Last updated on December 15th, 2025 at 11:29 am

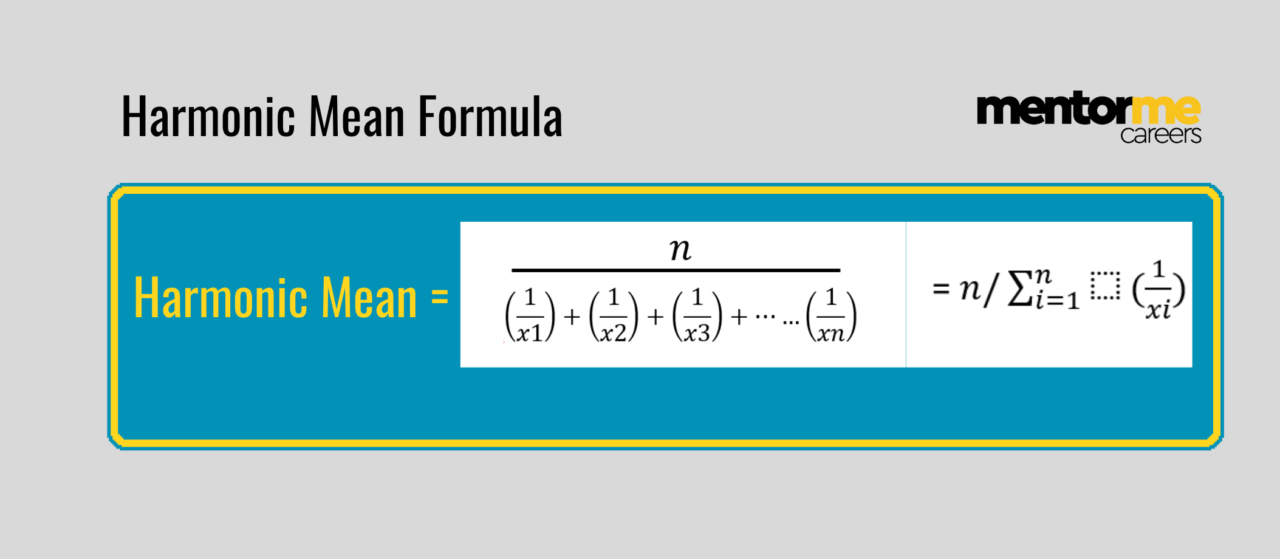

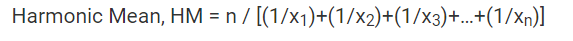

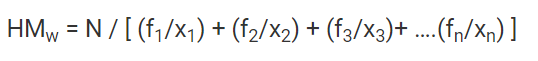

Harmonic mean formula: For n positive numbers \(x_1,…,x_n\), the harmonic mean is HM = n ÷ (1/x1 + 1/x2 + … + 1/xn). Use HM to average rates (speed, P/E ratios) where denominators matter.

In statistics, data science or just general everyday decisions, we always are interested in knowing the middle value.

Like what’re the average marks, average speed or average returns etc.

In technical terms, we also call it central tendency.

Example: harmonic mean of 2 and 8.

- Number of observations n=2n = 2n=2.

- Compute reciprocals: 1/2=0.51/2 = 0.51/2=0.5. 1/8=0.1251/8 = 0.1251/8=0.125.

- Sum reciprocals: 0.5+0.125=0.6250.5 + 0.125 = 0.6250.5+0.125=0.625.

- Apply formula: HM=n/(sum reciprocals)=2/0.625HM = n / ({sum reciprocals}) = 2 / 0.625HM=n/(sum reciprocals)=2/0.625.

- Division: 2÷0.625=3.22 ÷ 0.625 = 3.22÷0.625=3.2.

Result: HM = 3.2

I will try to make this article as practical and easy as possible. So hang on and read till the end.

Applications of Harmonic Mean Formula Example

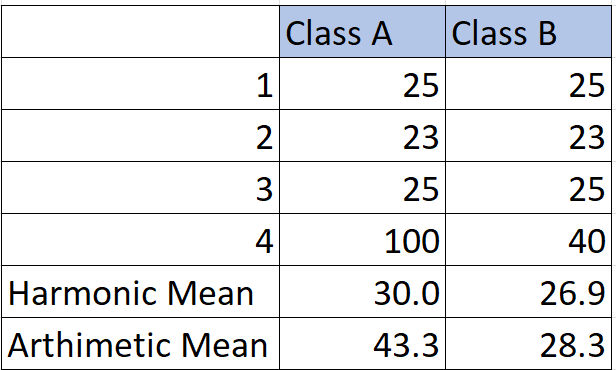

Consider the following example Class A students and Class B students. You want to find out what’s the average score of students. However, there is a problem, which is that in class A students, there is one student who has got 100. So how is that a problem?

