Last updated on November 13th, 2025 at 12:55 pm

In this article we discuss the comprehensive coverage of the limitations of accounting.

So, you start reading the annual reports of a company and tabulating the numbers. While you punch in those numbers and believe this is a great company?

But what if I told you that you might feel great because the accountant wants you to feel that way? So, just like as an analyst, you seek to be right in understanding a company. Similarly, an accountant’s job is to make you feel good about the numbers. An accountant is not even remotely interested in whether your business is good, bad or ugly.

Accounting audits ensure the following of accounting principles, not investing principles.

What is accounting?

Accounting is the systematic process of recording, classifying, summarizing, and analyzing financial transactions of a business to provide insights into its financial position and performance.

It forms the backbone of every business decision helping stakeholders evaluate profitability, liquidity, and sustainability.

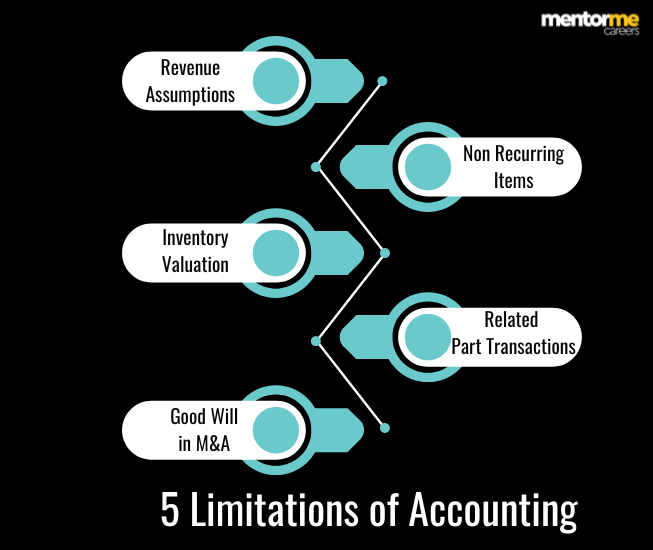

Limitations of Accounting Key Takeaways

- Revenue Manipulation is first and big limitations of accounting.

- Exceptional items should be non recurring and limited amount

- Over and under valuing inventory to manipulate profitability

- Laundering income as expenses through internal related party transactions

- Unwanted acquisitions. For eg cox and kings case where huge debt was taken to buy out and launder banks company.

Why understanding its limitations matters?

While accounting offers quantitative accuracy, it’s not free from limitations.

Failing to recognize these boundaries can lead to misinterpretations of financial health, poor decision-making, and incomplete business insights.

Understanding these limitations helps: Prevent overreliance on outdated financial data.

Support better strategic and managerial decisions.

Integrate qualitative and modern analytical tools for holistic evaluation.

The Rozy Pictures in Accounting

When you invite someone to your home to sell the house, what do you do? Do you go and show him every problem you faced in that house? Also, maybe you also tell him how obnoxious your neighbour’s dogs are, as they constantly bark at night?

Now, you don’t do that, and I don’t think no one in this world will do that. However, ask yourself why? Because it hurts sales.

Then, how do you expect a company, no matter how good they are, can you expect them to give you an accurate picture?

Let me give you some statistics here.

Financial statement fraud is the most costly form of occupational fraud, causing a median loss of $1,000,000;

Gettry Marcus’ Certified Fraud Examiners

Now, there you go; it’s the most common fraud that can be done because it’s so easy.

Limitation Number 1- Revenue Manipulation

Revenue manipulation occurs when companies inflate or misreport sales to show higher earnings or meet market expectations. It’s one of the most common financial statement frauds.

The number one place and the most frequent place to manipulate financial statements is revenue. Let me show you how a company and its accountants can do that.

- Booking Revenue Ahead

So, how does this work? E.g., You run a company, and the customer pays you for a monthly subscription, but you show an invoice for an annual plan. According to the principle, there is nothing wrong in this, but it bloats the revenue more than it should.

