So, imagine you are running a business and you have sold your products or services on credit. And the payments are due to come in the coming few months. However, you need funds to manage your working capital expenses like salary, raw materials etc. How would you pay for them? Now the usual answer is that we could take a bank loan or overdraft facilities. But there are also more innovative methods of managing this i.e Invoice discounting and invoice factoring. In this article I will explain you both and also show you the difference between factoring and bill discounting with real life scenarios.

Invoice Discounting and Invoice Factoring

So without complicating things, and understanding it on a very simple context. The difference between factoring and bill discounting is the “Time Frame”.

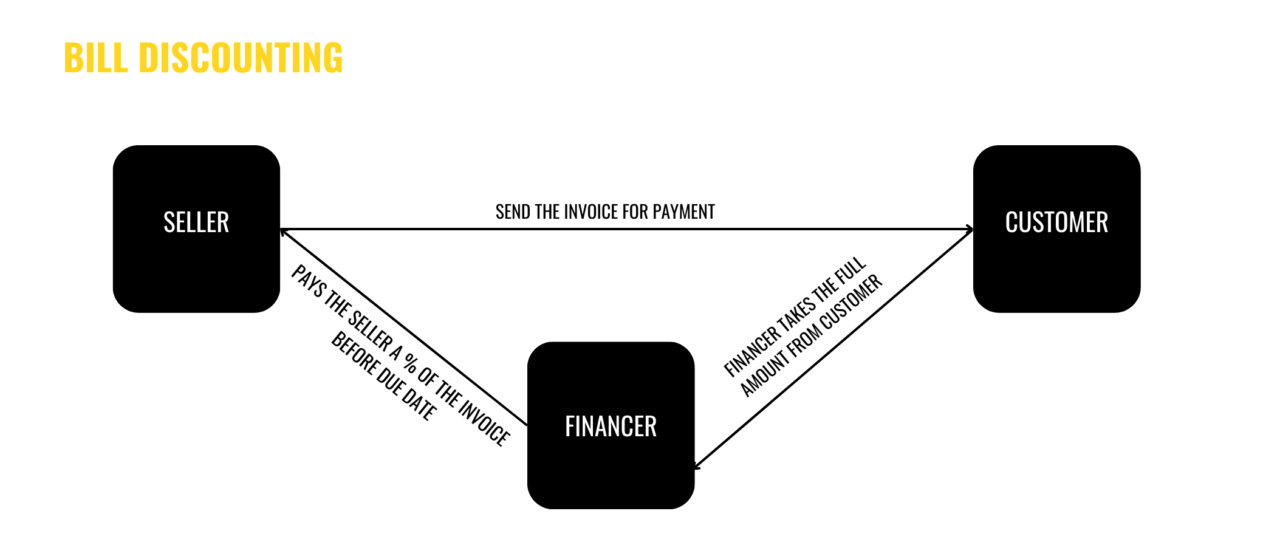

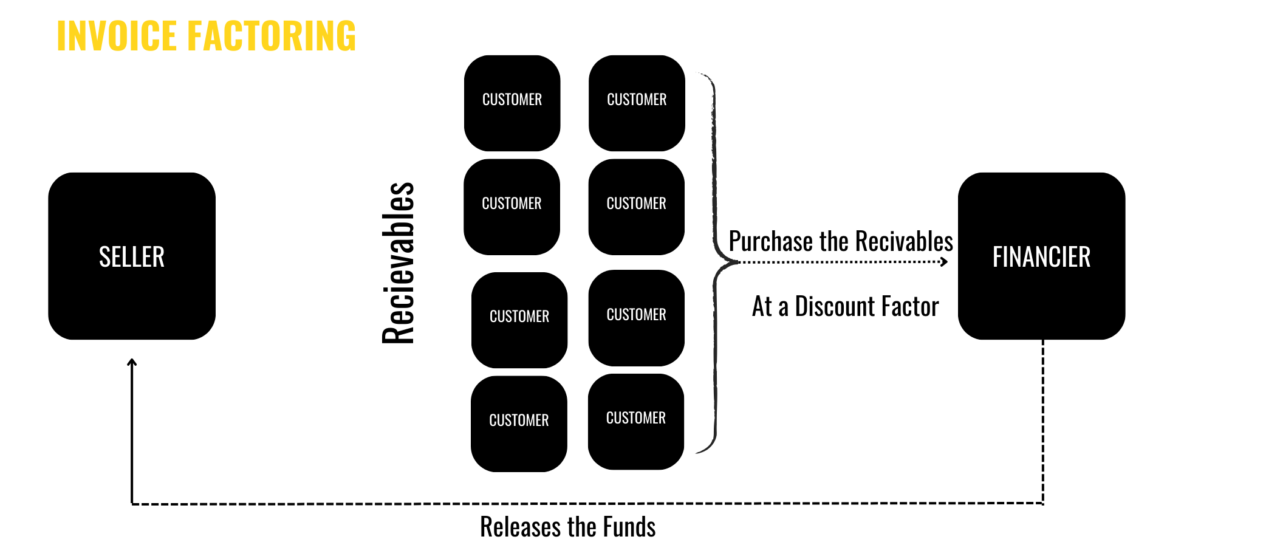

- Incase you are financing an incvoice who’s payment is in the future then we call it as bill discounting.

- Whereas in case of factoring the financier is basically buying all your recievables whether already due or to be paid in the future.

Types of Bill Discounting

There are various kinds of bill discounting products which are provided by the financial institutions. Let me take you briefly through some of them;

- LC Backed Bill Discounting: This is majorly done in international business’s where the customer have give given letters of credit to the buyer.

- Clean Bill Discounting: As the name suggest, the main feature of this type of discounting is that borrowers don’t need to furnish any extra documents to get their bills discounted.

- Partial turnover discounting: This is where the company selects the proportion of the total recivables that it wants to discount to get the funds.

- Full turnover discounting: When the borrower duscouts the entire invoices which are recivable.

- Undisclosed Discounting: The name should make it very clear, that the borrower’s customers have no idea that the discounting is actually taking place.

What are the disadvantages of Invoice Discounting?

If you look closely on the invoice discounting process or factoring, not in reality but somewhat is like debt. The only difference is that when you take invoice discounting method of financing, is that you are getting paid earlier for the work you have already done. However, with debt the objective might for future uses of the capital but majorly invoice

discounting method is a working capital arrangement. So let me summarisze the disadvantages are;

- High rates of discounting which might be charged to smaller companies with limited credit history.

- Operational issues, where customer of the borrower Is not comfortable with talking to a third party.

FAQ’s

What is the average rate for invoice discounting?

So, usually in the industry invoice discounting is anywhere between 2.5 to 6% depending on the invoice payments.

How safe is bill discounting?

From an investment perspective bill discounting carry delay risk, because companies can get away with delayed payments without affecting their credit rating.

What are the factors affecting bill discounting?

There can be many factors that affect bill discounting, however some of the most important factors usually is the creditworthiness of the buyer and seller.

Is Bill Discounting a loan?

Not in theory but in a way its an off balance sheet loan. Because the interest is charged in the form of a discount to the invoice payment.

Is bill discounting bad for a business?

Depends on the cost versus benefit. If the cost of collecting recievables is higher than the discounting then discounting can be good.