Well, that one score shoots up the average and gives you a false sense of performance.

So, the solution to that is Harmonic Mean.

- Which will give a lesser weightage to the extreme values

- More weightage to the regular non-extreme values.

Making the average measurement more reliable.

So what’s important for you to remember is, when it is used.

When the data has larger extreme values.

Harmonic Mean Formula

Now, as discussed in the last part, regarding giving less weightage to the larger extreme values?

Hence we need to understand first the weightage process of normal arithmetic.

- This is equal to the case of a normal average; in other words, if we have four data observations, then each has 25%.

- The harmonic process is exactly the opposite; we take the reverse of the values, i.e. Class A (1/25+1/23…..+1/100).

- Hence you can observe that 100, a larger extreme value, becomes even smaller.

- So 25 gets a weightage of 4%, 100 gets a weightage of 1%

- Next, we added up all the reversed values (1/25+1/23/+1/25+1/100)=0.13

- Divide N/( 0.13)= 4/0.13 which equals 29.96.

Measuring Central Tendency with Harmonic Mean

The harmonic mean is a robust measure of central tendency, especially useful when the data set includes large outliers. By averaging the reciprocals of the data points, the harmonic mean gives a more accurate representation of the central value, particularly in scenarios involving rates and ratios. This method is rigidly defined and provides consistency across various applications.

3 Harmonic Mean Formula Applications

In finance, the harmonic mean is used to average rates, ratios, or multiples, particularly when the values indicate “price per unit” or when each data point should be equally weighted by quantity rather than numerical size.

Method: How to Apply the Harmonic Mean (Step-by-Step)

- Identify that the data represents ratios or rates

Examples: P/E ratios, speed, cost per unit, returns per unit, etc.

Harmonic mean is appropriate when you want each observation to contribute equally. - List all values (x₁, x₂, x₃ … xn)

These should be positive non-zero values (harmonic mean cannot be computed with zero). - Take the reciprocal of each value

Compute:

1/x₁, 1/x₂, 1/x₃ … 1/xn - Add all the reciprocals together

Sum = (1/x₁ + 1/x₂ + … 1/xn) - Divide the number of observations by the sum of reciprocals

Harmonic Mean (HM) =

n / (Σ 1/xᵢ) - Interpret the result

The harmonic mean gives a better “central value” when averaging ratios because it reduces the impact of extreme high values.

Every time you come across a situation to check if harmonic means can be used, follow the below rule.

The harmonic mean is used when a fixed quantity is repeatedly applied for a result.

Application 1: Finding the average speed of Cars

Let me take an example here. What should be the average speed?

- Reverse the speed values : 3/(1/10+1/20+1/30)= 16.36 Km/Hr

Application 2: Investing in Mutual funds across Periods

Again, notice here that the investment amount must be the same across periods.

So, for example, You invest $5000 across five periods, with the purchase price of a mutual fund being $100, $200, $75, $150, or $300. What’s the average price per unit?

So, the solution would be:5/ (1/100+1/200+1/75+1/150+1/300)

You can test the values and check that the simple average gives a wrong answer for total investments.

Application 3: P/E Ratio

So I plotted the Harmonic Mean of the NIFTY PE Ratio using the harmonic mean and simple average. Notice how initially HM and AM are identical, but as we keep progressing, adding more values then the simple average overestimates the mean. Hence harmonic mean makes more sense.

The Relationship of Harmonic Mean, Arithmetic Mean, Geometric Mean

The above three means are also called Pythagorean means.

You might be wondering, am I going to make this complicated? Not.

However, let’s try to play a little with numbers.

- Arithmetic Mean: a +b /2

- Geometric Mean:√ab

- Harmonic Mean: 2/(1/a+ 1/b) or 2 ab/(a+b)

So we can replace 2ab with geometric mean square because GM is √ab.

- Therefore, harmonic mean = 2 (GM)²/(a+b)

but 2/(a+b) can also be said to reverse AM.

Hence, Harmonic Mean= (GM)²/AM

Harmonic Mean Formula Vs. Mean/Median & Mode

By the way, the arithmetic mean is also called mean in general parlance. Also, the concept of median and mode, which of course, is not a part of this article, but I will share some quick light.

All that median is trying to do is to find the middle position (N+1)/2 in case of an odd number of total observations, while the N/2 position is in case of even. This needs to happen while the data is arranged in ascending order.

Why? How else would the position make sense right?