“They (Byju’s) have had to move parts of their revenue for it to be approved as per Indian Accounting Standard (Ind-AS) 115 rules… For example, revenue projected in one financial year for a multi-year fee can’t be used as that year’s revenue alone,” said an industry executive who spoke to ET recently.

Economic Times Article

In the above case, Byju was overbooking the revenue as per the information provided by Deloitte, its auditing firm.

- Other Income

Impact:

- Misleads investors about company performance.

- Artificially boosts stock prices or management bonuses.

- Leads to restatements, penalties, or legal actions (e.g., Satyam case in India).

How to Avoid It:

Follow revenue recognition principles (IFRS 15 / Ind AS 115) strictly.

Use independent audit checks for large end-of-quarter transactions.

Enforce internal control systems that tie revenue recognition to delivery or service completion.

You might be fooled into believing that a company has a fantastic profit after tax, but the devil is in the details. The company might have bought and sold private companies, showing huge gains.

Limitation Number 2- Exceptional Items

Exceptional items are one-off income or expenses that don’t recur in regular operations often used to distort profitability in a given period.

Example:

A company records ₹10 crore profit from the sale of old machinery as part of its “operating income,” inflating its operational profit margin.

Impact:

- Creates a false impression of profitability and operational efficiency.

- Misleads analysts and investors tracking performance trends.

How to Avoid It:

Disclose exceptional items separately in the financial statements. Avoid classifying non-operating gains/losses as part of recurring business results.

Follow Ind AS 1 for presentation consistency and transparency.

An easy and often overlooked place, exceptional items are not so exceptional these days with companies. So, the crux is, put; nothing doesn’t have an explanation for extraordinary items. However, these entries can be red flags if they are often too often.

Limitation Number 3- Inventory Valuation Gimmicks

These occur when companies manipulate inventory figures to impact cost of goods sold (COGS) and profits usually by overvaluing unsold goods or delaying write-offs.

There are a lot of scopes to manipulate the costs if you can’t manipulate the revenue. Moreover, giving the impression that the margins are increasing.

For example:

Company ABC is the in the business of manufacturing sugar, and it buys sugar cane in advance. In the market, sugar cane costs are rising, leading to lower margins in the profit and loss statement. The CFO came up with the idea that we could stop buying new sugar cane and use the FIFO inventory valuation method.

Impact:

- Overstates assets and net income.

- Misleads lenders and investors about working capital health.

- Causes abrupt write-downs later when inventories are corrected.

How to Avoid It:

Follow lower of cost or NRV principle (Ind AS 2).

Conduct regular physical verification of stock.

Implement inventory aging reports and automatic obsolescence checks.

So, the result is that in the income statement, older inventories are cheaper, leading to higher margins in the books. However, in reality, nothing has changed.

Limitation Number 4: Employee Kickbacks

Kickbacks are illegal payments or rewards given by vendors or employees in exchange for preferential treatment, contracts, or procurement approvals.

There is no way to identify if all the transactions done with employees and senior managers are legitimate. There might be many such kickbacks in the form of marketing, travelling expenses or even consulting income. Which is nothing but the management of costs.

Also, in the same category, I would like to point out another method where accounting can be used very creatively.

Suppose you have an interest expense, which could lower your profitability in the books. So a simple method to manipulate that is to create a capitalised asset in the balance sheet and depreciate it after a couple of years.

Example:

A purchasing manager receives 2% of every contract value from a supplier in exchange for approving inflated prices.

Impact:

- Financial loss and inflated project costs.

- Erodes company integrity and trust.

- Legal consequences under anti-corruption laws (Prevention of Corruption Act in India).

How to Avoid It:

Establish whistleblower channels and vendor rotation policies.

Enforce dual-authorization in procurement.

Conduct forensic audits and random supplier reviews.

Limitation Number 5: Mergers and Acquisitions

M&A manipulation occurs when companies use mergers or acquisitions to hide poor performance, inflate goodwill, or disguise losses through accounting adjustments.

