Last updated on January 19th, 2026 at 12:24 pm

Choosing the right equity research firm can shape your learning curve, career growth, and long-term earnings. A firm qualifies as a top equity research firm when it delivers high-quality research, follows strong governance and ethics, offers exposure to real investment decisions, and provides structured learning for analysts. Other key factors include the depth of sector coverage, credibility with investors, use of advanced research tools, and career progression opportunities.

Equity research firms in India broadly fall into three categories. Buy-side firms (mutual funds, PMS, hedge funds) focus on research for internal investment decisions and reward performance. Sell-side firms (brokerages and investment banks) publish research for clients and generate revenue through trading and advisory services. KPO research firms support global banks and asset managers with financial modeling, data analysis, and reporting, making them a popular entry point for freshers.

This list is designed for students, fresh graduates, and early-career professionals who want clarity on where to start, how firms differ, and which type of equity research role best fits their goals—whether it’s learning fundamentals, gaining global exposure, or building a long-term buy-side career.

So, in this article I will show enumerate the complete list of equity research companies in India. Also will cover not just the Top equity research firms in India from the broking side but also Kpo’s. So let’s get started.

What is Equity Research?

Equity research is basically a function, where the analyst performs fundamental analysis of public or private listed companies. There are two categories of research, firstly buy side equity research and second is sell side equity research. Sell side equity research is basically all the research done by a stock broking firm, whereas buy side equity research is realted to research done by asset management company itself. I have listed down the difference between the two below.

Buy Side vs Sell Side Equity Research

| Criteria | Buy Side Equity Research | Sell Side Equity Research |

|---|---|---|

| Objective | Make investment decisions for institutional investors, hedge funds, and asset managers. | Provide research and recommendations to clients, typically investment banks and brokerage firms. |

| Focus | Generating alpha and maximizing returns on investments. | Providing reports and stock recommendations for clients. |

| Revenue Model | Earns from portfolio performance and asset management fees. | Earns from commissions, advisory fees, and trading revenue. |

| Clientele | Institutional investors, hedge funds, mutual funds, and private equity firms. | Investment banks, brokerage firms, retail investors. |

| Research Approach | Confidential, proprietary, and used internally. | Publicly available or distributed to clients. |

| Work Nature | Long-term investment perspective, detailed financial modeling. | Short-term market analysis, earnings forecasts, and reports. |

| Compensation | Higher salaries and performance-based bonuses. | Base salary plus bonuses linked to research accuracy and client relationships. |

| Career Progression | Investment Analyst → Portfolio Manager → Chief Investment Officer. | Equity Research Associate → Senior Analyst → Head of Research. |

Category of Equity Research Firms in India

So there are multiple ways to look at these companies however, let me categorise it on the basis of;

- Tier 1 – Equity Research firms in India

- Tier 2- KPO based

- Tier 3- Boutique equity research companies

Tier 1 Equity Research Companies in India

Dreaming of a Career in Equity Research?

Unlock your potential with the Equity Research Analyst Course by Mentor Me Careers. Learn the skills top companies like Goldman Sachs, Morgan Stanley, and JP Morgan demand in their equity analysts.

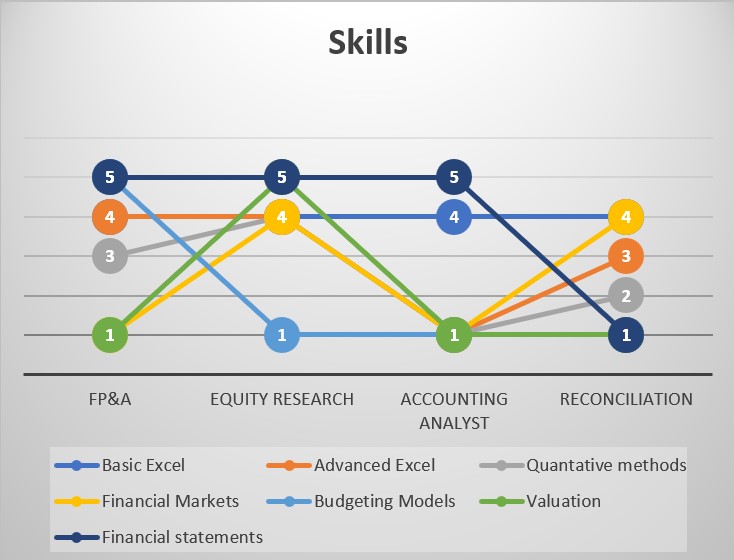

In-Demand Skills

Excel, Valuation Models, and Reports

100% Placement Assistance

Trusted by 1500+ Recruiters

Industry Mentors

Learn from Experienced Equity Analysts

So let me first start with the most premium and sought after companies to work with in this field. And first in my list is

Crisil Global Equity Research

Now, Crisil is a one of those companies in this business for decades. In fact it still is one of the top employers from Ivy League b schools in India.