Similarly, the model is trying to find the data which repeats itself the most.

So frequency is what we are trying to find.

In summary, it means is the

- Mean: algebraic addition divided by the no of observations

- Media: Is the middle position of data arranged in an ascending order

- Mode: The data that repeats itself the most

Uses of Harmonic Mean Formula

Given below are some of the popular uses of the harmonic mean

- It can be used in speed calculation because speed is already a ratio of distance over time.

- Heavily used in finance when dealing with multiple

- It can be used to finance patterns in the Fibonacci series

- Very helpful when dealing with data which has larger extreme values

Weighted Harmonic Mean for More Accurate Analysis

In certain scenarios, it’s beneficial to apply a set of weights to the harmonic mean to reflect the importance of different data points. This weighted harmonic mean ensures that the calculation accounts for varying significance among the values, providing a more nuanced and precise result. This approach is particularly useful in finance and investment analysis, where not all data points carry equal importance.

Weighted Harmonic Mean Formula

This is just a special case, where along with finding the mean, we also wish to assign weightage.

However, all the weights should add up to 1.

So, all that changed from our previous formula, instead of just reciprocal. We know are dividing it by the weightage.

An unweighted harmonic mean(HM), assigns equal weightage to all values, right?

However, if you wish to assign weightage, then you could use this method.

Just to add here, this is not a special case of just harmonic mean, but you could also find weighted arithmetic mean too.

Advantages of Harmonic Mean Formula Versus Averages

Consider that you are evaluating a mutual fund investment scheme. Which one of the below questions will you be interested in asking?

- What was the highest return for a particular month?

2. Or what have been the average returns?

Let’s take the example on this sheet: Franklin Templeton MF.

Average | Median |

0.58% | 1.02% |

After the analysis, we concluded that the average monthly return is:

- Does the central location itself give you any information?

- What if we were to find how much each day fluctuates from the centre?

- Because we are always interested in the average fluctuation, which will somehow affect our capital volatility.

- Imagine investing in a fund, and even though the returns are good at 21% annual.

- Just when you were planning to buy a house, the fund experienced a -70% fluctuation.

- This is why we are learning statistics and managing risk is more important than targeting returns.

Harmonic Mean Formula Additional Examples

Application of Harmonic Mean Example -1

You have to find the harmonic mean of the average P/E ratio of the index of the stocks of Company A and Company B.

- Company A has a market capitalization of US$1 billion and earnings of US$20 million.

- Company B has a market capitalization of US$20 billion and earnings of US$5 billion.

- The index comprises 40% of Company A and 60% of Company B.

We first need to calculate the P/E of each company.

The calculation can be done in the following way:

- P/E (Company A) = ($1 billion) / ($20 million) = 50

- P/E (Company B) = ($20 billion) / ($5 billion) = 4

We must use the weighted harmonic mean to calculate the P/E ratio of the Index.

Using the formula for the weighted harmonic mean, the P/E ratio of the index can be found:

P/E(Index) = (0.4+0.6) / (0.4/50 + 0.6/4) = 6.33

Application of Harmonic Mean Example-2

This central tendency method is particularly useful for rates or ratios. For example, look at the harmonic mean of P/E Ratios of Nifty

What this does is the exact opposite of the weighted mean.

The higher the value, the lower the proportion.

If you had calculated the average rate of P/E, how would you calculate it? You would have got 30 and if you had calculated the Weighted mean you would have got 32.

P/E Ratios- nifty | Inverse Value(1/x) |

25 | 4% |

35 | 3% |

40 | 3% |

20 | 5% |

Sum of Inverse | 14% |

HM (no of obs/ sum of inverse) | 27.86 |

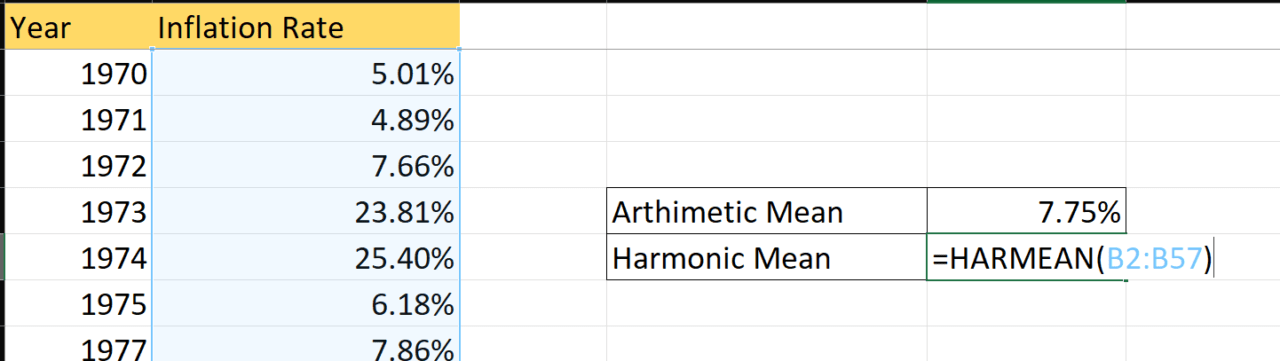

Harmonic Mean Formula in Excel?