Amid all the seriousness of a merger and acquisition activity, I could also charge ” Merger Expenses”. In other words, although I might acquire another company for, let’s say, X, but I pay in the books X+ 20%. However, you will never know who got that X+20%, and it can also be paid in the form of stock issued to the other party.A Brief look at Accounting Standards.

Impact:

- Creates artificial balance sheet strength.

- Misleads shareholders about synergy value.

- Results in large impairment charges later when goodwill is tested.

How to Avoid It:

Conduct independent due diligence before M&A deals.

Follow IFRS 3 / Ind AS 103 (Business Combinations) for fair-value accounting. Test goodwill annually for impairment and disclose acquisition rationale transparently.

| Manipulation Type | Example | Impact | How to Avoid It |

|---|---|---|---|

| Revenue Manipulation | Recording sales before delivery | Misleads investors | Follow IFRS 15, audit revenue cut-offs |

| Exceptional Items | Classifying asset sale profit as operating income | Inflates margins | Disclose separately under Ind AS 1 |

| Inventory Gimmicks | Overvaluing obsolete stock | Overstates profit | Apply lower of cost or NRV, verify physically |

| Employee Kickbacks | Procurement bribes | Inflated costs | Whistleblower policy, dual approvals |

| M&A Manipulation | Inflated goodwill post-acquisition | Hides losses | Fair valuation, annual impairment test |

Real-World Examples of Accounting Limitations

| Limitation | Example | Impact |

| Historical Cost Principle | A company reports machinery bought 10 years ago at ₹10,00,000 despite its current value being ₹30,00,000. | Results in undervaluation of assets. |

| Non-Monetary Factors Ignored | Employee satisfaction or brand loyalty not recorded in accounts. | Misses out on qualitative success indicators. |

| Inflation Not Considered | Revenue looks higher, but purchasing power has decreased. | Misleading profit trends. |

| Different Accounting Standards | GAAP vs. IFRS differences make comparison across borders difficult. | Lack of comparability. |

| Window Dressing | Management manipulates timing of transactions to show higher profits. | Misleads investors and stakeholders. |

How to Avoid Limitations of Accounting

Use managerial accounting to avoid limitations

- Track non-financial indicators

- Use cloud accounting tools

- Use dashboards & analytics

- Use internal audits & controls

- Adopt IFRS where possible

| Manipulation Type | How to Avoid It |

|---|---|

| Revenue Manipulation | Follow IFRS 15 / Ind AS 115 revenue recognition rules; enforce delivery-based recognition; conduct independent audit checks for quarter-end sales. |

| Exceptional Items Misuse | Disclose exceptional items separately; avoid including non-operating gains/losses in operating profit; follow Ind AS 1 presentation guidelines. |

| Inventory Valuation Gimmicks | Use lower of cost or NRV (Ind AS 2); conduct regular physical verification; maintain inventory aging reports and write-off controls. |

| Employee Kickbacks | Implement whistleblower mechanisms; enforce dual approval for procurement; conduct forensic audits and vendor rotation. |

| M&A Manipulation | Use fair-value accounting (Ind AS 103 / IFRS 3); conduct independent due-diligence; test goodwill annually for impairment and disclose acquisition rationale. |

Loop Holes in Accounting Standards

One of the reasons why there exists limitations in accounting, is for the trade off that happens with flexibility. On one side business’s want flexibility to fit in their complex business assumptions, but at the cost of accuracy.

A brief Look at International Financial Reporting Standards

The sole objecting of IFRS is to ensure uniformity, not transparency. It’s not possible to have uniformity with accuracy at the same time. Think about it for a second. Let us assume the research and development expenses and the accounting standard in IFRS for it.

So let’s look at what the IAS 38 Standard says.

Under IAS 38, an intangible asset arising from development must be capitalised if an entity can demonstrate all of the following criteria:

- the technical feasibility of completing the intangible asset (so that it will be available for use or sale)

- intention to complete and use or sell the asset

- ability to use or sell the asset

- existence of a market or, if to be used internally, the usefulness of the asset

- availability of adequate technical, financial, and other resources to complete the asset

- the cost of the asset can be measured reliably.

