liability insurance for the next twelve months. The portion attributed to the current accounting period is treated as a prepaid expense.

Is prepaid insurance a debit or credit?

In accounting, prepaid insurance is initially recorded as a debit to the “Prepaid Insurance” asset account and a credit to the “Cash” or “Bank” account. This reflects the fact that the company has made a payment in advance for insurance coverage, which increases the prepaid insurance asset but decreases the cash or bank balance.

As the insurance coverage is consumed over time, the prepaid insurance asset is gradually reduced, and an expense is recognized. This is done by debiting the “Insurance Expense” account and crediting the “Prepaid Insurance” asset account. The goal is to match the expense with the period in which the insurance coverage is being utilized.