Now generally speaking in case of Crisil, you should either be from

- Ivy League top 10 b -schools

- CFA level 2 & above

- Or A chartered accountantand this criteria is very stringent only for global equity research, not other business’s of Crisil.

Transparent Value

Based out of Mumbai, transparent value is another premium name in this business. However, in terms of the scale of hiring, this might not be that common. However the research experience you can get working with them is just awesome.

Generally category of people they hire:

- CFA’s,CA, MBA’S

- Graduates

Now the interesting thing about transparent value is that they are not very stringent on qualifications alone.

Evalue serve

Another crown in India which specialises in research is EVS, as it is popularly known. EVS can be a difficult gate to open, when you apply. Majorly because of their entry level requirements.

Generally speaking the following background is acceptable at EVS;

- CFA,CA’S, MBA’s(Top 10)

Rarely have I seen graduates being entertained here for interviews. Which I think is not because of their policy but because of their client requirements.

Also check out our equity research interview question blog

Nomura

NOMURA is a global financial services company which is origanally from Japan. It is japans largest investment bank.

Equity Research Analyst Job at Nomura

– Join as an integral part of India Equity research team.

– The role will involve supporting senior analysts based in India.

– The successful candidates will be part of a highly-regarded team with a mandate for research on stocks listed in India.

– Work on financial statements of companies, build and maintain earnings and valuation models.

– Track & report news/events on coverage names, maintaining industry/ company databases.

Key Skills:

– Strong knowledge of accounting, financial statement analysis and security valuation

– Distinctive academic record: consistently highly graded within their peer group

– Excellent communication skills (written and oral) with attention to detail

– Solid analytical skills, including ability to perform data analysis

– Ability to work under pressure, multitasking and meet deadlines

– Advanced knowledge of MS Excel & MS PPT; Bloomberg exposure will be added advantage

Tier 2 KPO Based Top Equity Research Firms in India

Now, in this category I will discuss the companies that hire all kinds of people. Moreover, you also need to remember that these firms might not be directly in research. However, it would still be relevant and value to freshers to start their journey with these firms.

Visible Alpha

Based out Mumbai and NCR region, visible alpha hires wide variety of candidates. However, their work is not directly related to equity research but related to a platform. The platform is a research application, which uses existing research models to update the information to the user.

Daloopa

Daloopa is also based out NCR region and their research primarily covers the real estate asset. Another place where you can kick start your career with normal and average qualification. However, do note that the entry level test is 120 questions related to financial statement analysis. Which is not a cake walk at any cost.

Tier 3- Boutique equity research companies

Finally moving into the final category of top equity research firms in India, with minimal requirements. Note that I call these as tier 3 not because the work is tier 3 but because of the compensation.

Generally speaking Tier 3 boutique research firms tend to pay 3.5 to 4 LPA for a fresher. However, the benefit is that, the experience is priceless. In fact, with these firms you learn much faster than the more established companies. Let me list down some very well known names;

- Avendus Capital

- Puranrtha Investment Advisors

- Gallaghar and Mohan

- Equities capital advisors

- Moxie capital

Expanding Opportunities with Investment Management and Alternative Data

In recent years, the field of investment research has evolved significantly with the integration of alternative data sources. These data sets provide unique insights that traditional methods might overlook. Firms specializing in investment management are increasingly leveraging alternative data to enhance their research capabilities and make more informed investment decisions.

Fundamental Research with a Modern Twist

Traditional fundamental research remains at the core of equity analysis. However, combining it with alternative data sources, such as social media sentiment, satellite imagery, and transaction data, offers a comprehensive view of the market. This modern approach not only improves accuracy but also provides a competitive edge in the fast-paced world of investment management.

Conclusion

Equity research is an exciting career for those who are intellectually inclined towards business. Also if you wish to learn the requisite skills for this industry, then you can pursue the Equity research course by Mentor me careers, which guarantees interviews. Also is one of the most highest reviewed live courses in research.

Related Articles

- Valuation of equity shares guide

- Research analyst Salary

- Top internships for research analyst in India