So there are 6 ways of capitalising development expenses and this leads to a lot of mis use of getting the fancy and creating accounting to seep in.

Role of Financial Analysis, Managerial Accounting & Modern Tools

Financial Analysis:

Helps interpret ratios, trends, and comparative statements to detect inconsistencies and performance gaps.

Managerial Accounting:

Goes beyond traditional accounting by providing forward-looking, decision-oriented insights such as budgeting, forecasting, and variance analysis reducing dependency on historical data alone.

Modern Tools & Technologies:AI & Automation: Detects anomalies and fraud patterns.

Data Analytics & Dashboards: Offers real-time decision-making.

Cloud Accounting Software: Improves transparency, compliance, and scalability.

Sustainability Reporting: Incorporates ESG (Environmental, Social, Governance) data for 360° performance evaluation.

Examples:

Zoho Books

QuickBooks

Tally Prime

SAP, Oracle

Power BI dashboards

Addressing Limitations through Operational Efficiency

One way to mitigate these limitations of accounting is by focusing on operational efficiency. By improving how a business operates, you can get a clearer picture of its financial health. Look beyond the financial statements and assess the popularity and reliability of its products, customer feedback, and market presence.

Enhancing Financial Transparency

Ensuring transparent financial transactions and accurate cash flow statements are crucial for reliable financial analysis. Using comprehensive study material and rigorous preparation of financial statements can help identify discrepancies early. Maintaining thorough accounting records and understanding various branches of accounting can provide a more accurate view of a company’s financial health.

Conclusion

Always trust no one when analysing companies. The reality of a business’s financials is reflected in the popularity of its products and happy customers. More insights are generated by looking at companies, customer feedback and reliability. Hence move out of the financial statements and also correlate whether the same feedback is received in the product’s market, as is shown in the financial statements. The key benefit of reporting and the flexibility itself is the biggest limitation of accounting.

Frequently Asked Questions

The five key limitations are:

1.Dependence on historical cost

2.Ignoring qualitative factors

3.Inability to adjust for inflation

4.Variation in accounting standards

5.Possibility of manipulation or window dressing

Accounting focuses on quantifiable data. Non-monetary aspects like employee morale, brand value, and customer loyalty aren’t recorded, even though they influence long-term success.

Inflation causes book values of assets and profits to appear outdated. As purchasing power falls, reported profits might seem high even when real gains are minimal.

Different countries follow varying principles (e.g., IFRS, GAAP), leading to differences in recognition, measurement, and disclosure making direct comparison difficult.

Managerial accounting introduces budgeting, forecasting, and performance analysis, offering real-time and predictive insights that complement traditional accounting data.

Absolutely. Financial statements remain essential for baseline evaluation, but they should be interpreted with context, considering inflation, non-financial data, and modern analytical insights.

1.Historical Costs: This head of the income statement is such that it records transactions based on historical costs, transactions which might not at times be reflective of the current market conditions and therefore serve to misrepresent financial performance.

2. Non-Financial Factors: It fails to take into account non-financial factors such as employees’ morale, customer satisfaction, and market conditions, which are likely to weigh a lot in the performance of the company.

3. Estimates and Assumptions: Income statements depend on estimates and assumptions for items such as depreciation and bad debt; this feature can introduce bias and inaccuracy.

4. One-Off Items: One-off or non-recurring items may cause the result to be distorted, and hard to read concerning the company’s ongoing operational performance.

5. Accounting Policies: Different accounting methods and policies can create incomparability among firms, which makes it very difficult to evaluate financial performance consistently for different organizations.

IFRS

1. Complexity and cost, which require significant modifications and training.

2. Subjectivity of judgment, thus leading to discrepancies.

3. Frequent measurements at fair value cause much volatility.

4. Extensive disclosure leading to information overload.

GAAP

1. Rules-based approach limiting flexibility and adaptability.

2. Numerous rules increase complexity and chance of errors.

3. Understate assets and incomes as a possibility of the conservative approach.

4. Fair value measurements introduce volatility and subjectivity.