Last updated on October 23rd, 2024 at 03:41 pm

So, you heard about risk management, and quickly got the most relevant keyword. Which is FRM Course, and thought of it as a ticket to glory with this certification. Now, before you jump the gun and start paying the fees and studying for this exam, read my little guide on the FRM Course.

What is The FRM Course?

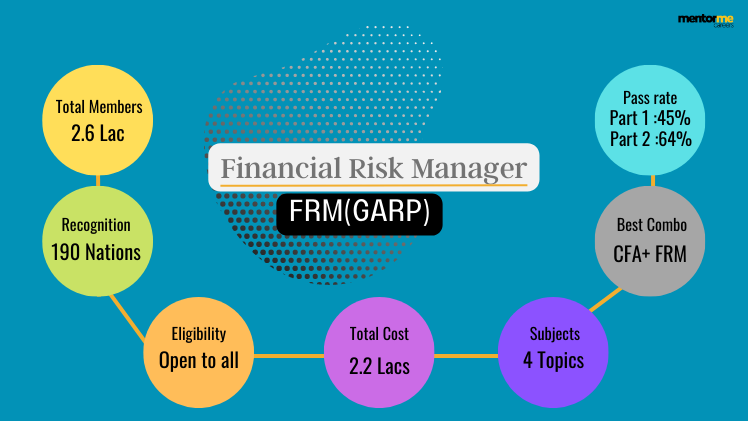

Now, the FRM course is one of the best-known certifications, or rather the most relevant risk management certification in the world. And just like the CFA program is popular for investment jobs. While the CA program is known for accounting careers.

Similarly, the FRM Course is known for financial risk management careers, which is given by GARP or Global Association of Risk Professionals. Another interesting piece of fact is that since 2018, CFA program candidates have been dropping. On the other hand, FRM Course candidates have seen almost a 40% growth. I will explain the reason in this article.

FRM Full form

FRM Full form stands for Financial Risk Manager Certification By GARP, financial risk management course qualification.

The FRM Certification: A Globally Recognized Credential

The FRM certification is globally recognized as a gold standard in financial risk management. Awarded by GARP, this certification signifies a professional’s expertise and commitment to managing financial risks. The rigorous curriculum and examination process ensure that only the most competent candidates earn the FRM designation, making it a prestigious credential in the field of risk management.

FRM Course Eligibility

So, just like the CFA program, even the FRM Course doesn’t have any eligibility. It’s an open door that anyone can open irrespective of their educational background But you need to be on the final year of your graduation.

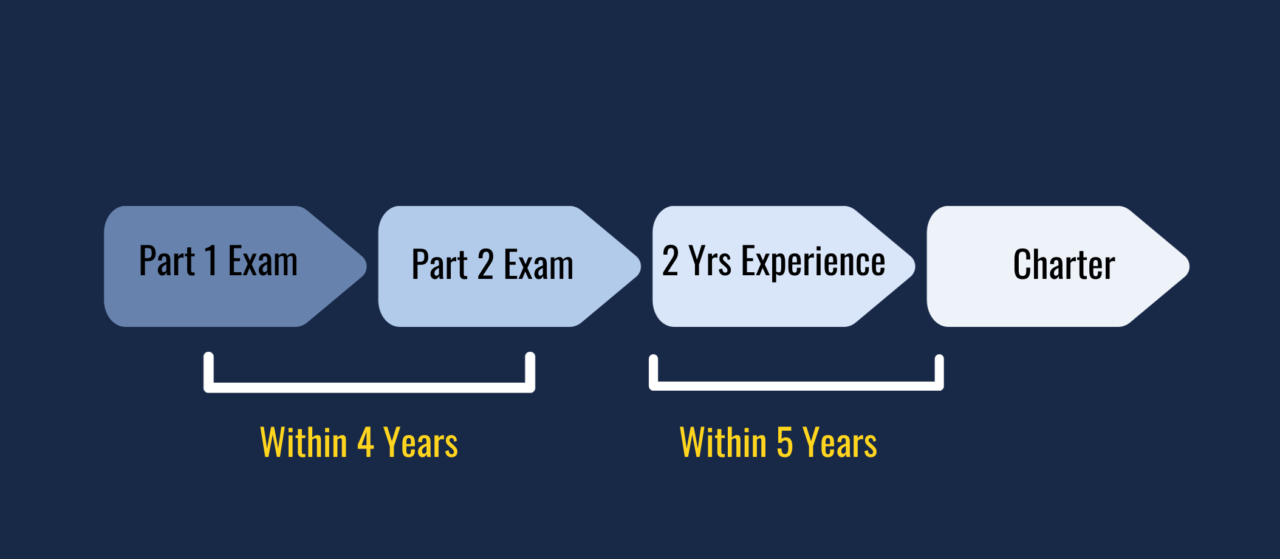

However, in order to write the initials(FRM) after your name you need to fulfill the following conditions