Calculating the harmonic mean in excel is easy because it saves the trouble of manually finding the inverse using the harmonic mean.

God bless bill gates for creating spreadsheets!

However a word of caution, the harmonic mean doesn’t work with negative or zero values.

You can practice this in this template:

Advantages of Harmonic Mean

While we saw how to calculate this and, at the same time, learnt when to use it.

Now its time to look at its advantages:

- It’s appropriate for the time and rate calculation

- It can be useful for derived mathematical calculation

- The harmonic mean isn’t affected by the outliers

Disadvantages of Harmonic Mean

Of course, nothing comes without some shortcomings, and this method likewise has some challenges.

- The method is complex.

- It gets affected by extreme values in opposite situations to the arithmetic mean.

Arithmetic vs geometric vs harmonic mean

Three noteworthy types of averages employed in statistics and finance are the arithmetic, geometric, and harmonic means. For straightforward averages, the arithmetic mean functions best; for growth percentages and compounding, the geometric mean functions best; and for ratios and rates, the harmonic mean functions best. Especially in fields like investing, performance gauging, and quantitative analysis, choosing the suitable mean assures precise evaluation and accurate interpretation.

| Type of Mean | Formula (Simple) | Best Used For | Key Insight |

| Arithmetic Mean | (x₁ + x₂ + … + xₙ) / n | Normal averages, independent values | Highest among the three; not ideal for growth rates. |

| Geometric Mean | (x₁ × x₂ × … × xₙ)^(1/n) | Growth rates, returns, compounding | Captures compounding; always ≤ arithmetic mean. |

| Harmonic Mean | n / (1/x₁ + 1/x₂ + … + 1/xₙ) | Rates, ratios, speed, P/E averaging | Lowest mean; useful for rate-based datasets. |

Arithmetic Mean – best for simple averages.

Geometric Mean – best for percentage returns & compounding.

Harmonic Mean – best for rates and inversely related values.

Conclusion

Central tendency is a large and wide concept, having its application in modern-day machine learning.

It is important to understand the core objective of calculating central tendency, without which you can make some serious errors with your decisions. Imagine that you are deciding to invest $100 Mn in an investment opportunity while concluding its average risk.

Selecting an inappropriate method of calculation could mean disaster. Similarly, imagine you are trying to measure the chance of failure for a business project, and we casually look at a skewed sample.

The skewed sample might contain data from only successful projects and not failures.

Moreover, it is also possible that the data has a time bias, which was particularly favourable for this project. On the contrary, this could also be true with a data set that contains only failures.

You see, it’s not about calculating a value; it’s about what exactly we intend to do with that value.

We are in an education system that casually deals with concepts and fundamentals without any heed to their real-world relevance. Hence it’s important that as students of maths, finance or science, you push beyond what the curriculum draws on.

FAQ

The harmonic mean formula is:

HM = n / (1/x₁ + 1/x₂ + … + 1/xₙ)

It is based on reciprocals and is useful when averaging rates.

Use the harmonic mean when averaging rates, ratios, speeds, or multiples especially when each value carries equal weight but time or quantity varies. It’s ideal for finance metrics like P/E ratios.

The harmonic mean is usually the smallest because it gives greater weight to lower values, pulling the overall average down. This makes it more accurate for rate-based data.

In finance, the harmonic mean is used to average P/E ratios because it properly accounts for valuation distortions when earnings differ across companies. It avoids the bias created by high P/E outliers.

No. The harmonic mean cannot be used with zero (division by zero) or negative values, because reciprocals become undefined or misleading.

For any set of positive numbers:

Harmonic Mean ≤ Geometric Mean ≤ Arithmetic Mean

This is known as the HGA inequality and is always true unless all values are equal, in which case all three means are the same.

Yes. The F1 score in machine learning is the harmonic mean of precision and recall, giving a balanced measure of both metrics.

Related Articles

- How to calculate the average collection period?

- Capitalisation of average profit method formula

- Guide to the profit volume formula and excel template

- Proprietary ratio formula simplified

- Ratio analysis problems with solutions