- Pass the FRM Exam Part I

- Pass the FRM Exam Part II by December 31 of the fourth year of passing the FRM Part I

- Submit two years of full-time relevant financial risk management work experience

FRM Charter process image

FRM Course Membership Experience Type

So, you must note that not all types of experience is acceptable for the FRM membership. The FRM website clearly mentions the type of experience that is counted i.e

- Firstly the experience should be related to risk identification, monitoring, or risk management.

- For example; Risk analysis, model risk management, audit, and consulting.

So, notice that even audit is considered a part of risk management experience.

In my experience, generally, I have rarely seen anyone not qualifying for their membership because of experience criteria. Majorly the reason is subjectivity in explaining your experience with risk management.

The Importance of Relevant Work Experience in FRM Certification

A crucial aspect of earning the FRM certification is the requirement for relevant work experience. This experience must involve tasks related to risk identification, monitoring, or management. Roles such as risk analyst, model risk manager, auditor, and consultant typically qualify. This real-world experience ensures that as an FRM charterholders you are well-prepared to tackle complex risk management challenges in their professional careers.

Let me briefly touch upon the work experience requirement & Process

- Once you clear the FRM part 2 exam, you will be notified to submit 2 years of full time experience. Which needs to be done in the GARP Account.

- Another catch here is that if you take more than 5 years to submit the work experience, then you will have to retake the exams.

- Once your experience is verified which approximately takes about a month. Then the certificate issued.

FRM Course Curriculum

So the FRM course curriculum at the first level is very similar to the CFA level 1 exams. Which has basic knowledge and details on the foundational level subjects. However, the main risk management topics which are in depth start happening from Part 2 onwards. Below I have listed the broad-level coverage of FRM parts 1 and 2 of the exam. For detailed walkthrough on FRM syllabus

| FRM Part 1 | Weightage |

| Foundations of risk management | 20% |

| Quantitative analysis | 20% |

| Financial markets and products | 30% |

| Valuation and risk models | 30% |

| FRM Part 2 | Weightage |

| market risk measurement and management | 20% |

| credit risk measurement and management | 20% |

| Operational & Integrated Risk Management | 20% |

| Liquidity and Treasury Risk Measurement and Management | 15% |

| Risk management and investment management | 15% |

| Current issues in financial markets | 10% |

FRM Course Exam Dates

So, compared to other certification courses the FRM Course is simple i.e. two parts FRM Part 1 exam and Part 2 exam. Which by the way is conducted four times a year; following are the official updated dates of FRM Course exams;

| FRM Course Exam dates | Nov-23 | May-24 | Aug-24 | Nov-24 |

| Part 1 | 4th to 7th | 11 to 17th | 9th to 10th | 9th to 15th |

| Part 2 | 18th to 24th | 18th to 22nd | 9th to 10th | 16th to 19th |

FRM Course Training Fees & Exam Fees

Now, I would categorize FRM as neither too expensive nor too cheap. I would categorize it to a budget course, but nevertheless, let me list the details of the fee structure.

| Enrolment fee | Exam Fee | Average Training Fee | |||

| FRM Course Exam dates | Early | Standard | Late | ||

| Part 1 | USD 400.00 | USD 425.00 | USD 550.00 | USD 725.00 | INR 30,000.00 |

| Part 2 | USD 350.00 | USD 475.00 | USD 650.00 | INR 30,000.00 | |

Clarification on Enrolment Fee for FRM

So, let me explain the above structure in detail, the enrolment fee is a one-time registration charge. You only pay once, during the part 1 exam itself. So, even if you re-attempt the part 1 exam again, you only end up paying the exam fee.

FRM Exam Pattern

So I have listed out in a simple way, the basic FRM Course exam pattern; An important thing to remember is that currently FRM exam is tested in English only. However, you should expect the FRM course exam to be available in languages like Spanish in the future.

| Particulars | FRM Part I | FRM Part II |

| No. of Questions | 100 MCQs | 80 MCQs |

| Duration | 4 Hours | 4 Hours |

| Timings | Morning | Afternoon |

Difficulty of FRM Exam

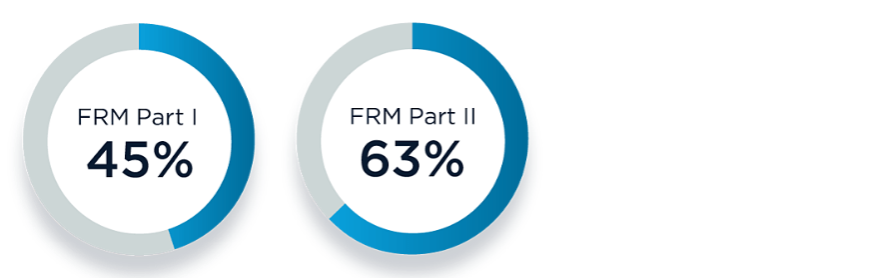

After all, you might be worried about this question, “Is the FRM Course difficult ?” So, the answer is that in terms of mathematical ability, the ability matches with that of the undergraduate level. However, during the exam preparation, you have to focus not on just knowing the formula but also on the application and logic.

Nevertheless, the pass rates are very similar to the CFA program at Level 1 and slightly higher at around 63% at Level 2.

FRM Jobs & Salary

So, any education and certification you pursue should be done with the intent to align yourself to a career or a job.And this FRM course is not different. So first let me list down the type of jobs you can target after the FRM Course.

- Risk Generalist

So, a risk generalist is the kind of person who makes himself involved in credit, market, and operational risk management activities. Which means identifying new risk threats to the companies and asset management firms,Secondly, being abreast with new sources of risk to the firm.

- Credit Risk Manager

So, the credit risk manager job profile after the FRM course is the one that deals with credit risk to an organization. For example, over leveraging, risk of default. The whole idea is that the firm should be able to recover from any risk event.

- Market Risk Manager

Firstly, the market here doesn’t mean the stock market but the business market. As, there are so many developments, new trends that keep happening and pose threats to the business.

- Operational Risk Manager

As businesses grow they become complex and that means there are threats internally in the interlinkage in the business. So, the job of the operational risk manager Is to minimize this risk.

FAQs Related to the FRM Course

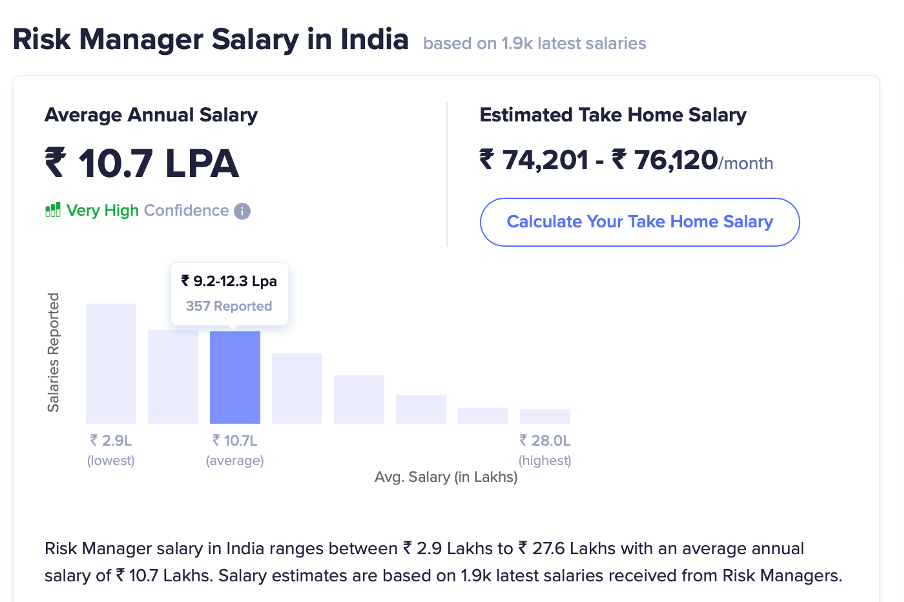

What is the expected salary as a FRM Charterholder?

On average as an entry-level candidate, you can expect anywhere between 5 -6 LPA after completion of the financial risk management course.

What are the job opportunities after the FRM Course?

After completion of the FRM course, an FRM candidate can get into credit risk management, operational risk management, or a Risk generalist profile

What are the fees for FRM Course?

The initial enrolment fees of FRM is $400 and the exam fee is $425 to $725 depending on whether you register early or late. The part 2 exam costs around $350 to $650, again on the same conditions of time.